Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Wealth Management Advisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

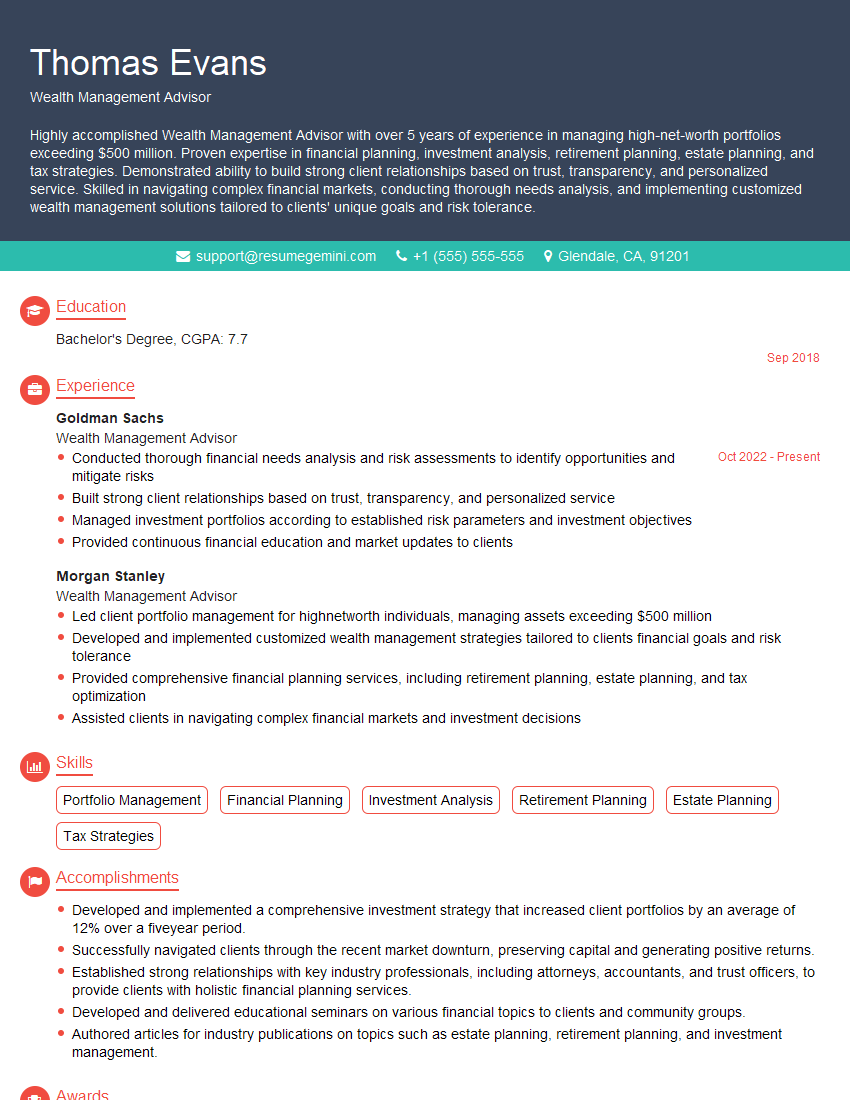

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Wealth Management Advisor

1. How do you approach developing a comprehensive financial plan for a high-net-worth individual?

Sample Answer:

- Establish a strong and thorough understanding of the client’s financial situation, goals, and risk tolerance.

- Conduct a comprehensive analysis of the client’s income, expenses, investments, and potential risks.

- Identify areas for improvement and develop tailored strategies to meet the client’s goals.

- Incorporate a range of financial instruments and investment vehicles to optimize returns and mitigate risks.

- Regularly monitor the plan’s progress, make adjustments as needed, and provide ongoing support to the client.

2. Explain the different asset allocation strategies you employ and how you determine the appropriate mix for a client.

Investment Objectives

- Identify client’s specific financial goals, risk tolerance, and time horizon.

Asset Class Correlation

- Consider the relationship between different asset classes (e.g., stocks, bonds, real estate) to optimize diversification.

Market Conditions

- Analyze current economic conditions and market trends to make informed investment decisions.

Client’s Risk Profile

- Assess the client’s ability and willingness to tolerate market fluctuations to determine an appropriate risk level.

3. Describe your experience in managing alternative investments, such as private equity, hedge funds, and real estate.

Sample Answer:

- Thorough knowledge of various alternative investment strategies and their potential returns and risks.

- Ability to conduct thorough due diligence and evaluate alternative investment opportunities.

- Strong network in the alternative investment industry and access to quality deals.

- Experience in structuring and negotiating alternative investment transactions.

4. How do you stay abreast of the latest financial trends and regulations that impact wealth management?

Sample Answer:

- Attend industry conferences, seminars, and workshops.

- Read professional publications and research studies.

- Network with other professionals in the field.

- Continuously pursue professional development and certifications.

5. Describe your approach to building and maintaining relationships with clients.

Sample Answer:

- Establish open and transparent communication channels.

- Listen actively to understand client needs and concerns.

- Provide regular updates on client portfolios and market conditions.

- Anticipate and proactively address client questions and concerns.

- Go the extra mile to build personal rapport and trust.

6. How do you handle market volatility and potential losses in client portfolios?

Sample Answer:

- Communicate clearly with clients about the nature of market volatility and potential risks.

- Stay informed about market conditions and potential risks.

- Rebalance client portfolios as needed to maintain the desired risk-return profile.

- Explore alternative investments or hedging strategies to mitigate risks.

- Provide emotional support and guidance to clients during market downturns.

7. Describe your experience in using financial planning software and tools.

Sample Answer:

- Proficient in using financial planning software, such as eMoney Advisor, MoneyGuidePro, or NaviPlan.

- Ability to create comprehensive financial plans, including cash flow analysis, retirement planning, and investment projections.

- Experience in using financial modeling tools to optimize client portfolios.

8. How do you handle conflicts of interest and ensure ethical decision-making?

Sample Answer:

- Adhere to industry regulations and ethical guidelines.

- Maintain a transparent and conflict-free relationship with clients.

- Avoid recommending products or services that are not in the client’s best interest.

- Regularly complete compliance training and certifications.

9. Describe a challenging situation you faced while working with a client and how you resolved it.

Sample Answer:

Situation:

Resolution:

- Collaborated with the client to clarify their goals and priorities.

- Developed a comprehensive financial plan that addressed their needs and concerns.

- Regularly communicated with the client to ensure their understanding and satisfaction.

10. Why are you interested in this role and why do you believe you are the best candidate?

Sample Answer:

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Wealth Management Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Wealth Management Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Wealth Management Advisors are responsible for providing comprehensive financial advice to high-net-worth individuals, families, and institutions. They develop and implement customized investment strategies, manage portfolios, and provide ongoing guidance to help clients meet their financial goals.

1. Client Relationship Management

Establish and maintain strong relationships with clients, understanding their financial needs, goals, and risk tolerance.

- Conduct detailed financial assessments and develop personalized financial plans tailored to client objectives.

- Communicate effectively with clients, providing clear and concise explanations of investment strategies and market trends.

2. Investment Management

Manage investment portfolios, selecting and recommending securities based on client risk tolerance and investment goals.

- Conduct thorough investment research and analysis to identify potential opportunities and mitigate risks.

- Monitor market conditions and adjust investment strategies as needed to meet client objectives.

3. Financial Planning

Provide comprehensive financial planning services, including retirement planning, estate planning, and tax optimization.

- Develop and implement strategies to maximize returns and minimize taxes while considering client’s overall financial situation.

- Coordinate with other professionals, such as accountants and lawyers, to ensure a cohesive financial plan.

4. Business Development

Continuously expand client base and generate new business opportunities through networking and marketing efforts.

- Develop and execute business development strategies to attract and acquire new clients.

- Attend industry events, conferences, and seminars to connect with potential clients and build professional relationships.

Interview Tips

Interviews for Wealth Management Advisor positions can be highly competitive. Here are some tips to help you ace the interview:

1. Showcase Your Technical Skills

Be prepared to demonstrate your strong understanding of investment principles, financial planning, and wealth management strategies.

- Quantify your accomplishments and provide specific examples of successful investment decisions you’ve made.

- Highlight your expertise in financial analysis, portfolio management, and risk assessment.

2. Emphasize Relationship-Building Abilities

Interviewers will be looking for candidates with excellent communication and interpersonal skills.

- Share examples of how you build rapport with clients and gain their trust.

- Describe your approach to active listening and understanding client needs.

3. Highlight Your Market Knowledge

Show the interviewer you have a deep understanding of the financial markets and industry trends.

- Discuss current economic and market conditions and their potential impact on client portfolios.

- Explain how you stay abreast of market trends and use research to inform your investment decisions.

4. Prepare for Behavioral Questions

Be prepared to answer questions about your work style, teamwork, and ethical decision-making.

- Use the STAR method to answer questions, providing specific examples of your actions and outcomes.

- Highlight your ability to work independently, prioritize tasks, and meet deadlines.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Wealth Management Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!