Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Transaction Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Transaction Manager so you can tailor your answers to impress potential employers.

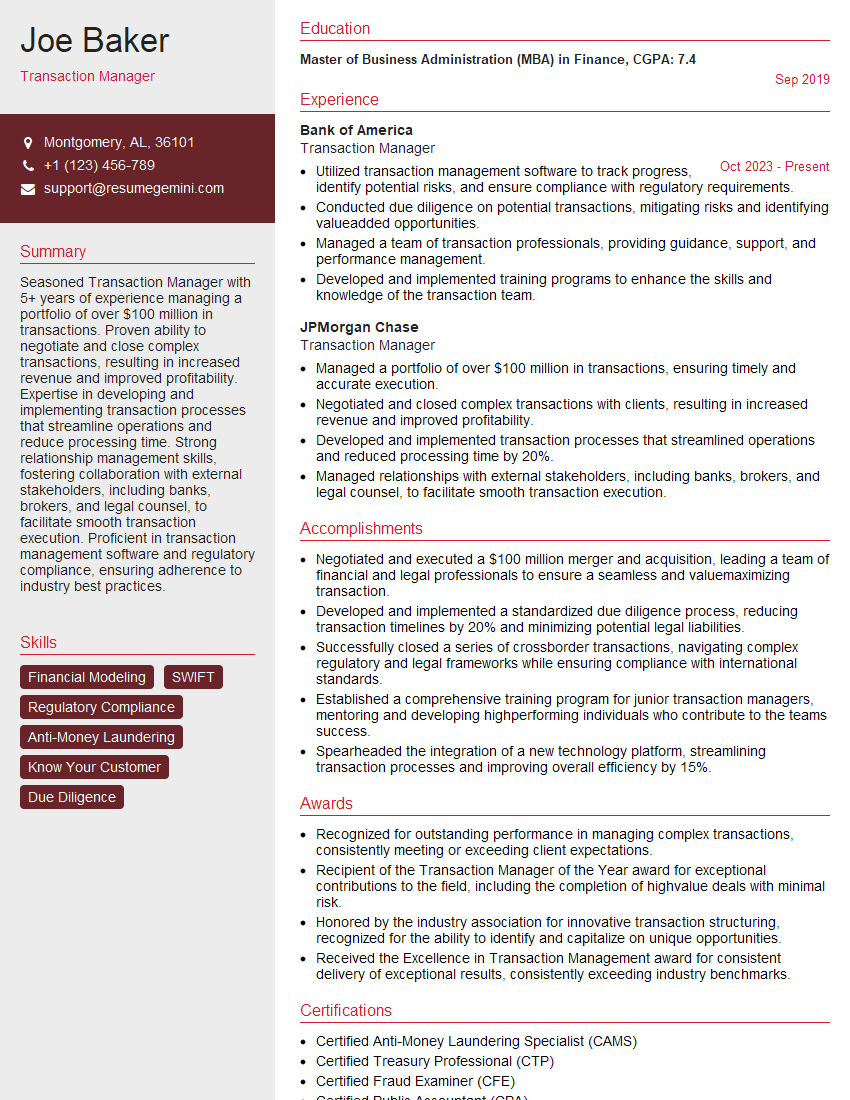

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Transaction Manager

1. Briefly describe the key responsibilities of a Transaction Manager?

- Manage the transaction life cycle, including initiation, negotiation, structuring, execution, and closing.

- Develop and implement transaction strategies and plans.

- Coordinate with internal and external stakeholders to ensure a smooth transaction process.

- Monitor and track transaction progress and identify potential risks and issues.

- Prepare and present financial models and analysis to support decision-making.

2. Explain the differences between a merger, acquisition, and spin-off?

Merger

- Two or more companies combine to form a single new entity.

- Can be horizontal (in the same industry) or vertical (in different industries).

Acquisition

- One company acquires another company and takes control of its assets and operations.

- Can be friendly (with the consent of the acquired company) or hostile (without consent).

Spin-off

- A company distributes a portion of its business or assets to its shareholders as a separate entity.

- Typically done to focus on core operations and improve shareholder value.

3. What are the key factors to consider when evaluating a potential transaction?

- Strategic fit and alignment with business objectives

- Financial implications, including acquisition cost, financing, and potential synergies

- Regulatory and legal considerations

- Market conditions and industry trends

- Management and employee retention plans

4. Describe the due diligence process involved in a transaction?

- Gathering and reviewing financial, legal, operational, and environmental information

- Conducting site visits and interviews with key personnel

- Verifying financial statements and other representations

- Identifying and assessing potential risks and liabilities

- Preparing due diligence reports and recommendations

5. What are the common challenges faced by Transaction Managers?

- Managing complex and high-stakes transactions

- Negotiating favorable terms and conditions

- Integrating acquired businesses and achieving synergies

- Managing regulatory and compliance requirements

- Coordinating with multiple stakeholders and managing expectations

6. How do you stay up-to-date on the latest trends and developments in the transaction market?

- Attending industry conferences and webinars

- Reading trade publications and research reports

- Networking with other professionals in the field

- Taking continuing education courses and certifications

7. What are the key qualities and skills required for a successful Transaction Manager?

- Strong analytical and financial modeling skills

- Excellent communication and interpersonal skills

- Ability to manage complex projects and negotiate effectively

- Knowledge of transaction law and regulations

- Understanding of business strategy and operations

8. Describe a challenging transaction you worked on and how you overcame the difficulties?

Provide a specific example of a transaction that posed significant challenges and explain how you successfully navigated them. Highlight your problem-solving skills, negotiation abilities, and ability to manage stakeholder expectations.

9. How do you approach managing risks and due diligence in a transaction?

- Develop a risk assessment plan

- Identify potential risks and conduct thorough due diligence

- Negotiate appropriate warranties and representations

- Monitor and mitigate risks throughout the transaction process

10. What are your career goals and aspirations?

Express your interest in the transaction management field and your aspirations for career growth. Highlight your desire to take on more responsibilities and contribute to the success of your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Transaction Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Transaction Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Transaction Managers play a crucial role in diverse organizations, particularly in banking, finance, and consulting. The scope of their responsibilities encompasses a wide range:Managing Transaction Processing

Transaction Managers oversee the smooth execution and settlement of complex financial transactions, ensuring adherence to regulatory guidelines and organizational policies.

Risk Management and Mitigation

They are responsible for evaluating potential risks associated with transactions, implementing safeguards, and monitoring compliance to minimize losses and protect the organization’s financial health.

Stakeholder Management

Transaction Managers collaborate with various internal and external stakeholders, including clients, regulators, and counterparties, to facilitate communication and ensure a seamless workflow.

Client Servicing and Relationship Management

They play a key role in nurturing client relationships by providing expert advice, resolving transaction-related queries, and building long-term business connections.

Interview Tips

Preparation is key to acing any job interview. Here are some essential tips for candidates seeking Transaction Manager positions:Research the Company and Role

Thoroughly research the company’s profile, including its industry, services, and recent developments. Understand the specific requirements of the Transaction Manager role to tailor your answers accordingly.

Practice Case Studies and Technical Questions

Transaction Managers are often tested on their ability to analyze and solve complex financial problems. Practice case studies involving risk assessment, transaction structuring, and financial modeling to demonstrate your proficiency.

Highlight Industry Knowledge and Regulatory Expertise

Showcase your up-to-date knowledge of industry trends and regulatory frameworks. Demonstrate your understanding of emerging technologies and their impact on transaction processing.

Quantify Achievements and Metrics

When sharing your experiences, focus on quantifying your accomplishments using specific metrics. This will provide tangible evidence of your value and impact in previous roles.

Demonstrate Communication and Interpersonal Skills

Transaction Managers require excellent communication and interpersonal skills to effectively interact with clients, colleagues, and regulators. Highlight your ability to convey complex information clearly, build strong relationships, and handle challenging situations.

Be Prepared for Behavioral Questions

Behavioral interview questions aim to assess your soft skills and work style. Prepare examples that showcase your problem-solving abilities, teamwork ethic, and commitment to delivering quality results.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Transaction Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.