Are you a seasoned Accountant Manager seeking a new career path? Discover our professionally built Accountant Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

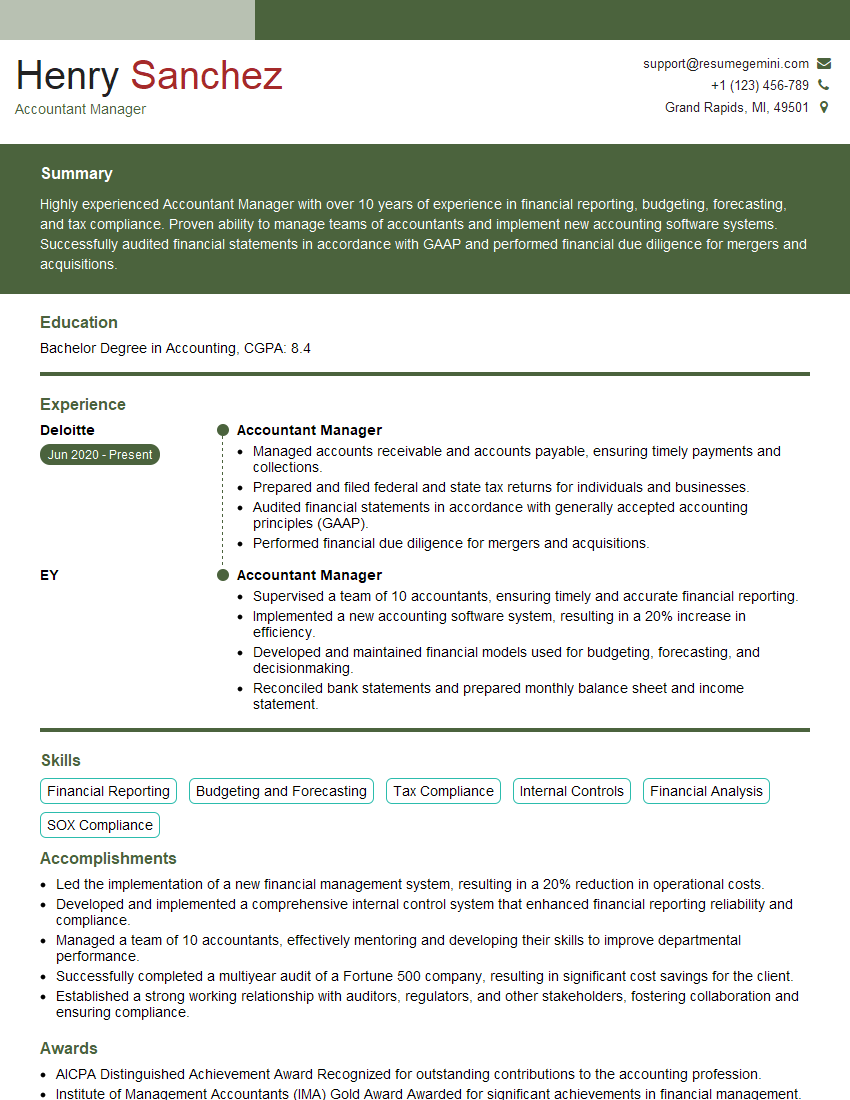

Henry Sanchez

Accountant Manager

Summary

Highly experienced Accountant Manager with over 10 years of experience in financial reporting, budgeting, forecasting, and tax compliance. Proven ability to manage teams of accountants and implement new accounting software systems. Successfully audited financial statements in accordance with GAAP and performed financial due diligence for mergers and acquisitions.

Education

Bachelor Degree in Accounting

May 2016

Skills

- Financial Reporting

- Budgeting and Forecasting

- Tax Compliance

- Internal Controls

- Financial Analysis

- SOX Compliance

Work Experience

Accountant Manager

- Managed accounts receivable and accounts payable, ensuring timely payments and collections.

- Prepared and filed federal and state tax returns for individuals and businesses.

- Audited financial statements in accordance with generally accepted accounting principles (GAAP).

- Performed financial due diligence for mergers and acquisitions.

Accountant Manager

- Supervised a team of 10 accountants, ensuring timely and accurate financial reporting.

- Implemented a new accounting software system, resulting in a 20% increase in efficiency.

- Developed and maintained financial models used for budgeting, forecasting, and decisionmaking.

- Reconciled bank statements and prepared monthly balance sheet and income statement.

Accomplishments

- Led the implementation of a new financial management system, resulting in a 20% reduction in operational costs.

- Developed and implemented a comprehensive internal control system that enhanced financial reporting reliability and compliance.

- Managed a team of 10 accountants, effectively mentoring and developing their skills to improve departmental performance.

- Successfully completed a multiyear audit of a Fortune 500 company, resulting in significant cost savings for the client.

- Established a strong working relationship with auditors, regulators, and other stakeholders, fostering collaboration and ensuring compliance.

Awards

- AICPA Distinguished Achievement Award Recognized for outstanding contributions to the accounting profession.

- Institute of Management Accountants (IMA) Gold Award Awarded for significant achievements in financial management.

- Certified Internal Auditor (CIA) Recognized for proficiency in internal auditing principles and practices.

- Certified Public Accountant (CPA) Certified by the state to perform auditing and accounting services.

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accountant Manager

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your experience with specific accounting software systems and industry regulations.

- Include a section on your resume that demonstrates your leadership and management skills.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Accountant Manager Resume

- Supervise a team of accountants to ensure timely and accurate financial reporting.

- Implement new accounting software systems to improve efficiency and accuracy.

- Develop and maintain financial models used for budgeting, forecasting, and decision-making.

- Reconcile bank statements and prepare monthly balance sheet and income statement.

- Manage accounts receivable and accounts payable to ensure timely payments and collections.

- Prepare and file federal and state tax returns for individuals and businesses.

- Audit financial statements in accordance with generally accepted accounting principles (GAAP).

- Perform financial due diligence for mergers and acquisitions.

Frequently Asked Questions (FAQ’s) For Accountant Manager

What are the key skills required for an Accountant Manager?

The key skills required for an Accountant Manager include financial reporting, budgeting and forecasting, tax compliance, internal controls, financial analysis, and SOX compliance.

What are the typical responsibilities of an Accountant Manager?

The typical responsibilities of an Accountant Manager include supervising a team of accountants, implementing new accounting software systems, developing and maintaining financial models, reconciling bank statements, managing accounts receivable and accounts payable, preparing and filing tax returns, and auditing financial statements.

What are the qualifications required for an Accountant Manager?

The typical qualifications required for an Accountant Manager include a bachelor’s degree in accounting, CPA certification, and several years of experience in accounting and finance.

What are the career prospects for an Accountant Manager?

Accountant Managers can advance to positions such as Controller, CFO, or other senior financial management roles.

What is the average salary for an Accountant Manager?

The average salary for an Accountant Manager in the United States is around $120,000 per year.

What are the top companies that hire Accountant Managers?

Top companies that hire Accountant Managers include Deloitte, EY, PwC, KPMG, and BDO.

What are the key challenges faced by Accountant Managers?

Key challenges faced by Accountant Managers include keeping up with changing accounting standards, managing risk and compliance, and ensuring the accuracy and reliability of financial reporting.

What are the key trends in the accounting profession?

Key trends in the accounting profession include the increasing use of technology, the globalization of business, and the growing importance of data analytics.