Are you gearing up for a career in Trust Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Trust Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

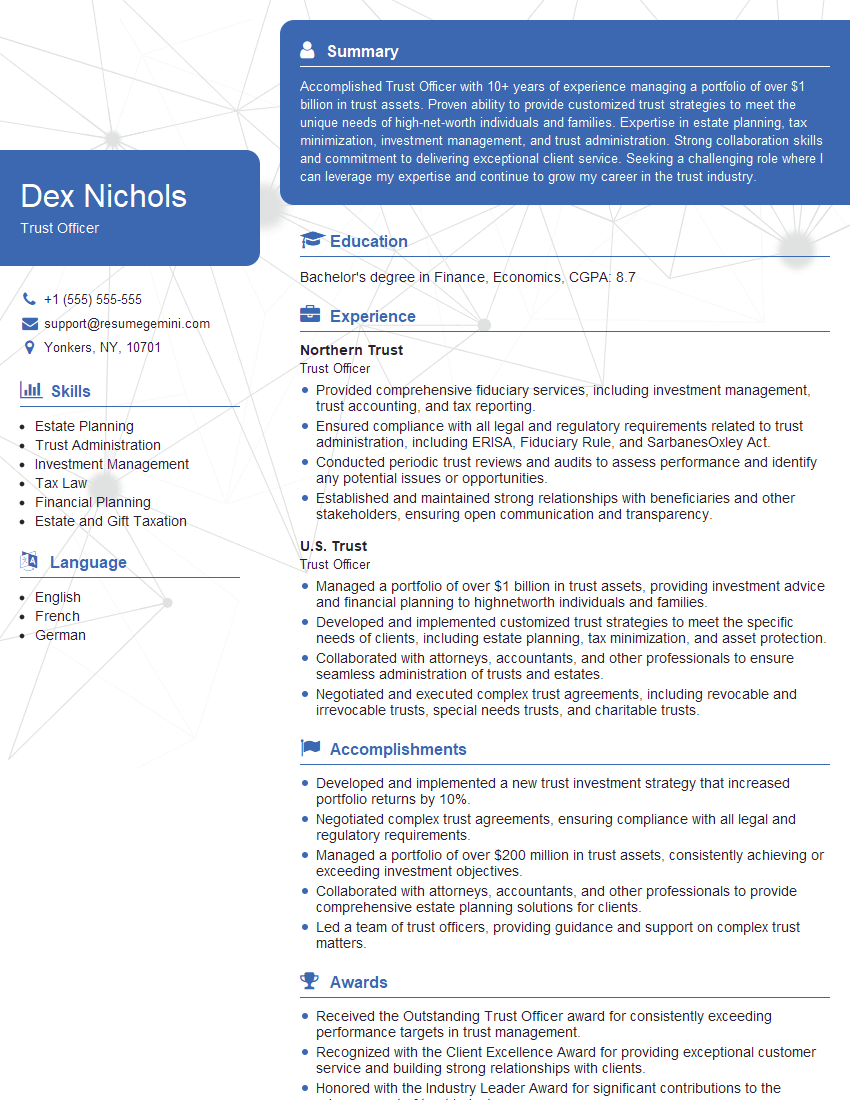

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Trust Officer

1. Describe the role and responsibilities of a Trust Officer.

As a Trust Officer, my primary responsibilities would revolve around managing and administering trusts for individuals, families, and institutions. My duties would include:

- Developing and implementing trust agreements in accordance with the client’s wishes

- Managing trust assets, including investments, real estate, and other properties

- Distributing trust income and assets to beneficiaries according to the terms of the trust

- Providing guidance and advice to clients on trust-related matters

- Ensuring compliance with all applicable laws and regulations

2. What are the key skills and qualifications required for a Trust Officer?

Technical Skills:

- Proficient in trust law and estate planning

- Expertise in investment management and financial analysis

- Strong understanding of tax laws and accounting principles

- Ability to read and interpret legal documents

- Experience in managing trust assets

Soft Skills:

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Strong analytical and problem-solving abilities

- High level of integrity and confidentiality

3. How do you approach developing a comprehensive trust plan for a client?

To develop a comprehensive trust plan, I follow a systematic approach:

- Meet with the client to understand their financial situation, objectives, and family dynamics

- Review relevant estate planning documents, such as wills and powers of attorney

- Identify the appropriate trust structure to meet the client’s needs (e.g., revocable living trust, irrevocable trusts)

- Draft the trust agreement and ensure it complies with all legal requirements

- Work with the client to appoint trustees and beneficiaries

- Fund the trust with the client’s assets

4. What is your understanding of fiduciary duty and how does it apply to the role of a Trust Officer?

Fiduciary duty is the highest legal duty of care that requires a person (the fiduciary) to act in the best interests of another person (the beneficiary). As a Trust Officer, I have a fiduciary duty to my clients, which means:

