Are you gearing up for an interview for a U.S. Revenue Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for U.S. Revenue Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

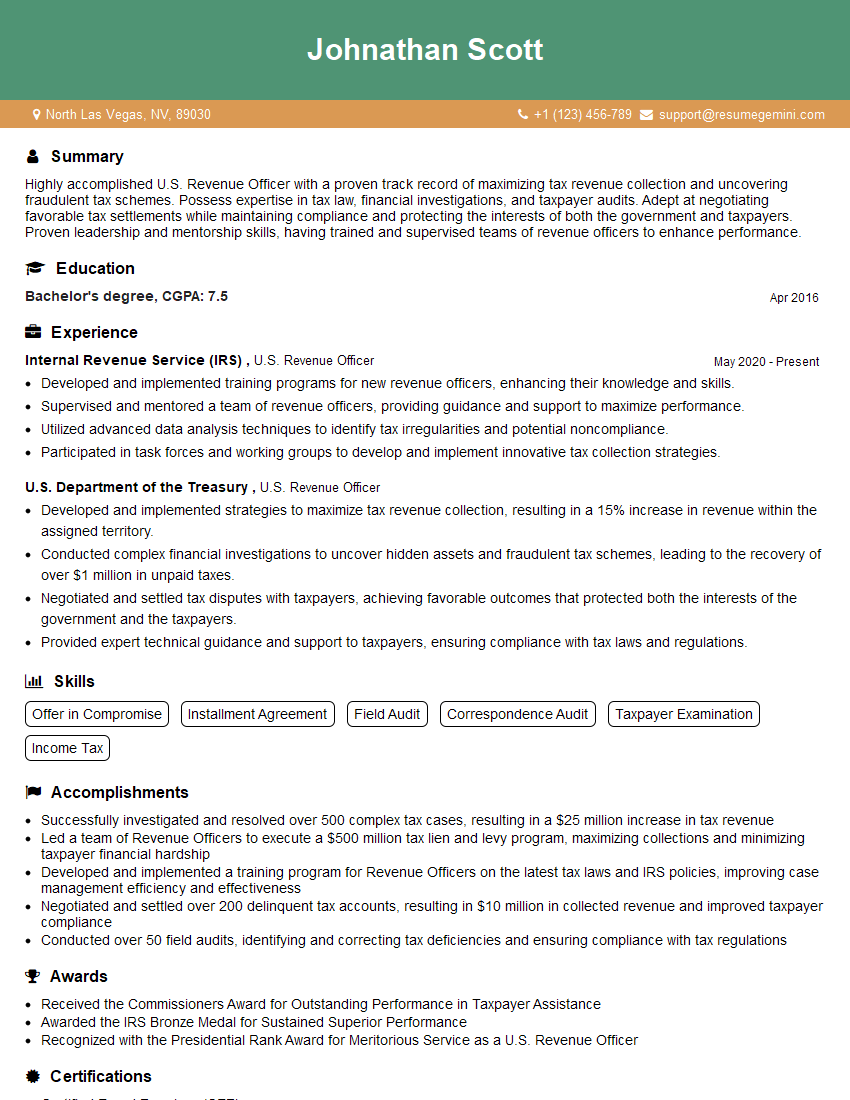

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For U.S. Revenue Officer

1. Describe the process of conducting an audit of an individual taxpayer.

Sample Answer

- Planning: Gather information about the taxpayer, such as income, expenses, and deductions, to determine the scope of the audit.

- Examination: Review the taxpayer’s records, interview the taxpayer and third parties, and analyze financial data to verify the accuracy of the return.

- Analysis: Evaluate the evidence gathered during the examination to determine if any adjustments are necessary.

- Resolution: Discuss the audit findings with the taxpayer, resolve any disagreements, and issue a final report.

2. Explain the difference between a civil and a criminal tax investigation.

Sample Answer

Civil Tax Investigation

- Focused on determining the correct tax liability.

- Involves the examination of financial records and interviews with the taxpayer.

- May result in additional tax, penalties, and interest being assessed.

Criminal Tax Investigation

- Focused on proving that the taxpayer has committed a crime, such as tax evasion or fraud.

- Involves the use of investigative techniques, such as search warrants and subpoenas.

- May result in criminal charges being filed and penalties, including imprisonment.

3. Discuss the ethical considerations involved in conducting a tax audit.

Sample Answer

- Confidentiality: Maintain the confidentiality of taxpayer information.

- Objectivity: Conduct the audit fairly and impartially.

- Professionalism: Act professionally and respectfully towards the taxpayer.

- Integrity: Adhere to ethical guidelines and avoid conflicts of interest.

4. Describe the different types of penalties that can be imposed for tax violations.

Sample Answer

- Civil Penalties: Fines, interest, and late payment penalties.

- Criminal Penalties: Imprisonment, fines, and restitution.

- Accuracy-Related Penalties: Penalties for understating tax liability due to negligence or disregard of rules.

- Fraud Penalties: Penalties for intentionally evading or defrauding the government.

5. Explain the tax implications of owning a rental property.

Sample Answer

- Rental Income: Rental income is generally taxable as ordinary income.

- Expenses: Expenses related to the property, such as mortgage interest, property taxes, and repairs, are deductible.

- Depreciation: The cost of the property can be depreciated over its useful life.

- Sale of Property: Gain or loss on the sale of the property is generally taxable.

6. Discuss the provisions of the Internal Revenue Code that relate to the taxation of businesses.

Sample Answer

- Subchapter C Corporations: Corporations that are taxed at the corporate level and shareholders are taxed on dividends.

- Subchapter S Corporations: Corporations that are not taxed at the corporate level and profits are passed through to shareholders.

- Partnerships: Entities that are not taxed at the entity level and profits and losses are passed through to partners.

- Limited Liability Companies (LLCs): Entities that can choose to be taxed as corporations, partnerships, or disregarded entities.

7. Explain the process of filing an Offer in Compromise (OIC).

Sample Answer

- Submit a formal request to the IRS, explaining the taxpayer’s financial situation and inability to pay the full tax liability.

- Provide documentation to support the taxpayer’s claims, such as income statements, bank statements, and medical expenses.

- Negotiate with the IRS on an acceptable settlement amount.

- If the IRS accepts the OIC, the taxpayer will be required to pay the agreed-upon amount to settle the tax debt.

8. Describe the procedures for seizing and selling property to satisfy a tax debt.

Sample Answer

- Notice and Demand: The IRS sends a notice and demand for payment to the taxpayer.

- Seizure: If the taxpayer does not pay, the IRS may seize property, such as cars, boats, and real estate.

- Notice of Sale: The IRS will publish a notice of sale and sell the seized property at a public auction.

- Proceeds: The proceeds from the sale will be used to satisfy the tax debt.

9. Discuss the taxpayer’s rights during an audit.

Sample Answer

- Right to representation.

- Right to receive a clear explanation of the purpose and scope of the audit.

- Right to examine and copy all documents and records used in the audit.

- Right to challenge the IRS’s findings.

- Right to a hearing before an Appeals Officer.

10. Explain the procedures for making a voluntary disclosure to the IRS.

Sample Answer

- Contact the IRS and request a Voluntary Disclosure Pre-Clearance Request (PC-211).

- Submit the completed PC-211, along with all relevant documentation.

- If the IRS grants pre-clearance, the taxpayer will be required to fully disclose all unreported income and pay all back taxes, penalties, and interest.

- In certain cases, the taxpayer may be eligible for reduced penalties or immunity from criminal prosecution.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for U.S. Revenue Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the U.S. Revenue Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

U.S. Revenue Officers are responsible for a wide range of duties related to the collection of taxes and ensuring compliance with tax laws. Their primary responsibilities include:

1. Taxpayer Assistance

Providing taxpayers with guidance and assistance on tax matters, including answering questions, explaining tax laws, and helping them to file their tax returns accurately.

2. Audits and Investigations

Conducting audits and investigations to ensure that taxpayers are complying with tax laws, including examining financial records, interviewing witnesses, and analyzing data.

3. Collection of Delinquent Taxes

Collecting delinquent taxes from individuals and businesses through various means, such as levies, liens, and seizures. They also negotiate payment plans with taxpayers who are unable to pay their taxes in full.

4. Enforcement of Tax Laws

Investigating and prosecuting cases of tax fraud and other tax violations. They work closely with other law enforcement agencies to ensure that individuals and businesses are held accountable for tax-related crimes.

5. Other Duties

U.S. Revenue Officers may also be required to perform other duties such as:

- Providing training to other IRS employees on tax laws and procedures

- Representing the IRS in court proceedings related to tax matters

- Conducting outreach programs to educate the public about tax laws and responsibilities

Interview Tips

To ace an interview for a U.S. Revenue Officer position, it is important to be well-prepared and to highlight your relevant skills and experience. Here are some tips to help you prepare for your interview:

1. Research the IRS and the Role of a Revenue Officer

Familiarize yourself with the mission and values of the IRS, as well as the specific duties and responsibilities of a Revenue Officer. This will help you to demonstrate your understanding of the position and the organization.

2. Practice Common Interview Questions

Prepare for common interview questions, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Consider how your skills and experience align with the requirements of the job.

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience, such as your knowledge of tax laws, your ability to conduct audits and investigations, and your experience in dealing with taxpayers.

4. Demonstrate Your Communication and Interpersonal Skills

U.S. Revenue Officers must be able to communicate effectively with taxpayers, colleagues, and other stakeholders. Highlight your strong communication, interpersonal, and negotiation skills.

5. Prepare for Behavioral Interview Questions

Behavioral interview questions ask you to describe how you have handled specific situations in the past. Prepare for questions such as “Tell me about a time when you resolved a conflict successfully.” These questions are designed to assess your problem-solving, decision-making, and teamwork skills.

6. Be Professional and Enthusiastic

Dress professionally and arrive on time for your interview. Show enthusiasm for the position and demonstrate your commitment to serving the public.

7. Ask Questions

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. Prepare questions about the specific role, the IRS, and the organization’s culture.

8. Follow Up

After your interview, send a thank-you note to the interviewer. This shows your appreciation for their time and consideration.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the U.S. Revenue Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!