Are you gearing up for an interview for a Trust Accounts Supervisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Trust Accounts Supervisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

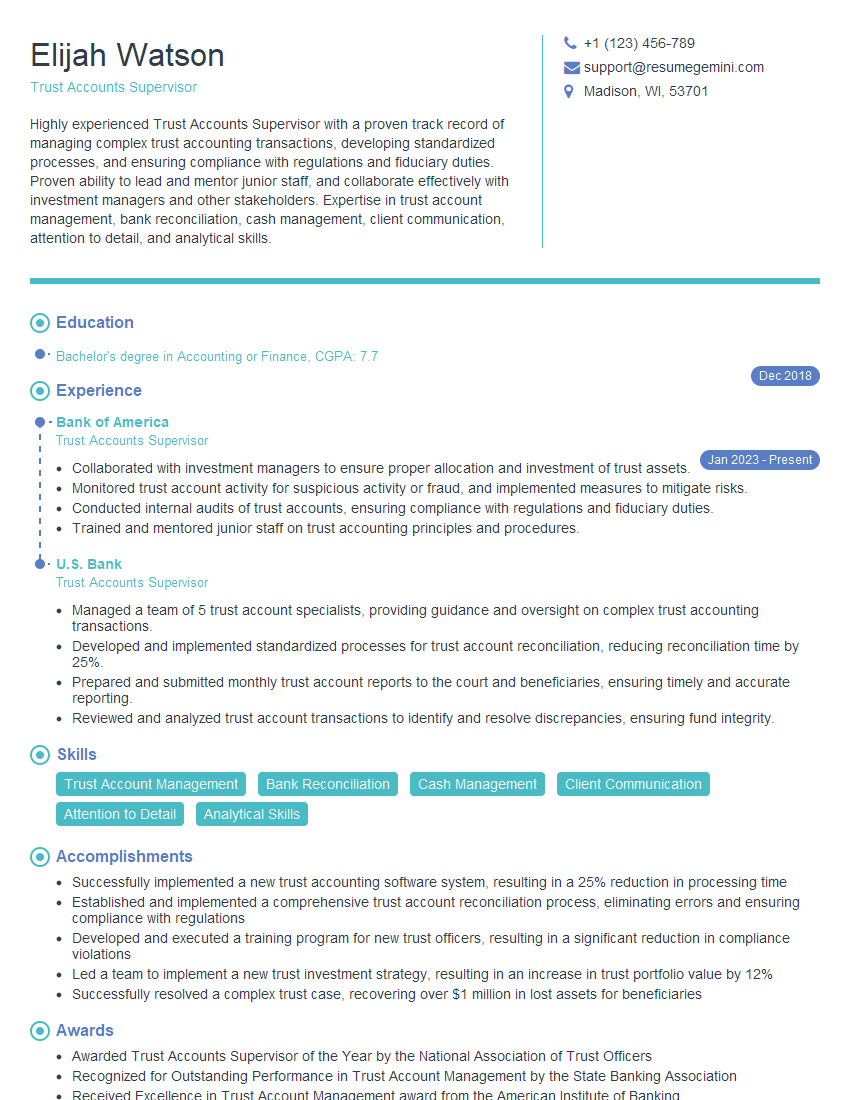

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Trust Accounts Supervisor

1. What is a trust account and what are the key responsibilities of a Trust Accounts Supervisor?

A trust account is a type of bank account that is used to hold funds in a fiduciary capacity. The key responsibilities of a Trust Accounts Supervisor include:

- Opening and maintaining trust accounts

- Depositing and withdrawing funds from trust accounts

- Reconciling trust account statements

- Preparing and filing trust accounting reports

- Ensuring compliance with all applicable laws and regulations

2. What are the different types of trust accounts and what are the specific requirements for each type?

Individual Trust Accounts

- Used to hold assets for the benefit of a specific individual

- Requirements: must be established by a written trust agreement, must appoint a trustee, must be used for the benefit of the beneficiary

Business Trust Accounts

- Used to hold assets for the benefit of a business

- Requirements: must be established by a written trust agreement, must appoint a trustee, must be used for the benefit of the business

Charitable Trust Accounts

- Used to hold assets for the benefit of a charitable organization

- Requirements: must be established by a written trust agreement, must appoint a trustee, must be used for the benefit of the charity

3. What are the most common errors that you see in trust account reconciliations?

The most common errors that I see in trust account reconciliations include:

- Unrecorded deposits

- Unrecorded withdrawals

- Incorrect calculation of interest earned

- Incorrect calculation of service charges

- Matching errors

4. What are the best practices for preventing errors in trust account reconciliations?

The best practices for preventing errors in trust account reconciliations include:

