Are you gearing up for an interview for a Technical Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Technical Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

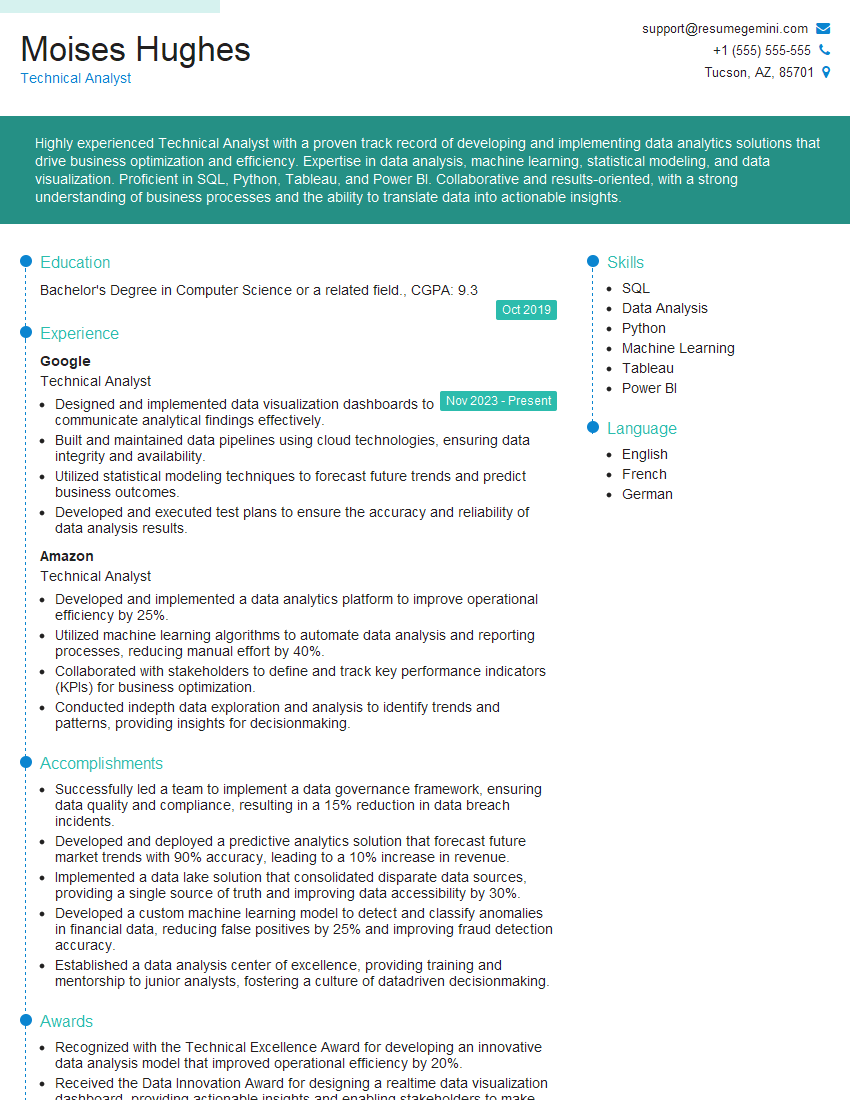

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Technical Analyst

1. What are the key responsibilities of a Technical Analyst?

The key responsibilities of a Technical Analyst include:

- Identify and analyze market trends, patterns and opportunities.

- Develop trading strategies and recommendations based on technical analysis.

- Monitor market data and identify potential investment opportunities.

- Provide trading recommendations and insights to clients.

- Stay up-to-date on the latest market trends and developments.

2. What are the different types of technical analysis?

Fundamental Analysis

- Examines the underlying economic and financial factors that affect a company’s performance.

- Uses financial ratios, earnings reports, and economic indicators.

Technical Analysis

- Focuses on the study of historical price and volume data to identify trends and patterns.

- Uses charts and indicators to identify potential trading opportunities.

Quantitative Analysis

- Uses mathematical and statistical models to analyze financial data.

- Can be used to predict future trends and identify potential investment opportunities.

3. What are the different types of technical indicators?

There are many different types of technical indicators, but some of the most common include:

- Moving averages

- Bollinger Bands

- Relative Strength Index (RSI)

- Stochastic oscillator

- Fibonacci retracement levels

4. How do you use technical analysis to identify trading opportunities?

Technical analysis can be used to identify trading opportunities by identifying trends, patterns, and support and resistance levels.

- Trends: Technical analysts identify trends by looking at the direction of the market over time. An uptrend is characterized by higher highs and higher lows, while a downtrend is characterized by lower highs and lower lows.

- Patterns: Technical analysts also look for patterns in the market, such as head and shoulders patterns, double tops and bottoms, and triangles. These patterns can indicate potential reversals or continuations in the trend.

- Support and Resistance Levels: Support levels are prices at which the market has difficulty falling below, while resistance levels are prices at which the market has difficulty rising above. Technical analysts use support and resistance levels to identify potential trading opportunities.

5. What are the risks of using technical analysis?

There are several risks associated with using technical analysis, including:

- False Signals: Technical analysis can generate false signals, which can lead to losses. For this reason, it is important to use a variety of technical indicators and to combine technical analysis with other methods of market analysis.

- Lagging Indicators: Technical indicators are lagging indicators, which means that they are based on historical data. This can make them less effective in identifying short-term trading opportunities.

- Subjectivity: Technical analysis is subjective, and different analysts can interpret the same data in different ways. This can lead to different trading decisions and results.

6. What are some of the challenges of being a Technical Analyst?

Some of the challenges of being a Technical Analyst include:

- The market is constantly changing: Technical Analysts must be able to keep up with the latest market trends and developments.

- There is a lot of information to analyze: Technical Analysts must be able to sift through a large amount of data and identify the most relevant information.

- Technical analysis can be complex: Technical Analysts must have a good understanding of the different types of technical indicators and how to use them effectively.

7. What are your favorite technical indicators and why?

Some of my favorite technical indicators include:

- Moving averages: Moving averages are a simple but effective way to identify trends. They can also be used to identify support and resistance levels.

- Bollinger Bands: Bollinger Bands are a volatility indicator that can help to identify potential trading opportunities. They can also be used to identify overbought and oversold conditions.

- Relative Strength Index (RSI): The RSI is a momentum indicator that can help to identify potential reversals in the trend.

8. What are your thoughts on the use of artificial intelligence (AI) in technical analysis?

I believe that AI has the potential to revolutionize technical analysis. AI can be used to automate the process of analyzing market data and identifying trading opportunities. This can help to reduce the risks associated with technical analysis and make it more accessible to a wider range of investors.

9. What are your career goals?

My career goals are to become a successful Technical Analyst and to help my clients achieve their financial goals. I am also interested in developing new and innovative ways to use technical analysis to identify trading opportunities.

10. Why should we hire you?

I believe that I am the best candidate for this position because I have the skills and experience that you are looking for. I am a highly motivated and results-oriented individual with a strong understanding of technical analysis. I am also a team player and I am able to work independently.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Technical Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Technical Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Technical Analysts are responsible for evaluating and interpreting technical data to identify investment opportunities. Key responsibilities include:

1. Data Analysis

Analyzing large datasets using statistical and mathematical techniques to identify trends, patterns, and relationships.

- Using data visualization tools to present findings in a clear and concise manner.

- Identifying potential investment opportunities and developing trading strategies based on their analysis.

2. Market Research

Conducting thorough research on relevant markets, industries, and companies to gain insights into their financial health and future prospects.

- Tracking economic indicators and industry trends to anticipate market movements.

- Developing models to forecast stock prices and identify undervalued or overvalued securities.

3. Risk Management

Assessing potential risks and developing strategies to mitigate losses associated with investment decisions.

- Implementing stop-loss orders and other risk-management techniques.

- Monitoring portfolio performance and adjusting strategies as needed to manage risk.

4. Client Communication

Providing clear and timely communication to clients regarding investment strategies, market updates, and performance results.

- Preparing and presenting investment recommendations to clients based on their financial goals and risk tolerance.

- Building and maintaining strong client relationships.

Interview Tips

Preparing for an interview for a Technical Analyst role requires not only a strong understanding of the job responsibilities but also the ability to demonstrate your analytical skills and market knowledge. Here are some effective tips to help you ace the interview:

1. Showcase Your Analytical Abilities

Highlight your expertise in data analysis, statistical modeling, and technical trading indicators. Use examples from your experience to demonstrate your ability to identify trends, patterns, and potential investment opportunities.

- Discuss projects where you used data visualization tools to present findings and communicate complex technical concepts clearly.

- Explain how you have successfully applied statistical and mathematical techniques to develop trading strategies or forecast stock prices.

2. Demonstrate Your Market Knowledge

Emphasize your deep understanding of the relevant markets, industries, and companies. Show that you are up-to-date on economic indicators and industry trends and can provide insights into their impact on investment decisions.

- Discuss examples where you have conducted thorough market research to identify undervalued or overvalued securities.

- Explain how you have used your knowledge of market dynamics to develop accurate financial forecasts.

3. Highlight Your Risk Management Skills

Emphasize your ability to assess and manage investment risks effectively. Explain how you have implemented risk-management techniques, such as stop-loss orders or portfolio diversification, to mitigate potential losses.

- Provide examples where you have developed and implemented risk management strategies that successfully protected client investments.

- Discuss your understanding of different risk metrics and how you use them to make informed investment decisions.

4. Enhance Your Communication Skills

Technical Analysts must be able to communicate their findings and recommendations clearly and effectively to clients. During the interview, demonstrate your strong communication skills by providing clear and concise responses to questions.

- Prepare examples of how you have presented complex technical information to clients in a manner they could easily understand.

- Explain how you build and maintain strong client relationships through effective communication and client service.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Technical Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!