Are you gearing up for a career in Underwriting Support Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Underwriting Support Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

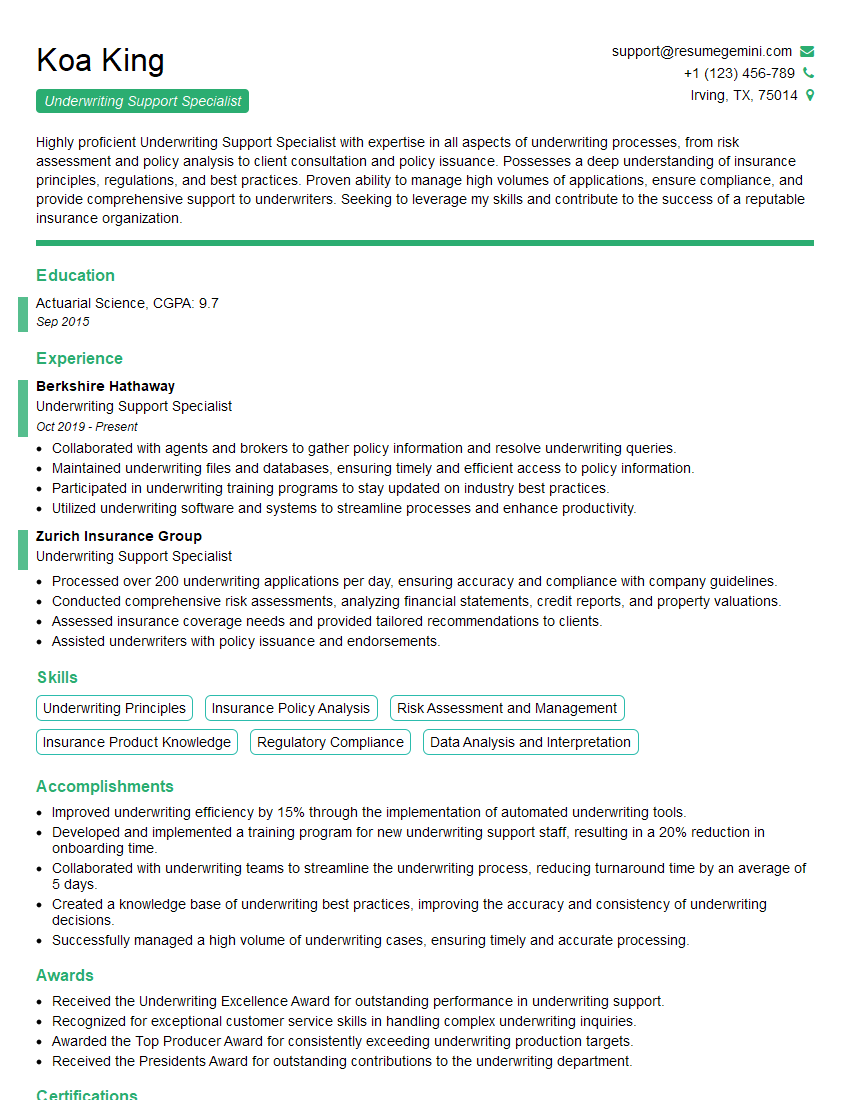

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Support Specialist

1. What are the key elements of an insurance policy that you typically review during the underwriting process?

As an Underwriting Support Specialist, I thoroughly inspect various policy elements during the underwriting process, including:

- Policyholder’s personal and business information (e.g., name, address, occupation, etc.)

- Coverage details (e.g., types of coverage, limits, deductibles, etc.)

- Property or asset descriptions (e.g., location, value, condition, etc.)

- Underwriting guidelines and criteria established by the insurer

- Exclusions, endorsements, and special conditions relevant to the policy

2. Can you describe the underwriting process and your role within it?

The underwriting process involves evaluating and assessing risk to determine whether an insurance policy should be issued and, if so, under what terms and conditions. My role as an Underwriting Support Specialist is to assist underwriters in this process by:

- Gathering and analyzing relevant data and documentation

- Conducting research and due diligence on policyholders and risks

- Preparing underwriting reports and summaries

- Supporting underwriters in making informed decisions

- Maintaining accurate and up-to-date underwriting files

3. What types of underwriting software and tools are you familiar with?

I am proficient in using various underwriting software and tools, including:

- Insurance policy management systems (e.g., Guidewire, Duck Creek)

- Underwriting databases and repositories (e.g., LexisNexis, ISO)

- Risk assessment and pricing software (e.g., Verisk, CCC Information Services)

- Data analytics tools for data mining and analysis

- Automated underwriting systems for efficient risk selection

4. How do you stay updated on changes in underwriting guidelines and regulations?

To stay abreast of evolving underwriting guidelines and regulations, I regularly engage in:

- Attending industry conferences, webinars, and training programs

- Reading industry publications and newsletters

- Participating in professional organizations and discussion forums

- Consulting with underwriters, insurance attorneys, and regulatory bodies

- Monitoring insurance news and legal developments

5. Can you explain the difference between standard and non-standard underwriting?

Standard underwriting is applied to risks that meet pre-established criteria and fall within an insurer’s standard appetite. These risks typically pose average or low levels of risk and can be underwritten using standardized processes and guidelines.

