Are you gearing up for a career in Title Processor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Title Processor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

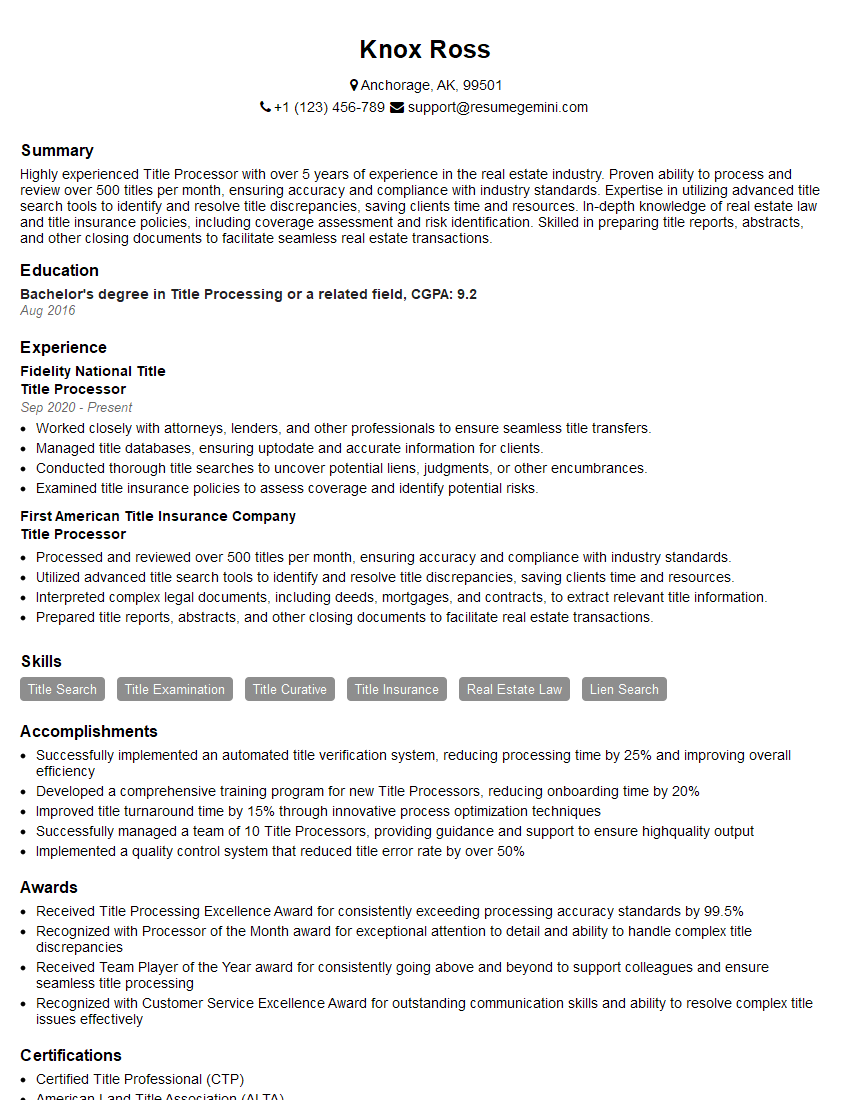

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Processor

1. What is a title search?

A title search is a process of examining public records to determine the ownership of a property and any liens or encumbrances that may be attached to it.

2. What are the different types of title searches?

Full search

- Examines all recorded documents relating to a property, including deeds, mortgages, liens, and judgments.

- Provides the most comprehensive information about the property’s ownership history and current status.

Limited search

- Examines only a specific period of time, such as the last 10 years.

- Less comprehensive than a full search, but less expensive and time-consuming.

Judgment search

- Examines court records to identify any judgments that have been entered against the property owner.

- Helps to determine if the property is subject to any liens or claims.

3. What are the common title defects?

Common title defects include:

- Forged or fraudulent deeds

- Undisclosed heirs or creditors

- Encroachments or boundary disputes

- Liens or judgments against the property

- Easements or restrictions on the property

4. What are the steps involved in a title insurance closing?

- Review the title commitment and explain it to the buyer and seller

- Prepare the closing documents, including the deed, mortgage, and title insurance policy

- Collect the necessary funds from the buyer and seller

- Sign and notarize the closing documents

- Record the deed and mortgage with the county recorder’s office

- Issue the title insurance policy to the buyer

5. What are the different types of title insurance policies?

Owner’s policy

- Protects the homeowner against losses due to title defects

- Typically issued for a one-time premium

Lender’s policy

- Protects the lender against losses due to title defects

- Typically required by lenders as a condition of financing

6. What are the benefits of title insurance?

- Provides peace of mind

- Protects against financial loss

- Facilitates the sale or refinancing of a property

7. What are the common challenges faced by title processors?

- Dealing with complex title issues

- Meeting deadlines

- Communicating effectively with buyers, sellers, lenders, and attorneys

- Staying up-to-date on changes in title laws and regulations

8. What are the qualities of a successful title processor?

- Attention to detail

- Strong analytical skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Knowledge of title laws and regulations

9. What are your strengths as a title processor?

- I have a strong attention to detail and am able to identify and resolve title issues quickly and accurately.

- I am able to meet deadlines and work independently with minimal supervision.

- I have excellent communication skills and am able to build rapport with clients and colleagues.

10. What are your weaknesses as a title processor?

- I can sometimes be too focused on the details and miss the big picture.

- I am still learning about some of the more complex title issues.

- I am not always the best at delegating tasks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Title Processors are responsible for ensuring the accuracy and completeness of real estate titles. They work closely with attorneys, lenders, and other parties to ensure that all legal requirements are met and that the title is clear and marketable.

1. Examine and verify title documents

Title Processors examine and verify a variety of title documents, including deeds, mortgages, and liens. They also research public records to ensure that there are no outstanding claims or encumbrances against the property.

- Review and analyze title reports, title searches, and other documents to identify potential title defects or issues.

- Conduct due diligence to identify any liens, judgments, or other encumbrances that may affect the title.

2. Prepare and issue title insurance policies

Once the title has been cleared, Title Processors prepare and issue title insurance policies. These policies protect the lender and the homeowner from any losses that may result from a defect in the title.

- Draft and review title insurance policies to ensure they accurately reflect the property’s ownership and title history.

- Explain the terms and conditions of title insurance policies to clients and answer any questions they may have.

3. Communicate with clients and other parties

Title Processors communicate with clients, attorneys, lenders, and other parties to keep them informed of the status of the title search and to resolve any issues that may arise.

- Provide regular updates to clients on the status of their title search and any potential issues that may arise.

- Respond to inquiries from clients, attorneys, lenders, and other parties in a timely and professional manner.

4. Maintain accurate records

Title Processors maintain accurate records of all title searches and transactions. These records are essential for tracking the progress of title searches and for providing documentation to clients and other parties.

- Maintain accurate and organized records of all title searches, transactions, and correspondence.

- Utilize software and technology to efficiently manage and track title-related information.

Interview Tips

Preparing for an interview for a Title Processor position can be daunting, but with the right tips and strategies, you can increase your chances of success. Here are some tips to help you ace your interview:

1. Research the company and the position

Before your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture, its values, and its specific needs. You should also learn as much as you can about the Title Processor position, including the key responsibilities and the qualifications required.

- Visit the company’s website to learn about its history, its mission, and its products or services.

- Read industry publications and articles to stay up-to-date on the latest trends and developments in the title insurance industry.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Brainstorm a list of potential interview questions and prepare thoughtful and well-rehearsed answers.

- Consider using the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your experience and skills.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you are serious about the position.

- Choose clothing that is clean, pressed, and appropriate for a business setting.

- Arrive at the interview location at least 15 minutes early to give yourself time to relax and prepare.

4. Be prepared to talk about your experience and skills

The interviewer will likely ask you about your experience and skills, so it is important to be prepared to talk about these in detail. Be sure to highlight your strengths and how they relate to the requirements of the Title Processor position.

- Quantify your accomplishments and provide specific examples of your success in previous roles.

- Demonstrate your knowledge of the title insurance industry and your understanding of the legal and regulatory requirements.

5. Ask questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the company and the position, and to show the interviewer that you are engaged and interested.

- Prepare a list of thoughtful questions that demonstrate your interest in the position and the company.

- Avoid asking questions that are too personal or that could be easily answered by researching the company online.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Title Processor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!