Are you gearing up for an interview for a Title Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Title Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

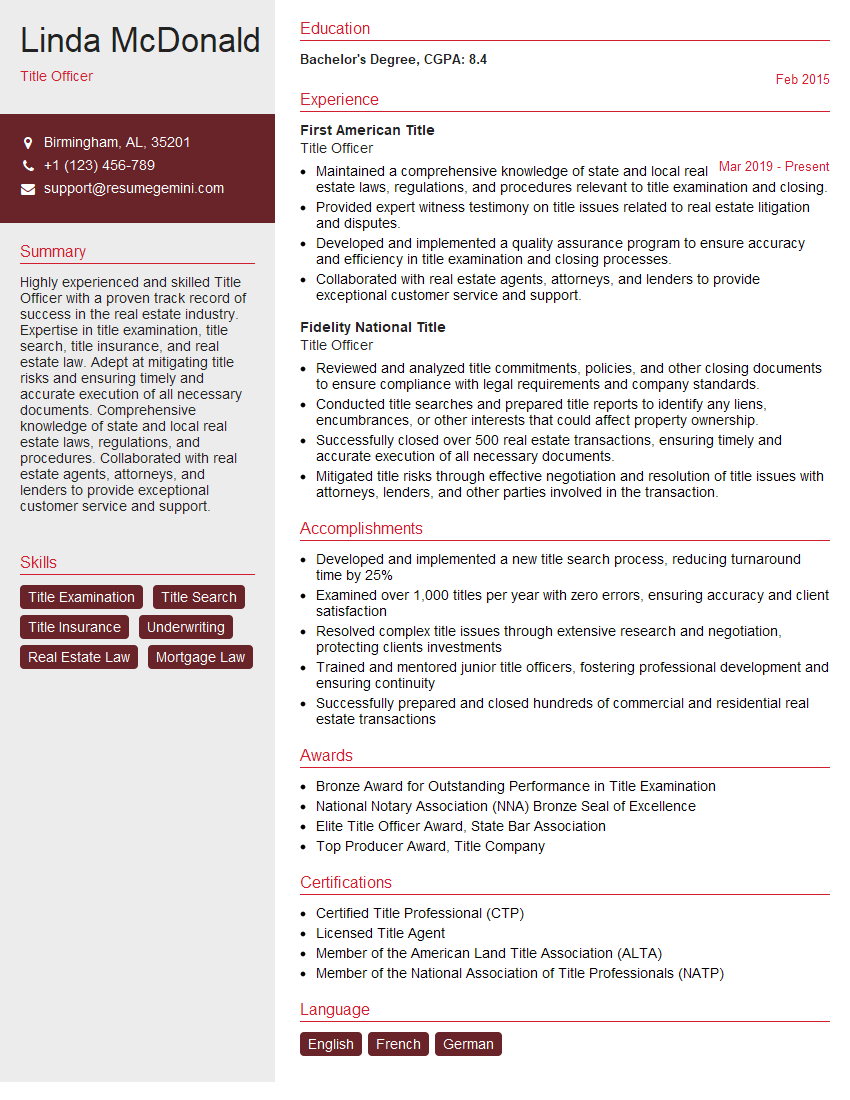

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Officer

1. What are the primary responsibilities of a Title Officer?

As a Title Officer, my primary responsibilities would include:

- Conducting title searches to determine the ownership and encumbrances on a property.

- Examining and analyzing title documents to ensure accuracy and compliance with legal requirements.

2. What types of title searches are commonly performed, and how do they differ?

Types of Title Searches:

- Title Search: Examines all documents affecting the title to a property from the present back to the origin of ownership.

- Judgment Search: Searches for any liens or judgments against the property owner.

- Lien Search: Searches for any outstanding liens or encumbrances on the property.

Differences:

- Scope: Title searches are more comprehensive, while judgment and lien searches focus on specific aspects.

- Time Period: Title searches cover a longer period, while judgment and lien searches typically focus on recent years.

3. What are the key elements to consider when examining a title document?

When examining a title document, I would focus on the following key elements:

- Grantor and Grantee: Verify the identity of the parties involved in the transaction.

- Legal Description: Ensure the property is accurately described and matches the property being purchased.

- Encumbrances: Identify any existing liens, easements, or other encumbrances that may affect the property.

- Covenants and Restrictions: Review any restrictions or obligations that may affect the use of the property.

- Notarization and Legal Compliance: Verify that the document is properly notarized and meets all legal requirements.

4. How do you handle title defects, and what are the common types of defects?

In the event of a title defect, my approach would be as follows:

- Identify the Defect: Determine the nature and extent of the defect.

- Research Options: Explore possible solutions, such as obtaining a title insurance policy or negotiating with the parties involved.

- Communicate with Clients: Inform clients of the defect and discuss potential solutions.

- Obtain Legal Advice: Seek guidance from an attorney if necessary.

Common Title Defects:

- Liens: Outstanding debts or judgments that can encumber the property.

- Easements: Rights granted to others to use the property for specific purposes.

- Encroachments: Structures or improvements that extend onto the property from a neighboring property.

- Adverse Possession: Claims by individuals who have unlawfully occupied and used the property for an extended period.

- Undisclosed Heirs: Unaccounted-for individuals with potential ownership rights.

5. What is the importance of title insurance, and how does it protect property owners?

Title insurance is crucial for property owners as it:

- Protects Against Title Defects: Insures against financial loss if a title defect is discovered after the purchase.

- Covers Legal Defense Costs: Provides coverage for legal expenses incurred in defending against claims related to title defects.

- Provides Peace of Mind: Gives property owners confidence in the security of their property ownership.

6. What is your understanding of the process of closing a real estate transaction?

The real estate closing process involves:

- Preparing Closing Documents: Preparing and reviewing loan documents, title documents, and other necessary paperwork.

- Finalizing Loan Approval: Ensuring the loan has been approved and all conditions have been met.

- Executing Documents: Having all parties sign the closing documents, including the deed, mortgage, and settlement statement.

- Disbursing Funds: Distributing the loan proceeds to the appropriate parties, including the seller and lender.

- Recording Documents: Submitting the signed documents to the county recorder’s office to create a public record of the transaction.

7. What software or technology do you commonly use in your role as a Title Officer?

As a Title Officer, I am proficient in using the following software and technology:

- Title Search Software: Specialized software that assists in conducting title searches and retrieving property data.

- Document Management Systems: Tools for securely storing, organizing, and accessing title documents.

- Property Information Databases: Resources that provide information on property ownership, sales history, and other relevant data.

- Online Closing Software: Platforms that facilitate electronic signatures and streamline the closing process.

- Legal Research Tools: Databases and resources that provide access to legal precedents and regulations related to real estate law.

8. How do you stay updated on changes in real estate laws and regulations?

To maintain my knowledge and expertise, I actively stay updated on changes in real estate laws and regulations through the following methods:

- Continuing Education Courses: Attending workshops, seminars, and conferences related to real estate law.

- Industry Publications: Subscribing to trade magazines, journals, and online resources that cover real estate legal developments.

- Legal Research: Regularly reviewing case law, statutes, and regulations to stay abreast of legal changes.

- Professional Affiliations: Participating in industry associations and networking with other professionals to share knowledge and stay informed.

9. What are some common ethical challenges you may encounter as a Title Officer?

As a Title Officer, I may encounter ethical challenges such as:

- Conflicts of Interest: Balancing the interests of multiple parties involved in a real estate transaction.

- Confidentiality: Maintaining the privacy of sensitive client information.

- Duty of Disclosure: Determining what information should be disclosed to clients regarding title defects or other material facts.

- Unethical Practices: Resisting pressure to engage in unethical or illegal activities, such as forging documents or misrepresenting information.

10. What sets you apart as an exceptional Title Officer candidate?

I believe my unique combination of skills and experience sets me apart as an exceptional Title Officer candidate:

- Proven Experience: Years of experience conducting title searches, examining title documents, and handling real estate transactions.

- In-depth Legal Knowledge: Comprehensive understanding of real estate laws and regulations, including title law, property law, and legal drafting.

- Analytical and Research Skills: Ability to analyze complex title documents, identify potential issues, and conduct thorough research to resolve them.

- Strong Communication Skills: Excellent written and verbal communication skills, allowing me to effectively convey information, explain legal concepts, and build strong relationships with clients.

- Commitment to Ethics: Uphold the highest ethical standards in all aspects of my work, ensuring the integrity and fairness of real estate transactions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Title Officers are responsible for ensuring the legal validity of the title to a property, this requires a deep understanding of real estate law and title insurance policies.

1. Conducting Title Searches

Involves reviewing public records to determine the ownership history of a property, and any liens or encumbrances that may affect the title.

- Examining deeds, mortgages, liens, and other documents related to the property.

- Identifying any potential defects or issues that could affect the title.

2. Title Examinations

Involves analyzing the title search results and issuing a title report. This report outlines the ownership history of the property, any liens or encumbrances, and any other relevant information that may affect the title.

- Reviewing title search results and identifying any potential issues.

- Issuing title reports that summarize the findings of the title search.

3. Title Insurance

Title officers work closely with title insurance companies to issue title insurance policies. Title insurance protects lenders and property owners from financial loss in the event of a title defect.

- Explaining title insurance policies to clients.

- Issuing title insurance policies.

4. Legal Assistance

May provide legal assistance to clients regarding real estate transactions. They may also represent clients in court proceedings related to title disputes.

- Providing legal advice to clients on real estate matters.

- Representing clients in court proceedings related to title disputes.

Interview Tips

Interviewing for a Title Officer position can be challenging, but with the right preparation, you can increase your chances of success. Here are some tips to help you prepare for the interview:

1. Research the Company and the Position

Before the interview, take time to research the company and the specific Title Officer position. Understand the company’s values, mission, and goals, as well as the specific responsibilities of the Title Officer role. This will help demonstrate your interest in the company and the position.

2. Prepare for Common Interview Questions

There are a number of common interview questions that you can expect to be asked, such as “What is your experience with title insurance?” or “How do you handle title disputes?” Prepare for these questions by practicing your answers and providing specific examples of your experience.

3. Showcase Your Skills and Experience

Highlight your skills and experience that are relevant to the Title Officer position. Emphasize your knowledge of real estate law, your experience with title searches and title insurance, and your ability to provide legal assistance to clients.

4. Ask Thoughtful Questions

At the end of the interview, be sure to ask thoughtful questions that demonstrate your interest in the company and the position. This is an opportunity to show the interviewer that you are engaged and have a genuine interest in the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Title Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!