Are you gearing up for a career in Underwriting Sales Representative? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Underwriting Sales Representative and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

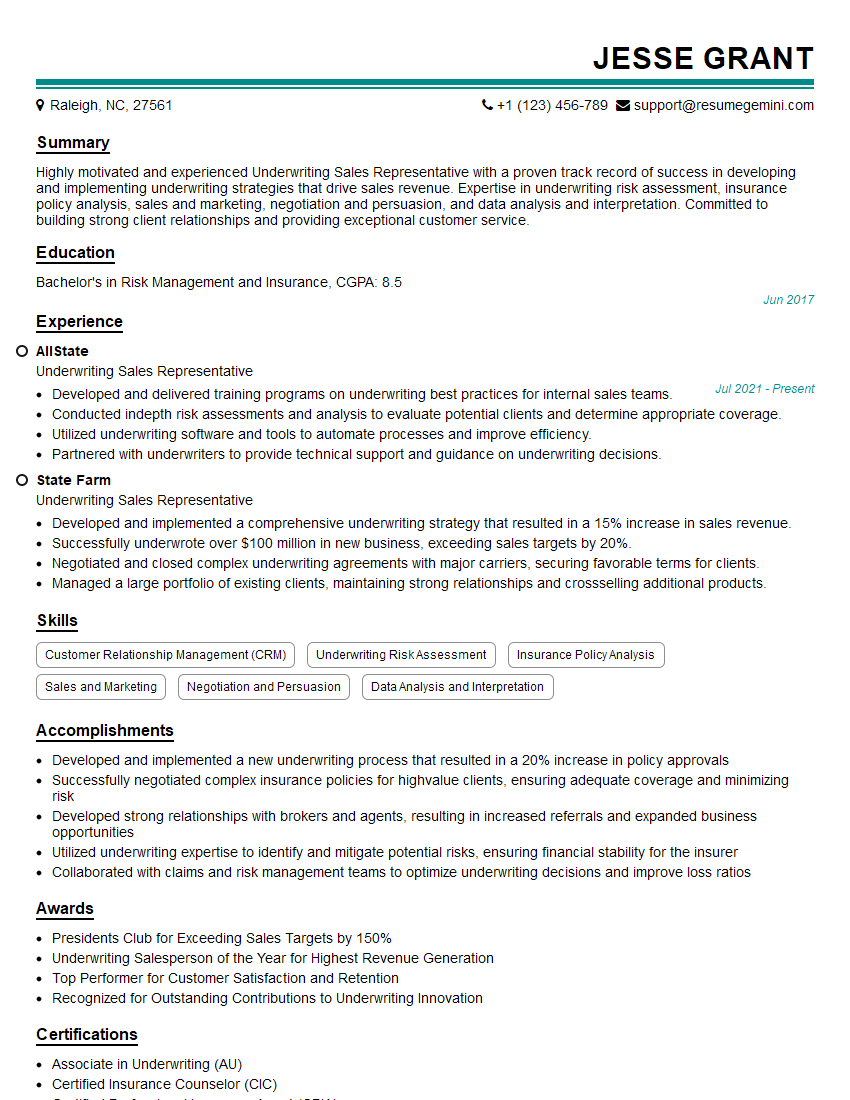

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Sales Representative

1. Describe the underwriting process for a commercial property insurance policy.

The underwriting process for a commercial property insurance policy involves the following steps:

- Application and Proposal: The applicant completes an application and provides a proposal outlining the coverage they are seeking.

- Underwriting Inspection: An underwriter reviews the application and may conduct a site inspection to assess the property’s risk.

- Risk Assessment: The underwriter analyzes the information gathered and evaluates the property’s insurability based on factors such as construction, occupancy, and location.

- Premium Calculation: The underwriter calculates the premium based on the risk assessment and other factors such as policy limits and deductibles.

- Policy Issuance: If the risk is acceptable, the underwriter issues the policy, which outlines the terms and conditions of the coverage.

2. What are the key factors that influence the underwriting decision for a commercial general liability policy?

- Industry and Operations: The type of business and its activities can significantly impact the risk profile.

- Claims History: Past claims experience provides insights into the likelihood of future incidents.

- Financial Stability: The financial health of the business can indicate its ability to manage potential liabilities.

- Loss Control Measures: The presence of safety protocols and risk management practices can mitigate the risk.

- Policy Limits and Deductibles: The chosen limits and deductibles affect the premium and the extent of coverage.

3. Explain how you would approach underwriting a large, complex risk such as a manufacturing facility.

For underwriting a large, complex risk, a comprehensive approach is necessary:

- Site Visit: Conduct a thorough site inspection to assess the facility, operations, and safety measures.

- Financial Analysis: Review the company’s financial statements to assess its stability and ability to manage potential losses.

- Loss Control Review: Evaluate the existing loss control program and identify areas for improvement.

- Risk Modeling: Utilize risk modeling tools to quantify the potential losses and evaluate various risk mitigation strategies.

- Collaboration: Work closely with the applicant to gather necessary information and address concerns.

4. Describe the different types of endorsements that can be added to a commercial property policy.

- Increased Limits: Increase coverage limits for certain perils or property.

- Extended Coverage: Add coverage for perils not included in the base policy, such as earthquakes or floods.

- Additional Interest: List additional parties with an insurable interest in the property.

- Exclusion Waiver: Remove certain exclusions from the policy.

- Special Form: Broaden the coverage to include all risks except those specifically excluded.

5. How do you handle underwriting a risk with a poor claims history?

When encountering a risk with a poor claims history, the following steps are crucial:

- Analyze Claims Experience: Review the claims history thoroughly to understand the patterns and root causes of losses.

- Assess Loss Control Measures: Evaluate the existing loss control program and identify areas for improvement.

- Consider Mitigation Strategies: Explore options to mitigate the risk, such as implementing additional safety measures or partnering with a risk management consultant.

- Adjust Premiums and Coverage: Adjust the premium and coverage limits based on the risk assessment and mitigation strategies.

- Communicate Clearly: Explain the rationale behind the underwriting decision to the applicant and provide recommendations for improvement.

6. What are the ethical considerations in the underwriting process?

- Confidentiality: Maintain the confidentiality of all information obtained during the underwriting process.

- Fairness: Treat all applicants equally and avoid discrimination based on factors such as race, religion, or gender.

- Objectivity: Make underwriting decisions based on objective risk assessment rather than personal biases.

- Professionalism: Conduct oneself in a professional and ethical manner throughout the underwriting process.

- Compliance: Adhere to all applicable laws and regulations governing insurance underwriting.

7. Describe your experience in using underwriting software and tools.

I have experience using various underwriting software and tools, including:

- Insurance Rating Bureaus: Access data and ratings from organizations such as ISO and Verisk to assess risk.

- Risk Assessment Software: Utilize software to quantify risk exposure and evaluate potential losses.

- Policy Management Systems: Manage policies, track claims, and generate reports efficiently.

- Spreadsheets and Databases: Analyze data, perform calculations, and maintain underwriting records.

8. Explain how you would handle a disagreement with a client over an underwriting decision.

When handling a disagreement with a client, I would follow these steps:

- Listen Actively: Listen attentively to the client’s concerns and perspectives.

- Explain the Decision: Clearly articulate the rationale behind the underwriting decision, citing specific data and risk factors.

- Explore Options: Discuss potential options to mitigate the risk or adjust the coverage as appropriate.

- Be Empathetic: Understand the client’s position and strive to find a mutually acceptable solution.

- Document the Conversation: Summarize the discussion, including the client’s concerns and the agreed-upon resolution.

9. Describe your sales strategy for acquiring new clients.

My sales strategy for acquiring new clients involves the following:

- Networking: Attend industry events, join professional organizations, and connect with potential clients through referrals.

- Cold Calling: Reach out to businesses that fit my target market and identify decision-makers.

- Value Proposition: Highlight the value and benefits of our underwriting services, emphasizing our expertise and risk management capabilities.

- Personalized Approach: Tailor solutions to meet the specific needs and risk profiles of each client.

- Follow-Up: Stay in touch with prospects, answer their questions, and provide ongoing support.

10. How do you stay up-to-date on industry trends and best practices in underwriting?

- Continuing Education: Attend workshops, conferences, and webinars to enhance my knowledge and skills.

- Professional Development: Read industry publications, articles, and whitepapers to stay informed about emerging risks and underwriting practices.

- Networking: Connect with industry professionals, underwriters, and risk managers to exchange insights and learn from others.

- Research and Analysis: Conduct research on industry trends, loss data, and risk mitigation strategies.

- Collaboration: Share knowledge and best practices within the underwriting team to stay current with advancements in the field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Sales Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Sales Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Underwriting Sales Representative is responsible for generating new sales leads, developing and maintaining relationships with clients, and providing underwriting support to the sales team. This role requires a deep understanding of the underwriting process, as well as excellent sales and communication skills.

1. Sales and Marketing

Prospect and qualify new clients Develop and maintain relationships with clients Identify and pursue sales opportunities Prepare and deliver sales presentations Negotiate and close deals

2. Underwriting Support

Review and analyze applications for insurance coverage Assess risk and determine appropriate underwriting guidelines Recommend and implement underwriting decisions Provide technical assistance to the sales team

3. Customer Service

Respond to client inquiries Resolve client issues Provide ongoing support to clients

4. Other Responsibilities

Stay up-to-date on industry trends Participate in professional development activities Maintain a positive and professional image

Interview Tips

Preparing for an interview for an Underwriting Sales Representative position can be daunting, but there are some key steps you can take to increase your chances of success.

1. Know the Job Description

Before you start preparing for your interview, it’s important to understand the job description thoroughly. Make sure you have a clear understanding of the key responsibilities of the role, as well as the qualifications and experience required.

2. Highlight Your Skills

In your resume and cover letter, be sure to highlight the skills and experience that are most relevant to the job description. For example, if the job description requires a strong understanding of the underwriting process, make sure to mention any experience you have in this area.

3. Research the Company

It’s also important to do your research on the company before your interview. This will help you understand the company’s culture and values, as well as its products and services. You can find this information on the company’s website, social media pages, and news articles.

4. Practice Your Answers

Once you have a good understanding of the job description and the company, it’s time to start practicing your answers to common interview questions. This will help you feel more confident and prepared during your interview.

Here are some common interview questions that you may be asked:

- Tell me about your experience in underwriting.

- What are your strengths and weaknesses as an underwriter?

- How do you stay up-to-date on industry trends?

- What are your goals for your career?

- Why are you interested in working for this company?

5. Dress Professionally

First impressions matter, so it’s important to dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure that your clothes are clean and pressed.

6. Be Confident

Confidence is key in any interview, but it’s especially important in an interview for an Underwriting Sales Representative position. This is a high-pressure role, so you need to be able to demonstrate that you have the confidence and skills to succeed.

7. Be Enthusiastic

Enthusiasm is another important quality for an Underwriting Sales Representative. This is a challenging role, but it can also be very rewarding. If you’re not enthusiastic about the job, it will be difficult to succeed.

8. Be Yourself

It’s important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just be honest and authentic, and let your personality shine through.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Underwriting Sales Representative, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Underwriting Sales Representative positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.