Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Underwriting Clerks Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

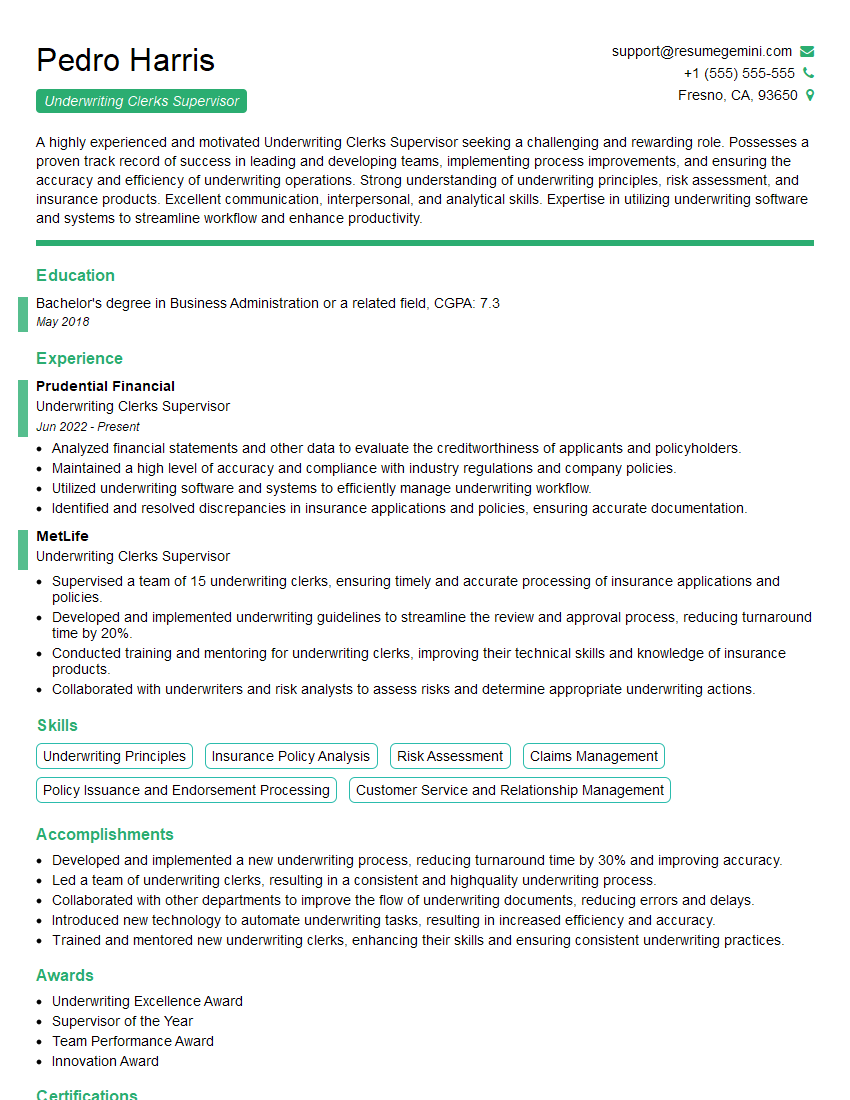

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Clerks Supervisor

1. What is the purpose of an insurance policy, and what are its key components?

An insurance policy is a contract between an insurance company and an individual or business that provides financial protection against specific risks. Key components include:

- Named insured: The person or entity protected by the policy.

- Covered perils: The specific events or situations that the policy covers.

- Policy period: The time frame during which the policy is in effect.

- Policy limits: The maximum amount the insurance company will pay for covered losses.

- Deductible: The amount the insured must pay out-of-pocket before the insurance company starts to cover costs.

2. Describe the underwriting process.

Risk assessment

- Identify and evaluate the risks associated with a potential insured.

- Analyze their financial stability, claims history, and other relevant factors.

Underwriting guidelines

- Establish guidelines to determine if a risk is acceptable for coverage.

- Set premium rates and policy terms based on the risk assessment.

Risk assumption

- Decide whether to approve or decline the insurance application.

- Set policy terms and conditions to manage the risk.

3. What are the different types of insurance policies?

Insurance policies vary based on the type of risk they cover. Common types include:

- Property insurance: Covers damage to buildings, equipment, and other physical assets.

- Liability insurance: Protects against claims for bodily injury or property damage caused by the insured.

- Health insurance: Covers medical expenses and other healthcare costs.

- Life insurance: Provides financial protection for the beneficiaries in the event of the insured’s death.

- Vehicle insurance: Covers damage to vehicles and protects against liability claims arising from accidents.

4. What are the duties and responsibilities of an Underwriting Clerks Supervisor?

An Underwriting Clerks Supervisor typically has the following duties:

- Supervise and train underwriting clerks

- Review and approve underwriting decisions

- Develop and implement underwriting guidelines

- Maintain relationships with brokers and agents

- Stay up-to-date on industry trends and regulations

5. What are the qualities and skills required to be a successful Underwriting Clerks Supervisor?

Successful Underwriting Clerks Supervisors typically possess:

- Strong technical knowledge of insurance underwriting principles

- Excellent communication and interpersonal skills

- Leadership and management abilities

- Analytical and problem-solving skills

- Attention to detail and strong organizational skills

6. How do you stay up-to-date on the latest underwriting trends and regulations?

I stay informed about industry developments by:

- Attending industry conferences and seminars

- Reading trade publications and journals

- Participating in professional organizations

- Networking with other underwriting professionals

- Completing continuing education courses

7. What is your approach to managing a team of underwriting clerks?

My approach to managing a team of underwriting clerks is to:

- Create a positive and supportive work environment

- Set clear expectations and goals

- Provide regular feedback and guidance

- Empower my team to make decisions

- Celebrate successes and recognize achievements

8. How do you resolve conflicts between underwriting clerks?

When resolving conflicts between underwriting clerks, I:

- Listen to both sides of the story

- Identify the root cause of the conflict

- Work with the clerks to develop a mutually acceptable solution

- Document the resolution and follow up to ensure it is effective

9. What is your experience with using insurance underwriting software?

I have extensive experience using [name of insurance underwriting software]. I am proficient in all aspects of the software, including data entry, risk assessment, and policy issuance.

10. What are your career goals?

My career goal is to become an Underwriting Manager. I am confident that my skills and experience in underwriting, team management, and customer service will enable me to succeed in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Clerks Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Clerks Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriting Clerks Supervisor is responsible for overseeing and directing the work of underwriting clerks who evaluate and assess risks associated with insurance policies. They ensure that underwriting guidelines are followed, and policies are issued accurately and efficiently.

1. Manage Underwriting Clerks

Interviewers will be curious about your experience and skills related to managing people. Discuss the approach you take toward being a leader and how you seek to get the best results from underwriting staff.

- Assign, review, and evaluate the work of underwriting clerks.

- Train and develop underwriting clerks to enhance their skills and knowledge.

- Monitor and track the performance of underwriting clerks to ensure efficiency and accuracy.

- Provide feedback and guidance to underwriting clerks to improve their performance.

- Maintain a positive and supportive work environment for underwriting clerks.

2. Review and Assess Underwriting Risks

The interviewer will ask questions to test your knowledge of risk management.

- Review and assess underwriting risks associated with insurance policies.

- Make decisions on whether to accept or decline insurance policies based on risk assessment.

- Recommend appropriate insurance coverage and premiums based on risk assessment.

- Stay up-to-date on underwriting guidelines and regulations.

- Collaborate with other departments, such as sales and claims, to assess and manage risks.

3. Ensure Compliance with Regulations

Provide examples of your experience in ensuring compliance with industry regulations and laws. The best responses will provide specific examples of how you maintained compliance and any positive outcomes that resulted.

- Ensure that underwriting clerks follow underwriting guidelines and regulations.

- Monitor and audit underwriting practices to ensure compliance with regulations.

- Report any non-compliance issues to management and take corrective actions.

- Stay up-to-date on industry regulations and compliance requirements.

- Provide training to underwriting clerks on compliance-related topics.

4. Maintain Accurate Records

The interviewer will ask about your experience maintaining accurate records. They will want to know that you are detail-oriented and organized.

- Maintain accurate records of underwriting transactions and decisions.

- File and store underwriting documents securely and in accordance with regulations.

- Provide timely and accurate information to internal and external stakeholders.

- Utilize technology to streamline record-keeping and data management.

- Conduct regular audits to ensure the accuracy and completeness of records.

Interview Preparation Tips

Preparing for an interview for the position of Underwriting Clerks Supervisor can help you make a great impression on the hiring manager and increase your chances of getting the job. Here are some tips to help you ace your interview:

1. Research the Company and the Position

Before the interview, take some time to research the insurance company and the specific position you are applying for. This will help you understand the company’s culture, goals, and the specific responsibilities of the role. You can find information on the company’s website, LinkedIn, and other online sources.

Knowing about the day-to-day responsibilities for an Underwriting Clerk Supervisor will assist you with putting together responses that highlight your experience and skills that are directly applicable to the job.

2. Practice Answering Common Interview Questions

There are some common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice answering these questions in advance so that you can deliver your responses confidently and clearly.

Review the key job responsibilities for an Underwriting Clerk Supervisor. Consider questions that the interviewer may ask that relate to these responsibilities. Prepare thoughtful and specific responses that showcase your abilities.

3. Prepare Questions to Ask the Interviewer

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the position and the company and show that you are engaged and interested in the role.

Before the interview, come up with a few thoughtful questions to ask the interviewer. Questions about the company’s underwriting process, their risk management strategies, their growth plans, or their commitment to employee development are all appropriate.

4. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time, or even a few minutes early. This shows that you are respectful of the interviewer’s time and that you are serious about the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Underwriting Clerks Supervisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.