Are you a seasoned Auditing Clerk seeking a new career path? Discover our professionally built Auditing Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

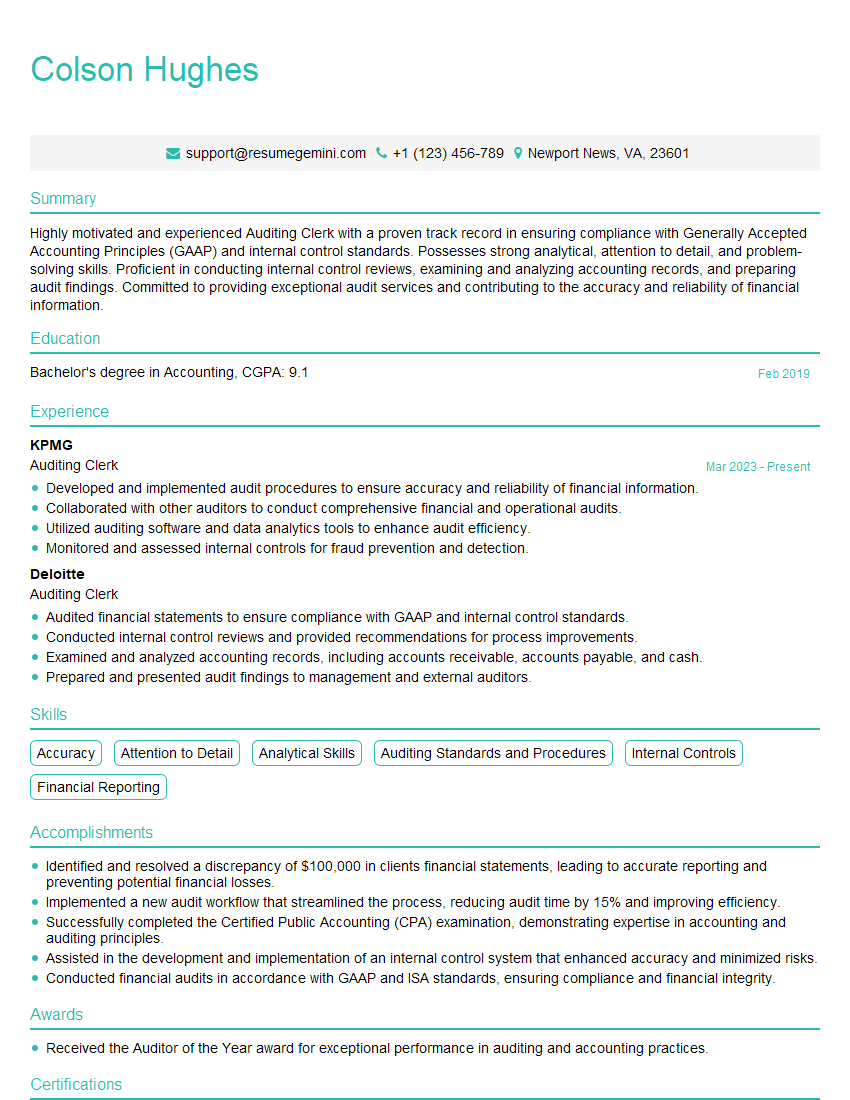

Colson Hughes

Auditing Clerk

Summary

Highly motivated and experienced Auditing Clerk with a proven track record in ensuring compliance with Generally Accepted Accounting Principles (GAAP) and internal control standards. Possesses strong analytical, attention to detail, and problem-solving skills. Proficient in conducting internal control reviews, examining and analyzing accounting records, and preparing audit findings. Committed to providing exceptional audit services and contributing to the accuracy and reliability of financial information.

Education

Bachelor’s degree in Accounting

February 2019

Skills

- Accuracy

- Attention to Detail

- Analytical Skills

- Auditing Standards and Procedures

- Internal Controls

- Financial Reporting

Work Experience

Auditing Clerk

- Developed and implemented audit procedures to ensure accuracy and reliability of financial information.

- Collaborated with other auditors to conduct comprehensive financial and operational audits.

- Utilized auditing software and data analytics tools to enhance audit efficiency.

- Monitored and assessed internal controls for fraud prevention and detection.

Auditing Clerk

- Audited financial statements to ensure compliance with GAAP and internal control standards.

- Conducted internal control reviews and provided recommendations for process improvements.

- Examined and analyzed accounting records, including accounts receivable, accounts payable, and cash.

- Prepared and presented audit findings to management and external auditors.

Accomplishments

- Identified and resolved a discrepancy of $100,000 in clients financial statements, leading to accurate reporting and preventing potential financial losses.

- Implemented a new audit workflow that streamlined the process, reducing audit time by 15% and improving efficiency.

- Successfully completed the Certified Public Accounting (CPA) examination, demonstrating expertise in accounting and auditing principles.

- Assisted in the development and implementation of an internal control system that enhanced accuracy and minimized risks.

- Conducted financial audits in accordance with GAAP and ISA standards, ensuring compliance and financial integrity.

Awards

- Received the Auditor of the Year award for exceptional performance in auditing and accounting practices.

Certificates

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Auditor (CISA)

- Certified Government Auditing Professional (CGAP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Auditing Clerk

- Highlight your relevant skills and experience in your resume, such as proficiency in auditing standards and procedures, internal controls, and financial reporting.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Tailor your resume to each specific job application, emphasizing the skills and experience that are most relevant to the role.

- Proofread your resume carefully for any errors before submitting it.

- Consider obtaining professional certification, such as the Certified Internal Auditor (CIA) credential, to enhance your credibility.

Essential Experience Highlights for a Strong Auditing Clerk Resume

- Audited financial statements to ensure adherence to GAAP and internal control standards

- Conducted internal control reviews and provided recommendations for process improvements

- Examined and analyzed accounting records, including accounts receivable, accounts payable, and cash

- Prepared and presented audit findings to management and external auditors

- Developed and implemented audit procedures to ensure accuracy and reliability of financial information

- Collaborated with other auditors to conduct comprehensive financial and operational audits

- Utilized auditing software and data analytics tools to enhance audit efficiency

- Monitored and assessed internal controls for fraud prevention and detection

Frequently Asked Questions (FAQ’s) For Auditing Clerk

What are the key responsibilities of an Auditing Clerk?

Auditing Clerks are responsible for conducting internal control reviews, examining and analyzing accounting records, preparing audit findings, and collaborating with other auditors to ensure the accuracy and reliability of financial information.

What skills are required to be an Auditing Clerk?

Auditing Clerks should possess strong analytical, attention to detail, and problem-solving skills. They should also be proficient in auditing standards and procedures, internal controls, and financial reporting.

What are the career prospects for an Auditing Clerk?

Auditing Clerks can advance to roles such as Senior Auditor, Audit Manager, or even Chief Audit Executive. They may also specialize in specific areas of auditing, such as forensic accounting or information technology auditing.

What is the salary range for an Auditing Clerk?

The salary range for an Auditing Clerk varies depending on experience, qualifications, and location. According to Indeed, the average salary for an Auditing Clerk in the United States is around $60,000 per year.

What are some tips for writing a standout Auditing Clerk resume?

Highlight your relevant skills and experience, quantify your accomplishments, tailor your resume to each specific job application, proofread carefully, and consider obtaining professional certification.

What are the common challenges faced by Auditing Clerks?

Auditing Clerks may face challenges such as tight deadlines, complex accounting issues, and the need to stay up-to-date on auditing standards and regulations.

What is the difference between an Auditing Clerk and an Auditor?

Auditing Clerks typically assist Auditors in conducting audits and have less experience and responsibility. Auditors are responsible for planning and executing audits, evaluating internal controls, and reporting on audit findings.

What is the best way to prepare for an Auditing Clerk interview?

To prepare for an Auditing Clerk interview, research the company and the role, practice answering common interview questions, and dress professionally.