Are you a seasoned Accountant seeking a new career path? Discover our professionally built Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

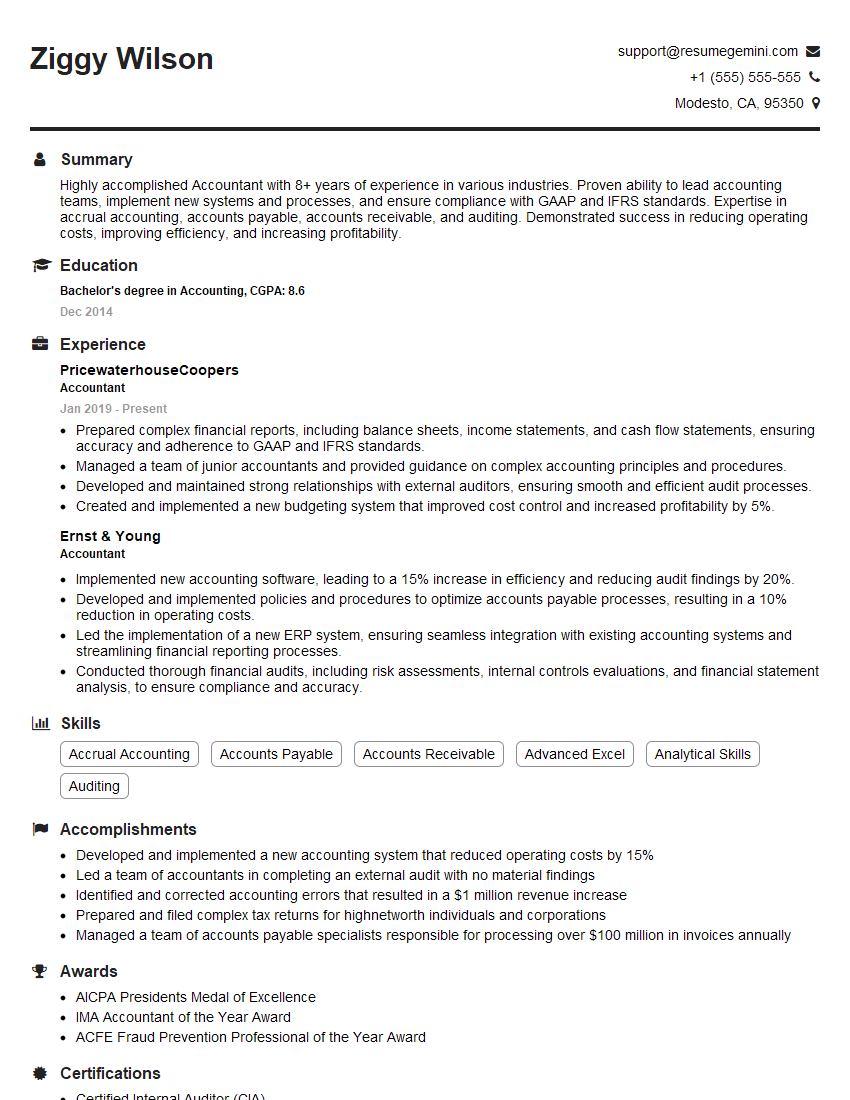

Ziggy Wilson

Accountant

Summary

Highly accomplished Accountant with 8+ years of experience in various industries. Proven ability to lead accounting teams, implement new systems and processes, and ensure compliance with GAAP and IFRS standards. Expertise in accrual accounting, accounts payable, accounts receivable, and auditing. Demonstrated success in reducing operating costs, improving efficiency, and increasing profitability.

Education

Bachelor’s degree in Accounting

December 2014

Skills

- Accrual Accounting

- Accounts Payable

- Accounts Receivable

- Advanced Excel

- Analytical Skills

- Auditing

Work Experience

Accountant

- Prepared complex financial reports, including balance sheets, income statements, and cash flow statements, ensuring accuracy and adherence to GAAP and IFRS standards.

- Managed a team of junior accountants and provided guidance on complex accounting principles and procedures.

- Developed and maintained strong relationships with external auditors, ensuring smooth and efficient audit processes.

- Created and implemented a new budgeting system that improved cost control and increased profitability by 5%.

Accountant

- Implemented new accounting software, leading to a 15% increase in efficiency and reducing audit findings by 20%.

- Developed and implemented policies and procedures to optimize accounts payable processes, resulting in a 10% reduction in operating costs.

- Led the implementation of a new ERP system, ensuring seamless integration with existing accounting systems and streamlining financial reporting processes.

- Conducted thorough financial audits, including risk assessments, internal controls evaluations, and financial statement analysis, to ensure compliance and accuracy.

Accomplishments

- Developed and implemented a new accounting system that reduced operating costs by 15%

- Led a team of accountants in completing an external audit with no material findings

- Identified and corrected accounting errors that resulted in a $1 million revenue increase

- Prepared and filed complex tax returns for highnetworth individuals and corporations

- Managed a team of accounts payable specialists responsible for processing over $100 million in invoices annually

Awards

- AICPA Presidents Medal of Excellence

- IMA Accountant of the Year Award

- ACFE Fraud Prevention Professional of the Year Award

Certificates

- Certified Internal Auditor (CIA)

- Certified Management Accountant (CMA)

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accountant

- Highlight your most relevant skills and experience at the top of your resume.

- Use specific examples to quantify your accomplishments and demonstrate your impact on the organization.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully for any errors in grammar or spelling.

- Consider getting your resume reviewed by a career counselor or professional resume writer.

Essential Experience Highlights for a Strong Accountant Resume

- Led the implementation of a new accounting software, resulting in a 15% increase in efficiency and a 20% reduction in audit findings.

- Developed and implemented policies and procedures to optimize accounts payable processes, leading to a 10% reduction in operating costs.

- Conducted thorough financial audits, including risk assessments, internal controls evaluations, and financial statement analysis, to ensure compliance and accuracy.

- Prepared complex financial reports, including balance sheets, income statements, and cash flow statements, ensuring accuracy and adherence to GAAP and IFRS standards.

- Managed a team of junior accountants and provided guidance on complex accounting principles and procedures.

- Developed and maintained strong relationships with external auditors, ensuring smooth and efficient audit processes.

- Created and implemented a new budgeting system that improved cost control and increased profitability by 5%.

Frequently Asked Questions (FAQ’s) For Accountant

What are the key skills and qualifications for an Accountant?

The key skills and qualifications for an Accountant include a Bachelor’s degree in Accounting, proficiency in accrual accounting, accounts payable, accounts receivable, auditing, and financial reporting. Additionally, strong analytical, communication, and interpersonal skills are essential.

What are the career prospects for Accountants?

Accountants are in high demand across a wide range of industries. With experience, Accountants can advance to senior positions such as Controller, CFO, or Partner. They can also specialize in areas such as auditing, tax, or forensic accounting.

What is the average salary for an Accountant?

The average salary for an Accountant varies depending on experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for Accountants was $73,500 in May 2021.

What are the different types of accounting roles?

There are many different types of accounting roles, including Financial Accountant, Management Accountant, Tax Accountant, Auditor, and Forensic Accountant. Each type of accounting role has its own unique responsibilities and requirements.

What is the difference between a CPA and an Accountant?

A CPA (Certified Public Accountant) is an Accountant who has passed the Uniform CPA Examination and met additional state requirements. CPAs are licensed to provide a wider range of services than Accountants, including auditing and tax preparation.

What are the ethical responsibilities of Accountants?

Accountants have a responsibility to act with integrity and objectivity. They must also comply with all applicable laws and regulations.