Are you a seasoned Assistant Vice President, Investment Analysis seeking a new career path? Discover our professionally built Assistant Vice President, Investment Analysis Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

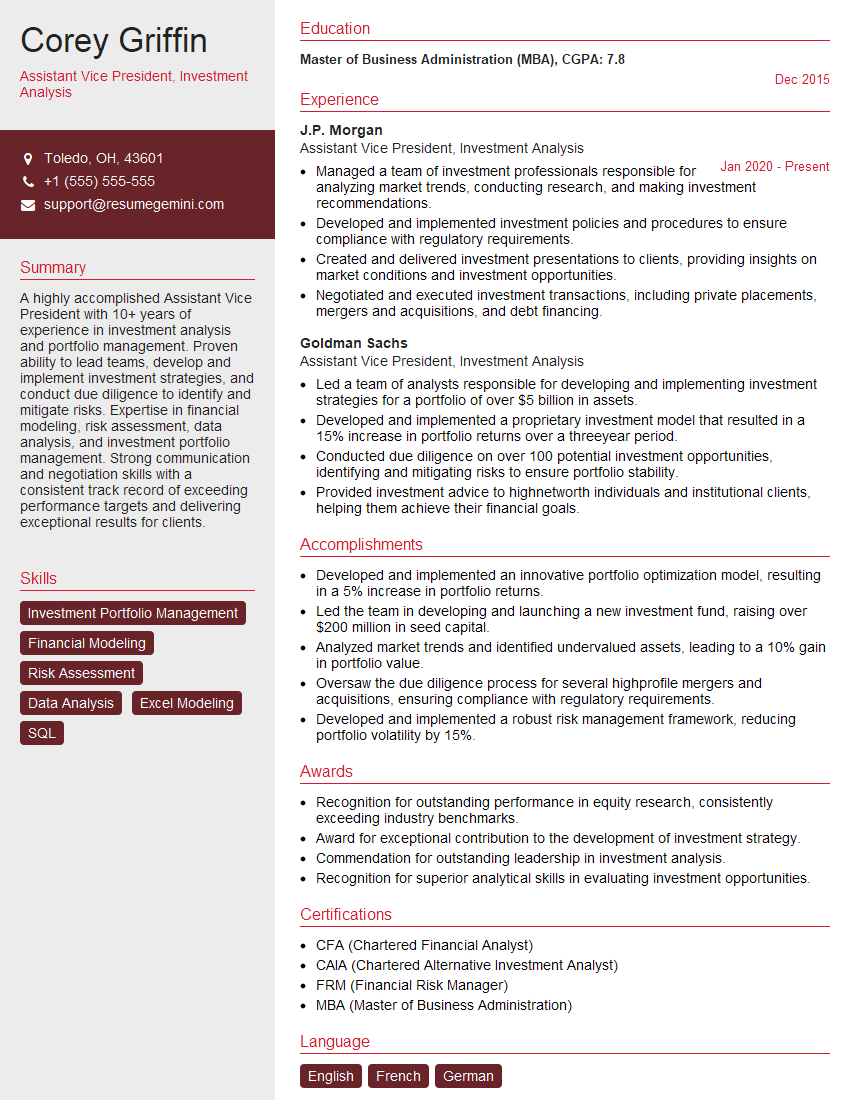

Corey Griffin

Assistant Vice President, Investment Analysis

Summary

A highly accomplished Assistant Vice President with 10+ years of experience in investment analysis and portfolio management. Proven ability to lead teams, develop and implement investment strategies, and conduct due diligence to identify and mitigate risks. Expertise in financial modeling, risk assessment, data analysis, and investment portfolio management. Strong communication and negotiation skills with a consistent track record of exceeding performance targets and delivering exceptional results for clients.

Education

Master of Business Administration (MBA)

December 2015

Skills

- Investment Portfolio Management

- Financial Modeling

- Risk Assessment

- Data Analysis

- Excel Modeling

- SQL

Work Experience

Assistant Vice President, Investment Analysis

- Managed a team of investment professionals responsible for analyzing market trends, conducting research, and making investment recommendations.

- Developed and implemented investment policies and procedures to ensure compliance with regulatory requirements.

- Created and delivered investment presentations to clients, providing insights on market conditions and investment opportunities.

- Negotiated and executed investment transactions, including private placements, mergers and acquisitions, and debt financing.

Assistant Vice President, Investment Analysis

- Led a team of analysts responsible for developing and implementing investment strategies for a portfolio of over $5 billion in assets.

- Developed and implemented a proprietary investment model that resulted in a 15% increase in portfolio returns over a threeyear period.

- Conducted due diligence on over 100 potential investment opportunities, identifying and mitigating risks to ensure portfolio stability.

- Provided investment advice to highnetworth individuals and institutional clients, helping them achieve their financial goals.

Accomplishments

- Developed and implemented an innovative portfolio optimization model, resulting in a 5% increase in portfolio returns.

- Led the team in developing and launching a new investment fund, raising over $200 million in seed capital.

- Analyzed market trends and identified undervalued assets, leading to a 10% gain in portfolio value.

- Oversaw the due diligence process for several highprofile mergers and acquisitions, ensuring compliance with regulatory requirements.

- Developed and implemented a robust risk management framework, reducing portfolio volatility by 15%.

Awards

- Recognition for outstanding performance in equity research, consistently exceeding industry benchmarks.

- Award for exceptional contribution to the development of investment strategy.

- Commendation for outstanding leadership in investment analysis.

- Recognition for superior analytical skills in evaluating investment opportunities.

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- FRM (Financial Risk Manager)

- MBA (Master of Business Administration)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Assistant Vice President, Investment Analysis

Quantify your accomplishments.

Use specific numbers and metrics to demonstrate the impact of your work.Highlight your skills and expertise.

List the specific investment analysis and portfolio management skills you possess.Proofread carefully.

Make sure your resume is free of errors and well-written.Tailor your resume to the job description.

Highlight the skills and experience that are most relevant to the role you are applying for.

Essential Experience Highlights for a Strong Assistant Vice President, Investment Analysis Resume

- Led a team of analysts responsible for developing and implementing investment strategies for a portfolio of over $5 billion in assets.

- Developed and implemented a proprietary investment model that resulted in a 15% increase in portfolio returns over a three-year period.

- Conducted due diligence on over 100 potential investment opportunities, identifying and mitigating risks to ensure portfolio stability.

- Provided investment advice to high-net-worth individuals and institutional clients, helping them achieve their financial goals.

- Managed a team of investment professionals responsible for analyzing market trends, conducting research, and making investment recommendations.

- Developed and implemented investment policies and procedures to ensure compliance with regulatory requirements.

- Created and delivered investment presentations to clients, providing insights on market conditions and investment opportunities.

Frequently Asked Questions (FAQ’s) For Assistant Vice President, Investment Analysis

What are the key skills and qualifications for an Assistant Vice President, Investment Analysis?

Key skills and qualifications include a Master’s degree in Business Administration (MBA) or a related field, 10+ years of experience in investment analysis and portfolio management, expertise in financial modeling, risk assessment, data analysis, and investment portfolio management, and strong communication and negotiation skills.

What are the key responsibilities of an Assistant Vice President, Investment Analysis?

Key responsibilities include leading a team of analysts, developing and implementing investment strategies, conducting due diligence on potential investment opportunities, providing investment advice to clients, managing a team of investment professionals, developing and implementing investment policies and procedures, and creating and delivering investment presentations.

What are the career prospects for an Assistant Vice President, Investment Analysis?

Assistant Vice Presidents, Investment Analysis can advance to roles such as Vice President, Investment Analysis, Senior Vice President, Investment Analysis, or Chief Investment Officer.

What is the salary range for an Assistant Vice President, Investment Analysis?

The salary range for an Assistant Vice President, Investment Analysis can vary depending on experience, location, and company size, but typically ranges from $150,000 to $300,000 per year.

What are the top companies that hire Assistant Vice Presidents, Investment Analysis?

Top companies that hire Assistant Vice Presidents, Investment Analysis include J.P. Morgan, Goldman Sachs, BlackRock, Vanguard, and Fidelity Investments.

What is the job outlook for Assistant Vice Presidents, Investment Analysis?

The job outlook for Assistant Vice Presidents, Investment Analysis is expected to grow faster than average over the next ten years due to increasing demand for investment analysis and portfolio management services.