Non-standard underwriting, on the other hand, is used for risks that deviate from standard underwriting parameters. These risks may present unique or complex characteristics that require a more customized approach. Non-standard underwriting involves additional research, analysis, and potential risk mitigation measures to determine appropriate coverage terms and conditions.

6. How do you handle underwriting inquiries and requests from external parties (e.g., brokers, agents)?

I address underwriting inquiries and requests from external parties with professionalism and efficiency:

- Promptly respond to inquiries via email, phone, or online portals

- Provide clear and concise information regarding policy coverage, underwriting guidelines, and risk assessment processes

- Gather additional documentation or data as needed to facilitate the underwriting process

- Collaborate with underwriters to resolve complex inquiries or requests

- Maintain open communication and a positive relationship with external parties

7. Can you describe a challenging underwriting scenario you encountered and how you resolved it?

In a recent case, I encountered an underwriting scenario involving a complex risk profile and limited available information. I took the following steps to resolve the situation:

- Conducted thorough research and due diligence to gather additional data and insights

- Consulted with underwriters and industry experts to seek their perspectives and guidance

- Explored alternative underwriting options and risk mitigation strategies

- Prepared a detailed analysis and recommendation to present to the underwriting team

- Participated in discussions and provided technical support to reach a final underwriting decision

8. What do you consider to be the most important qualities and skills for a successful Underwriting Support Specialist?

In my opinion, the most crucial qualities and skills for a successful Underwriting Support Specialist include:

- Strong attention to detail and accuracy

- Excellent analytical and problem-solving abilities

- Proficient use of underwriting software and tools

- Effective communication and interpersonal skills

- Understanding of underwriting principles and guidelines

- Ability to work independently and as part of a team

- Commitment to ethical and professional standards

9. How do you prioritize and manage multiple underwriting tasks and deadlines?

I prioritize and manage multiple underwriting tasks and deadlines effectively by:

- Creating a clear and organized daily or weekly schedule

- Identifying and focusing on high-priority tasks first

- Delegating tasks to team members when appropriate

- Utilizing technology tools for task management and prioritization

- Communicating regularly with underwriters and other stakeholders to stay informed and adjust priorities as needed

10. What are your career goals and aspirations as an Underwriting Support Specialist?

As an Underwriting Support Specialist, my career goals and aspirations include:

- Continuing to develop my technical skills and knowledge in underwriting

- Growing my responsibilities and taking on more complex underwriting tasks

- Mentoring and supporting junior team members

- Contributing to the overall success of the underwriting team

- Potentially transitioning to a more senior underwriting role in the future

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Support Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Support Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriting Support Specialists play a crucial role in the insurance industry, providing essential support to underwriters in assessing and evaluating insurance risks.

1. Data Gathering and Analysis

Collect and analyze relevant information from various sources, such as applications, disclosures, medical records, and financial statements.

- Verify and cross-check data to ensure accuracy and completeness.

- Prepare underwriting reports and summaries for underwriters’ review.

2. Risk Assessment

Assist underwriters in identifying and assessing potential risks associated with insurance applications.

- Review underwriting guidelines and policies to ensure compliance.

- Conduct research and due diligence to gather information about applicants and policyholders.

3. Policy Issuance and Endorsements

Prepare and issue insurance policies based on underwriting decisions.

- Process policy endorsements and amendments, ensuring accurate documentation.

- Maintain policy records and track policy status.

4. Customer Support

Provide support to policyholders and agents by answering inquiries and resolving issues.

- Explain policy terms and conditions, clarify coverage, and process claims.

- Maintain a professional and courteous demeanor while interacting with customers.

Interview Tips

Preparing thoroughly for an interview is essential to making a positive impression and showcasing your skills and qualifications.

1. Research the Company and Position

Study the company’s website, annual reports, and LinkedIn profile to gain an understanding of their mission, values, and current projects.

- Identify the specific requirements of the Underwriting Support Specialist role and tailor your answers accordingly.

- Prepare questions to ask the interviewer, demonstrating your interest in the company and the position.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experiences, such as data analysis, risk assessment, and customer support.

- Provide specific examples that demonstrate your proficiency in these areas.

- Quantify your accomplishments whenever possible, using metrics to showcase your impact.

3. Prepare for Common Interview Questions

Practice answering common interview questions, such as “Tell me about yourself” and “Why are you interested in this role?”.

- Develop concise and well-structured answers that highlight your qualifications.

- Use the STAR method (Situation, Task, Action, Result) to provide specific examples.

4. Practice Your Presentation

Rehearse your answers and delivery in front of a mirror or with a friend or family member.

- Pay attention to your body language, eye contact, and speaking voice.

- Time yourself to ensure your answers are within the appropriate range.

Next Step:

Now that you’re armed with the knowledge of Underwriting Support Specialist interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Underwriting Support Specialist positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini