Are you gearing up for an interview for a Vat Operator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Vat Operator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

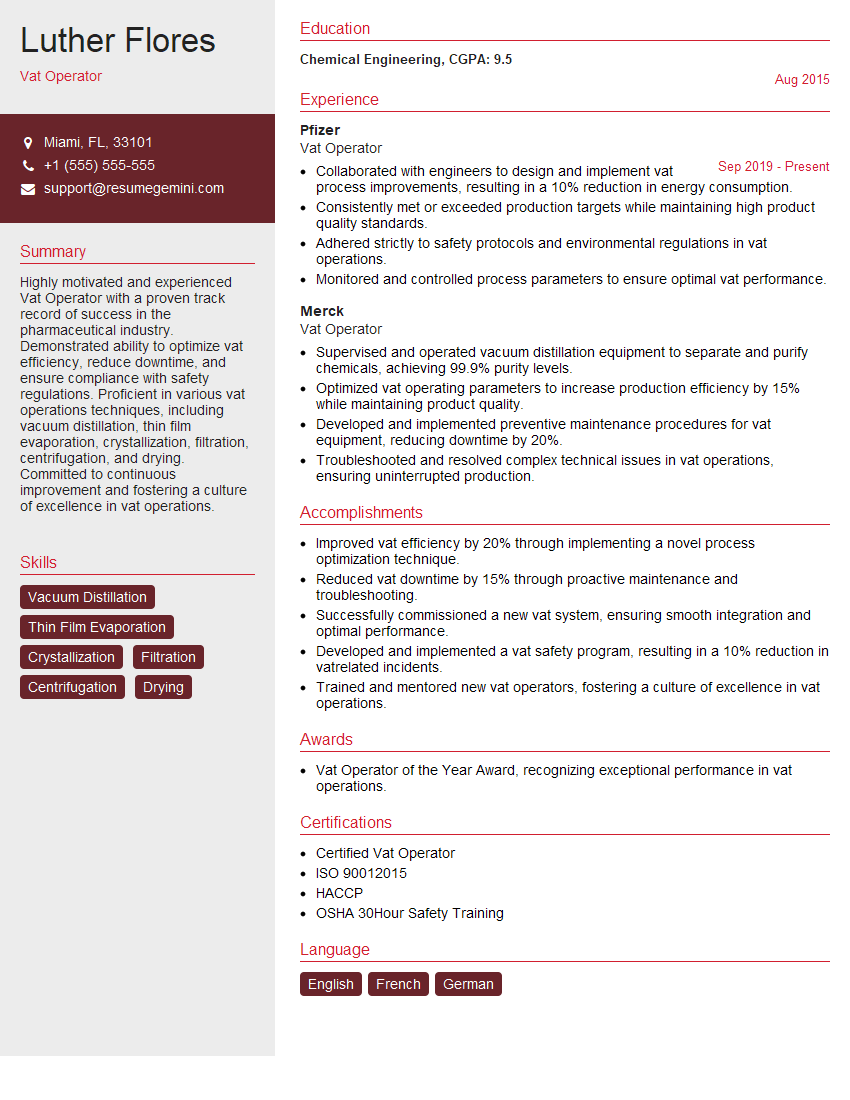

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Vat Operator

1. Explain the concept of Value Added Tax (VAT) and how it is calculated?

- Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production and distribution.

- It is calculated as a percentage of the selling price of the goods or services, and is typically added to the price at the point of sale.

- The amount of VAT charged is equal to the difference between the output tax and the input tax.

2. What are the different types of VAT returns and when are they due?

- The main types of VAT returns in the United States are:

- Quarterly Return (Form 1040-ES): Due on April 15, June 15, September 15, and January 15 of the following year.

- Semi-Annual Return (Form 1120-ES): Due on April 15 and September 15.

- Annual Return (Form 1040): Due on April 15 of the following year.

3. What are the penalties for late or incorrect VAT returns?

- Penalties for late filing of VAT returns vary depending on the jurisdiction.

- In general, penalties are assessed as a percentage of the outstanding tax liability.

- Penalties for incorrect VAT returns may also be imposed, and can be significant.

4. What are the key steps involved in the VAT registration process?

- The key steps involved in the VAT registration process are:

- Determine if you are required to register for VAT.

- Collect the required documentation.

- Complete the VAT registration form.

- Submit the form to the tax authority.

- Wait for the tax authority to process your application.

5. What are the benefits of using a VAT software solution?

- Using a VAT software solution can provide a number of benefits, including:

- Automated calculations: The software can automatically calculate the amount of VAT due on your sales and purchases.

- Reduced risk of errors: The software can help to reduce the risk of errors in your VAT calculations.

- Improved efficiency: The software can help to streamline your VAT processes and improve efficiency.

6. What are the main differences between a flat-rate VAT scheme and a standard VAT scheme?

- The main differences between a flat-rate VAT scheme and a standard VAT scheme are:

- Flat-rate scheme: You pay a fixed percentage of your turnover as VAT, regardless of your actual expenses.

- Standard scheme: You charge VAT on your sales and reclaim VAT on your purchases.

7. What are the key VAT regulations that apply to your industry?

- The key VAT regulations that apply to my industry are:

- VAT Act 1994

- VAT Regulations 1995

- HMRC VAT Notice 700

8. What are the common VAT errors that you have come across?

- The most common VAT errors that I have come across are:

- Incorrect VAT registration

- Incorrect VAT calculations

- Late filing of VAT returns

9. How do you stay up to date with the latest VAT regulations?

- I stay up to date with the latest VAT regulations by:

- Reading HMRC publications

- Attending HMRC webinars

- Networking with other VAT professionals

10. What is your experience with using VAT software?

- I have experience using a variety of VAT software solutions, including:

- Sage 50cloud

- QuickBooks Online

- Xero

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Vat Operator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Vat Operator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Vat Operator is responsible for the safe and efficient operation of the vat system in a manufacturing or industrial setting. They work closely with other team members to ensure that the vat system is running smoothly and that all products meet quality standards.

1. Monitor and Control Vat System

The Vat Operator monitors and controls the vat system to ensure that it is operating within specified parameters. This includes monitoring temperature, pressure, pH levels, and other variables.

- Ensures that the vat system is operating within specified parameters

- Monitors temperature, pressure, pH levels, and other variables

2. Load and Unload Vats

The Vat Operator loads and unloads vats from the vat system. This may involve using cranes, forklifts, or other equipment.

- Loads and unloads vats from the vat system

- Uses cranes, forklifts, or other equipment to assist with loading and unloading

3. Clean and Maintain Vat System

The Vat Operator cleans and maintains the vat system to ensure that it is operating properly. This may involve cleaning vats, piping, and other equipment.

- Cleans and maintains the vat system

- Cleans vats, piping, and other equipment

4. Follow safety procedures

The Vat Operator adheres to all safety procedures and regulations to ensure the safety of themselves and others.

- Adheres to all safety procedures and regulations

- Ensures the safety of themselves and others

Interview Tips

To prepare for an interview for a Vat Operator position, it is important to review the key job responsibilities and identify your skills and experience that are most relevant to the position. You should also be prepared to answer questions about your experience with vat systems, your safety procedures, and your troubleshooting skills.

1. Research the company and the position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you to better understand the company’s culture and the requirements of the position.

- Visit the company’s website

- Read reviews of the company on websites like Glassdoor and Indeed

- Talk to people in your network who work for the company

- Attend company events, if possible

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer interview questions

- Situation: Describe the situation or challenge you faced.

- Task: Explain the task or goal you were responsible for.

- Action: Describe the actions you took to complete the task.

- Result: Explain the results of your actions.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you take the interview seriously.

- Choose clothing that is clean, pressed, and appropriate for the occasion.

- Arrive at the interview location on time.

- Be polite and respectful to everyone you meet.

4. Be yourself

It is important to be yourself during the interview. The interviewer wants to get to know you and your personality. So be yourself, be confident, and let your personality shine through.

- Be genuine and authentic.

- Show the interviewer who you are and what you are passionate about.

- Don’t try to be someone you’re not.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Vat Operator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.