Are you gearing up for an interview for a Title Inspector position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Title Inspector and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

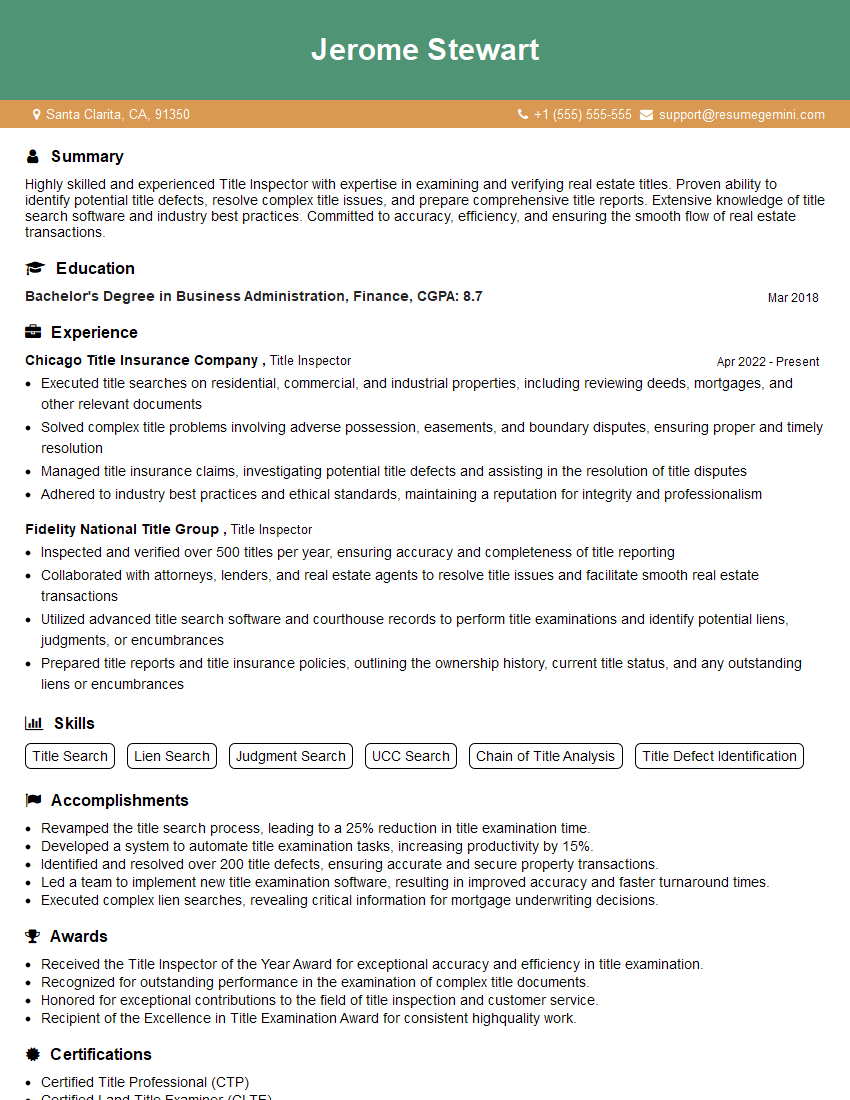

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Inspector

1. Explain the process of title examination?

The title examination process involves several steps to ensure the validity and accuracy of a property’s title:

- Review of Legal Description: Examining the property’s legal description to ensure it accurately identifies the boundaries and location of the property.

- Chain of Title Search: Tracing the history of ownership of the property through deeds, mortgages, and other legal documents to establish a clear and unbroken chain of title.

- Identification of Encumbrances: Searching for any liens, judgments, easements, or other encumbrances that may affect the property’s title and marketability.

- Analysis of Exceptions: Reviewing any exceptions or reservations noted in previous deeds to determine their impact on the property’s title.

- Verification of Current Ownership: Confirming the identity of the current owner and ensuring that they have the legal right to convey the property.

- Preparation of Title Report: Summarizing the findings of the title examination and providing an assessment of the property’s title status, including any defects or concerns.

2. What are the different types of title insurance policies available?

Owner’s Policy:

- Protects the homeowner from financial loss if there is a defect in the title.

- Covers issues that existed before the policy was issued.

Lender’s Policy:

- Protects the lender’s interest in the property if there is a defect in the title.

- Covers issues that existed before the policy was issued.

3. What are the common title defects that you have encountered in your experience?

Some common title defects I have encountered include:

- Unrecorded Deeds: Deeds that have not been properly recorded in the public record, potentially creating a gap in the chain of title.

- Forged Documents: Fraudulent or altered deeds or mortgages that purport to convey ownership or create liens.

- Undisclosed Heirs: Unknown heirs or beneficiaries who may have an interest in the property that is not reflected in the title records.

- Boundary Disputes: Disputes over the exact location of property boundaries, which can affect ownership and usage rights.

- Encroachments: Structures or improvements that extend beyond the legal boundaries of a property.

4. How do you handle a title search with missing or incomplete records?

When dealing with missing or incomplete records in a title search, I take the following steps:

- Consult with Historical Records: Review old maps, deeds, and other historical documents to gather information about the property’s ownership history.

- Utilize Public Notices: Search for public notices, such as legal notices or foreclosures, that may provide additional details about the title.

- Conduct Interviews: Talk to current and former owners, neighbors, and local officials to gather information about the property and its history.

- Consider Affidavits: Obtain sworn statements from individuals with knowledge of the property’s ownership to establish facts that are not documented.

- Seek Legal Advice: If necessary, consult with an attorney who specializes in title law to obtain guidance and legal remedies.

5. Explain the concept of adverse possession and how it can affect title?

Adverse possession is a legal doctrine that allows a person to gain ownership of property by possessing it openly, notoriously, exclusively, and continuously for a specified period of time, even without a legal title.

