Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Title Investigator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

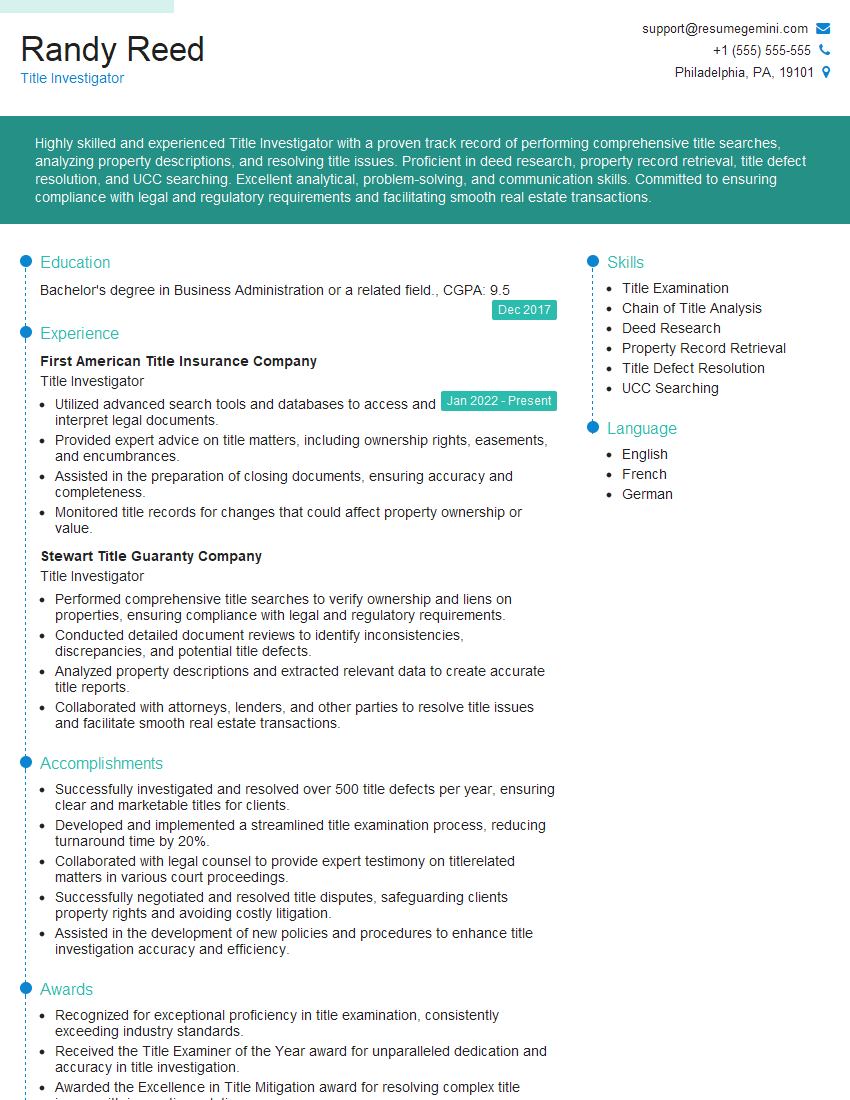

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Investigator

1. What is the difference between a title search and a lien search?

A title search is a comprehensive examination of the public records to determine the ownership and encumbrances of a property. A lien search, on the other hand, is a narrower search that focuses on identifying any liens or other encumbrances that may affect the title to a property.

Title searches are typically more comprehensive and time-consuming than lien searches, and they can reveal a wider range of potential title defects. Lien searches, on the other hand, are more focused and less expensive, and they can provide a quick and easy way to identify any liens or other encumbrances that may affect the title to a property.

2. What are some of the most common title defects?

Common title defects include:

- Forged deeds

- Undisclosed liens

- Encroachments

- Easements

- Restrictive covenants

Other title defects include:

- Boundary disputes

- Zoning violations

- Tax liens

- Mechanic’s liens

- Lis pendens

3. What are some of the most important factors to consider when evaluating a title report?

- The completeness of the search

- The accuracy of the information

- The clarity of the language

- The presence of any title defects

- The overall risk to the lender

4. What are some of the most common types of title insurance?

- Owner’s title insurance protects the homeowner against financial loss if there is a defect in the title to their property.

- Lender’s title insurance protects the lender against financial loss if there is a defect in the title to the property that secures the loan.

- Builder’s title insurance protects the builder against financial loss if there is a defect in the title to the property that they are building.

5. What are some of the most important factors to consider when choosing a title insurance company?

- The financial strength of the company

- The experience of the company

- The reputation of the company

- The cost of the insurance

- The coverage provided by the insurance

6. What are some of the most common mistakes that title investigators make?

- Failing to conduct a thorough search of the public records

- Misinterpreting the information in the public records

- Failing to identify potential title defects

- Issuing a title report that contains errors or omissions

- Failing to properly advise the client of the risks associated with the title

7. What are some of the most important qualities of a successful title investigator?

- Attention to detail

- Analytical skills

- Research skills

- Communication skills

- Customer service skills

8. What are some of the most common challenges that title investigators face?

- The increasing complexity of the real estate market

- The increasing number of title defects

- The need to keep up with the latest changes in the law

- The need to meet the demands of clients

9. What are some of the most important trends in the title insurance industry?

- The increasing use of technology

- The globalization of the real estate market

- The increasing demand for title insurance

- The development of new title insurance products

10. What are your career goals?

- To become a licensed title agent

- To open my own title company

- To become an expert in the field of title insurance

- To help people protect their property rights

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Investigator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Investigator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Title investigators play a crucial role in ensuring the clear and accurate transfer of real estate ownership. Their responsibilities involve meticulously examining and verifying title documents to guarantee that properties are free from any legal encumbrances or ownership disputes.

1. Title Examination

Thoroughly examine title documents, including deeds, mortgages, and liens, to ascertain the rightful ownership of a property and identify potential defects or encumbrances.

- Review title history to trace the chain of ownership and uncover any unresolved claims or disputes.

- Identify and analyze title defects, such as liens, judgments, easements, and boundary disputes, to determine their impact on the property’s value and marketability.

2. Title Report Preparation

Compile and issue comprehensive title reports that summarize the findings of the title examination. These reports provide a detailed account of the property’s ownership status, including any liens, encumbrances, or other relevant information.

- Provide clear and concise explanations of title defects and their potential implications.

- Recommend courses of action to resolve title defects and ensure a smooth property transfer.

3. Risk Assessment and Mitigation

Evaluate title risks associated with a property and develop strategies to minimize them. This involves identifying and addressing potential issues that could affect the property’s value or marketability.

- Analyze title data to identify patterns or trends that indicate potential risks.

- Propose title insurance policies or other measures to protect clients against financial losses resulting from title defects.

4. Client Communication and Consultation

Communicate effectively with clients to provide clear and timely updates on the status of title investigations. Provide expert guidance and advice to clients regarding title-related matters and explain the implications of title defects.

- Build strong relationships with clients by fostering open communication and trust.

- Attend client meetings to discuss title search findings and answer any questions or concerns.

Interview Tips

To ace an interview for a Title Investigator position, it is crucial to prepare thoroughly and showcase your knowledge and skills. Here are some tips to help you succeed:

1. Research the Company and Position

Familiarize yourself with the company’s culture, values, and areas of expertise. Research the specific job requirements and responsibilities to tailor your answers accordingly.

- Visit the company website to learn about their mission, history, and services.

- Read industry publications or articles to stay updated on current trends and best practices in title investigation.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience that align with the job requirements. Quantify your accomplishments and provide specific examples to demonstrate your abilities.

- Showcase your proficiency in title examination, report writing, and risk assessment.

- Mention any successful resolutions of complex title defects or disputes that you have handled.

3. Prepare for Common Interview Questions

Anticipate common interview questions and prepare your answers in advance. Practice delivering your responses clearly and confidently.

- Explain your understanding of title insurance and its role in real estate transactions.

- Describe your approach to identifying and mitigating title risks.

- Discuss a challenging title investigation you have encountered and how you resolved it.

4. Ask Thoughtful Questions

Asking insightful questions demonstrates your interest and engagement. Prepare questions that show your understanding of the industry and alignment with the company’s goals.

- Inquire about the company’s approach to title insurance and risk management.

- Ask about the company’s commitment to customer satisfaction and quality assurance.

- Request information about opportunities for professional development and career growth.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for the interview on time. Your appearance and punctuality convey respect for the interviewer and the opportunity.

- Choose attire that is clean, pressed, and appropriate for a business setting.

- Plan your route and allow ample time for travel to avoid any last-minute delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Title Investigator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.