- I must always act in the best interests of the beneficiaries

- I have a duty to manage trust assets prudently and diligently

- I must avoid any conflicts of interest

- I am held to a high standard of accountability for my actions

5. Describe how you stay up-to-date with industry regulations and legal changes related to trusts.

To ensure compliance and provide the most up-to-date advice to my clients, I continuously engage in professional development activities:

- Attend conferences and seminars on estate planning and trust administration

- Read industry publications and legal journals

- Participate in professional organizations, such as the American Bar Association’s Trust and Estate Law Section

- Seek guidance from experienced professionals, such as estate attorneys and tax advisors

6. What are the ethical considerations that a Trust Officer must adhere to?

As a Trust Officer, I am bound by ethical principles that guide my conduct:

- Confidentiality: I must keep all client information confidential

- Conflicts of interest: I must avoid any situations that could create a conflict of interest

- Impartiality: I must treat all beneficiaries fairly and impartially

- Competence: I must provide services within my area of expertise and refer clients to other professionals when necessary

- Honesty and integrity: I must be honest and transparent in all my dealings

7. How do you handle complex trust disputes and disagreements between beneficiaries?

When faced with trust disputes, I prioritize the following steps:

- Identify the source of the dispute and gather all relevant information

- Review the trust document and applicable laws to determine the rights and responsibilities of the parties involved

- Facilitate communication between the beneficiaries and encourage mediation or alternative dispute resolution methods

- If necessary, seek legal counsel to protect the interests of the beneficiaries and ensure the proper administration of the trust

8. Describe your experience in managing trust investments and achieving investment objectives.

Throughout my career, I have successfully managed trust investments for a diverse clientele:

- Developed and implemented investment strategies aligned with the trust’s investment objectives and risk tolerance

- Monitored and analyzed investment performance to ensure it meets the desired outcomes

- Collaborated with financial advisors and investment professionals to enhance portfolio returns

- Regularly reported on investment performance and provided recommendations to clients

9. How do you incorporate tax strategies into your trust administration responsibilities?

To minimize tax burdens and maximize benefits for beneficiaries, I employ various tax strategies:

- Consider tax implications during trust design and asset distributions

- Utilize tax-advantaged investment vehicles, such as IRAs and 529 plans

- Coordinate with tax professionals to ensure compliance with tax laws and regulations

- Stay informed about tax code changes and their impact on trusts

10. What are the current trends and challenges in the trust administration industry?

The trust administration industry is evolving, and I keep abreast of the latest trends and challenges:

- Increased regulatory scrutiny and compliance requirements

- Growing demand for tailored trust solutions to meet diverse client needs

- Advancements in technology and the use of digital tools in trust management

- Rising awareness of cybersecurity risks and the importance of data protection

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Trust Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Trust Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Trust Officers play a crucial role in wealth management and fiduciary services. They are responsible for managing and administering trusts, estates, and other fiduciary accounts. Their primary job responsibilities encompass the following:

1. Trust Management

• Establish and administer trusts according to the settlor’s wishes

• Distribute trust assets to beneficiaries as per the trust document

• Manage trust investments to ensure their growth and preservation

2. Estate Administration

• Administer estates according to the deceased’s will or trust document

• Distribute estate assets to beneficiaries

• Manage estate investments and assets

3. Fiduciary Services

• Act as a fiduciary for individuals and organizations

• Provide investment advice and management

• Manage financial affairs

4. Customer Relationship Management

• Develop and maintain relationships with trustors, beneficiaries, and other stakeholders

• Communicate effectively with clients and provide them with regular updates

• Ensure excellent customer service

Interview Tips

To ace the interview for a Trust Officer position, it’s essential to prepare thoroughly and showcase your expertise in trust management, estate administration, and fiduciary services.

1. Research the Company and the Role

• Gather information about the trust company, its values, and its specific business practices.

• Learn about the key responsibilities of the Trust Officer role and how it aligns with your skills and experience.

2. Practice Behavioral Interview Questions

• Prepare for questions that delve into your past experiences and behaviors.

• Use the STAR method (Situation, Task, Action, Result) to structure your answers, providing specific examples that demonstrate your abilities.

• Emphasize skills such as problem-solving, communication, and attention to detail.

3. Quantify Your Accomplishments

• When describing your previous experiences, use quantifiable data to showcase your results.

• For instance, instead of saying “Managed trust accounts,” you could say “Managed a portfolio of trust accounts, resulting in an average annual return of 8% over a five-year period.”

4. Be Enthusiastic and Professional

• Convey your passion for trust management and helping clients.

• Maintain a professional demeanor throughout the interview, and ask thoughtful questions that demonstrate your interest.

5. Prepare Questions for the Interviewers

• Asking thoughtful questions shows your engagement and interest in the position.

• Prepare questions that explore the company’s culture, growth opportunities, and the challenges and opportunities within the industry.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Trust Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!