Are you gearing up for an interview for a Treasury Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Treasury Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

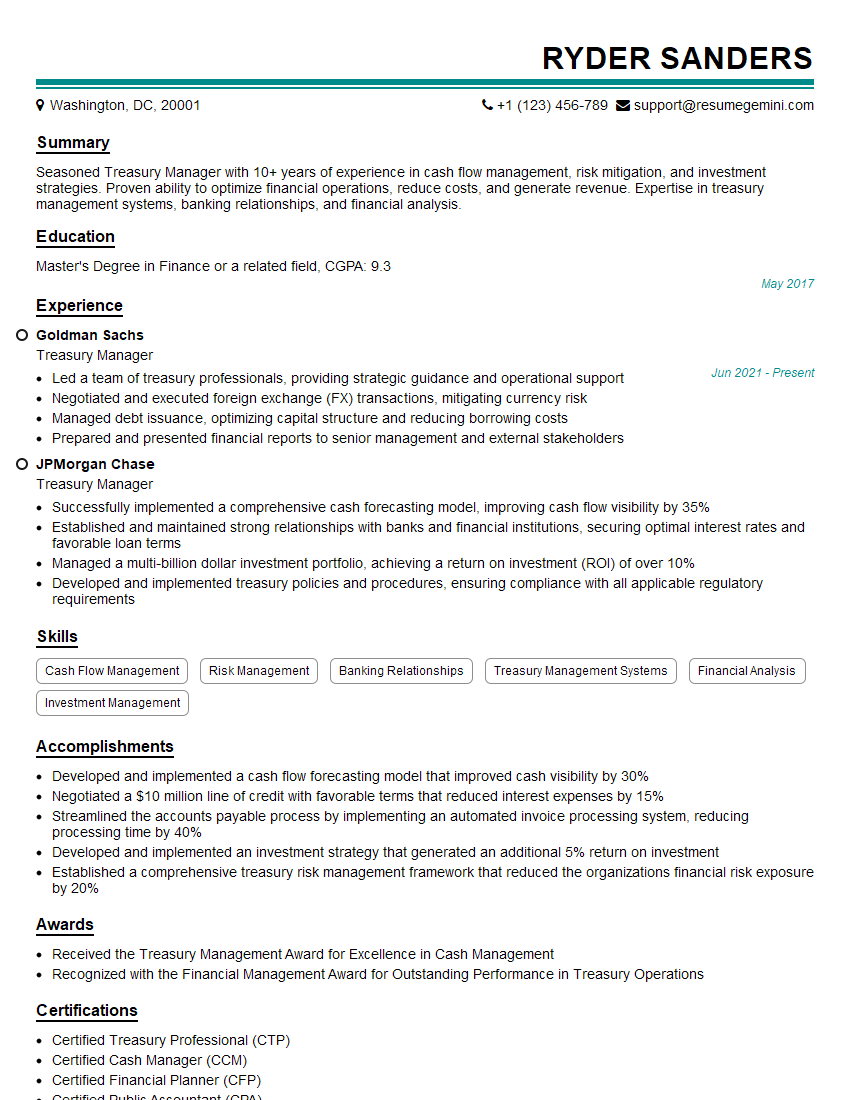

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Treasury Manager

1. Explain the key responsibilities of a Treasury Manager?

As a Treasury Manager, my primary responsibilities would be:

- Managing the company’s financial liquidity and cash flow

- Developing and executing treasury strategies to optimize financial performance

- Forecasting cash flows and managing working capital

- Investing excess cash and hedging against financial risks

- Managing relationships with banks and other financial institutions

- Providing financial advice and guidance to senior management

2. What are the key financial metrics that you would track and monitor as a Treasury Manager?

Liquidity metrics

- Current ratio

- Quick ratio

- Cash conversion cycle

Profitability metrics

- Net income

- Gross profit margin

- Operating profit margin

Solvency metrics

- Debt-to-equity ratio

- Times interest earned ratio

- Debt-to-asset ratio

3. How would you develop and execute a treasury strategy?

I would take the following steps to develop and execute a treasury strategy:

