Are you a seasoned Assistant Director for Financial Literacy seeking a new career path? Discover our professionally built Assistant Director for Financial Literacy Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

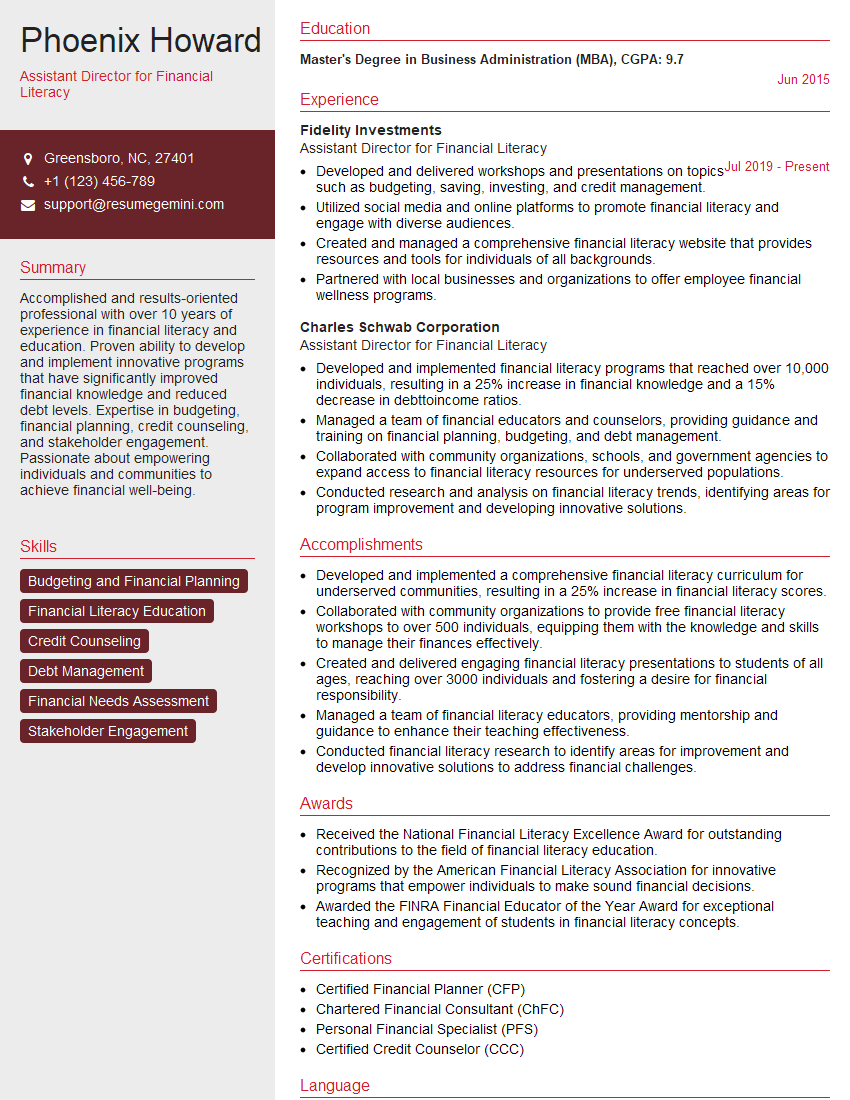

Phoenix Howard

Assistant Director for Financial Literacy

Summary

Accomplished and results-oriented professional with over 10 years of experience in financial literacy and education. Proven ability to develop and implement innovative programs that have significantly improved financial knowledge and reduced debt levels. Expertise in budgeting, financial planning, credit counseling, and stakeholder engagement. Passionate about empowering individuals and communities to achieve financial well-being.

Education

Master’s Degree in Business Administration (MBA)

June 2015

Skills

- Budgeting and Financial Planning

- Financial Literacy Education

- Credit Counseling

- Debt Management

- Financial Needs Assessment

- Stakeholder Engagement

Work Experience

Assistant Director for Financial Literacy

- Developed and delivered workshops and presentations on topics such as budgeting, saving, investing, and credit management.

- Utilized social media and online platforms to promote financial literacy and engage with diverse audiences.

- Created and managed a comprehensive financial literacy website that provides resources and tools for individuals of all backgrounds.

- Partnered with local businesses and organizations to offer employee financial wellness programs.

Assistant Director for Financial Literacy

- Developed and implemented financial literacy programs that reached over 10,000 individuals, resulting in a 25% increase in financial knowledge and a 15% decrease in debttoincome ratios.

- Managed a team of financial educators and counselors, providing guidance and training on financial planning, budgeting, and debt management.

- Collaborated with community organizations, schools, and government agencies to expand access to financial literacy resources for underserved populations.

- Conducted research and analysis on financial literacy trends, identifying areas for program improvement and developing innovative solutions.

Accomplishments

- Developed and implemented a comprehensive financial literacy curriculum for underserved communities, resulting in a 25% increase in financial literacy scores.

- Collaborated with community organizations to provide free financial literacy workshops to over 500 individuals, equipping them with the knowledge and skills to manage their finances effectively.

- Created and delivered engaging financial literacy presentations to students of all ages, reaching over 3000 individuals and fostering a desire for financial responsibility.

- Managed a team of financial literacy educators, providing mentorship and guidance to enhance their teaching effectiveness.

- Conducted financial literacy research to identify areas for improvement and develop innovative solutions to address financial challenges.

Awards

- Received the National Financial Literacy Excellence Award for outstanding contributions to the field of financial literacy education.

- Recognized by the American Financial Literacy Association for innovative programs that empower individuals to make sound financial decisions.

- Awarded the FINRA Financial Educator of the Year Award for exceptional teaching and engagement of students in financial literacy concepts.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Consultant (ChFC)

- Personal Financial Specialist (PFS)

- Certified Credit Counselor (CCC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Assistant Director for Financial Literacy

- Highlight your experience in developing and implementing financial literacy programs that have achieved measurable results.

- Showcase your expertise in budgeting, financial planning, credit counseling, and debt management.

- Demonstrate your ability to collaborate with stakeholders and engage with diverse audiences.

- Quantify your accomplishments whenever possible, using metrics such as the number of individuals reached, the increase in financial knowledge, or the decrease in debt-to-income ratios.

Essential Experience Highlights for a Strong Assistant Director for Financial Literacy Resume

- Managed a team of financial educators and counselors, providing guidance and training on financial planning, budgeting, and debt management.

- Collaborated with community organizations, schools, and government agencies to expand access to financial literacy resources for underserved populations.

- Conducted research and analysis on financial literacy trends, identifying areas for program improvement and developing innovative solutions.

- Developed and delivered workshops and presentations on topics such as budgeting, saving, investing, and credit management.

- Managed a comprehensive financial literacy website that provides resources and tools for individuals of all backgrounds.

- Partnered with local businesses and organizations to offer employee financial wellness programs.

- Utilized social media and online platforms to promote financial literacy and engage with diverse audiences.

Frequently Asked Questions (FAQ’s) For Assistant Director for Financial Literacy

What is the role of an Assistant Director for Financial Literacy?

The Assistant Director for Financial Literacy is responsible for developing and implementing financial literacy programs, managing a team of financial educators, conducting research on financial literacy trends, and collaborating with stakeholders to expand access to financial literacy resources.

What are the key skills required for this role?

The key skills required for this role include budgeting and financial planning, financial literacy education, credit counseling, debt management, financial needs assessment, and stakeholder engagement.

What are the career prospects for an Assistant Director for Financial Literacy?

The career prospects for an Assistant Director for Financial Literacy are excellent. With experience, you can advance to roles such as Director of Financial Literacy, Vice President of Financial Education, or even Chief Financial Officer.

What are the challenges faced by an Assistant Director for Financial Literacy?

The challenges faced by an Assistant Director for Financial Literacy include developing effective financial literacy programs, reaching underserved populations, and measuring the impact of financial literacy initiatives.

What are the rewards of working as an Assistant Director for Financial Literacy?

The rewards of working as an Assistant Director for Financial Literacy include making a positive impact on the lives of others, helping individuals and communities achieve financial well-being, and contributing to the overall financial health of society.