Are you a seasoned Account Underwriter seeking a new career path? Discover our professionally built Account Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

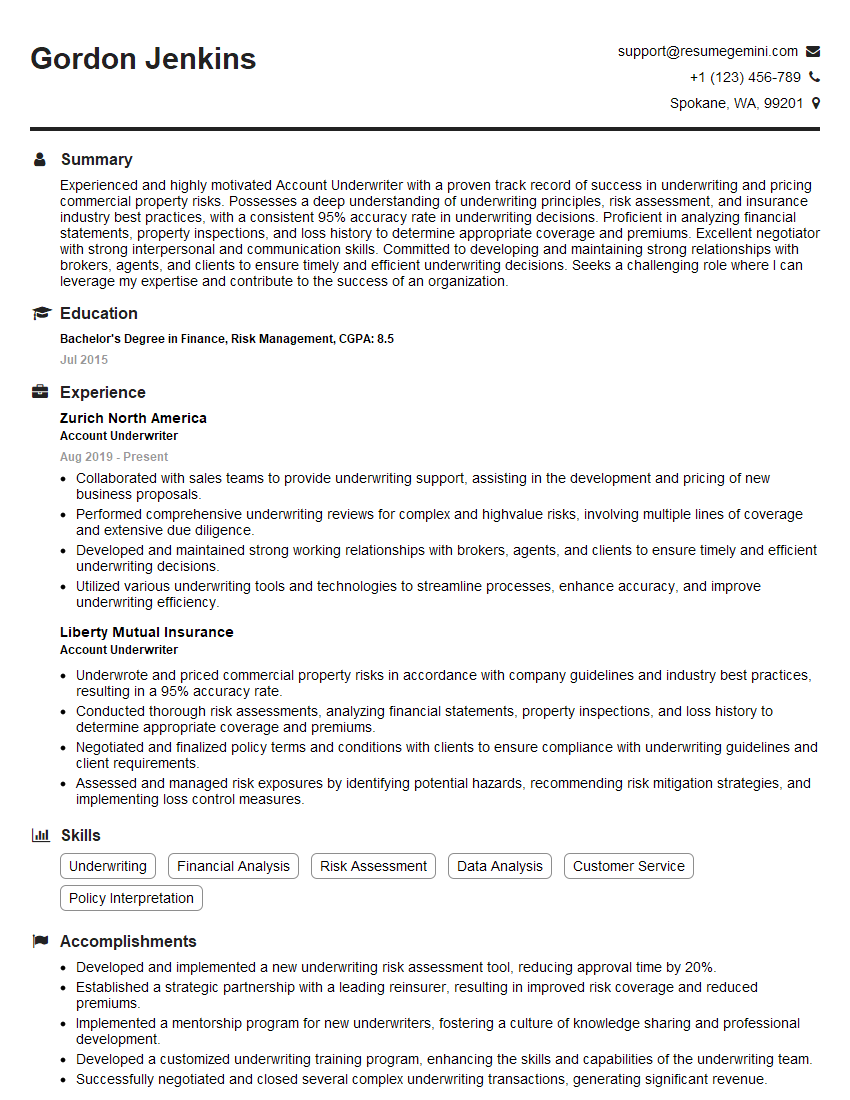

Gordon Jenkins

Account Underwriter

Summary

Experienced and highly motivated Account Underwriter with a proven track record of success in underwriting and pricing commercial property risks. Possesses a deep understanding of underwriting principles, risk assessment, and insurance industry best practices, with a consistent 95% accuracy rate in underwriting decisions. Proficient in analyzing financial statements, property inspections, and loss history to determine appropriate coverage and premiums. Excellent negotiator with strong interpersonal and communication skills. Committed to developing and maintaining strong relationships with brokers, agents, and clients to ensure timely and efficient underwriting decisions. Seeks a challenging role where I can leverage my expertise and contribute to the success of an organization.

Education

Bachelor’s Degree in Finance, Risk Management

July 2015

Skills

- Underwriting

- Financial Analysis

- Risk Assessment

- Data Analysis

- Customer Service

- Policy Interpretation

Work Experience

Account Underwriter

- Collaborated with sales teams to provide underwriting support, assisting in the development and pricing of new business proposals.

- Performed comprehensive underwriting reviews for complex and highvalue risks, involving multiple lines of coverage and extensive due diligence.

- Developed and maintained strong working relationships with brokers, agents, and clients to ensure timely and efficient underwriting decisions.

- Utilized various underwriting tools and technologies to streamline processes, enhance accuracy, and improve underwriting efficiency.

Account Underwriter

- Underwrote and priced commercial property risks in accordance with company guidelines and industry best practices, resulting in a 95% accuracy rate.

- Conducted thorough risk assessments, analyzing financial statements, property inspections, and loss history to determine appropriate coverage and premiums.

- Negotiated and finalized policy terms and conditions with clients to ensure compliance with underwriting guidelines and client requirements.

- Assessed and managed risk exposures by identifying potential hazards, recommending risk mitigation strategies, and implementing loss control measures.

Accomplishments

- Developed and implemented a new underwriting risk assessment tool, reducing approval time by 20%.

- Established a strategic partnership with a leading reinsurer, resulting in improved risk coverage and reduced premiums.

- Implemented a mentorship program for new underwriters, fostering a culture of knowledge sharing and professional development.

- Developed a customized underwriting training program, enhancing the skills and capabilities of the underwriting team.

- Successfully negotiated and closed several complex underwriting transactions, generating significant revenue.

Awards

- Received the Underwriter of the Year award for outstanding underwriting performance.

- Honored with the Presidents Award for exceptional contributions to underwriting excellence.

- Recognized as a top performer in underwriting accuracy, exceeding industry benchmarks by 15%.

- Awarded the Underwriting Excellence Award for consistent highquality underwriting decisions.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Certified Insurance Services Representative (CISR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Account Underwriter

- Quantify your accomplishments: Use numbers and metrics to demonstrate the impact of your work. For instance, instead of saying ‘Assessed risk exposures’, say ‘Assessed risk exposures for over 200 commercial properties, resulting in a 15% reduction in loss ratios.’

- Highlight your technical skills: Make sure to mention your proficiency in relevant underwriting tools and technologies, such as rating software, risk assessment models, and policy management systems.

- Emphasize your soft skills: Underwriting involves a lot of collaboration and communication. Highlight your strong interpersonal skills, ability to build relationships, and provide excellent customer service.

- Tailor your resume to the job description: Carefully review the job description and identify the key responsibilities and qualifications required. Tailor your resume accordingly, highlighting your relevant skills and experience.

Essential Experience Highlights for a Strong Account Underwriter Resume

- Underwrite and price commercial property risks according to company guidelines and industry best practices.

- Conduct thorough risk assessments, involving financial statement analysis, property inspections, and loss history review.

- Negotiate and finalize policy terms and conditions with clients to meet underwriting requirements and client expectations.

- Assess and manage risk exposures by identifying potential hazards and recommending risk mitigation strategies.

- Collaborate with sales teams to provide underwriting support, assist in proposal development, and ensure alignment with underwriting guidelines.

- Perform comprehensive underwriting reviews for complex and high-value risks, involving multiple lines of coverage and extensive due diligence.

Frequently Asked Questions (FAQ’s) For Account Underwriter

What is the primary role of an Account Underwriter?

The primary role of an Account Underwriter is to evaluate and assess risks associated with commercial property insurance policies. They determine the appropriate coverage and premiums, negotiate policy terms, and manage risk exposures to protect the interests of the insurance company and its clients.

What are some of the key skills required for an Account Underwriter?

Key skills for an Account Underwriter include: underwriting expertise, financial analysis, risk assessment, data analysis, customer service, policy interpretation, and proficiency in underwriting tools and technologies.

What is the career path for an Account Underwriter?

Account Underwriters can advance to senior underwriting roles, such as Senior Underwriter, Chief Underwriter, or Underwriting Manager. With experience and additional qualifications, they may also move into management or leadership positions within the insurance industry.

What are the earning prospects for an Account Underwriter?

The earning potential for an Account Underwriter varies depending on experience, qualifications, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Underwriters in 2021 was $76,730.

What are the top qualities of a successful Account Underwriter?

Successful Account Underwriters possess strong analytical and problem-solving skills, attention to detail, and the ability to make sound judgments based on complex information. They are also effective communicators, both written and verbal, and have the ability to build and maintain strong relationships with clients and colleagues.