- Assess the company’s financial position and objectives

- Develop a treasury policy that aligns with the company’s overall strategy

- Identify and evaluate potential financial risks

- Develop and implement strategies to mitigate financial risks

- Monitor the performance of the treasury strategy and make adjustments as needed

4. What are the different types of financial instruments that a Treasury Manager can use to manage financial risks?

Treasury Managers can use a variety of financial instruments to manage financial risks, including:

- Derivatives (e.g., forwards, futures, options)

- Bonds

- Stocks

- Mutual funds

- Exchange-traded funds (ETFs)

5. What are the different types of hedging strategies that a Treasury Manager can use?

Treasury Managers can use a variety of hedging strategies to manage financial risks, including:

- Interest rate hedging

- Currency hedging

- Commodity hedging

- Inflation hedging

6. How would you measure the effectiveness of a treasury strategy?

I would measure the effectiveness of a treasury strategy based on the following criteria:

- The reduction in financial risks

- The improvement in financial performance

- The level of compliance with regulatory requirements

7. What are the biggest challenges facing Treasury Managers today?

Treasury Managers are facing a number of challenges today, including:

- The increasing complexity of the global financial markets

- The rising volatility of interest rates and currency exchange rates

- The increasing regulatory requirements

- The need to manage financial risks in an increasingly uncertain economic environment

8. What are the key trends that are shaping the role of Treasury Managers?

The following key trends are shaping the role of Treasury Managers:

- The increasing use of technology in treasury management

- The growing importance of environmental, social, and governance (ESG) factors in investment decisions

- The need for Treasury Managers to have a strong understanding of both financial and non-financial risks

- The increasing demand for Treasury Managers with a global perspective

9. What are your strengths and weaknesses as a Treasury Manager?

Strengths

- Strong technical skills in treasury management

- Excellent financial modeling and analysis skills

- Proven track record of success in managing financial risks

- Strong leadership and communication skills

Weaknesses

- Limited experience in managing global treasury operations

- Need to further develop my understanding of ESG factors

10. What are your career goals?

My career goal is to become a CFO. I believe that my skills and experience as a Treasury Manager will provide me with a strong foundation for success in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Treasury Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Treasury Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Treasury Managers are responsible for overseeing the financial activities of an organization, ensuring compliance with regulations and maximizing the organization’s financial performance. Key responsibilities include:

1. Cash Management

Forecasting cash flows, managing bank relationships, and optimizing cash balances to ensure availability and liquidity.

- Develop and implement cash flow management strategies

- Negotiate and maintain banking relationships

2. Investment Management

Investing surplus funds in a prudent and profitable manner, adhering to investment guidelines and risk management principles.

- Develop and implement investment strategies

- Monitor and manage investment portfolios

3. Risk Management

Identifying, assessing, and mitigating financial risks, including currency risk, interest rate risk, and credit risk.

- Develop and implement risk management policies

- Monitor and assess financial risks

4. Regulatory Compliance

Ensuring compliance with all applicable financial regulations, including reporting requirements and accounting standards.

- Monitor regulatory changes

- Prepare and file financial reports

Interview Tips

To ace the interview for a Treasury Manager position, it is crucial to prepare thoroughly. Here are some tips:

1. Research the Company

Familiarize yourself with the company’s industry, financial performance, and recent news. This demonstrates your interest and preparation.

- Visit the company website and social media pages

- Read industry publications and news articles

2. Practice Your Answers

Anticipate common interview questions and prepare clear and concise answers that highlight your skills and experience.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

- Quantify your accomplishments with specific metrics and examples

3. Emphasize Value Addition

Highlight how your skills and expertise can contribute to the company’s financial success. Quantify your accomplishments and demonstrate how you have created value in your previous roles.

- Discuss specific projects or initiatives where you made a significant impact

- Explain how your skills align with the company’s objectives

4. Be Confident and Professional

Present yourself with confidence and demonstrate your professionalism throughout the interview. Dress appropriately, arrive on time, and engage with the interviewers in a respectful manner.

- Maintain eye contact and speak clearly and concisely

- Use active listening skills and ask thoughtful questions

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Treasury Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!