Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

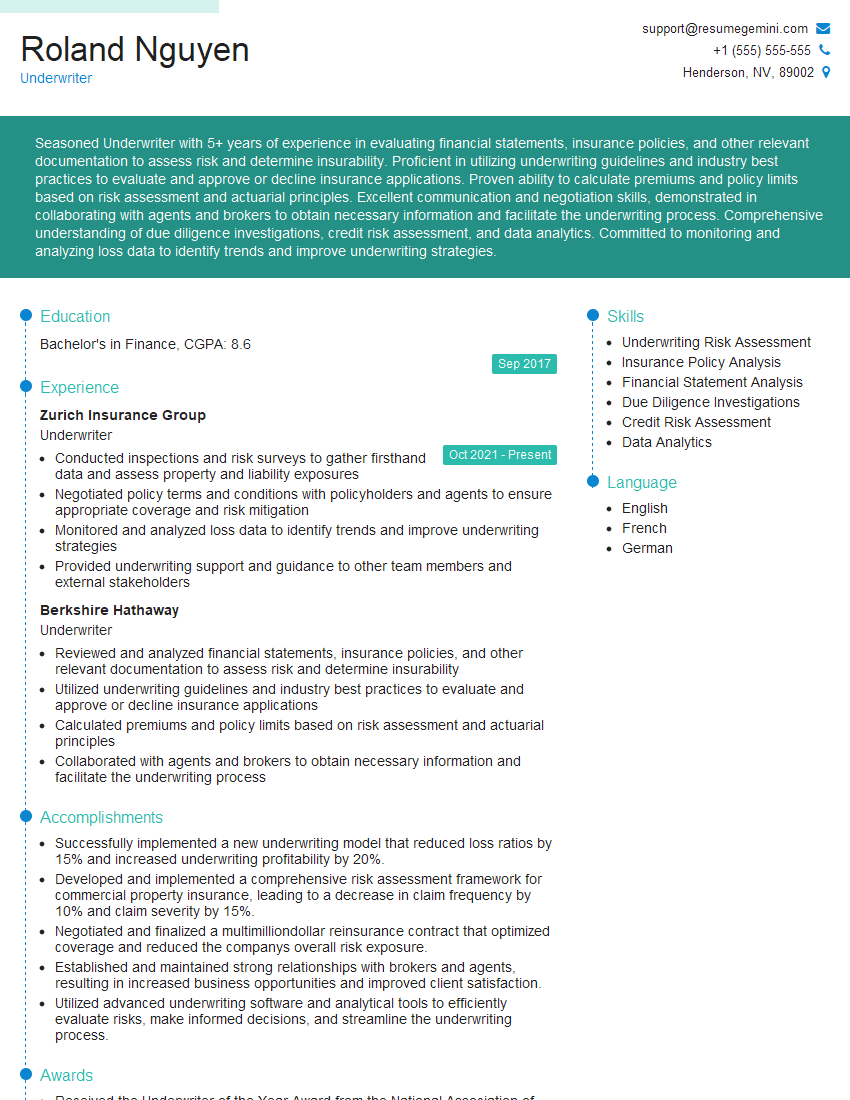

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriter

1. Describe the underwriting process you are familiar with and how you would approach underwriting a new class of business?

The underwriting process involves assessing and evaluating the risk associated with an insurance policy. Here’s how I approach underwriting:

- Gather Data: Collect and analyze relevant data about the applicant, their business, and the proposed coverage.

- Identify Risks: Determine the potential risks associated with the policy, considering factors such as the applicant’s industry, financial stability, and claims history.

- Evaluate Risk: Use statistical models, industry knowledge, and experience to evaluate the likelihood and severity of the identified risks.

- Calculate Premium: Determine an appropriate premium that reflects the level of risk assumed.

- Review Policy Terms: Ensure that the policy terms accurately reflect the underwriting decision and protect the interests of all parties.

When underwriting a new class of business, I would:

- Research the Industry: Gather information about the specific industry, its risks, and underwriting practices.

- Seek Expertise: Consult with experts and underwriters who specialize in the new class of business.

- Develop Guidelines: Establish underwriting guidelines that are tailored to the specific risks associated with the new business.

- Monitor Results: Regularly review the performance of the underwriting decisions to identify any areas for improvement.

2. How do you stay up-to-date on industry trends and changes in underwriting practices?

- Industry Conferences and Events: Attend industry conferences and webinars to learn about new developments and best practices.

- Professional Development Courses: Take continuing education courses and certifications to enhance my knowledge and skills.

- Research and Analysis: Regularly read industry publications, reports, and case studies to stay informed about emerging trends and regulatory changes.

- Networking: Connect with other underwriters, brokers, and industry professionals to exchange insights and ideas.

- Collaboration: Participate in internal and external working groups to contribute to the advancement of underwriting practices.

3. Explain how you determine the appropriate level of coverage for a policyholder.

- Assess Risk: Evaluate the potential risks and liabilities faced by the policyholder.

- Review Financial Situation: Consider the policyholder’s financial capacity and ability to manage potential losses.

- Analyze Policy Objectives: Determine the policyholder’s specific coverage needs and goals.

- Consider Industry Benchmarks: Review industry standards and guidelines for coverage levels in similar businesses.

- Balance Risk and Cost: Strike a balance between providing adequate protection and keeping the premium affordable for the policyholder.

4. Describe your experience in using technology to enhance the underwriting process.

- Data Analytics: Utilized data analytics tools to identify patterns, predict risks, and improve pricing accuracy.

- Underwriting Automation: Leveraged underwriting automation software to streamline the application review and decision-making process.

- Risk Modeling: Employed risk modeling software to assess and quantify potential losses.

- Customer Relationship Management (CRM): Used CRM systems to manage policyholder interactions, track claims, and provide personalized service.

- Artificial Intelligence (AI): Explored the use of AI algorithms to enhance underwriting accuracy and efficiency.

5. Explain how you handle complex or high-risk underwriting situations.

- Seek Expert Input: Consult with senior underwriters, actuaries, or industry experts to gain additional perspectives.

- Thorough Due Diligence: Conduct extensive research and analysis to gather all relevant information.

- Structured Decision-Making: Use a structured framework to weigh risks, consider alternatives, and make informed decisions.

- Collaboration: Involve key stakeholders, such as claims adjusters and brokers, to share insights and coordinate efforts.

- Escrow or Conditional Approval: Utilize underwriting mechanisms such as escrow or conditional approval to manage high-risk situations.

6. Describe your experience in managing a portfolio of insurance policies.

- Policy Tracking: Maintained a comprehensive database to track all policies under my management.

- Renewal Management: Proactively planned and executed policy renewals to ensure continuity of coverage.

- Claims Monitoring: Regularly reviewed claims activity to identify potential trends and manage loss exposures.

- Portfolio Analysis: Conducted regular portfolio analysis to identify areas for improvement and optimize risk management.

- Reporting and Communication: Prepared regular reports and communicated key metrics to senior management.

7. Explain how you balance the need for profitability with providing fair and reasonable coverage to policyholders.

- Risk-Based Pricing: Developed and implemented risk-based pricing models to ensure that premiums accurately reflect the level of risk assumed.

- Customer Segmentation: Divided policyholders into different segments based on their risk profiles and underwriting needs.

- Targeted Marketing: Focused marketing efforts on policies that provide value and protection while maintaining profitability.

- Claims Management: Implemented effective claims management strategies to minimize unnecessary losses and ensure fair settlements.

- Reinsurance: Utilized reinsurance mechanisms to transfer high-risk exposures and balance the portfolio.

8. Describe your experience in using data to drive decision-making in the underwriting process.

- Data Collection: Collected and organized relevant data from various sources, including policy applications, claims history, and industry databases.

- Data Analysis: Used statistical techniques and machine learning algorithms to analyze data and identify patterns and trends.

