Are you gearing up for a career in Wealth Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Wealth Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

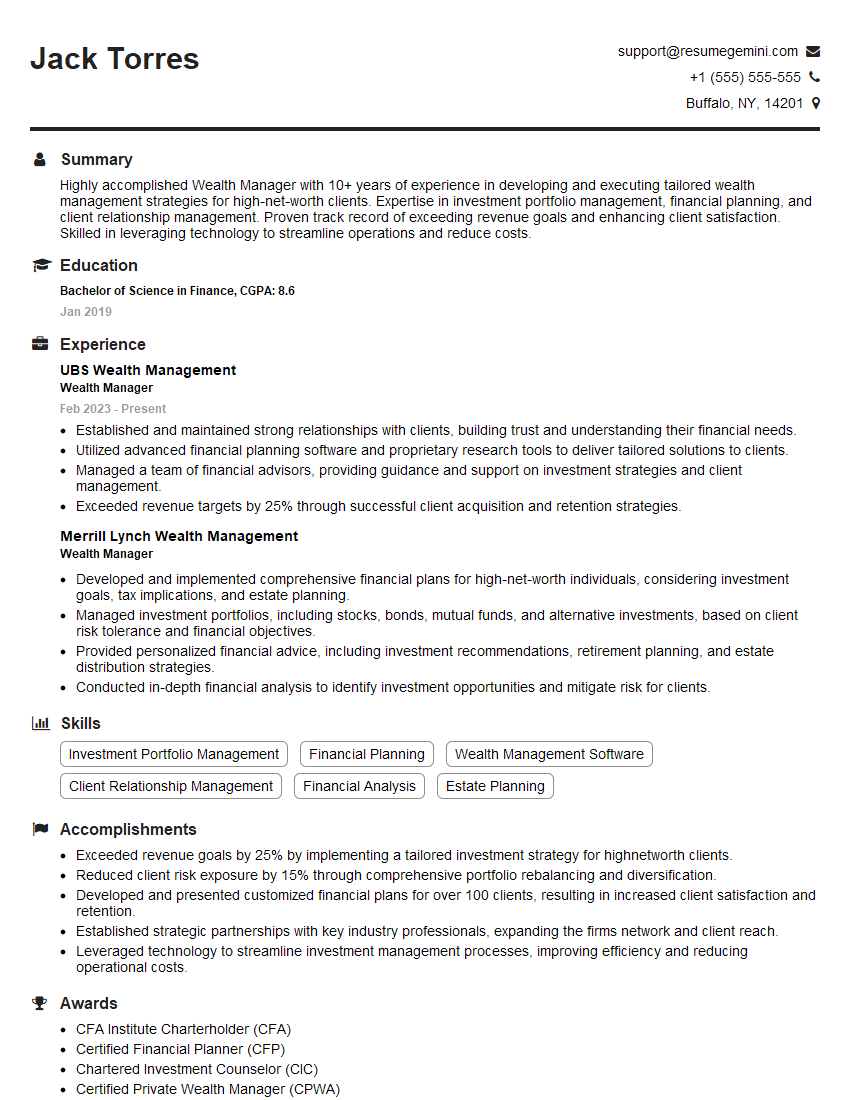

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Wealth Manager

1. How would you determine an appropriate asset allocation for a client?

I would take into account a number of factors, including the client’s age, risk tolerance, investment goals, and time horizon. I would also consider the current market conditions and the client’s tax situation.

- Once I have gathered all of this information, I would develop an asset allocation strategy that is tailored to the client’s individual needs.

- I would regularly review the client’s portfolio and make adjustments as needed.

2. What are some of the key trends that you are seeing in the wealth management industry?

Changing demographics

- The baby boomer generation is retiring in large numbers, and this is creating a significant transfer of wealth.

- The millennial generation is also beginning to accumulate wealth, and they have different investment needs than baby boomers.

Increasing demand for financial advice

- As people become more complex and their investment portfolios grow, they are increasingly seeking out professional financial advice.

- This is creating a demand for wealth managers who can provide personalized advice and guidance.

Technology is changing the way wealth management is delivered

- Wealth managers are increasingly using technology to improve their service offerings.

- This includes using technology to automate tasks, provide clients with access to their accounts, and deliver personalized investment advice.

3. What are some of the challenges that you face as a wealth manager?

One of the main challenges is managing client expectations.

- Clients often have unrealistic expectations about what their investments can achieve.

- It is important to manage these expectations and educate clients about the risks and rewards of investing.

Another challenge is staying up-to-date on the latest investment trends and regulations.

- The wealth management industry is constantly evolving, and it is important to stay abreast of the latest changes.

- This can be challenging, but it is essential for providing clients with the best possible advice.

4. What are some of the most important qualities of a successful wealth manager?

- Strong communication skills

- Ability to build relationships

- Investment knowledge

- Analytical skills

- Attention to detail

- Integrity

5. What are some of the most important trends that you are seeing in the financial markets?

Rising interest rates

- The Federal Reserve is raising interest rates, and this is having a significant impact on the financial markets.

- Higher interest rates make it more expensive for businesses to borrow money, and this can slow down economic growth.

Trade tensions

- The United States and China are engaged in a trade war, and this is creating uncertainty in the financial markets.

- Businesses are concerned about the impact of tariffs, and this is causing them to delay investment decisions.

Technological innovation

- Technology is changing the way that businesses operate, and this is having a major impact on the financial markets.

- Companies that are able to adapt to new technologies will be more successful than those that cannot.

6. How do you stay up-to-date on the latest investment trends and regulations?

- I read industry publications and attend conferences.

- I also meet with other wealth managers and financial professionals to exchange ideas.

- Additionally, I take continuing education courses to ensure that I am up-to-date on the latest regulations.

7. What are your favorite financial planning tools and resources?

- I use a variety of financial planning tools and resources to help my clients.

- Some of my favorites include Morningstar, Bloomberg, and Capital IQ.

- I also use a number of software programs to help me manage my clients’ portfolios.

8. What are some of the most common mistakes that investors make?

- One of the most common mistakes that investors make is investing too much money in a single asset class.

- This can be risky, because if the value of that asset class declines, the investor could lose a significant amount of money.

- Another common mistake is not diversifying enough.

- Diversifying your portfolio means investing in a variety of different asset classes, such as stocks, bonds, and real estate.

- This helps to reduce risk and improve the chances of achieving your investment goals.

9. What are some of the most important factors to consider when choosing a wealth manager?

- When choosing a wealth manager, it is important to consider a number of factors, including the manager’s experience, qualifications, and track record.

- It is also important to make sure that the manager is a good fit for your individual needs and investment goals.

- You should interview several different wealth managers before making a decision.

10. How do you measure your success as a wealth manager?

I measure my success as a wealth manager by the following criteria:

- Client satisfaction

- Investment performance

- Professional development

I believe that it is important to be successful in all three of these areas in order to be a truly successful wealth manager.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Wealth Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Wealth Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Wealth Managers are responsible for managing the financial assets of high-net-worth individuals and families. They provide personalized investment advice and develop comprehensive financial plans to help their clients achieve their financial goals.

1. Investment Management

Wealth Managers conduct thorough research and analysis to identify suitable investment opportunities for their clients. They make investment recommendations based on their client’s risk tolerance, investment objectives, and time horizon.

- Analyze market trends and economic data.

- Develop and implement investment strategies.

- Monitor and manage investment portfolios.

2. Financial Planning

Wealth Managers help clients develop comprehensive financial plans that address their short-term and long-term financial goals. They consider factors such as income, expenses, assets, liabilities, and retirement planning.

- Create cash flow statements.

- Develop retirement and estate plans.

- Provide tax planning advice.

3. Relationship Management

Wealth Managers build strong relationships with their clients based on trust and confidentiality. They communicate regularly with clients to understand their needs and preferences.

- Meet with clients to discuss their financial goals.

- Respond to client inquiries and provide updates.

- Attend industry events and networking functions.

4. Regulatory Compliance

Wealth Managers are required to comply with various regulations and ethical guidelines. They must maintain confidentiality of client information and avoid any conflicts of interest.

- Stay updated on regulatory changes.

- Follow company policies and procedures.

- Obtain necessary licenses and certifications.

Interview Tips

Preparing for a Wealth Manager interview requires thorough research and practice. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s culture, history, and financial performance. Read industry news and articles to gain insights into the latest trends.

- Visit the company’s website.

- Read industry publications.

- Network with professionals in the field.

2. Practice Behavioral Interview Questions

Behavioral interview questions focus on specific examples of your work experience. Prepare answers that highlight your skills and abilities in areas such as:

- Client relationship management.

- Investment analysis.

- Financial planning.

- Regulatory compliance.

3. Prepare Technical Questions

Be prepared to answer technical questions related to investment management and financial planning. Study topics such as:

- Investment strategies.

- Financial statement analysis.

- Estate planning.

- Regulatory compliance.

4. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive on time for your interview. Maintain a positive attitude and be respectful throughout the interview process.

- Wear a suit or business casual attire.

- Arrive 15 minutes early for your interview.

- Make eye contact and smile.

Next Step:

Now that you’re armed with the knowledge of Wealth Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Wealth Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini