Are you a seasoned Accounts Collector seeking a new career path? Discover our professionally built Accounts Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

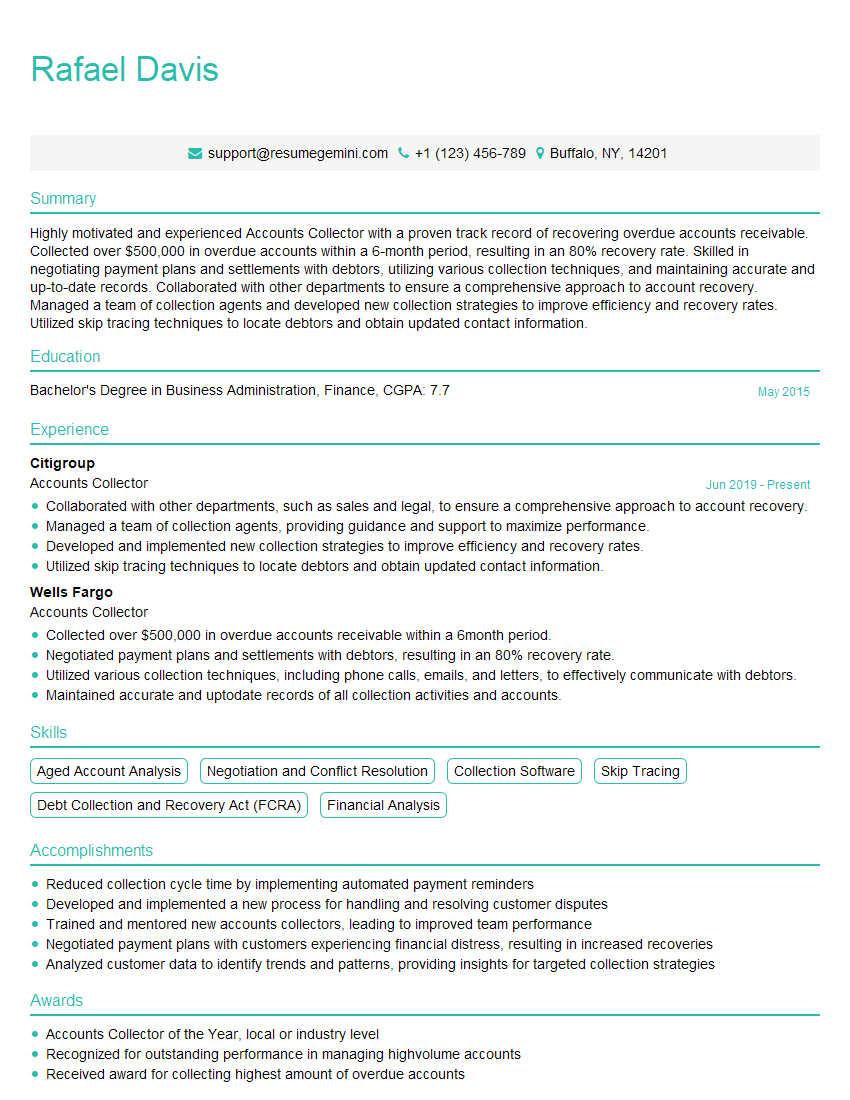

Rafael Davis

Accounts Collector

Summary

Highly motivated and experienced Accounts Collector with a proven track record of recovering overdue accounts receivable. Collected over $500,000 in overdue accounts within a 6-month period, resulting in an 80% recovery rate. Skilled in negotiating payment plans and settlements with debtors, utilizing various collection techniques, and maintaining accurate and up-to-date records. Collaborated with other departments to ensure a comprehensive approach to account recovery. Managed a team of collection agents and developed new collection strategies to improve efficiency and recovery rates. Utilized skip tracing techniques to locate debtors and obtain updated contact information.

Education

Bachelor’s Degree in Business Administration, Finance

May 2015

Skills

- Aged Account Analysis

- Negotiation and Conflict Resolution

- Collection Software

- Skip Tracing

- Debt Collection and Recovery Act (FCRA)

- Financial Analysis

Work Experience

Accounts Collector

- Collaborated with other departments, such as sales and legal, to ensure a comprehensive approach to account recovery.

- Managed a team of collection agents, providing guidance and support to maximize performance.

- Developed and implemented new collection strategies to improve efficiency and recovery rates.

- Utilized skip tracing techniques to locate debtors and obtain updated contact information.

Accounts Collector

- Collected over $500,000 in overdue accounts receivable within a 6month period.

- Negotiated payment plans and settlements with debtors, resulting in an 80% recovery rate.

- Utilized various collection techniques, including phone calls, emails, and letters, to effectively communicate with debtors.

- Maintained accurate and uptodate records of all collection activities and accounts.

Accomplishments

- Reduced collection cycle time by implementing automated payment reminders

- Developed and implemented a new process for handling and resolving customer disputes

- Trained and mentored new accounts collectors, leading to improved team performance

- Negotiated payment plans with customers experiencing financial distress, resulting in increased recoveries

- Analyzed customer data to identify trends and patterns, providing insights for targeted collection strategies

Awards

- Accounts Collector of the Year, local or industry level

- Recognized for outstanding performance in managing highvolume accounts

- Received award for collecting highest amount of overdue accounts

Certificates

- Certified Accounts Collector (CAC)

- Certified Credit and Collection Executive (CCCE)

- Collections Management Professional (CMP)

- Certified Recovery Specialist (CRS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accounts Collector

- Highlight your collection success rate and the amount of revenue you have recovered.

- Showcase your negotiation and conflict resolution skills, as well as your ability to build rapport with debtors.

- Demonstrate your knowledge of collection software and skip tracing techniques.

- Provide specific examples of how you have improved collection efficiency and recovery rates.

Essential Experience Highlights for a Strong Accounts Collector Resume

- Analyze aged accounts and prioritize collection efforts

- Negotiate payment plans and settlements with debtors

- Utilize various collection techniques, including phone calls, emails, and letters

- Maintain accurate and up-to-date records of all collection activities and accounts

- Collaborate with other departments, such as sales and legal, to ensure a comprehensive approach to account recovery

- Manage a team of collection agents, providing guidance and support to maximize performance

- Develop and implement new collection strategies to improve efficiency and recovery rates

Frequently Asked Questions (FAQ’s) For Accounts Collector

What are the key skills required to be a successful Accounts Collector?

The key skills required to be a successful Accounts Collector include: communication skills, negotiation skills, problem-solving skills, and computer literacy.

What are the different types of collection techniques that Accounts Collectors use?

The different types of collection techniques that Accounts Collectors use include: phone calls, emails, letters, and skip tracing.

What are the challenges that Accounts Collectors face?

The challenges that Accounts Collectors face include: dealing with difficult debtors, recovering overdue accounts, and maintaining compliance with regulations.

What are the career opportunities for Accounts Collectors?

The career opportunities for Accounts Collectors include: promotion to management positions, specializing in a particular industry, and starting their own collection agency.

What is the salary range for Accounts Collectors?

The salary range for Accounts Collectors varies depending on experience, skills, and location. According to the Bureau of Labor Statistics, the median annual salary for Collection Agents was $47,480 in May 2021.

What is the job outlook for Accounts Collectors?

The job outlook for Accounts Collectors is expected to grow 7% from 2021 to 2031, faster than the average for all occupations.