Are you gearing up for a career in Tax Revenue Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Tax Revenue Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

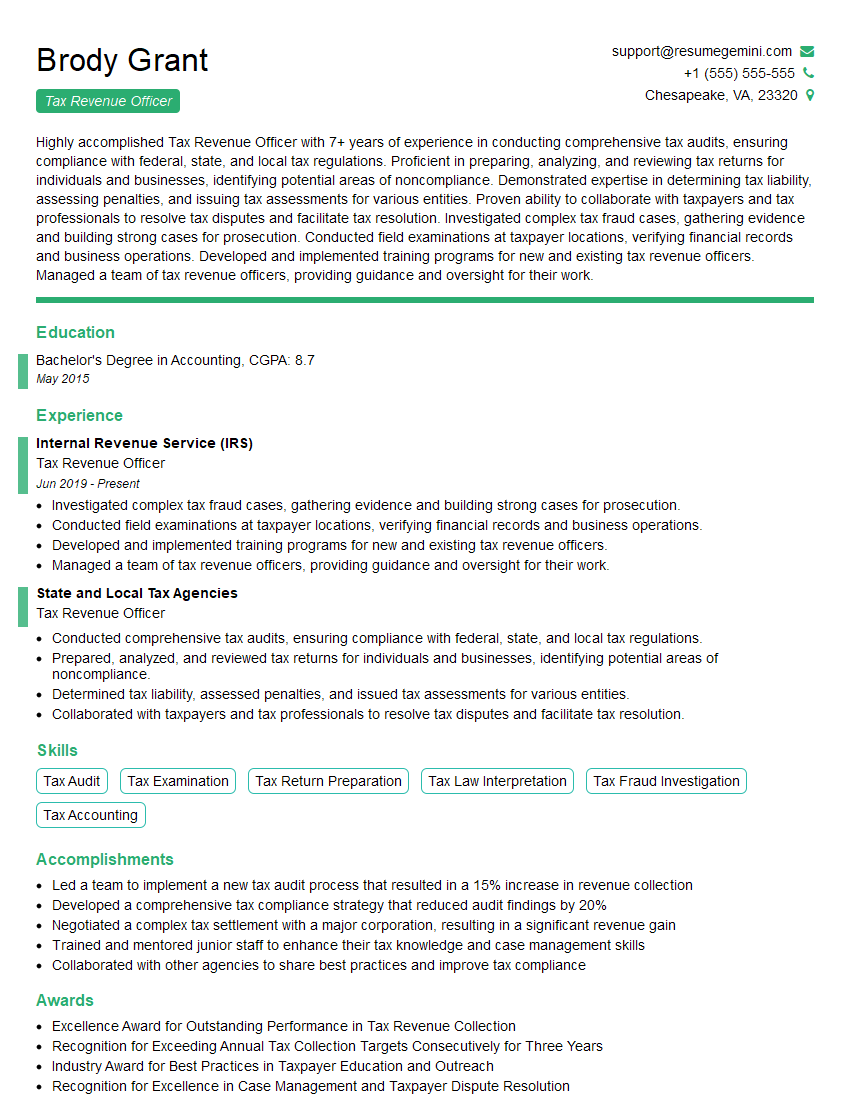

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Revenue Officer

1. What are the primary responsibilities of a Tax Revenue Officer?

As a Tax Revenue Officer, my primary responsibilities would include:

- Processing and reviewing tax returns for accuracy and completeness

- Investigating and resolving tax issues, including audits and appeals

- Collecting and managing tax revenue, including enforcement actions

- Providing guidance and assistance to taxpayers on tax matters

- Maintaining up-to-date knowledge of tax laws and regulations

2. What are the key skills and qualifications required to excel as a Tax Revenue Officer?

Technical Skills

- Advanced knowledge of tax laws, regulations, and accounting principles

- Expertise in tax audit and investigation techniques

- Strong analytical and problem-solving abilities

- Excellent written and verbal communication skills

- Proficiency in using tax software and databases

Non-Technical Skills

- Attention to detail and accuracy

- Integrity and confidentiality

- Ability to work independently and as part of a team

- Strong work ethic and commitment to meeting deadlines

- Excellent interpersonal skills

3. Can you describe the process of conducting a tax audit?

The process of conducting a tax audit typically involves the following steps:

- Planning: Gathering information about the taxpayer and selecting audit techniques

- Examination: Analyzing the taxpayer’s records and interviewing the taxpayer

- Reporting: Preparing an audit report that summarizes the findings and recommendations

4. How do you approach resolving tax disputes or appeals?

Resolving tax disputes or appeals involves several key steps:

- Understanding: Gaining a clear understanding of the taxpayer’s position and the basis for the dispute

- Analysis: Reviewing the relevant tax laws and regulations to determine the applicable rules

- Negotiation: Working with the taxpayer to reach a mutually acceptable resolution that complies with tax laws

- Documentation: Preparing a written agreement that outlines the terms of the settlement

5. What strategies do you use to detect and prevent tax fraud?

To detect and prevent tax fraud, I employ the following strategies:

- Data Analysis: Using data analytics to identify unusual or suspicious patterns in taxpayer returns

- Risk Assessment: Identifying taxpayers who are at high risk of committing tax fraud based on specific indicators

