Are you gearing up for a career in Underwriting Account Representative? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Underwriting Account Representative and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

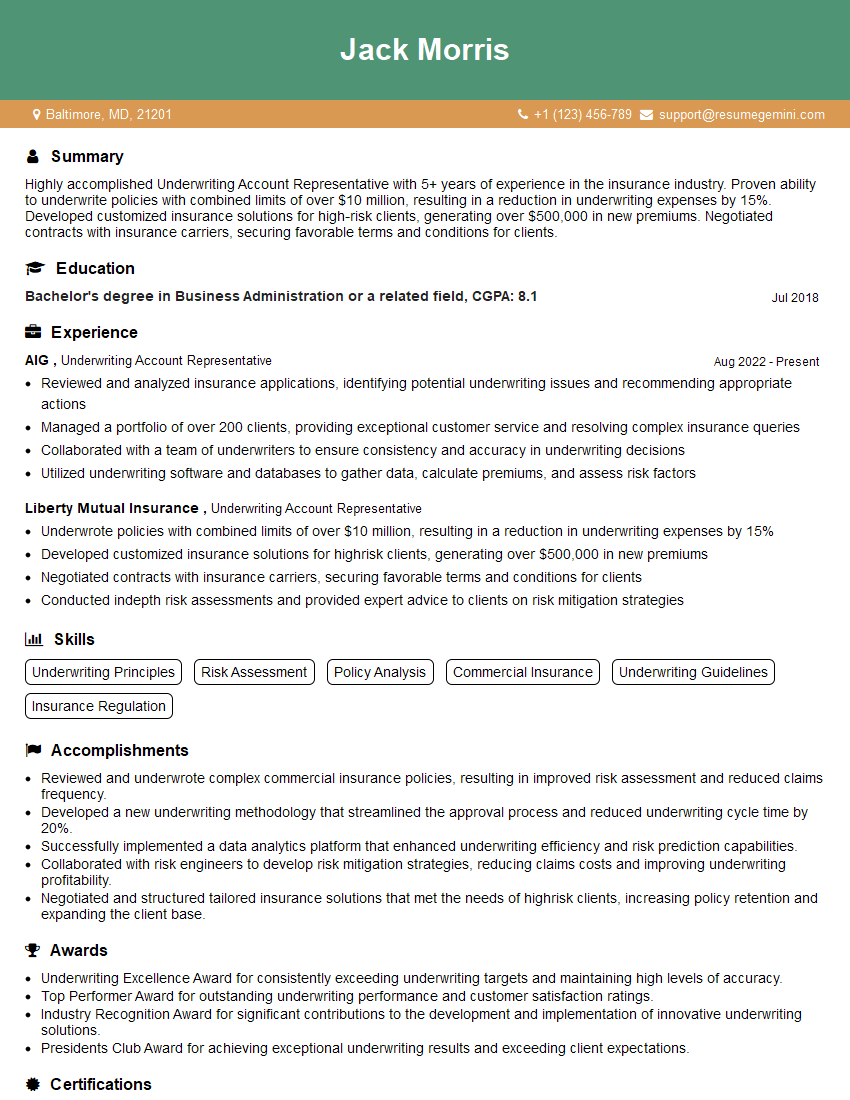

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Account Representative

1. Explain the key components of an insurance policy?

An insurance policy is a legal contract between an insurance company and an insured individual or organization. It outlines the terms and conditions of the coverage, including the following key components:

- Policyholder: The individual or organization that purchases the insurance policy.

- Insured: The person or property that is covered under the policy.

- Insurance company: The company that provides the insurance coverage.

- Coverage: The specific risks or events that are covered under the policy.

- Premium: The amount of money that the policyholder pays to the insurance company in exchange for coverage.

- Deductible: The amount of money that the policyholder must pay out-of-pocket before the insurance coverage begins.

- Limits of liability: The maximum amount of money that the insurance company will pay for a covered claim.

2. Describe the underwriting process for a commercial property insurance policy?

The underwriting process for a commercial property insurance policy involves several key steps:

Assessment of risk

- Evaluating the property’s location, construction, and occupancy.

- Identifying potential hazards and vulnerabilities.

- Estimating the potential financial impact of a loss.

Premium Calculation

- Determining the appropriate premium rate based on the assessed risk.

- Calculating the total premium amount to be paid by the policyholder.

Policy Issuance

- Drafting and issuing the insurance policy.

- Outlining the terms and conditions of coverage.

- Providing the policyholder with a copy of the policy.

3. What are the key factors that determine the premium for a commercial general liability insurance policy?

The key factors that determine the premium for a commercial general liability insurance policy include:

- Industry: The type of business or industry in which the policyholder operates.

- Size: The size of the business, including the number of employees and revenue.

- Location: The location of the business, including the crime rate and natural disaster risks in the area.

- Claims history: The policyholder’s past claims experience.

- Coverage limits: The amount of coverage that the policyholder purchases.

4. Explain the different types of coverage available under a commercial property insurance policy?

Commercial property insurance policies provide coverage for various types of losses, including:

- Building coverage: Protects the physical structure of the building, including its walls, roof, and foundation.

- Business personal property coverage: Protects the contents of the building, such as furniture, equipment, and inventory.

- Loss of income coverage: Provides compensation for lost income due to a covered loss.

- Extra expense coverage: Covers additional expenses incurred as a result of a covered loss, such as temporary relocation costs.

- Flood insurance: Provides coverage for losses caused by flooding.

5. What are the responsibilities of an Underwriting Account Representative?

As an Underwriting Account Representative, my primary responsibilities include:

- Underwriting and risk assessment: Evaluating insurance applications to determine the level of risk and appropriate coverage.

- Premium calculation: Calculating and setting insurance premiums based on the assessed risk and policy terms.

- Policy issuance: Issuing insurance policies to clients, ensuring they meet the underwriting guidelines and client needs.

- Customer service: Providing excellent customer service to policyholders, answering their questions, and addressing their concerns.

- Claims processing: Assisting with claims processing, reviewing and evaluating claims, and ensuring timely settlement.

6. Describe the different types of insurance products that you have experience in underwriting?

Throughout my career, I have gained experience in underwriting various insurance products, including:

- Commercial property insurance

- Commercial general liability insurance

- Business interruption insurance

- Workers’ compensation insurance

- Professional liability insurance

7. How do you stay up-to-date with the latest trends and regulations in the insurance industry?

To stay abreast of the latest trends and regulations in the insurance industry, I actively engage in the following practices:

- Continuing education: Regularly attending industry conferences, webinars, and training programs.

- Professional development: Pursuing industry certifications and designations, such as the Chartered Property Casualty Underwriter (CPCU).

- Industry publications: Subscribing to and reading insurance trade journals and newsletters.

- Networking: Participating in industry events and connecting with peers to exchange knowledge and insights.

8. What software or tools do you use in your role as an Underwriting Account Representative?

In my role, I am proficient in utilizing various software and tools to enhance my efficiency and productivity, including:

- Insurance underwriting software: Specialized software designed for underwriting and policy management.

- Spreadsheets and data analysis tools: Used for data analysis, risk assessment, and premium calculations.

- Customer relationship management (CRM) systems: For managing client relationships and tracking interactions.

- Communication and collaboration tools: Such as email, instant messaging, and video conferencing.

9. How do you handle situations where you need to decline coverage to a potential client?

When faced with the need to decline coverage to a potential client, I approach the situation with empathy, professionalism, and transparency. Here’s how I navigate such situations:

- Explain the reasons clearly: I provide clear and specific reasons for declining coverage, based on the underwriting guidelines and risk assessment.

- Offer alternative solutions: If possible, I explore alternative coverage options or refer the client to other insurers who may be able to provide coverage.

- Maintain a positive relationship: I strive to maintain a positive relationship with the client, even if I cannot offer coverage. I thank them for their application and encourage them to consider future business with us.

10. Can you provide an example of a complex underwriting case that you successfully handled?

Recently, I handled a complex underwriting case involving a large manufacturing facility with unique risks. The case required:

- Thorough risk assessment: I conducted a detailed on-site inspection and analyzed the facility’s operations, safety protocols, and potential hazards.

- Collaboration with experts: I consulted with engineers and industry specialists to gain insights into the specific risks associated with the manufacturing processes.

- Customized coverage: Based on the assessment, I developed a customized insurance solution that addressed the facility’s unique needs and provided comprehensive protection.

- Successful negotiation: I negotiated favorable terms with reinsurers to ensure the client received adequate coverage at a competitive premium.

Through this process, I was able to provide the client with the necessary coverage while effectively managing the underwriting risk.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Account Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Account Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriting Account Representatives are responsible for managing and developing relationships with existing and potential clients in the insurance industry. They are involved in all aspects of the underwriting process, from reviewing applications and assessing risk to issuing policies and managing claims. Key job responsibilities typically include:

1. Client Management

Underwriting Account Representatives are responsible for developing and maintaining relationships with clients. This involves meeting with clients to discuss their insurance needs, providing them with coverage options, and answering their questions.

- Meet with clients to discuss insurance needs

- Provide coverage options and answer questions

- Develop and maintain client relationships

2. Underwriting Process

Underwriting Account Representatives are responsible for reviewing insurance applications and assessing risk. This involves analyzing financial statements, loss history, and other relevant data to determine the likelihood of a loss. They also determine the appropriate coverage and premium for the policy.

- Review insurance applications and assess risk

- Analyze financial statements, loss history, and other data

- Determine the appropriate coverage and premium

3. Policy Issuance

Once the underwriting process is complete, Underwriting Account Representatives are responsible for issuing policies to clients. This involves preparing and sending the policy documents, as well as collecting the premium payment.

- Prepare and send policy documents

- Collect the premium payment

- Issue policies to clients

4. Claims Management

Underwriting Account Representatives are also responsible for managing claims. This involves investigating claims, determining coverage, and settling claims with clients. They also work with claims adjusters to ensure that claims are handled fairly and efficiently.

- Investigate claims

- Determine coverage

- Settle claims with clients

- Work with claims adjusters

Interview Tips

To ace an interview for an Underwriting Account Representative position, it is important to be prepared and to have a strong understanding of the key job responsibilities. Here are some tips to help you prepare for your interview:

1. Research the company

Before your interview, take some time to research the company. Learn about their history, their products and services, and their company culture. This will show the interviewer that you are interested in the company and that you have taken the time to learn about them.

- Visit the company website

- Read about the company in industry publications

- Talk to people who work or have worked at the company

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked in an interview for an Underwriting Account Representative position. These questions may include:

- “Tell us about yourself.”

- “Why are you interested in this position?”

- “What are your strengths and weaknesses?”

- “What is your experience with underwriting?”

- “How do you handle difficult clients?”

Take some time to practice your answers to these questions so that you can deliver them confidently and clearly in your interview.

3. Be prepared to ask questions

Asking questions at the end of an interview shows the interviewer that you are interested in the position and that you are engaged in the conversation. It also gives you an opportunity to learn more about the company and the position.

- “What are the biggest challenges facing the company right now?”

- “What is the company’s culture like?”

- “What is the next step in the interview process?”

4. Dress professionally

First impressions matter. Make sure to dress professionally for your interview. This means wearing a suit or business casual attire.

5. Be yourself

The most important thing is to be yourself in your interview. The interviewer wants to get to know the real you. So be yourself, be confident, and show the interviewer why you are the best person for the job.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Underwriting Account Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!