- Using a reconciliation checklist

- Matching all deposits and withdrawals to the bank statement

- Calculating interest earned and service charges accurately

- Reviewing the reconciliation for accuracy before submitting it

5. What are the key internal controls that should be in place for trust accounts?

The key internal controls that should be in place for trust accounts include:

- Segregation of duties

- Authorization of all transactions

- Regular reconciliation of trust account statements

- Independent review of trust account reconciliations

6. What are the most common red flags that indicate potential fraud in trust accounts?

The most common red flags that indicate potential fraud in trust accounts include:

- Unauthorized withdrawals

- Large or unusual deposits

- Frequent changes in account balances

- Missing or altered documentation

- Suspicious activity by account holders

7. What are the steps that you would take if you suspected fraud in a trust account?

If I suspected fraud in a trust account, I would take the following steps:

- Document the suspected fraud

- Report the suspected fraud to my supervisor

- Cooperate with the internal audit department

- Take steps to prevent further fraud from occurring

8. What are the most important qualities of a successful Trust Accounts Supervisor?

The most important qualities of a successful Trust Accounts Supervisor include:

- Strong accounting skills

- Attention to detail

- Excellent communication skills

- Ability to work independently

- Understanding of trust accounting principles

9. What are your strengths and weaknesses as a Trust Accounts Supervisor?

My strengths as a Trust Accounts Supervisor include my strong accounting skills, attention to detail, and excellent communication skills. I am also able to work independently and have a good understanding of trust accounting principles. My weakness is that I am relatively new to the field of trust accounting, but I am eager to learn and grow in my role.

10. What are your career goals?

My career goal is to become a Certified Trust and Fiduciary Advisor (CTFA). I also hope to eventually become a partner in a CPA firm.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Trust Accounts Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Trust Accounts Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Trust Accounts Supervisor plays a crucial role in managing and safeguarding trust funds, ensuring compliance with financial regulations and ethical standards.

1. Trust Accounting and Reconciliations

Supervising the accurate and timely recording of trust transactions, maintaining detailed ledgers, and reconciling bank statements.

- Managing trust disbursements and payments, adhering to court orders and legal requirements.

- Preparing financial reports, including asset and income summaries, for beneficiaries and courts.

2. Compliance and Risk Management

Ensuring adherence to trust laws, regulations, and ethical guidelines, mitigating financial and legal risks.

- Monitoring trust investments and transactions for compliance with investment policies and fiduciary duties.

- Implementing internal controls and procedures to prevent fraud and misuse of trust assets.

3. Beneficiary Relations

Maintaining open communication with beneficiaries, providing regular account updates, and addressing their inquiries or concerns.

- Explaining trust terms, account balances, and investment strategies to beneficiaries.

- Assisting beneficiaries with accessing trust funds when necessary and authorized.

4. Team Leadership and Supervision

Leading and supervising a team of trust accounting staff, providing guidance, training, and performance management.

- Assigning tasks, monitoring progress, and providing feedback to improve team efficiency.

- Creating a positive and supportive work environment, fostering professional development within the team.

Interview Tips

To ace the interview for a Trust Accounts Supervisor position, consider the following tips and preparation strategies:

1. Research the Organization and Role

Thoroughly research the organization, its mission and values, and the specific responsibilities of the Trust Accounts Supervisor role.

- Visit the organization’s website, read news articles, and connect with employees on LinkedIn for insights.

- Review the job description carefully, identifying key responsibilities and qualifications required.

2. Prepare Examples of Your Skills and Experience

Quantify and highlight your accomplishments in previous trust accounting roles. Use the STAR method (Situation, Task, Action, Result) to effectively articulate your experiences.

- For example, describe a time you implemented a new accounting system, resulting in a significant increase in accuracy and efficiency.

- Emphasize your knowledge of trust laws, regulations, and ethical guidelines, providing specific examples of your compliance efforts.

3. Demonstrate Your Attention to Detail and Accuracy

Trust accounting requires meticulous attention to detail and accuracy. Provide examples that showcase your strong analytical and numerical abilities.

- Mention instances where you detected errors or discrepancies in trust accounts and took prompt corrective actions.

- Highlight your experience in preparing financial reports with zero errors and meeting strict deadlines.

4. Emphasize Your Communication and Interpersonal Skills

Effective communication is essential for building strong relationships with beneficiaries and colleagues. Showcase your ability to communicate complex financial information clearly and sensitively.

- Share examples of how you handled difficult conversations with beneficiaries, addressing their concerns professionally and empathetically.

- Describe your experience in providing guidance and training to staff, fostering a positive and supportive team environment.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Trust Accounts Supervisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.