Are you a seasoned Accounting Assistant seeking a new career path? Discover our professionally built Accounting Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

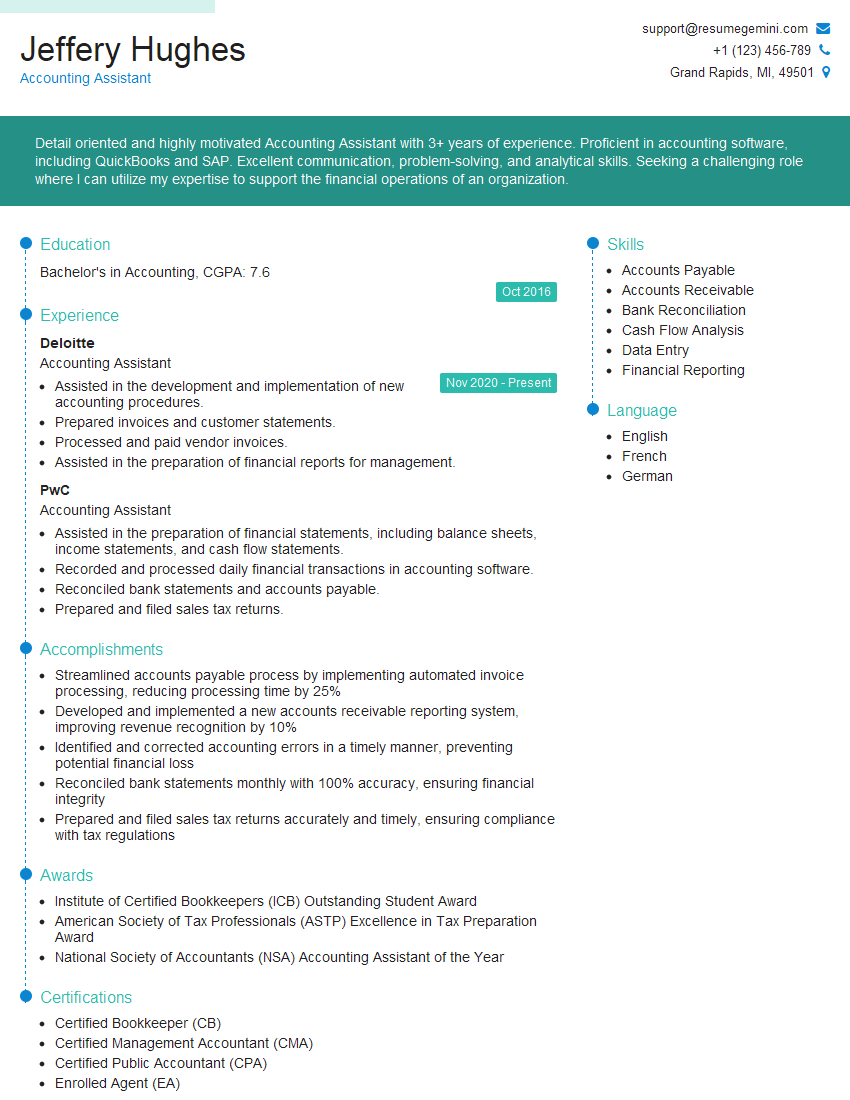

Jeffery Hughes

Accounting Assistant

Summary

Detail oriented and highly motivated Accounting Assistant with 3+ years of experience. Proficient in accounting software, including QuickBooks and SAP. Excellent communication, problem-solving, and analytical skills. Seeking a challenging role where I can utilize my expertise to support the financial operations of an organization.

Education

Bachelor’s in Accounting

October 2016

Skills

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Cash Flow Analysis

- Data Entry

- Financial Reporting

Work Experience

Accounting Assistant

- Assisted in the development and implementation of new accounting procedures.

- Prepared invoices and customer statements.

- Processed and paid vendor invoices.

- Assisted in the preparation of financial reports for management.

Accounting Assistant

- Assisted in the preparation of financial statements, including balance sheets, income statements, and cash flow statements.

- Recorded and processed daily financial transactions in accounting software.

- Reconciled bank statements and accounts payable.

- Prepared and filed sales tax returns.

Accomplishments

- Streamlined accounts payable process by implementing automated invoice processing, reducing processing time by 25%

- Developed and implemented a new accounts receivable reporting system, improving revenue recognition by 10%

- Identified and corrected accounting errors in a timely manner, preventing potential financial loss

- Reconciled bank statements monthly with 100% accuracy, ensuring financial integrity

- Prepared and filed sales tax returns accurately and timely, ensuring compliance with tax regulations

Awards

- Institute of Certified Bookkeepers (ICB) Outstanding Student Award

- American Society of Tax Professionals (ASTP) Excellence in Tax Preparation Award

- National Society of Accountants (NSA) Accounting Assistant of the Year

Certificates

- Certified Bookkeeper (CB)

- Certified Management Accountant (CMA)

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accounting Assistant

- Highlight your accounting software proficiency and experience with specific software packages.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it to make sure there are no errors.

Essential Experience Highlights for a Strong Accounting Assistant Resume

- Assisted in the preparation of financial statements, including balance sheets, income statements, and cash flow statements.

- Recorded and processed daily financial transactions in accounting software.

- Reconciled bank statements and accounts payable.

- Prepared and filed sales tax returns.

- Assisted in the development and implementation of new accounting procedures.

- Prepared invoices and customer statements.

- Processed and paid vendor invoices.

Frequently Asked Questions (FAQ’s) For Accounting Assistant

What are the key responsibilities of an Accounting Assistant?

The key responsibilities of an Accounting Assistant include recording and processing financial transactions, reconciling bank statements, preparing invoices and customer statements, processing vendor invoices, and assisting in the preparation of financial reports.

What are the qualifications for an Accounting Assistant?

The qualifications for an Accounting Assistant typically include a high school diploma or equivalent, with some college coursework in accounting preferred. Some employers may also require experience in accounting software.

What are the career prospects for an Accounting Assistant?

Accounting Assistants can advance to positions such as Accountant, Senior Accountant, and Controller. With additional education and experience, they may also become Certified Public Accountants (CPAs).

What is the salary range for an Accounting Assistant?

The salary range for an Accounting Assistant can vary depending on experience, location, and employer. According to the Bureau of Labor Statistics, the median annual salary for Accounting Assistants was $49,410 in May 2021.

What are some tips for writing a standout Accounting Assistant resume?

Some tips for writing a standout resume include highlighting your accounting software proficiency, quantifying your accomplishments, tailoring your resume to each job you apply for, and proofreading your resume carefully before submitting it.

What are some common interview questions for Accounting Assistants?

Some common interview questions for Accounting Assistants include questions about your experience with accounting software, your understanding of accounting principles, and your ability to work independently and as part of a team.

What are some professional development opportunities for Accounting Assistants?

Some professional development opportunities for Accounting Assistants include attending workshops and conferences, taking online courses, and earning professional certifications such as the Certified Public Accountant (CPA) certification.

What are some common challenges faced by Accounting Assistants?

Some common challenges faced by Accounting Assistants include dealing with deadlines, working with large amounts of data, and keeping up with changing accounting regulations.