- Audit Selection: Prioritizing and selecting taxpayers for audits based on their risk profile

- Collaboration: Working with other government agencies and law enforcement to share information and investigate potential fraud cases

6. How do you stay up-to-date with the latest tax laws and regulations?

To stay up-to-date with the latest tax laws and regulations, I actively engage in the following activities:

- Continuous Education: Attending training and workshops offered by professional organizations and government agencies

- Research: Reading tax journals and publications, as well as reviewing government websites and databases

- Networking: Connecting with other tax professionals and sharing knowledge

- Subscription Services: Subscribing to tax newsletters and alerts to receive up-to-date information

7. How do you prioritize your workload and manage multiple tasks effectively?

To prioritize my workload and manage multiple tasks effectively, I utilize the following strategies:

- Task Prioritization: Using a system to rank tasks based on importance and urgency

- Time Management: Allocating specific time slots for different tasks and adhering to a schedule

- Delegation: Assigning tasks to team members when appropriate to optimize efficiency

- Technology: Using project management software or other tools to track progress and stay organized

- Flexibility: Being adaptable and adjusting my schedule as needed to handle unexpected events or changing priorities

8. Can you describe your experience in communicating complex tax information to taxpayers?

In my previous role as a Tax Revenue Officer, I developed strong communication skills to effectively convey complex tax information to taxpayers. Here are some of my experiences:

- Taxpayer Education: Conducting workshops and presentations to educate taxpayers on tax laws and their obligations

- Individual Tax Assistance: Providing personalized guidance to taxpayers with complex tax situations, explaining tax concepts and regulations

- Written Communication: Drafting clear and concise letters, notices, and other written communications to convey tax decisions and responsibilities

- Mediation: Facilitating discussions and negotiations between taxpayers and the tax authority to resolve disputes and reach mutually acceptable outcomes

9. How do you maintain confidentiality and protect sensitive taxpayer information?

Maintaining confidentiality and protecting sensitive taxpayer information is paramount in my role. I adhere to the following practices:

- Data Security: Ensuring the secure storage and handling of taxpayer data, both electronically and physically

- Limited Access: Granting access to taxpayer information only to authorized personnel on a need-to-know basis

- Privacy Laws: Complying with relevant privacy laws and regulations to safeguard taxpayer information

- Ethical Conduct: Upholding ethical standards and maintaining the integrity of the tax system by protecting taxpayer privacy

- Training and Awareness: Participating in ongoing training and awareness programs to stay updated on confidentiality best practices

10. How do you handle situations involving uncooperative or resistant taxpayers?

Dealing with uncooperative or resistant taxpayers requires a combination of professionalism and tact. Here’s my approach:

- Communication: Establishing open and respectful communication channels, actively listening to the taxpayer’s perspective

- Empathy: Understanding the taxpayer’s circumstances and acknowledging their concerns

- Clear Expectations: Outlining the required actions and timelines, while providing clear consequences for non-compliance

- Collaboration: Exploring alternative solutions or payment arrangements, if appropriate

- Enforcement: Taking appropriate enforcement actions, such as liens or levies, as a last resort, while prioritizing fair and equitable treatment

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Revenue Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Revenue Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Tax Revenue Officer is responsible for ensuring compliance with tax laws and regulations. They work closely with taxpayers to ensure accurate tax reporting and collection.

1. Tax Return Review

Reviews tax returns for accuracy and compliance with tax laws.

- Verifies taxpayer information.

- Ensures that all necessary documentation is included.

2. Tax Audit

Conducts tax audits to verify the accuracy of tax returns.

- Examines financial records and other relevant documents.

- Interviews taxpayers and third parties.

3. Tax Collection

Collects delinquent taxes and ensures timely payment.

- Issues notices and levies.

- Works with taxpayers to establish payment plans.

4. Taxpayer Education

Provides taxpayer education and outreach to promote compliance.

- Conducts workshops and seminars.

- Develops and distributes informational materials.

Interview Tips

To ace the interview for a Tax Revenue Officer position, it is important to:

1. Research the Position and Company

Thoroughly research the job description and the organization’s mission and values. Understanding the company’s culture and goals will help you tailor your answers to the specific requirements of the role.

- Visit the company’s website and social media pages.

- Read industry news and articles to stay up-to-date on current trends.

2. Highlight Your Skills and Experience

Emphasize your skills and experience that are relevant to the job responsibilities of a Tax Revenue Officer. Quantify your accomplishments whenever possible.

- Discuss your experience in conducting tax audits and reviewing tax returns.

- Highlight your knowledge of tax laws and regulations.

3. Demonstrate Problem-Solving Abilities

Tax Revenue Officers often face complex problems. Showcase your problem-solving abilities by providing examples of how you have successfully resolved issues in the past.

- Describe a situation where you had to resolve a complex tax issue for a taxpayer.

- Explain how you approached the problem and the steps you took to find a solution.

4. Practice Your Interview Skills

Practice answering common interview questions to boost your confidence and improve your delivery. Seek feedback from a friend or family member to enhance your presentation.

- Prepare for questions about your experience, skills, and motivation.

- Practice answering questions in a clear and concise manner.

Next Step:

Now that you’re armed with the knowledge of Tax Revenue Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Revenue Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini