Are you gearing up for an interview for a Vault Teller position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Vault Teller and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

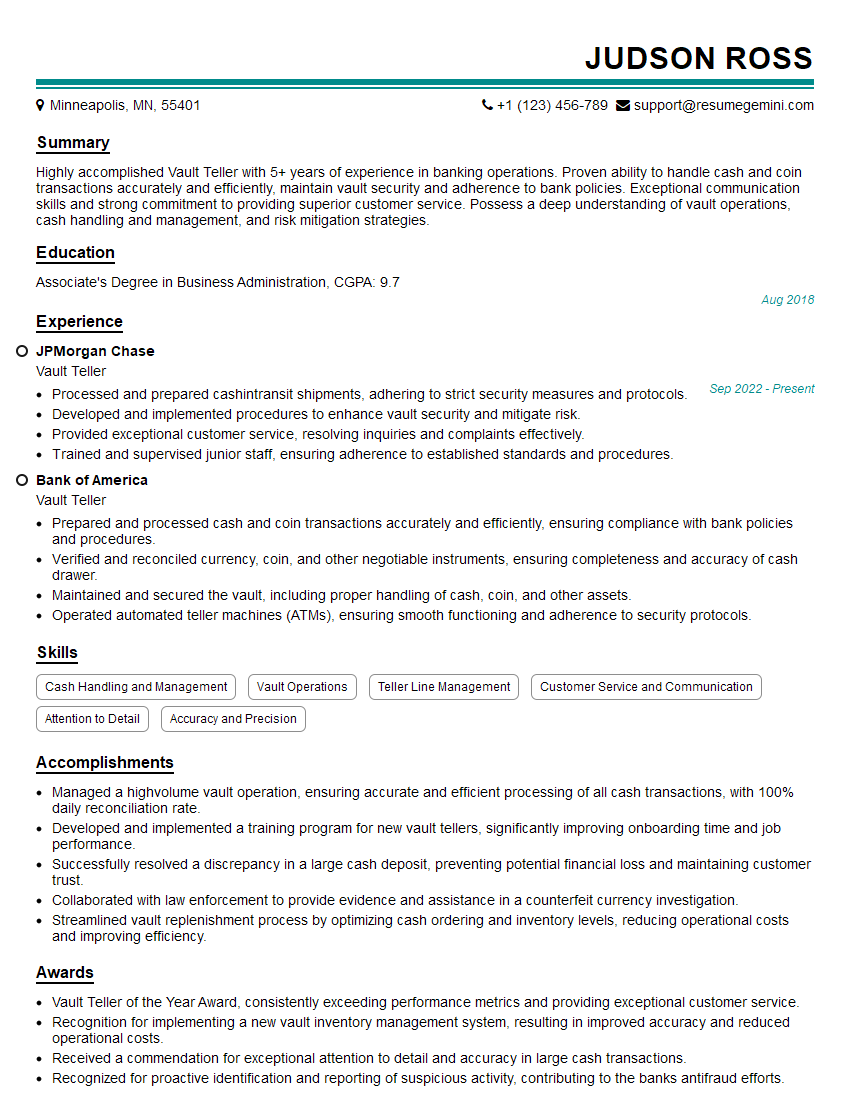

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Vault Teller

1. Explain the process of cash handling in a vault.

In a vault, cash handling involves several key steps to ensure accuracy, security, and compliance. Typically, the process includes:

- Receiving cash: Verifying the amount and authenticity of cash received from tellers or other sources.

- Sorting and counting: Using automated machines or manual counting to sort and count cash by denomination.

- Preparing cash for storage: Packaging cash in secure bags or boxes, labeling them appropriately for easy identification.

- Storing cash securely: Depositing cash in designated vaults or safes, ensuring proper access controls and security measures.

- Reconciling cash balances: Periodically comparing cash on hand with records to ensure accuracy and prevent discrepancies.

2. How do you ensure the accuracy of cash transactions in a high-volume environment?

Minimizing Errors

- Utilizing automated cash counting machines to reduce manual errors.

- Implementing double-counting procedures to verify the accuracy of transactions.

- Regularly reconciling cash balances to identify and correct any discrepancies.

Preventing Fraud

- Maintaining strict access controls to the vault and cash handling areas.

- Using security cameras and surveillance systems to monitor activities.

- Following established procedures for handling suspicious transactions or counterfeit currency.

3. Describe your experience with handling large sums of money and how you maintain composure under pressure.

During my previous role as a Vault Teller at ABC Bank, I was responsible for handling significant amounts of cash on a daily basis. To maintain composure under pressure:

- Focus on accuracy: Prioritizing accuracy over speed, ensuring that all transactions are processed correctly.

- Time management: Effectively managing time to complete tasks efficiently without compromising accuracy.

- Stress management techniques: Utilizing deep breathing exercises or other techniques to remain calm and focused.

- Clear communication: Communicating effectively with colleagues and supervisors to seek assistance or clarify instructions when needed.

4. How do you stay up-to-date with industry regulations and best practices related to vault operations?

To stay current with industry regulations and best practices, I actively engage in the following:

- Attending industry conferences and workshops: Participating in events that provide updates on regulatory changes and industry trends.

- Reading industry publications: Subscribing to magazines and newsletters that cover vault operations and security practices.

- Networking with peers: Connecting with other Vault Tellers and industry professionals to share knowledge and experiences.

- Regular training and certification: Undergoing training programs and obtaining certifications to enhance my skills and stay informed about the latest industry standards.

5. Describe a situation where you identified and resolved a discrepancy in cash handling.

In a previous role, I encountered a discrepancy in cash handling when reconciling the vault balance. Upon further investigation, I discovered that a deposit slip had been incorrectly recorded, resulting in a shortage in the vault’s cash balance.

- Identifying the error: Carefully reviewing deposit slips and comparing them with the actual cash received.

- Rectifying the error: Correcting the deposit slip and adjusting the vault balance accordingly.

- Reporting the issue: Informing my supervisor and taking appropriate steps to prevent similar errors in the future.

- Learning from the experience: Analyzing the cause of the error and implementing measures to enhance accuracy in cash handling procedures.

6. What are the key security measures you take when working in a vault environment?

To ensure the security of the vault environment, I adhere to the following key security measures:

- Access control: Limiting access to the vault to authorized personnel only.

- Surveillance: Monitoring the vault using security cameras and other surveillance systems.

- Dual control: Requiring two authorized individuals to be present when accessing or handling cash.

- Regular inspections: Regularly inspecting the vault’s physical security features, such as locks, alarms, and lighting.

- Incident reporting: Promptly reporting any unusual activities or security breaches to supervisors and relevant authorities.

7. How do you prioritize tasks and manage your time effectively in a fast-paced vault environment?

In a fast-paced vault environment, I prioritize tasks and manage my time effectively through the following strategies:

- Time management techniques: Utilizing time management techniques such as the Eisenhower Matrix to prioritize tasks based on urgency and importance.

- Delegation: Delegating non-critical tasks to colleagues when appropriate to ensure timely completion of all responsibilities.

- Effective planning: Planning my day in advance to anticipate potential bottlenecks and allocate time accordingly.

- Communication: Communicating effectively with colleagues to coordinate tasks and avoid duplication of efforts.

- Continuous improvement: Regularly reviewing my workflow and identifying areas for improvement to enhance efficiency.

8. What is your understanding of the role of a Vault Teller in preventing money laundering?

As a Vault Teller, I understand the critical role I play in preventing money laundering. My responsibilities include:

- Monitoring transactions: Being vigilant in monitoring cash transactions for suspicious patterns or large amounts that may be indicative of money laundering.

- Reporting suspicious activities: Promptly reporting any suspicious activities or transactions to supervisors and relevant authorities.

- Compliance with regulations: Staying up-to-date with anti-money laundering regulations and implementing them in my daily work.

- Maintaining confidentiality: Maintaining the confidentiality of customer information and transactions to prevent the disclosure of sensitive data to unauthorized individuals.

- Training and awareness: Actively participating in training programs and sharing knowledge with colleagues to enhance awareness of money laundering prevention.

9. How do you handle customer inquiries or requests related to cash handling?

When handling customer inquiries or requests related to cash handling, I prioritize the following:

- Active listening: Listening attentively to the customer’s inquiry or request to fully understand their needs.

- Clear communication: Providing clear and concise responses, ensuring that the customer understands the processes and procedures.

- Problem-solving: Identifying and addressing the customer’s concerns or requests promptly and efficiently.

- Privacy and confidentiality: Maintaining the confidentiality of customer information and transactions in accordance with bank policies.

- Professionalism: Maintaining a professional and courteous demeanor throughout all customer interactions.

10. Describe a situation where you demonstrated strong attention to detail while working as a Vault Teller.

In my previous role, I was responsible for counting and verifying large sums of cash. One instance where I demonstrated strong attention to detail was when I discovered a discrepancy of $10,000 during a cash count.

- Careful counting: Recounting the cash multiple times to ensure accuracy.

- Reconciliation: Reconciling the counted amount with the recorded amount to identify the discrepancy.

- Root cause analysis: Investigating the cause of the discrepancy to prevent similar errors in the future.

- Reporting and resolution: Reporting the discrepancy to my supervisor and working with the team to resolve the issue promptly.

- Enhanced procedures: Implementing additional measures to enhance accuracy in cash counting procedures.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Vault Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Vault Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Vault Tellers are responsible for the safekeeping of cash and other valuables in a bank or financial institution. They perform various tasks to ensure the accuracy and integrity of financial transactions, including:

1. Cash Management

Receiving and counting large sums of cash, both deposits, and withdrawals.

- Reconciling cash balances at the end of each day.

- Packaging and storing cash in a secure manner.

2. Vault Operations

Maintaining the integrity of the vault, including access control and security measures.

- Opening and closing the vault according to established procedures.

- Storing and retrieving valuables from the vault, such as jewelry, bonds, and precious metals.

3. Customer Service

Providing excellent customer service to both internal and external clients.

- Answering questions about vault services and procedures.

- Assisting customers with safe deposit box access and rentals.

4. Compliance and Reporting

Adhering to all applicable laws, regulations, and bank policies.

- Preparing and submitting reports on vault transactions and activities.

- Cooperating with internal and external auditors during inspections.

Interview Tips

Preparing for a Vault Teller interview can help you stand out from other candidates. Here are some tips to assist you in your preparation:

1. Research the Bank and the Vault Teller Role

Familiarize yourself with the bank’s history, services, and culture. Understand the specific responsibilities of the Vault Teller position and how it aligns with your skills and experience.

2. Emphasize Your Accuracy and Attention to Detail

Vault Tellers handle large sums of money and are responsible for maintaining accurate records. Showcase your strong numerical abilities, ability to follow procedures carefully, and meticulous attention to detail.

3. Highlight Your Security Awareness and Confidentiality

Vault Tellers have access to sensitive information and valuables. Highlight your understanding of security protocols, confidentiality, and your commitment to maintaining the integrity of the vault.

4. Practice Customer Service Skills

Vault Tellers interact with customers, including those accessing safe deposit boxes. Demonstrate your excellent communication skills, ability to handle inquiries, and provide a positive customer experience.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Vault Teller role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.