Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Tax Representative interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Tax Representative so you can tailor your answers to impress potential employers.

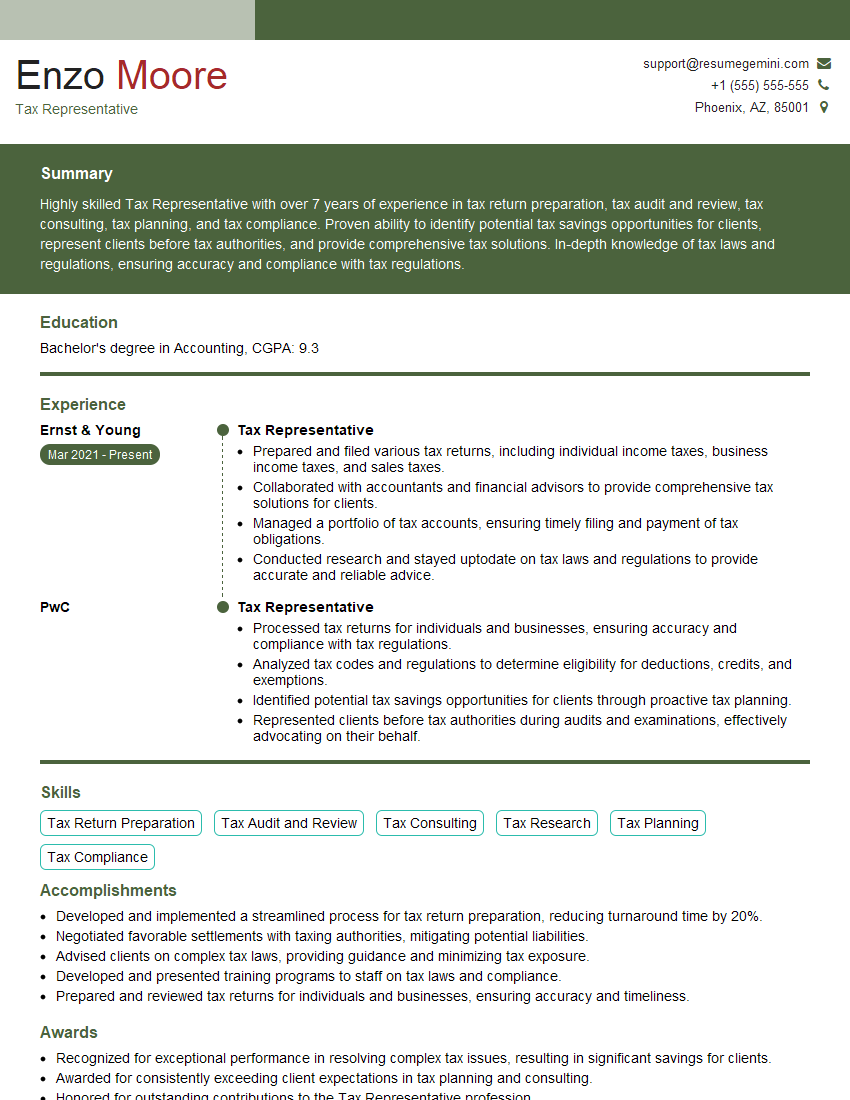

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Representative

1. What are the key responsibilities of a Tax Representative?

As a Tax Representative, my primary responsibilities would include:

- Representing clients before tax authorities and ensuring compliance with tax laws and regulations.

- Preparing and filing tax returns, conducting tax audits, and providing tax advice.

2. Describe the different types of taxes that a Tax Representative may be responsible for handling.

Federal Taxes

- Income tax

- Payroll tax

- Sales tax

State and Local Taxes

- Franchise tax

- Use tax

- Property tax

3. What are the qualities and skills that are essential for a successful Tax Representative?

To be successful in this role, I believe the following qualities and skills are crucial:

- Technical Expertise: Strong knowledge of tax laws and regulations.

- Communication Skills: Ability to clearly and effectively communicate with clients, tax authorities, and other professionals.

- Analytical Skills: Proficiency in analyzing tax issues and providing tailored solutions.

- Attention to Detail: Meticulous and organized approach to ensure accuracy in tax filings and other deliverables.

- Problem-Solving Skills: Ability to identify and resolve complex tax issues.

4. Explain the process of preparing and filing a tax return.

The process of preparing and filing a tax return involves the following steps:

- Gather necessary financial documents and information.

- Calculate income and expenses.

- Determine applicable tax deductions and credits.

- Complete the appropriate tax forms.

- File the return with the relevant tax authority.

5. Describe your experience with tax audits.

During my previous role, I have assisted clients with both routine and complex tax audits. My responsibilities included:

- Preparing for the audit, including gathering necessary documentation.

- Representing clients during the audit process.

- Negotiating with tax authorities to resolve any outstanding issues.

6. What are the current trends and developments in the tax industry?

The tax industry is constantly evolving, and recent trends include:

- Digitalization: Increasing use of technology for tax preparation and filing.

- Globalization: Growing complexity of international tax regulations.

- Tax Reform: Regular changes to tax laws and regulations.

7. How do you stay updated with the latest tax laws and regulations?

To ensure my knowledge is up-to-date, I regularly engage in the following activities:

- Attend industry conferences and seminars.

- Subscribe to tax publications and newsletters.

- Participate in continuing education courses.

8. Describe a challenging tax issue you have encountered and how you resolved it.

I recently assisted a client with a complex transfer pricing issue. The issue involved determining the appropriate transfer price for goods sold between the client’s foreign and domestic entities. Through thorough research and analysis, I developed a well-supported transfer pricing policy that satisfied both the client and the tax authorities.

9. Explain how you would approach a tax planning engagement for a multinational company.

When conducting tax planning for a multinational company, I would take the following steps:

- Analyze the company’s global operations and tax footprint.

- Identify potential tax risks and opportunities.

- Develop and implement tax-efficient strategies to optimize the company’s tax position.

- Monitor and review the implemented strategies to ensure ongoing compliance and effectiveness.

10. What are your strengths and weaknesses as a Tax Representative?

My strengths include:

- Strong technical expertise in tax laws and regulations.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

My areas for improvement include:

- Expanding my knowledge of international tax regulations.

- Further developing my expertise in tax audit defense.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Tax Compliance and Reporting

Ensure compliance with all applicable tax laws and regulations at local, state, and federal levels.

- Prepare and file timely and accurate tax returns, including corporate income taxes, sales and use taxes, payroll taxes, and other tax forms.

- Maintain detailed tax records and documentation.

2. Tax Planning and Advisory

Provide tax planning and consulting services to minimize tax liabilities while ensuring compliance.

- Analyze tax laws and propose strategies to optimize tax savings.

- Advise on tax implications of business transactions, such as mergers, acquisitions, and divestitures.

3. Tax Audit and Representation

Represent the company in tax audits and disputes with tax authorities.

- Prepare for and attend tax audits, present evidence, and negotiate settlements.

- Respond to tax inquiries and notices.

4. Tax Research and Analysis

Stay abreast of tax-related laws, regulations, and court rulings affecting the company.

- Conduct research and provide analysis on complex tax issues.

- Monitor tax policy changes and advise on their potential impact.

Interview Tips

1. Research the Company and Industry

Thoroughly research the company’s business, industry, and recent tax-related news.

- This will demonstrate your interest and understanding of the company’s tax environment.

- Read through the company’s website, annual reports, and press releases to gather information.

2. Prepare for Technical Questions

Expect questions related to tax accounting, tax law, and audit procedures.

- Review commonly asked tax interview questions and prepare answers that showcase your technical knowledge.

- Practice solving tax-related problems and case studies.

3. Highlight Your Communication and Interpersonal Skills

Communicating complex tax issues clearly and effectively is essential.

- Emphasize your ability to explain tax concepts to both internal and external stakeholders.

- Share examples of how you have successfully communicated with tax authorities, clients, and colleagues.

4. Show Your Enthusiasm for Tax

Demonstrate your passion for tax and your desire to learn and grow in the field.

- Share your experiences in related fields or extracurricular activities that showcase your interest in tax.

- Discuss your goals and aspirations in the tax profession.

- Ask insightful questions about the company’s tax function and industry trends.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!