Are you gearing up for a career in Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

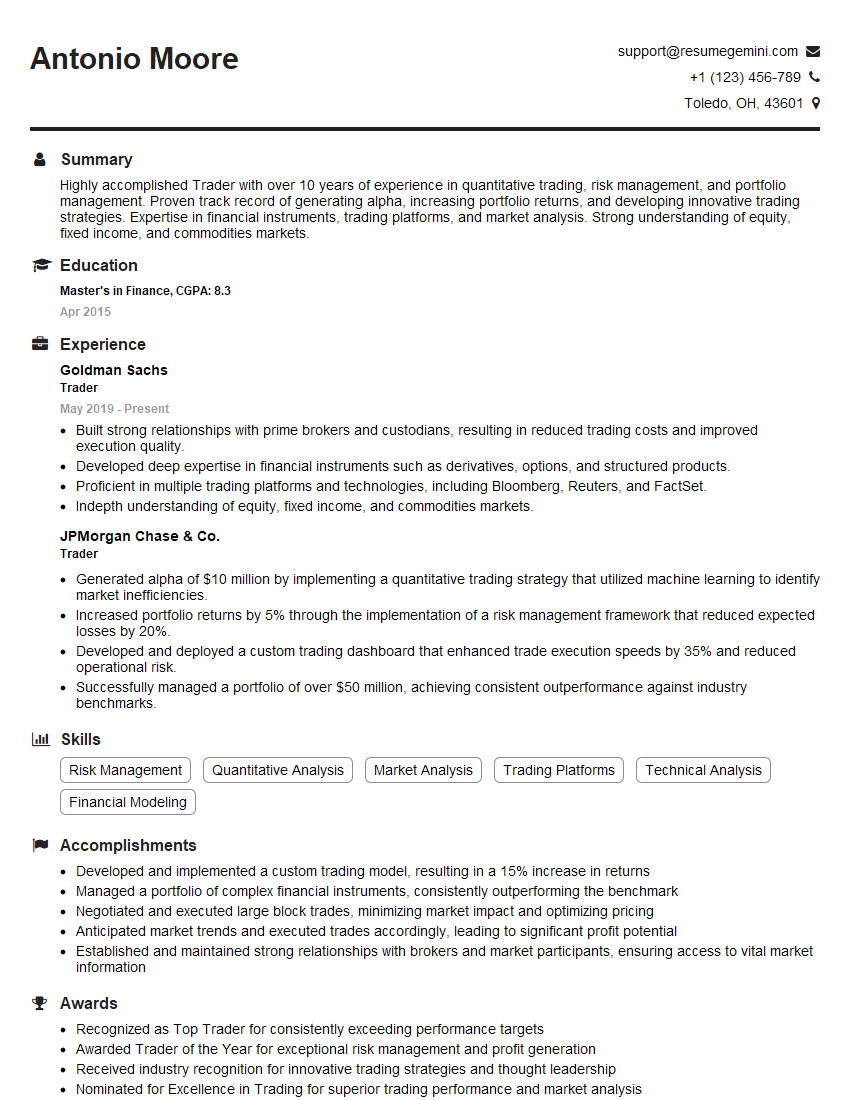

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Trader

1. Explain the concept of Value at Risk (VaR) and how it is used in risk management?

- Definition of VaR and its significance in risk management

- Different methods for calculating VaR (e.g., historical simulation, Monte Carlo simulation)

- Pros and cons of each method and how to choose the appropriate method for specific situations

- Applications of VaR in portfolio optimization, stress testing, and regulatory compliance

- Limitations and potential pitfalls of using VaR as a risk measure

2. Describe the different types of financial instruments that can be traded, and their key characteristics?

Equity Securities

- Common stock: Ownership interest in a company, entitling shareholders to dividends and voting rights

- Preferred stock: Hybrid security that combines features of common stock and bonds

Fixed Income Securities

- Bonds: Loan instruments that pay periodic interest payments and repay the principal at maturity

- Treasury bills: Short-term government debt instruments

- Corporate bonds: Bonds issued by corporations

Derivatives

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price

- Futures: Contracts that obligate the buyer and seller to exchange an underlying asset at a specified price on a future date

- Swaps: Contracts that exchange cash flows between two parties based on specified interest rates or indices

3. How do you assess the liquidity of a financial instrument and why is it important?

- Measures of liquidity: Trading volume, bid-ask spread, market depth

- Factors affecting liquidity: Market size, regulatory environment, economic conditions

- Importance of liquidity: Ease of execution, price discovery, risk management

- Consequences of low liquidity: Market volatility, difficulty in exiting positions, potential losses

4. Explain the concept of technical analysis and discuss its strengths and weaknesses?

- Definition of technical analysis and its principles

- Types of technical indicators and their applications (e.g., moving averages, support and resistance levels, chart patterns)

- Strengths: Simplicity, visual representation, potential for identifying price trends

- Weaknesses: Subjectivity, reliance on historical data, limited predictive power

5. Describe the role of market microstructure in trading and how it affects execution strategies?

- Components of market microstructure: Limit order book, bid-ask spread, market depth

- Impact on execution strategies: Liquidity, slippage, transaction costs

- Types of execution strategies: Market orders, limit orders, algorithmic trading

- Factors to consider: Trading volume, desired speed of execution, potential price impact

6. How do you evaluate the performance of a trading strategy and identify areas for improvement?

- Metrics for performance evaluation: Sharpe ratio, Sortino ratio, maximum drawdown

- Methods for identifying areas for improvement: Backtesting, simulation, statistical analysis

- Factors to consider: Risk tolerance, investment horizon, market conditions

- Importance of regular performance reviews for optimizing strategies

7. Discuss the ethical principles and regulations that govern trading activities?

- Principles of ethics in trading: Integrity, transparency, fairness

- Regulations governing trading: Insider trading laws, market manipulation rules, conflicts of interest

- Importance of adhering to ethical and regulatory guidelines

- Consequences of violating ethical or regulatory standards

8. Describe your experience in using trading technology and software?

- Proficiency in trading platforms (e.g., Bloomberg, Refinitiv Eikon)

- Experience with financial modeling and data analysis tools (e.g., Excel, Python)

- Understanding of risk management software and systems

- Ability to use technology to enhance trading efficiency and decision-making

9. How do you stay up-to-date on market trends and economic developments that affect trading?

- Regular monitoring of news, financial publications, and research reports

- Attendance at industry conferences and webinars

- Networking with other traders and analysts

- Use of social media and online forums for information sharing

- Importance of continuous learning and professional development

10. How do you manage stress and maintain emotional discipline in high-pressure trading environments?

- Techniques for stress management: Exercise, meditation, mindfulness

- Importance of setting realistic expectations and managing risk

- Strategies for controlling emotions and avoiding impulsive trading

- Role of support systems and mentorship in maintaining emotional discipline

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Traders play a critical role in the financial industry, executing trades and managing portfolios to generate profits and minimize risk. Their key responsibilities include:

1. Market Analysis and Trading Decisions

Traders continuously analyze financial markets, identify trends, and make trading decisions based on their analysis and market knowledge. They may specialize in specific asset classes such as stocks, bonds, commodities, or currencies.

- Conducting in-depth research and analysis of market fundamentals, technical indicators, and economic data.

- Identifying investment opportunities, assessing risk, and making informed trading decisions.

2. Trade Execution and Risk Management

Traders execute trades on behalf of clients or their firms, ensuring the timely and efficient execution of orders. They also manage risk by monitoring market conditions, adjusting trading strategies, and implementing stop-loss orders.

- Executing trades in a timely and accurate manner, adhering to predefined trading strategies.

- Maintaining appropriate risk levels, utilizing stop-loss orders, and managing open positions.

3. Portfolio Management and Performance Monitoring

Traders may manage portfolios of financial assets, ensuring their alignment with investment objectives and risk tolerance. They regularly monitor portfolio performance, adjust strategies as needed, and report to clients or superiors.

- Optimizing portfolio allocations, maintaining diversification, and rebalancing positions.

- Tracking portfolio performance, measuring returns, and managing risk-adjusted metrics.

4. Regulatory Compliance and Client Reporting

Traders must adhere to regulatory standards and industry best practices. They ensure compliance with anti-money laundering and know-your-customer regulations and provide timely and accurate reporting to clients and regulatory bodies.

- Meeting regulatory requirements and adhering to industry ethical standards.

- Preparing trading reports, summarizing performance, and providing analysis to clients.

Interview Tips

Preparing thoroughly for a trader interview is crucial. Here are some valuable tips to help you ace it:

1. Research the Company and Position

Before the interview, research the company, its trading strategies, and the specific position you’re applying for. This will demonstrate your interest and understanding of the opportunity.

- Review the company’s website, financial statements, and industry news.

- Identify key metrics related to the trading desk and their performance.

2. Showcase Your Trading Knowledge and Skills

Highlight your trading experience, technical skills, and analytical abilities. Provide specific examples of your successful trades and how you managed risk effectively.

- Quantify your trading results, using specific metrics such as Sharpe ratio or return on equity.

- Discuss your understanding of financial markets, trading techniques, and risk management strategies.

3. Emphasize Your Teamwork and Communication Abilities

Trading often involves collaboration and effective communication with colleagues. Demonstrate your ability to work in a team environment and communicate complex trading concepts clearly.

- Provide examples of successful collaboration with traders, analysts, or risk managers.

- Highlight your proficiency in presenting trading ideas and performance reports.

4. Prepare for Technical and Behavioral Questions

Expect a mix of technical and behavioral interview questions. Practice answering questions related to trading strategies, market analysis, and your motivations for pursuing a trading career.

- Review common trading interview questions and prepare thoughtful responses.

- Anticipate behavioral questions about your teamwork, problem-solving abilities, and ethical values.

5. Dress Professionally and Arrive on Time

Make a favorable first impression by dressing professionally and arriving at the interview on time. Remember that appearance and punctuality convey respect for the interviewers and the opportunity.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Trader, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Trader positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.