Feeling lost in a sea of interview questions? Landed that dream interview for Tax Technician but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Tax Technician interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

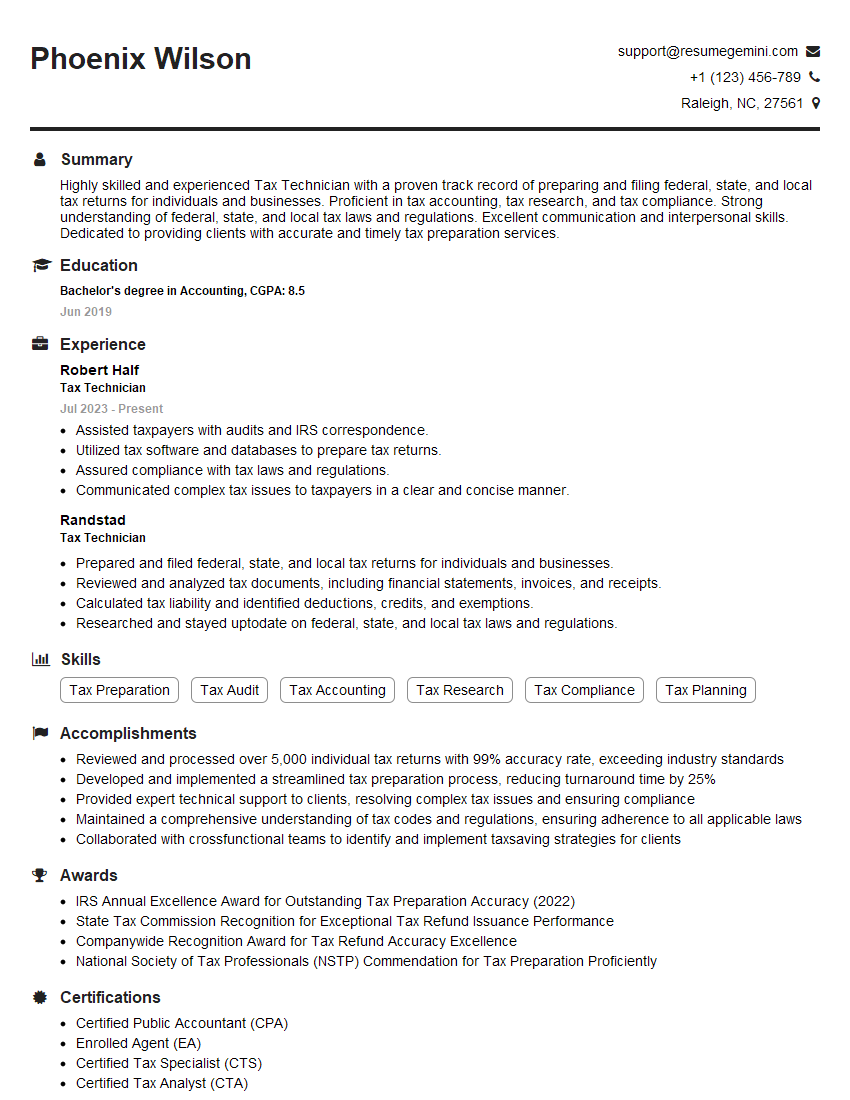

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Technician

1. Explain the different types of taxes individuals and businesses can expect to encounter?

The individual and business pay different types of taxes

- Income tax: Levied on individual and business income, including salaries, wages, and profits.

- Property tax: Assessed on real estate, such as land and buildings.

- Sales tax: Collected on the purchase of goods and services in some jurisdictions.

- Payroll tax: Paid by employees and employers to fund Social Security and Medicare.

- Estate tax: Levied on the transfer of wealth upon death.

2. Describe the various methods used to calculate depreciation?

- Straight-line method: Depreciates an asset evenly over its useful life.

- Declining balance method: Depreciates an asset faster in the early years of its useful life.

- Sum-of-the-years’ digits method: Allocates a larger depreciation expense in the early years of an asset’s useful life.

- Unit-of-production method: Depreciates an asset based on its usage or output.

3. Explain the concept of tax deductions and how they are applied?

Tax deductions reduce the taxable income, thus, reducing the amount of tax owed

- Standard deduction: A fixed amount that can be deducted from income without itemizing expenses.

- Itemized deductions: Specific expenses that can be deducted from income, such as mortgage interest, charitable contributions, and medical expenses.

4. Discuss the different types of tax audits and the procedures involved in each?

- Correspondence audit: Conducted through mail, often requesting documentation to verify specific items on a tax return.

- Office audit: Conducted at an IRS office, typically involving a review of a taxpayer’s records and an interview with the taxpayer.

- Field audit: Conducted at the taxpayer’s place of business or residence, involving a thorough examination of the taxpayer’s financial records.

5. Explain the importance of tax compliance and the consequences of non-compliance?

Tax compliance is important because it ensures that businesses and individuals pay their fair share of taxes

Non-compliance can lead to penalties, interest charges, and even criminal prosecution

6. Describe the role of technology in the tax preparation process?

Technology plays a crucial role in tax preparation, making it more efficient and accurate

- Tax software: Automates calculations, reduces errors, and provides guidance on tax laws.

- Electronic filing: Enables taxpayers to submit returns electronically, reducing processing time and improving accuracy.

7. Are you familiar with any recent changes in tax laws and how they may impact individuals or businesses?

- Tax Cuts and Jobs Act of 2017: Reduced corporate tax rates and modified individual tax brackets.

- CARES Act of 2020: Provided tax relief for individuals and businesses impacted by the COVID-19 pandemic.

8. Explain how you would approach a complex tax issue that you have not encountered before?

When faced with an unfamiliar tax issue, I would:

- Research relevant tax laws and regulations.

- Consult with colleagues or seek professional guidance.

- Analyze the specific facts of the situation.

- Consider multiple perspectives and potential solutions.

9. How do you prioritize your workload and manage multiple deadlines?

Utilizing effective time management and prioritizing techniques:

- Prioritizing tasks based on importance and urgency.

- Setting realistic deadlines and breaking down large projects into smaller tasks.

- Delegating tasks when appropriate to ensure timely completion.

- Communicating effectively with colleagues and supervisors to coordinate efforts.

10. Describe a situation where you successfully resolved a dispute with a taxpayer?

In my previous role, I effectively resolved a dispute with a taxpayer by:

- Understanding the taxpayer’s perspective and concerns.

- Thoroughly reviewing relevant tax laws and regulations.

- Presenting a clear and well-reasoned explanation of the tax liability.

- Negotiating a mutually acceptable resolution that complied with tax laws.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Technicians play a vital role in ensuring the smooth functioning of the tax system. Their responsibilities include:

1. Data Entry and Processing

Tax Technicians are responsible for entering and processing tax data, ensuring accuracy and completeness. They may also be responsible for reconciling tax data with other financial records.

- Enter tax data into computer systems.

- Review and verify tax data for accuracy.

- Reconcile tax data with other financial records.

2. Tax Return Preparation

Tax Technicians may assist in preparing tax returns for individuals or businesses. This includes gathering necessary information, completing tax forms, and ensuring that all required documentation is submitted.

- Gather necessary information for tax return preparation.

- Complete tax forms.

- Ensure that all required documentation is submitted.

3. Tax Audits and Reviews

Tax Technicians may assist in conducting tax audits and reviews. This includes reviewing tax returns, identifying potential errors, and recommending adjustments.

- Review tax returns.

- Identify potential errors.

- Recommend adjustments.

4. Tax Compliance

Tax Technicians stay up-to-date on tax laws and regulations to ensure compliance. They may also provide guidance to taxpayers on tax-related matters.

- Stay up-to-date on tax laws and regulations.

- Provide guidance to taxpayers on tax-related matters.

- Ensure compliance with tax laws and regulations.

Interview Tips

Preparing thoroughly for a Tax Technician interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Before the interview, take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and expectations.

- Visit the company’s website.

- Read the job description carefully.

- Talk to your recruiter or network.

2. Practice Your Answers

Take some time to practice answering common interview questions. This will help you feel more confident and prepared on the day of the interview.

- Use the STAR method (Situation, Task, Action, Result) when answering behavioral questions.

- Prepare specific examples of your work experience that demonstrate your skills and abilities.

- Practice answering questions about your tax knowledge and experience.

3. Dress Professionally

First impressions matter, so make sure you dress professionally for the interview. This means wearing clean, pressed clothing that is appropriate for a business setting.

- Wear a suit or dress pants and a button-down shirt.

- Make sure your shoes are clean and polished.

- Avoid wearing strong perfumes or colognes.

4. Be Punctual

Punctuality shows that you are respectful of the interviewer’s time. Plan to arrive at the interview 10-15 minutes early so you have time to check in and prepare.

- Give yourself plenty of time to get to the interview location.

- Allow for traffic and unexpected delays.

- If you are running late, call the interviewer as soon as possible to let them know.

5. Follow Up

After the interview, send a thank-you note to the interviewer. This is a great way to reiterate your interest in the position and thank them for their time.

- Send the thank-you note within 24 hours of the interview.

- Personalize the thank-you note and mention something specific from the interview.

- Reiterate your interest in the position.

Next Step:

Now that you’re armed with the knowledge of Tax Technician interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Technician positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini