Are you gearing up for a career in Transaction Processor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Transaction Processor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

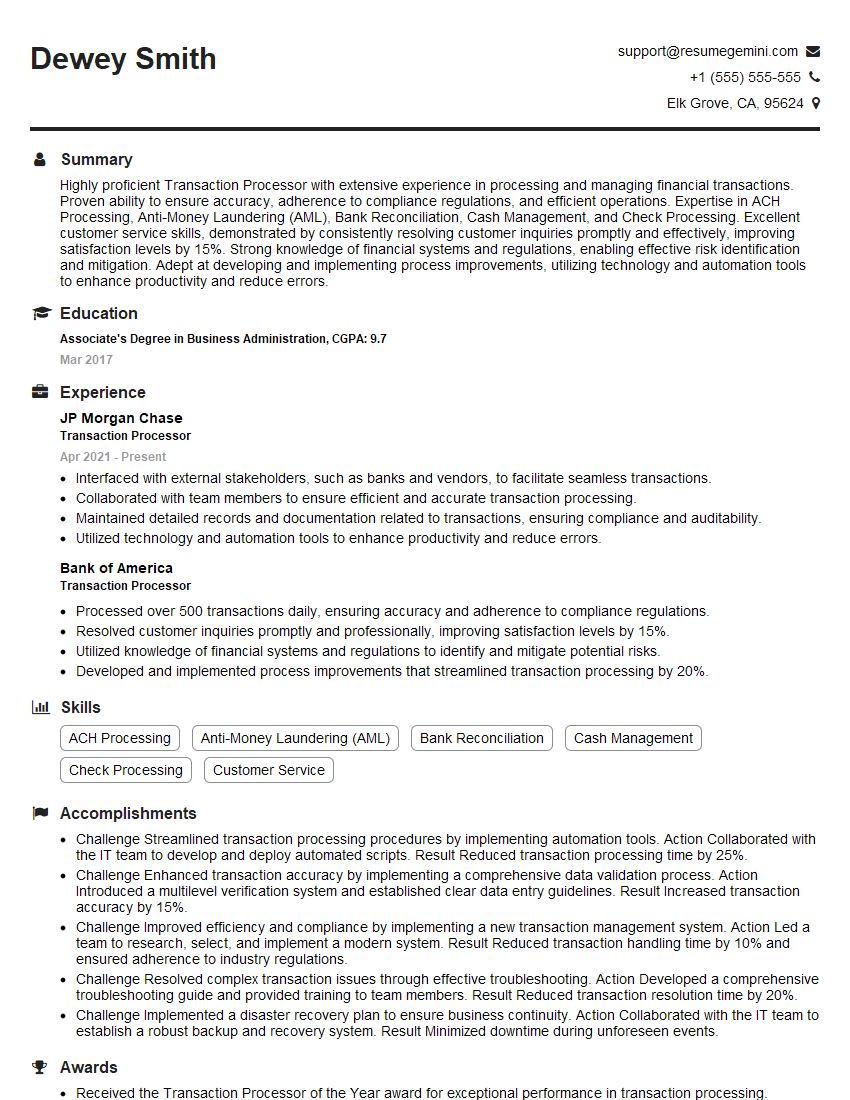

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Transaction Processor

1. What are the key responsibilities of a transaction processor?

- Record and process financial transactions accurately and efficiently.

- Maintain and update financial records, including general ledgers, accounts payable, and accounts receivable.

- Prepare and submit reports to management and external stakeholders.

- Reconcile bank statements and other financial accounts.

- Monitor and investigate discrepancies and errors.

2. What experience do you have in transaction processing systems?

- Experience with various transaction processing systems, such as ERP, SAP, or Oracle.

- Strong knowledge of accounting principles and practices.

- Experience in data entry, verification, and reconciliation.

- Ability to work independently and as part of a team.

- Excellent attention to detail and accuracy.

3. What are the challenges you have faced in transaction processing?

- Handling high volumes of transactions.

- Dealing with complex and unusual transactions.

- Ensuring data accuracy and integrity.

- Meeting deadlines and reporting requirements.

- Working with different departments and stakeholders.

4. How do you stay updated on the latest trends and best practices in transaction processing?

- Attending industry conferences and workshops.

- Reading industry publications and white papers.

- Taking online courses and certifications.

- Networking with other professionals in the field.

- Staying abreast of technological advancements.

5. What are your strengths and weaknesses as a transaction processor?

- Excellent attention to detail and accuracy.

- Strong knowledge of accounting principles and practices.

- Experience in transaction processing systems.

- Ability to work independently and as part of a team.

- Excellent communication and interpersonal skills.

- Lack of experience in certain specialized areas of transaction processing.

- Need to improve time management skills.

- Can be prone to feeling stressed in high-pressure situations.

Strengths:

Weaknesses:

6. What are your career goals and how does this role fit into them?

- Aspire to become a financial analyst or accountant.

- Believe that this role will provide a solid foundation in transaction processing.

- Eager to learn and grow within the company.

- Committed to contributing to the team’s success.

- Confident that my skills and experience will enable me to excel in this role.

7. What is your understanding of the Sarbanes-Oxley Act?

- Passed in 2002 in response to corporate financial scandals.

- Aims to improve corporate governance and financial reporting.

- Includes provisions for internal controls, financial reporting, and auditor independence.

- Requires companies to maintain accurate financial records and implement effective internal controls.

- Transaction processors play a vital role in ensuring compliance with Sarbanes-Oxley.

8. How do you handle discrepancies or errors in transaction processing?

- Thoroughly research the discrepancy or error.

- Consult with colleagues, supervisors, or other stakeholders.

- Review documentation and supporting evidence.

- Identify the root cause of the discrepancy or error.

- Take corrective action to resolve the issue.

- Document the investigation and resolution process.

9. What are some of the ethical considerations in transaction processing?

- Maintaining confidentiality of financial information.

- Avoiding conflicts of interest.

- Adhering to accounting principles and standards.

- Reporting any suspicious or illegal activities.

- Acting with integrity and professionalism.

10. What are your salary expectations for this role?

- Research industry benchmarks and company salary ranges.

- Consider your experience, skills, and qualifications.

- Be prepared to negotiate and justify your expectations.

- Avoid being too inflexible or unrealistic.

- Express willingness to discuss compensation and benefits.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Transaction Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Transaction Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Transaction Processors play a crucial role in a company’s finance operations by accurately and efficiently handling various types of financial transactions. Key job responsibilities include:

1. Transaction Processing

Processes a high volume of financial transactions, such as invoices, payments, deposits, and withdrawals.

- Verifies and enters data into accounting systems to ensure accuracy and completeness.

- Matches transaction details with supporting documentation to ensure compliance

2. Data Entry and Maintenance

Enters and updates financial data into accounting systems on a regular basis.

- Maintains accurate and organized records of transactions for future reference and auditing purposes.

- Reconciles bank accounts and financial statements to ensure accuracy and integrity

3. Customer Service

Responds to customer inquiries and resolves issues related to transactions.

- Provides clear and timely responses to customer requests, complaints, and disputes.

- Maintains a positive and professional demeanor while interacting with customers.

4. Compliance and Reporting

Adheres to relevant financial regulations and reporting standards.

- Prepares and submits financial reports, such as trial balances and income statements.

- Assists with internal and external audits to ensure compliance and accuracy of financial records.

Interview Tips

To ace the interview for a Transaction Processor position, candidates should focus on demonstrating their attention to detail, accuracy, and customer service skills. Here are some tips:

1. Research the Company and Position

Familiarize yourself with the company’s industry, operations, and specific job requirements. This will help you tailor your answers to the interviewer’s questions.

- Visit the company website and social media platforms to gather information.

- Read industry articles and reports to stay updated on trends and best practices in financial transaction processing.

- Practice answering common interview questions about your experience, skills, and motivations.

2. Highlight Your Accuracy and Attention to Detail

Emphasize your ability to handle high volumes of transactions with precision and accuracy. Provide examples of your experience in data entry, verification, and reconciliation.

- Use specific numbers and metrics to quantify your accomplishments, such as the number of transactions processed per hour or the accuracy rate of your data entry tasks.

- Explain how you use checklists, quality control measures, and other techniques to ensure the accuracy of your work.

- Highlight any relevant experience in industries with strict compliance regulations or high-volume transaction processing environments.

3. Demonstrate Your Customer Service Skills

Show that you are able to interact effectively with customers, resolve issues, and maintain a positive attitude. Provide examples of how you have handled difficult customer situations or provided excellent customer service in previous roles.

- Emphasize your empathy, patience, and ability to listen to and understand customer needs.

- Describe specific situations where you went above and beyond to help customers and resolve their issues.

- Explain how you use active listening skills and clear communication to build rapport with customers and provide effective assistance.

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. It also gives you an opportunity to gather additional information and clarify any questions you have about the role or the company.

- Prepare questions that demonstrate your interest in the company’s culture, growth opportunities, and commitment to compliance.

- Ask about the specific challenges and responsibilities associated with the role, and how you can contribute to the team.

- Inquire about the company’s financial reporting standards and industry best practices.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Transaction Processor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.