Feeling lost in a sea of interview questions? Landed that dream interview for Tax Specialist but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Tax Specialist interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

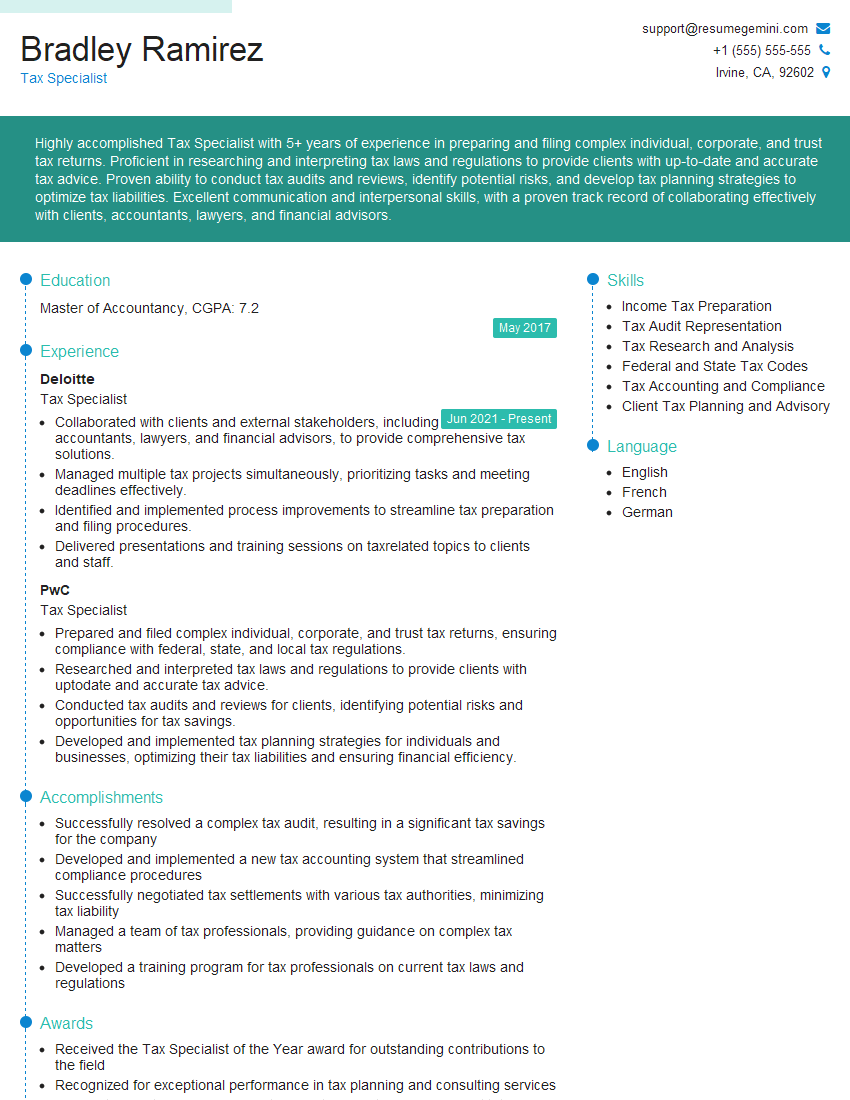

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Specialist

1. Explain the concept of transfer pricing and its importance in multinational corporations?

- Transfer pricing is a strategy used by multinational corporations (MNCs) to allocate costs and profits among their different entities.

- It’s important because it allows MNCs to optimize their tax strategies and manage their financial resources effectively.

- Transfer pricing can also help MNCs avoid double taxation and reduce their overall tax burden.

2. Discuss the key principles of withholding tax and how they apply to cross-border transactions?

- Withholding tax is a tax levied on payments made to non-resident taxpayers.

- In cross-border transactions, withholding tax is often applied to dividends, interest, and royalties.

- The key principles of withholding tax include the following:

- The tax is withheld at the source of the payment.

- The rate of withholding tax is determined by the tax treaty between the two countries involved.

- The recipient of the payment can often claim a refund of the withholding tax if they are not liable to pay tax in their home country.

3. Describe the different types of tax audits and the procedures involved in each?

- There are several different types of tax audits, including:

- Field audits

- Office audits

- Correspondence audits

- Special audits

- The procedures involved in each type of audit vary, but generally include the following steps:

- The auditor will request information from the taxpayer.

- The auditor will review the taxpayer’s information and make a determination.

- The auditor will issue a report to the taxpayer.

4. Explain the concept of tax planning and how it can be used to minimize tax liability?

- Tax planning is the process of analyzing a taxpayer’s financial situation and making recommendations to minimize their tax liability.

- Tax planning can be used to legally reduce taxes by taking advantage of deductions, credits, and other tax benefits.

- It’s important to note that tax planning is not the same as tax avoidance, which is the use of illegal means to reduce tax liability.

5. Discuss the challenges and opportunities of working in the field of international taxation?

- The field of international taxation is complex and constantly evolving, as it requires knowledge of multiple tax jurisdictions and regulations.

- However, it also provides many opportunities for professionals who are willing to learn and adapt.

- One of the biggest challenges is staying up-to-date on the latest tax laws and regulations.

- Another challenge is communicating with clients and colleagues in different countries, who may have different cultural backgrounds and perspectives.

- Despite these challenges, the field of international taxation offers many opportunities for professional growth and development.

6. Describe the role of tax treaties in reducing double taxation and promoting cross-border trade?

- Tax treaties are agreements between two or more countries that are designed to reduce double taxation and promote cross-border trade.

- Double taxation occurs when the same income is taxed in two different countries.

- Tax treaties typically include provisions that allocate taxing rights between the two countries and provide for the exchange of information between tax authorities.

- Tax treaties can also reduce the administrative burden for taxpayers who have business operations in multiple countries.

7. Explain the concept of tax havens and discuss the ethical implications of their use?

- Tax havens are countries or jurisdictions that offer low or no taxes to attract foreign businesses and individuals.

- While tax havens can be beneficial for businesses looking to reduce their tax liability, they can also be used for illegal activities such as tax evasion and money laundering.

- The use of tax havens raises a number of ethical concerns, including:

- They can lead to a loss of tax revenue for governments.

- They can create unfair competition for businesses that do not use tax havens.

- They can facilitate illegal activities.

8. Discuss the impact of globalization on international taxation?

- Globalization has had a significant impact on international taxation, as it has led to an increase in cross-border trade and investment.

- This has made it more difficult for tax authorities to track and tax multinational corporations, which has led to a number of tax avoidance schemes.

- Globalization has also increased the need for cooperation between tax authorities in different countries.

9. Explain the concept of thin capitalization and how it can be used to reduce tax liability?

- Thin capitalization is a tax avoidance scheme that involves a company borrowing money from a related party in a low-tax jurisdiction.

- The interest payments on the loan are then used to reduce the company’s taxable income in the high-tax jurisdiction.

- Thin capitalization rules are designed to prevent companies from using excessive debt to reduce their tax liability.

10. Discuss the future of international taxation and the challenges that tax professionals will face?

- The future of international taxation is uncertain, as there are a number of factors that could impact its development.

- One of the biggest challenges that tax professionals will face is the increasing complexity of the global tax landscape.

- Tax professionals will also need to keep up with the latest technological developments, as technology is increasingly being used to automate tax processes.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Specialists are responsible for a wide range of tasks, including preparing tax returns, providing tax advice, and representing clients before the IRS. To be successful in this role, candidates should have a strong understanding of tax laws and regulations, as well as excellent analytical and communication skills.

1. Prepare tax returns

Tax Specialists are responsible for preparing tax returns for individuals, businesses, and other organizations. This involves gathering all necessary financial information, calculating taxes owed, and completing the appropriate forms.

- Gather financial information from clients, including income statements, expense reports, and investment summaries.

- Calculate taxes owed using tax software or manual methods.

- Complete tax forms, including Form 1040, Form 1120, and Form 1065.

2. Provide tax advice

Tax Specialists also provide tax advice to clients. This may involve explaining tax laws and regulations, helping clients to make tax-related decisions, and representing clients before the IRS.

- Explain tax laws and regulations to clients in a clear and concise manner.

- Help clients to make tax-related decisions, such as choosing the right tax deductions and credits.

- Represent clients before the IRS, such as during audits or appeals.

3. Represent clients before the IRS

Tax Specialists may also represent clients before the IRS. This may involve attending audits, filing appeals, and negotiating settlements.

- Attend audits with clients and represent their interests.

- File appeals on behalf of clients who disagree with the IRS’s findings.

- Negotiate settlements with the IRS on behalf of clients.

4. Stay abreast of tax laws and regulations

Tax laws and regulations are constantly changing, so it is important for Tax Specialists to stay abreast of the latest changes. This may involve reading tax publications, attending seminars, and taking continuing education courses.

- Read tax publications, such as the Internal Revenue Code and the Treasury Regulations.

- Attend seminars and continuing education courses to stay up-to-date on the latest tax laws and regulations.

Interview Tips

To ace the interview for a Tax Specialist position, it is important to be well-prepared. This means understanding the key job responsibilities, being able to answer common interview questions, and having a few questions of your own to ask the interviewer. Here are a few tips to help you prepare for your interview:

1. Research the company and the position

Before your interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture and values, as well as the specific skills and experience they are looking for in a Tax Specialist.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully to identify the key skills and experience required for the position.

- Talk to your network to see if anyone you know has worked for the company or in a similar role.

2. Practice answering common interview questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is important to practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Make a list of common interview questions and practice answering them out loud.

- Ask a friend or family member to conduct a mock interview with you.

- Use the STAR method to answer behavioral questions.

3. Prepare questions to ask the interviewer

Asking the interviewer questions shows that you are interested in the position and the company. It also gives you an opportunity to learn more about the company and the position. Here are a few questions you can ask the interviewer:

- What are the biggest challenges facing the company right now?

- What is the company’s culture like?

- What are the opportunities for advancement within the company?

4. Be confident and enthusiastic

First impressions matter, so it is important to be confident and enthusiastic during your interview. Make eye contact with the interviewer, smile, and speak clearly and confidently. Be sure to dress professionally and arrive on time for your interview.

- Make eye contact with the interviewer and smile.

- Speak clearly and confidently.

- Dress professionally and arrive on time for your interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.