Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Title Department Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

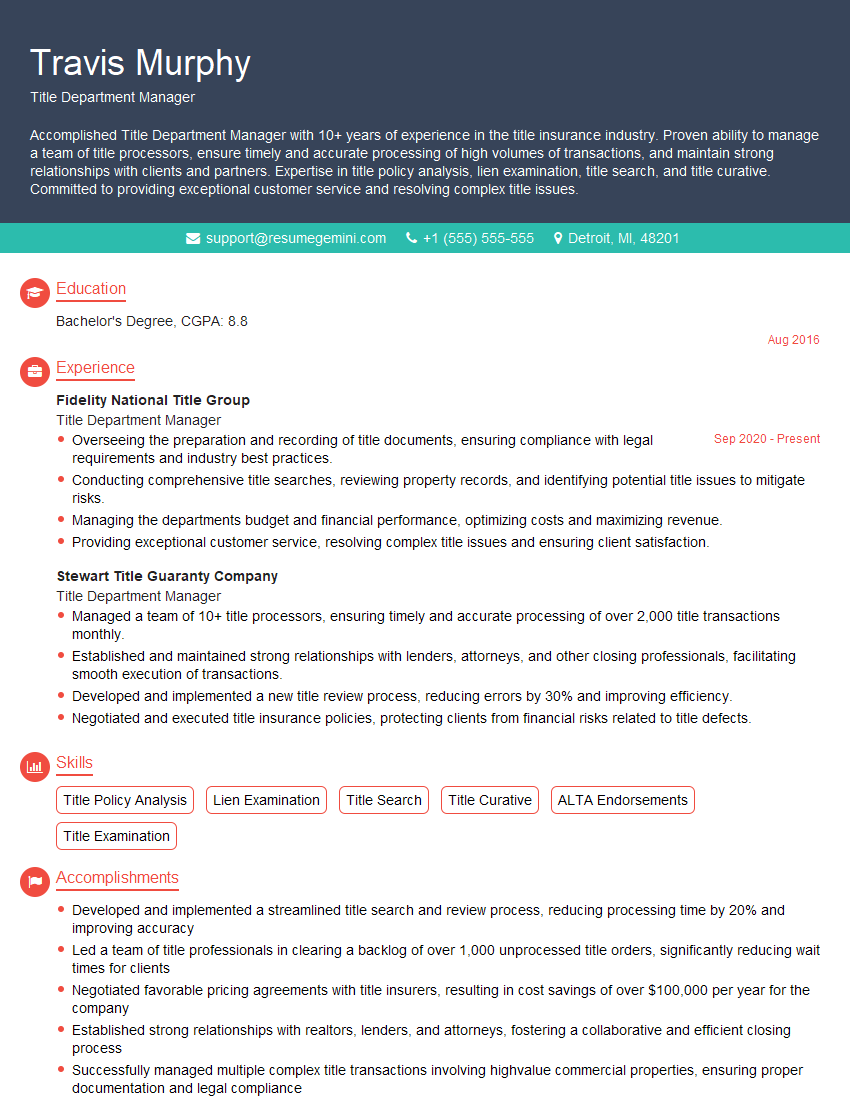

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Department Manager

1. What are the essential steps involved in the title transfer process?

The title transfer process involves several crucial steps:

- Verification of Ownership: Confirming the legal ownership of the property through title search and documentation review.

- Preparation of Title Documents: Drafting the deed, mortgage, and other necessary legal documents to transfer ownership.

- Execution of Documents: Obtaining signatures from the buyer and seller on the prepared documents.

- Recording of Documents: Submitting the executed documents to the relevant government agency for official recording.

- Disbursement of Funds: Facilitating the transfer of funds from the buyer to the seller and other parties involved.

2. How do you handle title disputes and resolve title defects?

Dispute Resolution:

- Identify the nature of the dispute and gather evidence to support the client’s position.

- Communicate with the opposing party and attempt to negotiate a resolution.

- If necessary, file a legal action to protect the client’s rights.

Defect Resolution:

- Analyze the title report to identify any defects or encumbrances.

- Conduct research to obtain necessary documentation or legal remedies.

- Work with attorneys and other professionals to resolve defects and ensure a clear title.

3. What are the different types of title insurance policies available?

- Owner’s Title Insurance: Protects the owner against financial loss due to title defects or liens on the property.

- Lender’s Title Insurance: Protects the lender against financial loss in case of a defective title.

- Reissue Rate Reduction Endorsement (RRRE): Provides a discount on title insurance premiums for subsequent transactions.

- ALTA Endorsements: Additional endorsements that enhance the coverage of title insurance policies.

4. What are the key considerations when determining the insurability of a title?

- Clear Title History: A thorough title search to ensure there are no outstanding liens, judgments, or other encumbrances.

- Proper Legal Description: An accurate legal description of the property to avoid any boundary disputes.

- Marketable Title: The property should be free from any defects or restrictions that would prevent its sale or use.

- Compliance with Zoning Laws: Verifying that the property’s use complies with local zoning regulations.

- Environmental Concerns: Assessing any potential environmental issues that could affect the value or insurability of the property.

5. How do you manage a team of title examiners and processors?

- Delegation of Responsibilities: Assigning tasks and responsibilities to team members based on their skills and experience.

- Establish Clear Processes: Implementing standardized procedures to ensure efficiency and accuracy.

- Communication and Collaboration: Fostering clear communication within the team and with external parties.

- Training and Development: Providing training and support to enhance team members’ knowledge and skills.

- Performance Monitoring: Regularly evaluating team performance and providing constructive feedback.

6. What are the common challenges faced by title department managers?

- Title Defects and Disputes: Identifying and resolving title defects and disputes that can delay or even halt real estate transactions.

- High Volume of Transactions: Managing a large number of transactions efficiently while maintaining accuracy and meeting deadlines.

- Regulatory Changes: Keeping up with evolving laws and regulations that impact title insurance and real estate transactions.

- Fraud and Forgery: Mitigating the risks associated with fraudulent documents and forged signatures.

- Technology Integration: Adapting to new technologies and software that streamline title processes.

7. How do you stay updated on the latest advancements in title insurance and real estate law?

- Continuing Education: Attending conferences, seminars, and webinars to stay abreast of industry trends and legal developments.

- Professional Organizations: Actively participating in professional organizations such as ALTA and NSPS to connect with industry experts and gain insights.

- Industry Publications: Reading industry publications, such as Title News and Land Title, to stay informed about advancements.

- Online Resources: Utilizing online resources provided by title insurance companies and legal databases.

- Networking and Collaboration: Engaging with other title professionals and attorneys to exchange knowledge and best practices.

8. What are your thoughts on the impact of technology on the title insurance industry?

- Increased Efficiency: Automation and digital tools streamline processes, reducing turnaround times and improving accuracy.

- Enhanced Accuracy: Technology helps eliminate human errors and ensures data integrity.

- Improved Communication: Online platforms facilitate seamless communication among title professionals, clients, and other stakeholders.

- Fraud Reduction: Advanced technologies detect and prevent fraud by verifying identities and documents.

- Customer Convenience: Online portals and mobile applications provide convenient access to title services for clients.

9. How do you measure the success of a title department?

- Transaction Volume: High transaction volume indicates a successful and well-functioning department.

- Accuracy and Timeliness: Delivering accurate and timely title reports is crucial for customer satisfaction and business efficiency.

- Customer Satisfaction: Positive feedback from clients is a valuable measure of departmental success.

- Employee Retention: A low employee turnover rate reflects a positive work environment and employee satisfaction.

- Return on Investment (ROI): Calculating the ROI of title department operations to assess profitability and efficiency.

10. What are your key strengths and how would they benefit our company?

- Extensive Title Industry Experience: Deep understanding of title insurance, real estate law, and industry best practices.

- Proven Management Skills: Strong leadership, organizational, and time management abilities to effectively manage a team and operations.

- Excellent Communication Skills: Ability to clearly and effectively communicate with clients, team members, and external stakeholders.

- Problem-Solving and Analytical Abilities: Skilled in identifying and resolving title defects and complex issues.

- Commitment to Excellence: Driven to deliver high-quality services, maintain accuracy, and exceed client expectations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Department Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Department Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Title Department Manager is responsible for overseeing all aspects of the title department, including title searches, title examinations, and the issuance of title insurance. They work closely with real estate agents, attorneys, and lenders to ensure that all transactions are closed smoothly and efficiently.

1. Title Searches

The Title Department Manager is responsible for ensuring that all title searches are conducted thoroughly and accurately. This includes reviewing public records, such as deeds, mortgages, and liens, to identify any potential issues that could affect the title to the property.

- Conduct title searches using various resources, such as public records, title companies, and online databases.

- Review and analyze title search results to identify any liens, encumbrances, or other issues affecting the property’s title.

2. Title Examinations

Once a title search has been completed, the Title Department Manager will perform a title examination. This involves reviewing the title search results and identifying any potential issues that could affect the insurability of the title. The Title Department Manager will then work with the title insurance company to resolve any issues and ensure that the title is clear.

- Examine title search results to determine the marketability and insurability of the property’s title.

- Identify and resolve any title defects or encumbrances that may affect the property’s title.

3. Issuance of Title Insurance

Once the title has been cleared, the Title Department Manager will issue a title insurance policy. This policy protects the lender and the homeowner from any financial losses that may result from a defect in the title. The Title Department Manager will work with the title insurance company to ensure that the policy is issued correctly and that all of the necessary requirements are met.

- Issue title insurance policies to protect lenders and homeowners against financial losses due to title defects.

- Explain title insurance policies to clients and answer their questions.

4. Supervision of Staff

The Title Department Manager is responsible for supervising a team of title examiners and other staff. This includes training new employees, providing ongoing support, and ensuring that all staff members are meeting the company’s standards.

- Supervise and manage a team of title examiners and other staff members.

- Provide training and support to staff to ensure they are knowledgeable and efficient in their roles.

Interview Tips

Preparing for an interview can be daunting, but following a few simple tips can help you increase your chances of success.

1. Research the Company

Before your interview, take some time to research the company. This will help you understand their business, their culture, and their values. You can find information about the company on their website, in their annual report, or in articles about the company. Knowing more about the company will help you answer questions intelligently and show that you’re interested in the position.

- Visit the company’s website to learn about their business, products, and services.

- Read the company’s annual report to get an understanding of their financial performance and their strategic goals.

2. Practice Your Answers

Once you’ve done your research, take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during your interview.

- Practice answering questions about your experience, skills, and qualifications.

- Prepare answers to questions about your career goals and why you’re interested in the position.

3. Dress Professionally

First impressions matter, so make sure you dress professionally for your interview. This means wearing a suit or other business attire. You should also make sure your clothes are clean and pressed. Dressing professionally will show the interviewer that you’re taking the interview seriously.

- Wear a suit or other business attire to your interview.

- Make sure your clothes are clean and pressed.

4. Be on Time

Punctuality is important, so make sure you arrive for your interview on time. If you’re running late, call the interviewer to let them know. Being on time will show the interviewer that you’re respectful of their time.

- Arrive for your interview on time.

- If you’re running late, call the interviewer to let them know.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Title Department Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.