Are you gearing up for a career in Unemployment Insurance Director? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Unemployment Insurance Director and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

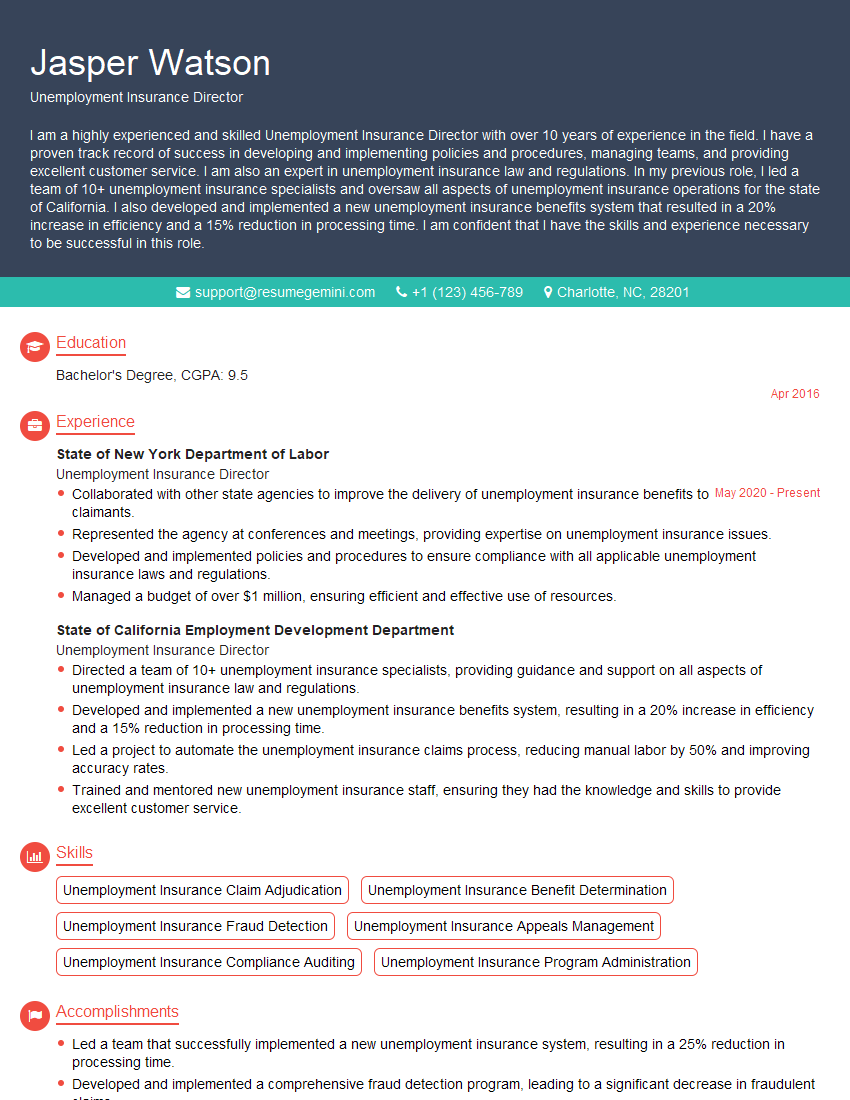

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Unemployment Insurance Director

1. What are the key components of an unemployment insurance program, and how do they work together?

- Eligibility criteria: Determine who is eligible to receive benefits, including requirements such as work history and job separation reasons.

- Benefit calculation: Establish the amount of benefits an individual will receive, based on their earnings and other factors.

- Benefit duration: Set the maximum length of time an individual can receive benefits.

- Employer contributions: Define the mechanism for collecting contributions from employers to fund the unemployment insurance trust fund.

- Adjudication process: Outline the process for determining whether an individual is eligible for benefits and resolving any disputes.

- Appeals process: Establish the procedures for individuals to appeal decisions related to their unemployment insurance claims.

2. What are the best practices for administering an unemployment insurance program effectively and efficiently?

Optimizing claim processing

- Streamlining application procedures: Simplifying the process of filing claims to reduce barriers and expedite approvals.

- Automating tasks: Utilizing technology to automate repetitive tasks, freeing up staff to focus on complex cases.

- Cross-training staff: Providing comprehensive training to staff to ensure they can handle various claim types efficiently.

Preventing fraud and abuse

- Implementing robust verification measures: Using multiple data sources and establishing strong identity verification protocols.

- Establishing clear guidelines: Providing clear criteria for eligibility and benefit calculations to reduce opportunities for misrepresentation.

- Investigating suspicious claims: Dedicating resources to investigating claims that raise red flags and pursuing appropriate actions.

3. How do you stay abreast of the latest trends and developments in unemployment insurance policy and best practices?

- Attending industry conferences and webinars: Participating in events to learn about emerging trends and innovative approaches.

- Reading industry publications and research: Staying informed through journals, white papers, and reports on unemployment insurance policies and practices.

- Networking with other unemployment insurance professionals: Establishing connections and exchanging ideas with colleagues in the field.

- Participating in professional development programs: Pursuing certifications or advanced degrees to enhance knowledge and skills.

4. What are the challenges facing unemployment insurance programs in today’s economy, and how would you address them?

- Economic volatility: Adapting to fluctuating unemployment rates by adjusting program parameters and providing support during economic downturns.

- Technological advancements: Embracing automation and digitalization to streamline processes and improve efficiency while addressing potential biases.

- Changing workforce dynamics: Addressing the needs of non-traditional workers, such as gig economy workers and independent contractors.

- Fraud prevention: Enhancing fraud detection and prevention measures to protect the integrity of the program and public funds.

5. What experience do you have in managing a team of employees and developing and implementing policies?

- Team Management: Demonstrating experience in setting clear goals, motivating staff, and resolving conflicts.

- Policy Development: Highlighting experience in researching, analyzing, and implementing policies to achieve organizational objectives.

- Stakeholder Engagement: Describing experience in engaging with stakeholders to gather input, build consensus, and ensure transparency.

6. What are your thoughts on the role of technology in the future of unemployment insurance?

- Fraud Detection: Utilizing artificial intelligence and data analytics to identify and prevent fraudulent claims.

- Automated Decision-making: Implementing AI-driven systems to facilitate eligibility determinations and benefit calculations.

- Personalized Services: Providing individualized support and guidance to claimants through chatbots and virtual assistants.

- Enhanced Accessibility: Making unemployment insurance services accessible through mobile applications and online portals.

7. How would you measure the success of an unemployment insurance program?

- Unemployment Rate: Monitoring the impact of the program on reducing unemployment levels.

- Timeliness of Benefits: Measuring the efficiency of the program in delivering benefits to eligible individuals.

- Fraud Prevention: Assessing the effectiveness of measures to prevent and detect fraudulent claims.

- Customer Satisfaction: Gathering feedback from claimants to evaluate the quality of services provided.

8. What do you see as the biggest challenge in the coming years for unemployment insurance programs?

- Economic Uncertainty: Navigating economic fluctuations and their impact on unemployment rates.

- Technological Disruption: Adapting to the changing nature of work and the need for upskilling and job retraining.

- Budget Constraints: Managing unemployment insurance programs within limited financial resources.

- Public Perception: Addressing misconceptions and building public trust in unemployment insurance systems.

9. What are your key strengths and weaknesses as they relate to this role?

- Strengths: Highlighting expertise in unemployment insurance policies, strong leadership skills, and a commitment to customer service.

- Weaknesses: Acknowledging areas for improvement, such as limited experience with specific technologies or a particular aspect of unemployment insurance administration.

- Development Plan: Outlining steps to address weaknesses, such as pursuing professional development opportunities or seeking mentorship.

10. Do you have any questions for me about the role or the organization?

- Vision for the Program: Inquiring about the organization’s long-term goals and strategic priorities for the unemployment insurance program.

- Key Challenges: Seeking insights into the specific challenges that the organization is currently facing or anticipating in the future.

- Opportunities for Collaboration: Exploring the potential for partnerships and collaborations with other departments or external stakeholders.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Unemployment Insurance Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Unemployment Insurance Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Unemployment Insurance Director is a highly responsible position that oversees the administration of unemployment insurance programs within a jurisdiction. This role plays a crucial part in ensuring that eligible individuals receive unemployment benefits and that employers comply with unemployment insurance laws.

1. Program Management

The director is responsible for the overall management of the unemployment insurance program, including developing and implementing policies, procedures, and guidelines that ensure efficient and effective program operations.

- Establish and maintain policies and procedures for determining eligibility and calculating benefit amounts.

- Develop and implement strategies to reduce fraud and abuse within the unemployment insurance system.

2. Fiscal Management

The director manages the financial aspects of the unemployment insurance program, including budgeting, forecasting, and accounting.

- Prepare and manage the unemployment insurance budget, ensuring that funds are allocated and utilized efficiently.

- Monitor and analyze financial data to identify trends and make informed decisions regarding program funding.

3. Legislative and Regulatory Compliance

The director ensures that the unemployment insurance program complies with all applicable laws and regulations at the federal and state levels.

- Stay abreast of changes in unemployment insurance laws and regulations, and provide guidance to staff on their implementation.

- Represent the unemployment insurance program before legislative bodies and regulatory agencies.

4. Stakeholder Relations

The director builds and maintains relationships with key stakeholders, including employers, employees, and community organizations.

- Provide training and education to employers and employees on unemployment insurance laws and procedures.

- Collaborate with community organizations to provide outreach and assistance to unemployed individuals.

Interview Tips

To ace the interview for the Unemployment Insurance Director position, it’s crucial to prepare thoroughly and demonstrate your knowledge, skills, and experience. Here are some tips to help you succeed:

1. Research the Organization and the Role

Familiarize yourself with the unemployment insurance agency and the specific responsibilities of the Director position. Understand the agency’s mission, goals, and the challenges it faces.

- Visit the agency’s website and review its annual reports and strategic plans.

- Reach out to individuals in your network who may have knowledge of the agency or the position.

2. Highlight Relevant Experience and Skills

Emphasize your experience in unemployment insurance program management, fiscal management, and stakeholder relations. Highlight your ability to develop and implement policies and procedures, manage budgets, and collaborate with diverse groups.

- Quantify your accomplishments and provide specific examples that demonstrate your impact.

- Be prepared to discuss your knowledge of unemployment insurance laws and regulations.

3. Prepare for Behavioral Questions

Behavioral interview questions focus on your past experiences and behaviors. They help the interviewer assess your problem-solving abilities, teamwork skills, and work ethic.

- Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions.

- Prepare examples that highlight your strengths and demonstrate your alignment with the requirements of the role.

4. Practice Your Answers

Practice answering common interview questions aloud. This will help you feel more confident and articulate during the actual interview.

- Ask a friend or colleague to conduct a mock interview with you.

- Record yourself answering questions and review your performance to identify areas for improvement.

5. Dress Professionally and Arrive Punctually

First impressions matter. Dress appropriately for the interview and arrive on time. Your punctuality and professional demeanor will demonstrate your respect for the interviewer and the position.

- Choose attire that is formal but comfortable.

- Allow ample time for travel and arrive at the interview location with a few minutes to spare.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Unemployment Insurance Director role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.