Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Teller Supervisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Teller Supervisor so you can tailor your answers to impress potential employers.

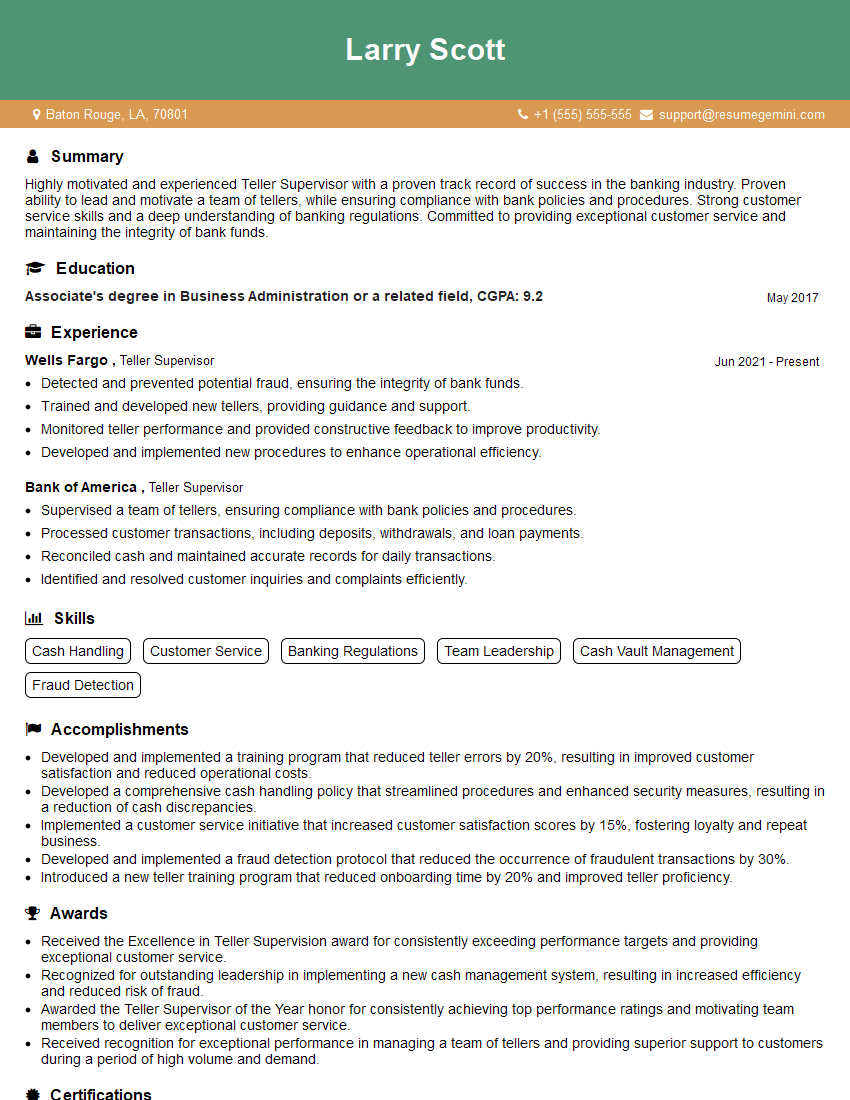

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Teller Supervisor

1. Describe the key responsibilities of a Teller Supervisor.

- Supervise and manage a team of tellers, ensuring efficient and accurate transactions

- Train and develop tellers, providing them with the necessary skills and knowledge to excel in their roles

- Maintain a safe and secure work environment, adhering to all bank policies and procedures

- Monitor teller performance, identify areas for improvement, and provide constructive feedback

- Resolve customer issues and complaints in a timely and professional manner

2. What are the key qualities and skills required to be an effective Teller Supervisor?

Interpersonal skills

- Excellent communication and interpersonal skills

- Ability to build and maintain positive relationships with customers and colleagues

- Empathy and understanding in dealing with customer concerns

Technical skills

- Thorough understanding of banking operations and procedures

- Proficient in using banking software and equipment

- Knowledge of cash handling and fraud prevention techniques

Leadership skills

- Strong leadership and motivational skills

- Ability to set clear expectations and provide guidance to tellers

- Create a positive and supportive work environment

3. How would you handle a situation where a customer is upset and demanding to speak to a manager?

- Remain calm and professional, even in the face of an upset customer

- Actively listen to the customer’s concerns and try to understand their perspective

- Emphasize with the customer and apologize for any inconvenience they may have experienced

- If necessary, escalate the issue to a manager, but only after attempting to resolve it yourself

- Follow up with the customer after the issue has been resolved to ensure their satisfaction

4. How would you motivate and engage a team of tellers?

- Set clear goals and expectations for tellers

- Recognize and reward achievements and good performance

- Provide opportunities for professional development and growth

- Foster a positive and supportive work environment

- Encourage teamwork and collaboration among tellers

5. How do you maintain a high level of customer service in a busy banking environment?

- Train tellers on the importance of providing excellent customer service

- Empower tellers to make decisions and resolve customer issues

- Monitor customer interactions and provide feedback to tellers

- Use technology to enhance the customer experience, such as online banking and mobile apps

- Create a welcoming and inviting atmosphere in the banking environment

6. What are some common challenges faced by Teller Supervisors, and how would you address them?

- High turnover rate: Provide competitive compensation and benefits, create a positive work environment, and offer opportunities for professional development

- Lack of motivation among tellers: Set clear goals and expectations, recognize and reward achievements, and foster a sense of teamwork

- Fraud prevention: Implement strong security measures, train tellers on fraud prevention techniques, and stay up-to-date on the latest fraud trends

- Customer complaints: Establish a clear process for handling customer complaints, train tellers on how to resolve issues effectively, and follow up with customers to ensure satisfaction

- Compliance with regulations: Stay up-to-date on all banking regulations and ensure that the branch is operating in compliance

7. How would you stay up-to-date on the latest banking trends and regulations?

- Attend industry conferences and workshops

- Read trade publications and online resources

- Network with other banking professionals

- Take advantage of training and development opportunities offered by the bank

- Stay informed about regulatory changes through official channels

8. What is your understanding of the role of technology in the banking industry?

- Technology is revolutionizing the banking industry, providing new opportunities to enhance customer service and efficiency

- Banks are increasingly using technology to automate tasks, reduce costs, and improve risk management

- As a Teller Supervisor, I believe it is important to embrace technology and stay up-to-date on the latest trends

- I am excited about the potential of technology to transform the banking experience for both customers and employees

9. What are your career goals and how does this position fit into your long-term plans?

- My long-term career goal is to become a Branch Manager

- I believe that the Teller Supervisor position is an excellent opportunity for me to develop the skills and experience necessary to achieve this goal

- In this role, I will gain valuable experience in managing a team, providing customer service, and ensuring compliance with regulations

- I am confident that I have the skills and motivation to succeed in this position and contribute to the success of your bank

10. Do you have any questions for me about the position or the bank?

- What are the key performance indicators for this role?

- What opportunities are there for professional development and advancement within the bank?

- What is the bank’s culture like?

- What are the bank’s goals for the next year?

- What is the bank’s commitment to customer service?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Teller Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Teller Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Teller Supervisors are responsible for overseeing and managing a team of tellers in a financial institution. Key job responsibilities include:

1. Managing and Coaching Staff

Supervising, training, and coaching tellers on cash handling procedures, customer service, and compliance.

- Leading and motivating a team to achieve performance goals.

- Providing performance feedback and developing improvement plans

2. Cash Handling and Operations

Ensuring proper cash handling procedures, including counting, verifying, and reconciling cash transactions.

- Maintaining accurate cash records and balancing daily transactions.

- Safeguarding cash and other valuables, following security protocols.

3. Customer Service and Sales

Providing excellent customer service, resolving customer inquiries, and cross-selling financial products.

- Identifying customer needs and recommending appropriate products.

- Handling customer complaints and resolving issues promptly

4. Compliance and Risk Management

Ensuring compliance with bank regulations, policies, and procedures.

- Identifying and reporting suspicious activities or potential fraud.

- Maintaining a safe and secure work environment.

Interview Tips

Preparing thoroughly for a Teller Supervisor interview is crucial. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the financial institution, its products, and the specific responsibilities of a Teller Supervisor.

- Check the company website and annual reports for information.

- Use industry news and articles to stay updated on current trends.

2. Highlight Relevant Skills and Experience

Emphasize your skills in cash handling, customer service, leadership, and compliance.

- Provide specific examples that demonstrate your ability to manage a team, resolve customer issues, and handle financial transactions.

- Quantify your accomplishments whenever possible, using metrics and data.

3. Prepare for Common Interview Questions

Practice answering common interview questions related to your skills, experience, and qualifications.

- Examples include questions about your leadership style, motivation, and ability to handle stress.

- Prepare concise and compelling answers that showcase your strengths.

4. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview demonstrates your interest and engagement.

- Inquire about the bank’s culture, growth opportunities, or any upcoming projects.

- This shows that you are proactive and eager to learn more about the organization.

5. Practice and Seek Feedback

Practice your interview responses with a friend, family member, or career counselor.

- They can provide constructive feedback on your delivery, tone, and content.

- Use this feedback to refine your answers and improve your confidence.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Teller Supervisor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.