Adverse possession can affect title by:

- Extinguishing the Original Owner’s Title: If an adverse possessor meets the legal requirements, they can gain legal title to the property, extinguishing the rights of the original owner.

- Creating a Cloud on the Title: Even if an adverse possession claim is not successful, it can still create a cloud on the title, making it difficult to sell or refinance the property.

6. What are the ethical considerations that you must adhere to as a title inspector?

As a title inspector, I am guided by the following ethical considerations:

- Confidentiality: Maintain the privacy of sensitive information obtained during title searches and examinations.

- Objectivity: Conduct thorough and unbiased examinations, regardless of the parties involved or the outcome desired.

- Conflict of Interest: Avoid any situations where personal or financial interests may compromise my professional objectivity.

- Competence: Maintain a high level of knowledge and skill in title examination practices, and continually seek professional development.

- Accuracy and Transparency: Provide accurate and transparent reports that clearly communicate the findings of the title examination.

7. Describe a complex title issue that you successfully resolved?

I once encountered a title issue involving a property that had been subdivided multiple times, resulting in several overlapping deeds and conflicting ownership claims.

To resolve the issue, I:

- Conducted a Thorough Title Search: Examined all available deeds, mortgages, and other documents to establish the chain of title and identify the conflicting claims.

- Identified the Root of the Problem: Pinpointed the point in time where the overlapping deeds originated and traced the ownership history back to that point.

- Communicated with the Involved Parties: Contacted the current owners and claimants to gather their perspectives and resolve any disputes amicably.

- Worked with an Attorney: Collaborated with a title attorney to prepare legal documents to rectify the overlapping claims and establish clear ownership.

8. How do you stay up-to-date with changes in real estate laws and title regulations?

To stay up-to-date with changes in real estate laws and title regulations, I:

- Attend Industry Conferences and Webinars: Participate in industry events to hear from experts and learn about the latest developments.

- Subscribe to Legal and Real Estate Publications: Read trade magazines, journals, and online resources to stay informed about legal and regulatory updates.

- Network with Professionals: Connect with other title inspectors, attorneys, and real estate agents to exchange knowledge and insights.

- Complete Continuing Education Courses: Regularly participate in educational programs to enhance my knowledge and skills.

9. Explain the importance of title insurance and how it protects property owners?

Title insurance is a form of insurance that protects property owners from financial losses due to defects in their property’s title.

Title insurance is important because it:

- Covers Unforeseen Title Issues: Protects against title defects that may not be discovered during a title search, such as undisclosed heirs or forged documents.

- Provides Peace of Mind: Gives property owners confidence that their title is clear and marketable.

- Facilitates Property Sales: Lenders typically require title insurance as a condition of approving a mortgage, ensuring a smooth and secure transaction.

10. Describe your experience in using title search software and technology?

I am proficient in using various title search software and technology, including:

- Title Plant Software: Access and analyze vast databases of title records and documents.

- GIS Systems: Utilize geographic information systems to visualize property boundaries and identify potential title issues.

- Automated Title Search Tools: Employ software to automate title searches and expedite the examination process.

- Cloud-Based Platforms: Leverage cloud technology for secure access to title records and collaboration with colleagues.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Inspector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Inspector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Title Inspectors are responsible for examining and verifying the accuracy of real estate titles. They ensure that the property is free of liens, encumbrances, and other legal issues that could affect its ownership or value.

1. Examine and verify real estate titles

Title Inspectors review legal documents, including deeds, mortgages, and liens, to determine the ownership and legal status of a property.

- Identify and resolve any title defects or discrepancies.

- Conduct title searches to uncover any potential issues with the property’s ownership or title.

2. Prepare and issue title reports

Title Inspectors compile and issue detailed title reports that summarize the findings of their title examination.

- Write clear and concise title reports that are easy to understand for clients.

- Provide recommendations on how to resolve any title issues that are discovered.

3. Stay up-to-date on real estate laws and regulations

Title Inspectors must stay abreast of changes in real estate laws and regulations that could impact their work.

- Attend industry conferences and seminars to stay informed about the latest legal developments.

- Read industry publications and legal journals to stay up-to-date on changes in the real estate industry.

4. Work with other professionals involved in real estate transactions

Title Inspectors collaborate with other professionals, such as real estate agents, attorneys, and lenders, to facilitate the smooth closing of real estate transactions.

- Communicate effectively with clients, real estate agents, and other parties involved in the transaction.

- Explain the title examination process and findings to clients in a clear and understandable manner.

Interview Tips

Preparing for a Title Inspector interview can help you present yourself confidently and increase your chances of success. Here are some tips to help you prepare for your interview:

1. Research the company and the position

Learn about the company’s history, culture, and mission. Also, review the job description carefully to understand the specific responsibilities of the Title Inspector position.

- Visit the company’s website and social media pages to gather information about their values and work environment.

- Read industry news and articles to stay informed about the latest trends and developments in the real estate industry.

2. Practice your answers to common interview questions

There are some common interview questions that you are likely to be asked during your Title Inspector interview.

- Tell me about your experience in title examination.

- What are the most important qualities of a successful Title Inspector?

- How do you stay up-to-date on changes in real estate laws and regulations?

3. Prepare questions to ask the interviewer

Asking thoughtful questions at the end of the interview shows that you are interested in the position and the company.

- What is the company’s culture like?

- What are the opportunities for professional development within the company?

- What are the company’s goals for the future?

4. Dress professionally and arrive on time

First impressions matter, so make sure to dress professionally and arrive on time for your interview.

- Wear a suit or business casual attire.

- Be punctual and arrive at the interview location a few minutes early.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Title Inspector interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!