Are you gearing up for a career in Unemployment Insurance Fraud Investigator? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Unemployment Insurance Fraud Investigator and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

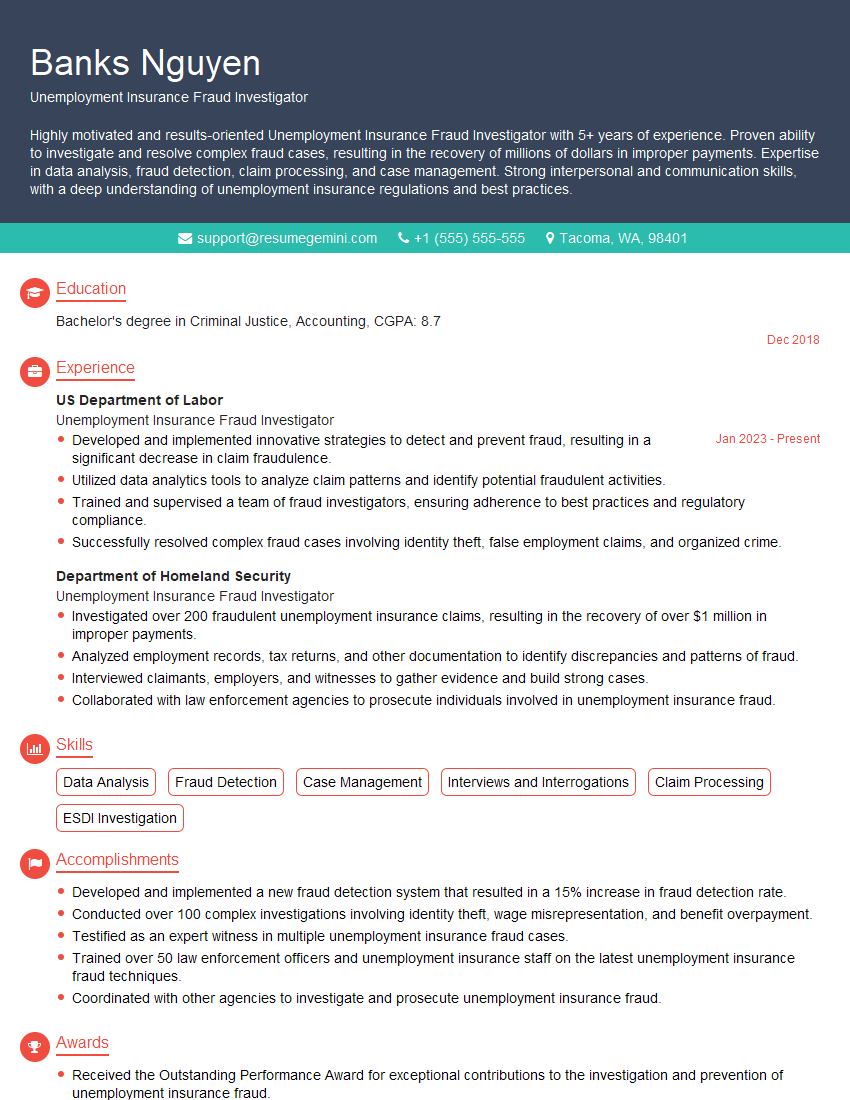

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Unemployment Insurance Fraud Investigator

1. What are the common red flags that may indicate unemployment insurance fraud?

As an Unemployment Insurance Fraud Investigator, I have encountered numerous red flags that may indicate potential fraud. These include:

- Inconsistent or conflicting information on applications

- Claims for benefits from multiple states simultaneously

- Unusually high or frequent claims for benefits

- Claims for benefits by individuals who are incarcerated or deceased

- Claims for benefits by individuals who are actively employed

2. How do you investigate unemployment insurance fraud claims?

Gathering Evidence:

- Interviewing the claimant and other involved parties

- Reviewing documentation, such as employment records and bank statements

- Conducting surveillance to observe the claimant’s activities

Analysis and Evaluation:

- Analyzing the evidence to identify inconsistencies or discrepancies

- Developing a theory of the case and identifying potential suspects

- Evaluating the evidence to determine if it is sufficient to support a finding of fraud

3. What are the challenges in investigating unemployment insurance fraud?

- Fraudulent claimants often use sophisticated methods to conceal their activities

- Limited resources and manpower may hinder thorough investigations

- Privacy laws and ethical considerations can limit access to certain information

- Fraudulent claimants may be manipulative and attempt to deceive investigators

- Investigating fraud can be time-consuming and complex

4. What are the potential consequences for individuals who commit unemployment insurance fraud?

- Criminal charges, including felony charges in some cases

- Fines and penalties

- Restitution for benefits fraudulently obtained

- Disqualification from future unemployment insurance benefits

- Damage to their reputation and employability

5. How do you stay up-to-date on the latest unemployment insurance fraud trends and techniques?

- Attending industry conferences and workshops

- Subscribing to professional journals and publications

- Networking with other fraud investigators

- Participating in online forums and discussion groups

- Studying case studies and best practices

6. What is your experience in working with law enforcement agencies?

In my previous role as a Fraud Investigator for the Department of Social Services, I collaborated closely with law enforcement agencies on numerous fraud cases. I have a strong understanding of the legal process and am comfortable working with law enforcement officers to apprehend and prosecute fraudsters.

7. How do you handle cases involving complex financial transactions?

I have experience in analyzing financial records and tracing the flow of funds. In cases involving complex financial transactions, I work closely with forensic accountants and financial institutions to uncover fraudulent activities. I am proficient in using data analytics tools to identify patterns and anomalies that may indicate fraud.

8. What is your understanding of the role of technology in unemployment insurance fraud?

Technology plays a significant role in unemployment insurance fraud. Fraudulent claimants often utilize sophisticated software and techniques to conceal their activities. I am familiar with the latest technological trends and am constantly updating my knowledge to stay ahead of fraudsters. I regularly use data mining and other analytical tools to detect fraudulent patterns and identify potential suspects.

9. How do you balance the need for thorough investigations with the need to resolve cases efficiently?

Thorough investigations are essential to ensure that fraud is uncovered and prosecuted. However, I also understand the need to resolve cases efficiently to minimize the impact on the unemployment insurance system. I prioritize cases based on their severity and potential impact. I work closely with my team to streamline the investigation process and minimize delays while maintaining the integrity of our investigations.

10. What motivates you to work as an Unemployment Insurance Fraud Investigator?

I am motivated by the desire to protect the integrity of the unemployment insurance system and ensure that benefits are only paid to those who are truly eligible. I am committed to fighting fraud and holding fraudsters accountable for their actions. I believe that my skills and experience make me an effective investigator and I am confident that I can contribute to the success of your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Unemployment Insurance Fraud Investigator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Unemployment Insurance Fraud Investigator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Unemployment Insurance Fraud Investigators are responsible for investigating and detecting fraudulent claims for unemployment insurance benefits. They work to protect the integrity of the unemployment insurance system and ensure that benefits are only paid to those who are eligible.

1. Investigate Suspected Fraudulent Claims

Fraud Investigators review unemployment insurance claims to identify potential fraud. They analyze data, interview claimants, and conduct other investigations to determine if fraud has occurred.

- Review unemployment insurance claims for inconsistencies or red flags that may indicate fraud

- Interview claimants, employers, and other individuals to gather information and evidence

- Conduct surveillance and other investigative techniques to gather evidence of fraud

2. Prepare and Present Cases for Prosecution

Fraud Investigators prepare and present cases for prosecution. They work with law enforcement and legal professionals to build strong cases against those who have committed fraud.

- Write detailed reports summarizing their findings and evidence

- Testify in court and provide expert testimony on unemployment insurance fraud

- Work with law enforcement and prosecutors to bring criminal charges against those who have committed fraud

3. Educate Employers and Public About Unemployment Insurance Fraud

Fraud Investigators play an important role in educating employers and the public about unemployment insurance fraud. They develop and present training materials, speak at conferences, and work with the media to raise awareness about the issue. They work to prevent fraud by teaching others ways to avoid it and providing information on the consequences of unemployment insurance fraud.

- Develop and deliver training materials on unemployment insurance fraud for employers and the public

- Speak at conferences and events to raise awareness about unemployment insurance fraud

- Work with the media to educate the public about unemployment insurance fraud

4. Develop and Implement Policies and Procedures to Prevent Fraud

Fraud Investigators work with the agency to develop and implement policies and procedures to prevent fraud. They analyze data, identify trends, and make recommendations to improve fraud detection and prevention efforts.

- Analyze data to identify trends and patterns in unemployment insurance fraud

- Develop and implement new policies and procedures to prevent fraud

- Work with other agencies and organizations to share information and best practices

Interview Tips

Interviews are one of the best opportunities you have to showcase your strengths and make a great impression. The following tips can help you prepare for your interview and increase your chances of success.

1. Research the Company and the Position

Take the time to research the agency and the specific position you are applying for. This will help you better understand the agency’s mission, values, and goals, as well as the specific responsibilities of the position. You should also familiarize yourself with the agency’s organizational structure, reporting relationships, and any recent news or developments.

- Visit the agency’s website and social media pages

- Read articles and news stories about the agency

- Talk to people who work or have worked for the agency

2. Practice Your Answers to Common Interview Questions

There are several common interview questions that you are likely to be asked. It is important to practice answering these questions in advance so that you can deliver your responses confidently and concisely. Some common interview questions include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What are your salary expectations?

- Why should we hire you?

3. Prepare Questions to Ask the Interviewer

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. It also gives you an opportunity to learn more about the agency and the position. Some good questions to ask include:

- What are the biggest challenges facing the agency right now?

- What are the most important qualities you are looking for in a candidate for this position?

- What is the next step in the interview process?

4. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you take the interview process seriously.

- Wear a suit or other business attire

- Be well-groomed and make eye contact

- Arrive on time for your interview

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Unemployment Insurance Fraud Investigator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.