- Risk Modeling: Developed risk models to predict future losses and assess the impact of different underwriting decisions.

- Decision Support: Presented data-driven insights and recommendations to support underwriting decisions.

- Continuous Improvement: Regularly monitored and evaluated the effectiveness of data-driven decision-making and made adjustments as needed.

9. Explain how you would approach underwriting a policy for a new and emerging technology.

- Research the Technology: Gather as much information as possible about the technology, its applications, and potential risks.

- Consult Experts: Seek advice from industry experts, scientists, and engineers who have knowledge of the technology.

- Develop Coverage Parameters: Establish clear coverage parameters that outline the scope of the policy and any exclusions or limitations.

- Assess Risk: Evaluate the potential risks associated with the technology and determine an appropriate premium rate.

- Monitor and Adjust: Regularly monitor the performance of the policy and make adjustments as needed based on emerging data and industry trends.

10. Describe your understanding of the principles of reinsurance and how it can be used to manage risk.

- Risk Transfer: Reinsurance is a mechanism by which insurers transfer a portion of their risk to other insurance companies.

- Capacity Expansion: It allows insurers to take on more risk than they would be able to on their own.

- Catastrophe Protection: Reinsurance provides protection against large, unexpected losses, such as natural disasters.

- Capital Management: It can help insurers manage their capital requirements and improve financial stability.

- Risk Sharing: Reinsurance facilitates the sharing of risk among multiple insurers, spreading the potential losses across a larger pool.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriters play a crucial role in assessing and managing risk for insurance companies. Their key responsibilities include analyzing insurance applications, evaluating risk factors, and determining the appropriate coverage and premium rates.

1. Risk Analysis and Assessment

Underwriters meticulously assess and evaluate insurance applications to determine the level of risk associated with the policyholder.

- Review financial statements, medical records, credit reports, and other relevant documents.

- Conduct site visits and interviews to gather additional information.

2. Policy Issuance and Pricing

Based on their risk analysis, underwriters determine the appropriate coverage terms and premium rates for the insurance policy.

- Negotiate policy terms and conditions with brokers and policyholders.

- Calculate premium rates based on actuarial data and risk assessment.

3. Claims Evaluation and Settlement

Underwriters participate in the claims process to evaluate the validity and extent of claims made by policyholders.

- Review claim submissions and investigate the circumstances surrounding the loss.

- Determine the amount of coverage and settlement based on policy terms and conditions.

4. Risk Management and Mitigation

Underwriters monitor and manage ongoing risks associated with insurance policies.

- Identify and address emerging risks that could impact the insurer’s financial stability.

- Implement risk mitigation strategies, such as reinsurance or policy exclusions.

Interview Tips

Preparing for an underwriter interview involves understanding the role, showcasing your skills, and demonstrating your ability to handle risk assessment and insurance principles.

1. Research the Company and Industry

Research the insurance company and the industry to gain insights into their underwriting practices and current trends.

- Understand their target market, underwriting guidelines, and claims history.

- Stay updated on industry news and regulations related to underwriting.

2. Highlight Your Skills and Experience

Emphasize your analytical skills, attention to detail, and strong understanding of insurance principles.

- Quantify your accomplishments whenever possible, focusing on specific metrics and outcomes.

- Provide examples of complex underwriting cases you have handled and the decisions you made.

3. Demonstrate Your Understanding of Risk

Discuss your understanding of risk factors, risk mitigation techniques, and claims evaluation.

- Explain your approach to evaluating different types of risks, such as property, liability, and financial risks.

- Provide examples of how you have identified and addressed potential risks in the past.

4. Practice Common Interview Questions

Prepare for common interview questions related to underwriting, such as:

- Why are you interested in becoming an underwriter?

- Tell me about a time you had to make a difficult underwriting decision.

- How do you stay up-to-date on industry trends and best practices?

Next Step:

Now that you’re armed with the knowledge of Underwriter interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Underwriter positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini