Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Universal Banker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

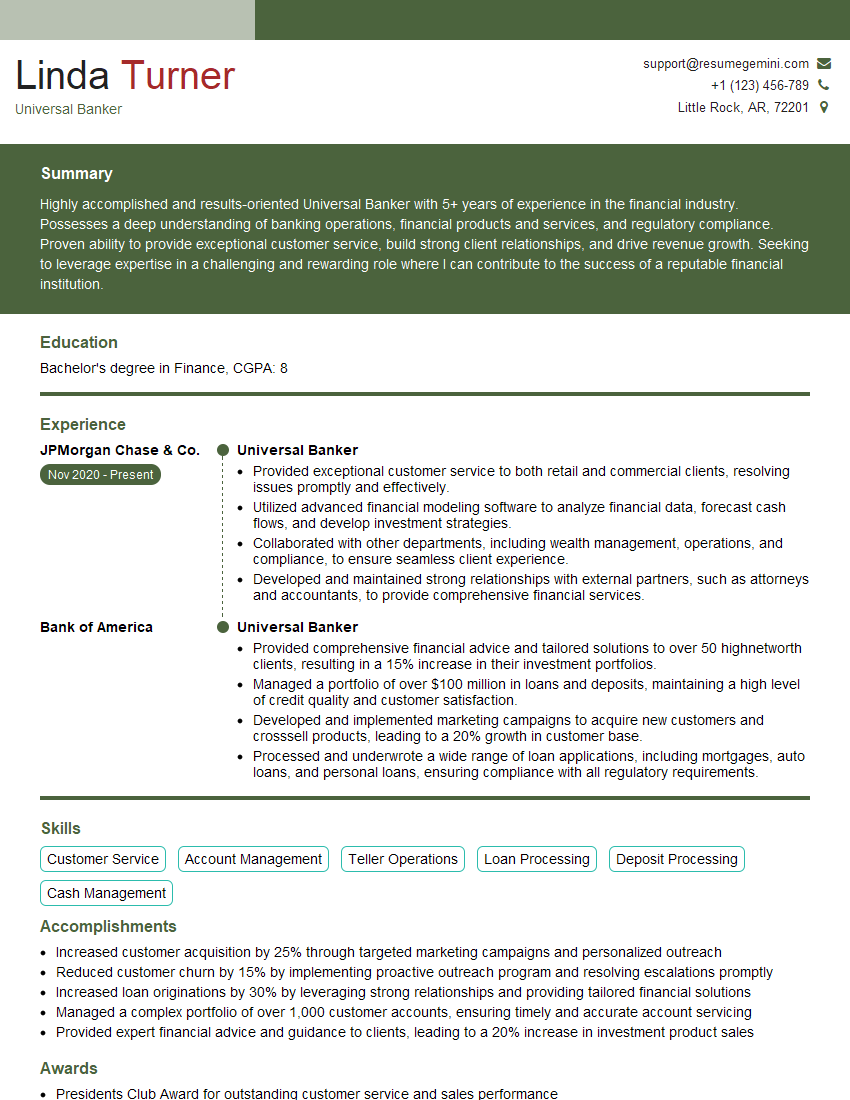

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Universal Banker

1. What are the key responsibilities of a Universal Banker?

- Provide a wide range of banking services to customers, including account opening, loan processing, and investment advising

- Develop and maintain relationships with customers, identifying their financial needs and providing tailored solutions

2. What are the different types of accounts that a Universal Banker can open for customers?

Checking Accounts

- Standard checking accounts

- Interest-bearing checking accounts

Savings Accounts

- Passbook savings accounts

- Money market accounts

3. What are the different types of loans that a Universal Banker can process for customers?

- Personal loans

- Auto loans

- Mortgages

- Business loans

4. What are the different types of investments that a Universal Banker can advise customers on?

- Stocks

- Bonds

- Mutual funds

- ETFs

5. What are the key qualities of a successful Universal Banker?

- Excellent customer service skills

- Strong sales and marketing skills

- Deep knowledge of banking products and services

- Ability to build and maintain strong relationships

6. What are the challenges that a Universal Banker may face in their role?

- Keeping up with the changing regulatory environment

- Meeting the needs of increasingly demanding customers

- Competing with other financial institutions for market share

7. How do you stay up-to-date on the latest banking products and services?

- Attending industry conferences and webinars

- Reading trade publications and industry news

- Consulting with colleagues and mentors

8. What is your sales strategy for increasing revenue and market share?

- Identify and target potential customers

- Develop and implement tailored marketing campaigns

- Build strong relationships with customers and provide excellent service

- Monitor results and make adjustments as needed

9. How can you use technology to enhance the customer experience?

- Use online and mobile banking platforms to provide customers with convenient and secure access to their accounts

- Utilize data analytics to identify customer needs and preferences

- Implement chatbots and other AI-powered tools to provide 24/7 customer support

10. What do you think the future of banking holds?

- The increasing use of digital technology

- The rise of personalized banking

- The growing importance of financial literacy

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Universal Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Universal Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Universal Banker

Universal Bankers are responsible for providing a comprehensive range of financial services to customers. They perform a wide range of duties, including:

1. Customer Service

Universal Bankers provide excellent customer service by greeting customers, answering questions, and resolving issues.

2. Transactions

They process a variety of transactions, such as deposits, withdrawals, and loan payments.

3. Accounts

Universal Bankers maintain and manage customer accounts, including checking, savings, and investment accounts.

4. Sales

They generate revenue for the bank by selling financial products and services, such as loans, credit cards, and insurance.

Interview Tips for Universal Banker Position

To prepare for an interview for a Universal Banker position, you should:

1. Research the bank

Learn about the bank’s history, products, and services, as well as the specific role you’re applying for.

2. Practice your answers to common interview questions

Some common interview questions for Universal Bankers include:

- Tell me about your experience in customer service.

- Why do you want to work as a Universal Banker?

- What are your strengths and weaknesses?

3. Dress professionally

First impressions matter, so dress professionally for your interview.

4. Be on time

Punctuality shows that you respect the interviewer’s time.

5. Be prepared to talk about your experience and skills

Highlight your customer service skills, your experience in banking, and your sales skills.

6. Ask questions

Asking questions shows that you’re interested in the position and the bank.

Next Step:

Now that you’re armed with the knowledge of Universal Banker interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Universal Banker positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini