Feeling lost in a sea of interview questions? Landed that dream interview for Trust Operations Assistant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Trust Operations Assistant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

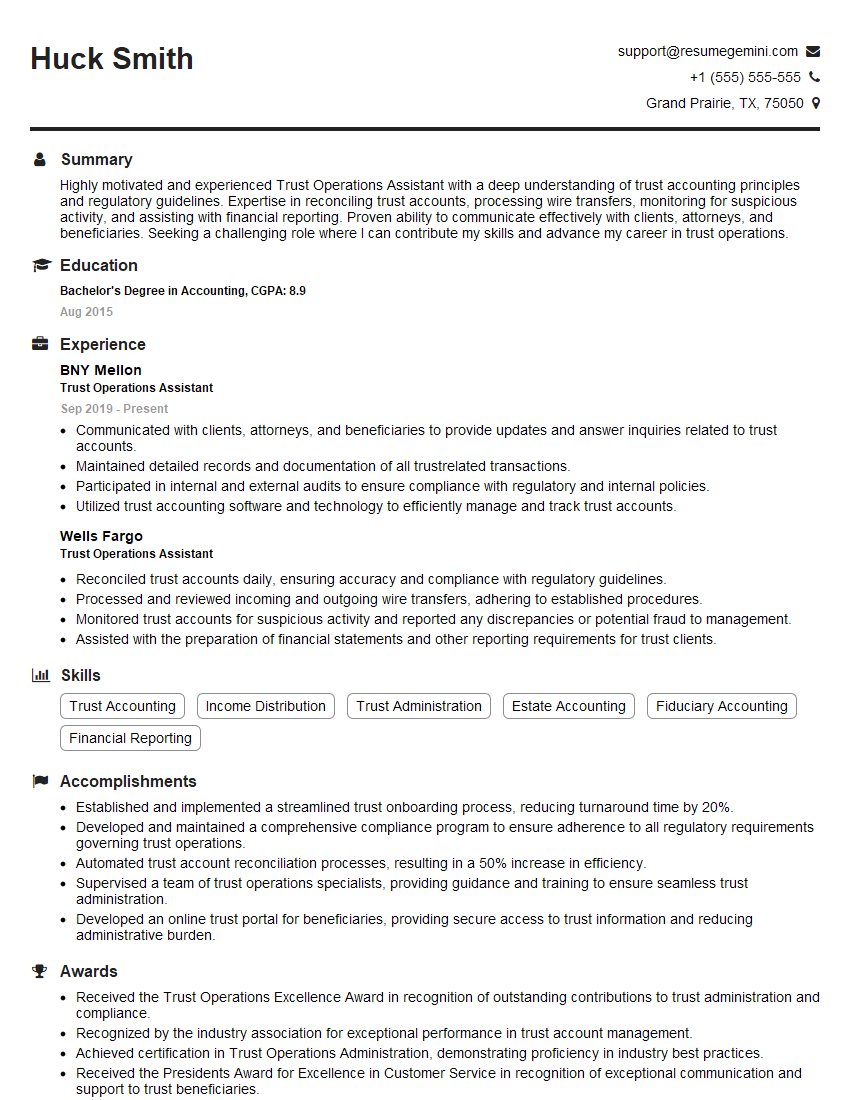

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Trust Operations Assistant

1. What is the purpose of a trust account?

A trust account is a specialized financial account established to hold and manage assets for the benefit of another party, known as the beneficiary. It is created under a legal agreement, called a trust, that specifies the terms of the account, including the distribution of funds and the powers and responsibilities of the trustee who manages the account.

2. What are the different types of trust accounts?

Revocable Trust

- Can be amended or revoked by the grantor during their lifetime.

- Assets in the trust are not subject to probate upon the grantor’s death.

Irrevocable Trust

- Cannot be amended or revoked once established.

- Assets in the trust are removed from the grantor’s estate for tax purposes.

3. What are the key responsibilities of a Trust Operations Assistant?

- Providing support to Trust Officers in managing trust accounts.

- Processing financial transactions, such as deposits, withdrawals, and distributions.

- Monitoring trust investments and preparing reports.

- Ensuring compliance with relevant regulations and laws.

- Communicating with beneficiaries and other stakeholders.

4. What is the importance of due diligence in trust operations?

Due diligence is crucial in trust operations to minimize risk and ensure the integrity of the trust. It involves verifying the identity of the parties involved, investigating potential conflicts of interest, and assessing the financial health of the trust. This process helps to protect the interests of the beneficiaries and the reputation of the trust company.

5. What are the key challenges you have faced as a Trust Operations Assistant?

One of the key challenges I have faced as a Trust Operations Assistant is staying up-to-date with the complex and evolving regulatory landscape governing trust operations. It requires continuous learning and attention to detail to ensure compliance and mitigate potential risks.

6. How do you handle confidential information related to trusts?

Maintaining confidentiality is paramount in trust operations. I adhere strictly to non-disclosure agreements and industry best practices. I limit access to sensitive information to authorized individuals on a need-to-know basis and employ secure communication channels and document storage systems.

7. What software and tools are you familiar with for trust operations?

I am proficient in various software and tools commonly used in trust operations, such as trust accounting systems, portfolio management platforms, and document management systems. I am also familiar with industry-specific software for tax reporting, compliance monitoring, and risk assessment.

8. How do you stay up-to-date with industry best practices and regulatory changes?

To stay current with industry best practices and regulatory changes, I regularly attend industry conferences, webinars, and training sessions. I also subscribe to industry publications and follow thought leaders in the field. Additionally, I actively participate in professional organizations to connect with peers and share knowledge.

9. What is your understanding of the Uniform Prudent Investor Act (UPIA)?

The Uniform Prudent Investor Act (UPIA) is a set of guidelines that govern the investment decisions of trustees. It requires trustees to act in the best interests of the beneficiaries, considering factors such as diversification, risk tolerance, and the overall investment objectives of the trust.

10. How do you prioritize and manage your workload in a fast-paced trust operations environment?

In a fast-paced trust operations environment, I prioritize my workload based on urgency, deadlines, and the potential impact on beneficiaries. I use a combination of task management tools, such as to-do lists and calendars, to stay organized and track my progress. I also seek support from colleagues and supervisors when necessary to ensure timely and efficient completion of tasks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Trust Operations Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Trust Operations Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Trust Operations Assistants play a vital role in the smooth functioning of trust operations, ensuring compliance and efficient administration.

1. Relationship Management

Foster and maintain positive relationships with settlors, beneficiaries, and other stakeholders by promptly addressing inquiries and providing updates.

- Respond to client inquiries promptly and professionally.

- Maintain accurate records of all client interactions.

2. Document Management

Manage and maintain trust documents, including financial statements, tax returns, and legal agreements, ensuring their accuracy and accessibility.

- Process and review trust documents for completeness and accuracy.

- Store and retrieve trust documents securely and efficiently.

3. Compliance Monitoring

Monitor trust operations for compliance with legal and regulatory requirements, ensuring the protection of trust assets and beneficiaries.

- Stay up-to-date on relevant laws and regulations.

- Conduct internal audits to identify and address compliance risks.

4. Administration and Reporting

Perform administrative tasks and prepare reports related to trust operations, ensuring accurate and timely reporting to beneficiaries and regulatory bodies.

- Prepare and distribute account statements.

- Generate and file tax returns on behalf of the trust.

Interview Tips

Preparing thoroughly for a Trust Operations Assistant interview is crucial for success. Here are some tips to help you ace the interview:

1. Research the Company and the Role

Research the trust company and the specific role you are applying for. Familiarize yourself with their services, industry standing, and any specialized requirements.

- Visit the company’s website and social media pages.

- Read industry news and articles to gain insights into the company and the role.

2. Highlight Your Skills and Experience

Emphasize your skills and experience that are relevant to the key responsibilities of the role. Quantify your accomplishments whenever possible.

- Provide specific examples of your experience in relationship management, document management, compliance monitoring, and administration.

- Use action verbs to describe your accomplishments, such as “managed,” “processed,” “monitored,” and “reported.”

3. Demonstrate Your Knowledge

Demonstrate your knowledge of trust operations, including legal and regulatory requirements. Be prepared to answer questions about trust administration, taxation, and compliance.

- Review the Uniform Trust Code (UTC) and other relevant laws and regulations.

- Stay up-to-date on industry best practices and trends.

4. Prepare Questions for the Interviewers

Preparing thoughtful questions for the interviewers shows your interest and engagement. It also gives you an opportunity to clarify any aspects of the role or the company.

- Ask about the company’s growth plans and industry outlook.

- Inquire about the opportunities for professional development and advancement.

Next Step:

Now that you’re armed with the knowledge of Trust Operations Assistant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Trust Operations Assistant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini