Are you a seasoned Advisor seeking a new career path? Discover our professionally built Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

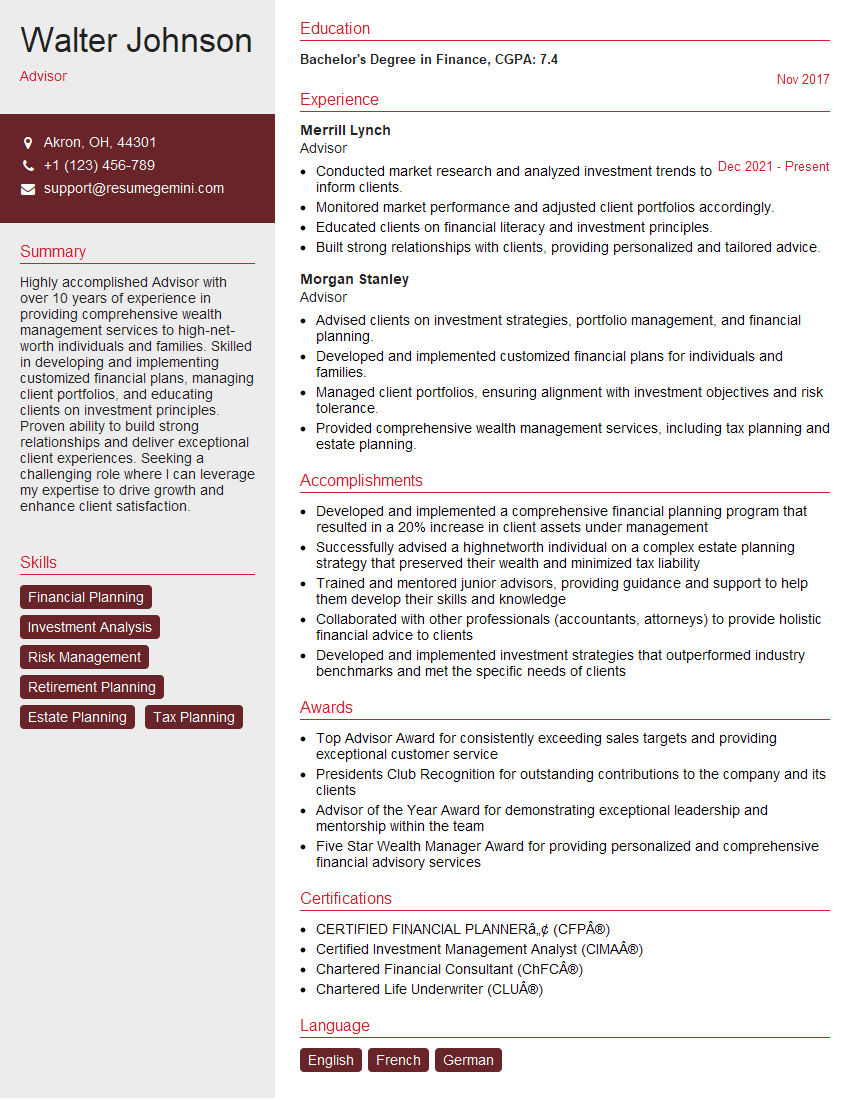

Walter Johnson

Advisor

Summary

Highly accomplished Advisor with over 10 years of experience in providing comprehensive wealth management services to high-net-worth individuals and families. Skilled in developing and implementing customized financial plans, managing client portfolios, and educating clients on investment principles. Proven ability to build strong relationships and deliver exceptional client experiences. Seeking a challenging role where I can leverage my expertise to drive growth and enhance client satisfaction.

Education

Bachelor’s Degree in Finance

November 2017

Skills

- Financial Planning

- Investment Analysis

- Risk Management

- Retirement Planning

- Estate Planning

- Tax Planning

Work Experience

Advisor

- Conducted market research and analyzed investment trends to inform clients.

- Monitored market performance and adjusted client portfolios accordingly.

- Educated clients on financial literacy and investment principles.

- Built strong relationships with clients, providing personalized and tailored advice.

Advisor

- Advised clients on investment strategies, portfolio management, and financial planning.

- Developed and implemented customized financial plans for individuals and families.

- Managed client portfolios, ensuring alignment with investment objectives and risk tolerance.

- Provided comprehensive wealth management services, including tax planning and estate planning.

Accomplishments

- Developed and implemented a comprehensive financial planning program that resulted in a 20% increase in client assets under management

- Successfully advised a highnetworth individual on a complex estate planning strategy that preserved their wealth and minimized tax liability

- Trained and mentored junior advisors, providing guidance and support to help them develop their skills and knowledge

- Collaborated with other professionals (accountants, attorneys) to provide holistic financial advice to clients

- Developed and implemented investment strategies that outperformed industry benchmarks and met the specific needs of clients

Awards

- Top Advisor Award for consistently exceeding sales targets and providing exceptional customer service

- Presidents Club Recognition for outstanding contributions to the company and its clients

- Advisor of the Year Award for demonstrating exceptional leadership and mentorship within the team

- Five Star Wealth Manager Award for providing personalized and comprehensive financial advisory services

Certificates

- CERTIFIED FINANCIAL PLANNER™ (CFP®)

- Certified Investment Management Analyst (CIMA®)

- Chartered Financial Consultant (ChFC®)

- Chartered Life Underwriter (CLU®)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Advisor

- Highlight your educational qualifications and relevant certifications.

- Showcase your experience in financial planning, investment analysis, and portfolio management.

- Quantify your accomplishments with specific examples and metrics.

- Emphasize your client-centric approach and ability to build strong relationships.

- Tailor your resume to each job description, highlighting the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Advisor Resume

- Advised clients on investment strategies, portfolio management, and financial planning

- Developed and implemented customized financial plans for individuals and families

- Managed client portfolios, ensuring alignment with investment objectives and risk tolerance

- Provided comprehensive wealth management services, including tax planning and estate planning

- Conducted market research and analyzed investment trends to inform clients

- Monitored market performance and adjusted client portfolios accordingly

- Educated clients on financial literacy and investment principles

Frequently Asked Questions (FAQ’s) For Advisor

What are the key skills required for an Advisor?

Key skills for an Advisor include financial planning, investment analysis, risk management, retirement planning, estate planning, and tax planning.

What is the average salary for an Advisor?

According to the U.S. Bureau of Labor Statistics, the median annual salary for financial advisors was $94,180 in May 2021.

What is the job outlook for Advisors?

The job outlook for Advisors is expected to grow 4% from 2021 to 2031, faster than the average for all occupations.

What are the different types of Advisors?

There are different types of Advisors, including financial advisors, investment advisors, wealth managers, and retirement planners.

What are the career advancement opportunities for Advisors?

Career advancement opportunities for Advisors include becoming a senior advisor, managing director, or chief investment officer.

What are the challenges faced by Advisors?

Challenges faced by Advisors include market volatility, regulatory changes, and client expectations.

What are the rewards of being an Advisor?

Rewards of being an Advisor include helping clients achieve their financial goals, making a positive impact on their lives, and earning a competitive salary.