Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Telephone Claims Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

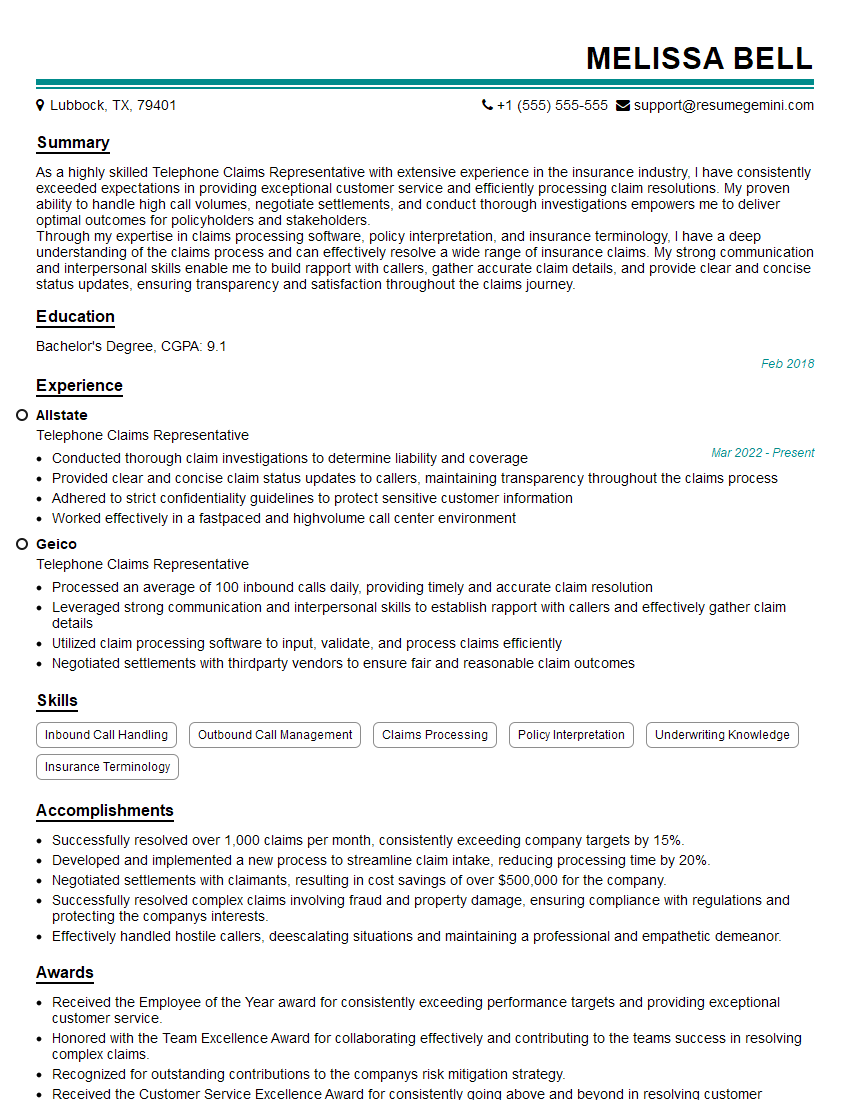

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Telephone Claims Representative

1. What is the process for handling a claim that involves property damage?

- Gather information about the claim, including the date, time, and location of the incident, as well as the names and contact information of the involved parties.

- Inspect the damaged property to assess the extent of the damage.

- Determine liability for the incident.

- Negotiate a settlement with the claimant.

- Authorize payment for the claim.

2. How do you determine the value of a claim?

Factors considered

- The extent of the damage

- The cost of repairs or replacement

- The age and condition of the property

- The value of the property

- The availability of comparable properties

Methods used

- Comparable sales analysis

- Cost approach

- Income approach

3. What are some of the challenges you have faced in your previous role as a Telephone Claims Representative?

- Dealing with difficult claimants

- Determining liability for complex claims

- Negotiating settlements that are fair to both the claimant and the insurance company

4. What are some of the qualities that make a successful Telephone Claims Representative?

- Excellent communication skills

- Strong negotiation skills

- Empathy and understanding

- Attention to detail

- Problem-solving skills

5. What is your experience with insurance regulations?

- Experience in handling claims involving property damage, bodily injury, and liability

- Knowledge of state insurance laws and regulations

- Experience in working with insurance companies and their adjusters

6. What is your experience with using insurance software?

- Experience in using insurance software to process claims

- Experience in using insurance software to generate reports

- Experience in using insurance software to track claims status

7. What is your experience with handling subrogation claims?

- Experience in identifying and pursuing subrogation claims

- Experience in negotiating settlements with third parties

- Experience in recovering funds for the insurance company

8. What is your experience with handling fraud claims?

- Experience in identifying and investigating fraud claims

- Experience in working with law enforcement and other agencies

- Experience in prosecuting fraud claims

9. What is your experience with handling workers’ compensation claims?

- Experience in handling workers’ compensation claims from start to finish

- Experience in negotiating settlements with injured workers and their attorneys

- Experience in representing the insurance company at hearings

10. What are your salary expectations?

- Research the average salary for Telephone Claims Representatives in your area

- Consider your experience and qualifications

- Be prepared to negotiate

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Telephone Claims Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Telephone Claims Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Telephone Claims Representatives are responsible for handling incoming phone calls from policyholders and claimants, and providing customer service and support. The key job responsibilities of a Telephone Claims Representative include:

1. Answering and screening incoming phone calls

Telephone Claims Representatives are responsible for answering and screening incoming phone calls from policyholders and claimants. They must be able to quickly and efficiently determine the nature of the call and route it to the appropriate person or department.

2. Taking and processing claims

Telephone Claims Representatives are responsible for taking and processing claims. They must be able to gather all of the necessary information from the caller, including their policy number, the date of the incident, and the details of the claim. They must also be able to process the claim and issue payment.

3. Providing customer service and support

Telephone Claims Representatives are responsible for providing customer service and support to policyholders and claimants. They must be able to answer questions, resolve complaints, and provide information about the claims process. They must also be able to build rapport with callers and make them feel comfortable.

4. Maintaining accurate records

Telephone Claims Representatives are responsible for maintaining accurate records of all claims they process. They must be able to keep track of the status of each claim and provide updates to policyholders and claimants as needed.

Interview Tips

Here are some interview tips to help you ace your interview for a Telephone Claims Representative position:

1. Research the company and the position

Before your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and the specific requirements of the job. You can find information about the company on their website, social media pages, and Glassdoor.

2. Practice your answers to common interview questions

There are a few common interview questions that you are likely to be asked during your interview for a Telephone Claims Representative position. These questions include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- How do you handle difficult customers?

- What is your experience with claims processing?

Take some time to practice your answers to these questions so that you can deliver them confidently and concisely during your interview.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time for your interview. Arriving late will show the interviewer that you are not taking the interview seriously.

4. Be yourself and be enthusiastic

The most important thing is to be yourself and be enthusiastic during your interview. The interviewer wants to get to know you and see if you are a good fit for the position. So, relax, be yourself, and show the interviewer why you are the best person for the job.

Next Step:

Now that you’re armed with the knowledge of Telephone Claims Representative interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Telephone Claims Representative positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini