Feeling lost in a sea of interview questions? Landed that dream interview for Tellers Supervisor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Tellers Supervisor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

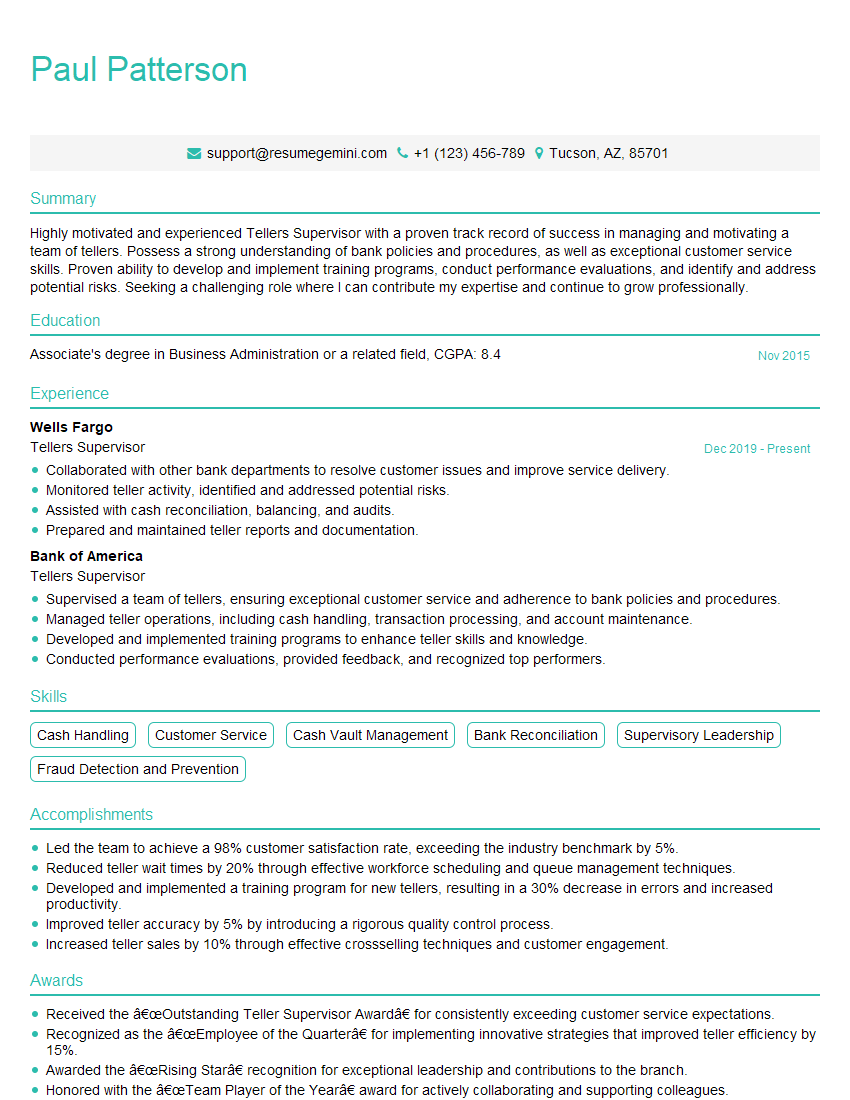

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tellers Supervisor

1. Describe your understanding of the role of a Teller Supervisor?

The Teller Supervisor plays a vital role in the bank’s operations by overseeing a team of tellers and ensuring the smooth functioning of daily transactions. Their responsibilities include:

- Managing the daily operations of the teller line, including cash handling, account inquiries, and customer service

- Providing guidance and support to tellers, resolving customer issues, and ensuring compliance with bank policies and procedures

- Monitoring teller performance, coaching and training staff, and addressing any performance concerns

- Balancing cash drawers, verifying deposits, and reconciling daily transactions to ensure accuracy

- Maintaining a positive and professional work environment, promoting teamwork, and fostering a customer-centric approach

2. How do you prioritize and manage multiple tasks effectively in a fast-paced environment?

Time Management Strategies

- Utilizing to-do lists and prioritizing tasks based on urgency and importance

- Delegating tasks to tellers and monitoring progress to ensure timely completion

- Streamlining processes and implementing technology to enhance efficiency

- Communicating effectively with tellers to clarify expectations and provide regular updates

Team Collaboration

- Fostering a supportive work environment where tellers feel comfortable asking for assistance

- Regularly monitoring teller performance and providing feedback to identify areas for improvement

- Organizing team meetings to discuss challenges, share best practices, and improve team dynamics

3. How do you handle customer complaints or difficult situations while maintaining a positive and professional demeanor?

When addressing customer complaints or difficult situations, it is crucial to maintain a positive and professional demeanor while effectively resolving the issue. Here’s how I approach such situations:

- Active Listening: Listening attentively to the customer’s concerns, acknowledging their feelings, and showing empathy

- Communication: Communicating clearly and respectfully, explaining the situation, and outlining potential solutions

- Problem-Solving: Working collaboratively with the customer to find a mutually acceptable resolution and addressing their concerns promptly

- Documentation: Documenting the complaint, resolution, and follow-up actions to ensure accuracy and accountability

- Follow-Up: Following up with the customer after the issue has been resolved to ensure their satisfaction and build rapport

4. Describe your experience in training and developing tellers to enhance their skills and performance.

- Identifying training needs through performance evaluations and customer feedback

- Developing and implementing training programs to address specific skill gaps

- Providing on-the-job training and coaching to reinforce learning and improve performance

- Evaluating training effectiveness through regular assessments and feedback

- Promoting a culture of continuous learning and professional development

5. How do you motivate and empower your team to provide excellent customer service?

- Recognition and Appreciation: Recognizing and rewarding tellers for their efforts and contributions to team success

- Empowerment: Granting tellers the authority to resolve customer issues within established guidelines

- Feedback and Coaching: Providing regular feedback and coaching to help tellers identify areas for improvement and enhance their skills

- Team Building Activities: Organizing team-building activities to foster camaraderie and improve communication

- Customer Success Stories: Sharing positive customer feedback and success stories to motivate the team and reinforce the importance of customer satisfaction

6. How do you stay up-to-date with industry regulations and best practices related to banking operations?

- Attending industry conferences and workshops

- Reading industry publications and online resources

- Participating in professional development programs and certifications

- Consulting with experts and regulatory bodies

- Encouraging tellers to stay informed and report any potential compliance concerns

7. Describe your experience in implementing new policies and procedures to improve efficiency and reduce risk within the teller operations.

- Conducting thorough risk assessments to identify potential vulnerabilities

- Developing and implementing policies and procedures to address identified risks

- Training tellers on new policies and procedures to ensure compliance and understanding

- Monitoring the effectiveness of implemented measures and making necessary adjustments

- Collaborating with other departments to ensure alignment and minimize disruption

8. How do you ensure that all cash transactions are processed accurately and accounted for?

- Establishing clear procedures for cash handling and accounting

- Training tellers on proper cash handling techniques and fraud prevention measures

- Conducting regular cash audits and reconciliations to ensure accuracy

- Implementing technology solutions to streamline cash processing and reduce errors

- Monitoring teller performance and investigating any discrepancies or suspicious activities

9. Describe your approach to maintaining a secure and compliant work environment for both tellers and customers.

- Enforcing strict security measures to protect customer information and assets

- Training tellers on security protocols and fraud prevention techniques

- Implementing physical security measures such as surveillance cameras and access control

- Regularly reviewing and updating security procedures to address emerging threats

- Fostering a culture of vigilance and reporting suspicious activities

10. How do you measure and evaluate the performance of your team and individual tellers?

- Establishing clear performance metrics aligned with bank goals

- Conducting regular performance evaluations to assess strengths and areas for improvement

- Providing tellers with specific feedback and coaching to support their development

- Utilizing data analysis to identify trends and patterns in teller performance

- Recognizing and rewarding tellers for exceptional performance and contributions

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tellers Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tellers Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Tellers Supervisor is responsible for the smooth operation of the teller line, ensuring that customers are served in a timely and courteous manner. They must have a strong understanding of bank policies and procedures, and be able to effectively train and supervise tellers.

1. Supervise and Train Tellers

The Tellers Supervisor is responsible for training and supervising tellers, ensuring that they are performing their duties in accordance with bank policies and procedures.

- Train and develop tellers on bank policies, procedures, and products.

- Observe and evaluate teller performance, providing feedback and coaching to improve performance.

2. Manage Teller Line Operations

The Tellers Supervisor is responsible for managing the teller line operations, ensuring that customers are served in a timely and courteous manner.

- Monitor teller line traffic and adjust staffing levels as needed.

- Resolve customer issues and complaints.

3. Maintain Branch Security

The Tellers Supervisor is responsible for maintaining branch security, ensuring that all policies and procedures are followed.

- Monitor branch security cameras and alarms.

- Report any suspicious activity to management.

4. Maintain Compliance with Regulations

The Tellers Supervisor is responsible for maintaining compliance with all applicable laws and regulations.

- Review and understand all applicable laws and regulations.

- Implement and maintain compliance programs.

Interview Tips

To ace your interview for a Tellers Supervisor position, it is important to be well-prepared. Here are a few tips to help you succeed:

1. Research the Company and Position

Before the interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals, and tailor your answers to the specific requirements of the position.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully and identify the key skills and experience required.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions beforehand so that you can deliver them confidently and concisely.

- Prepare a brief, 30-second to 1-minute overview of your experience and qualifications.

- Think about why you are interested in the position and the company, and be prepared to articulate your reasons.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience in the financial industry, particularly your experience in supervising tellers. Be prepared to discuss your responsibilities, accomplishments, and how they have prepared you for this role.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Focus on your skills and experience that are most relevant to the position you are applying for.

4. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the company. This shows that you are interested in the opportunity and that you are taking the interview seriously.

- Ask about the company’s culture, values, and goals.

- Ask about the specific responsibilities of the position.

Next Step:

Now that you’re armed with the knowledge of Tellers Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tellers Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini