Are you a seasoned Auto Claims Adjuster seeking a new career path? Discover our professionally built Auto Claims Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

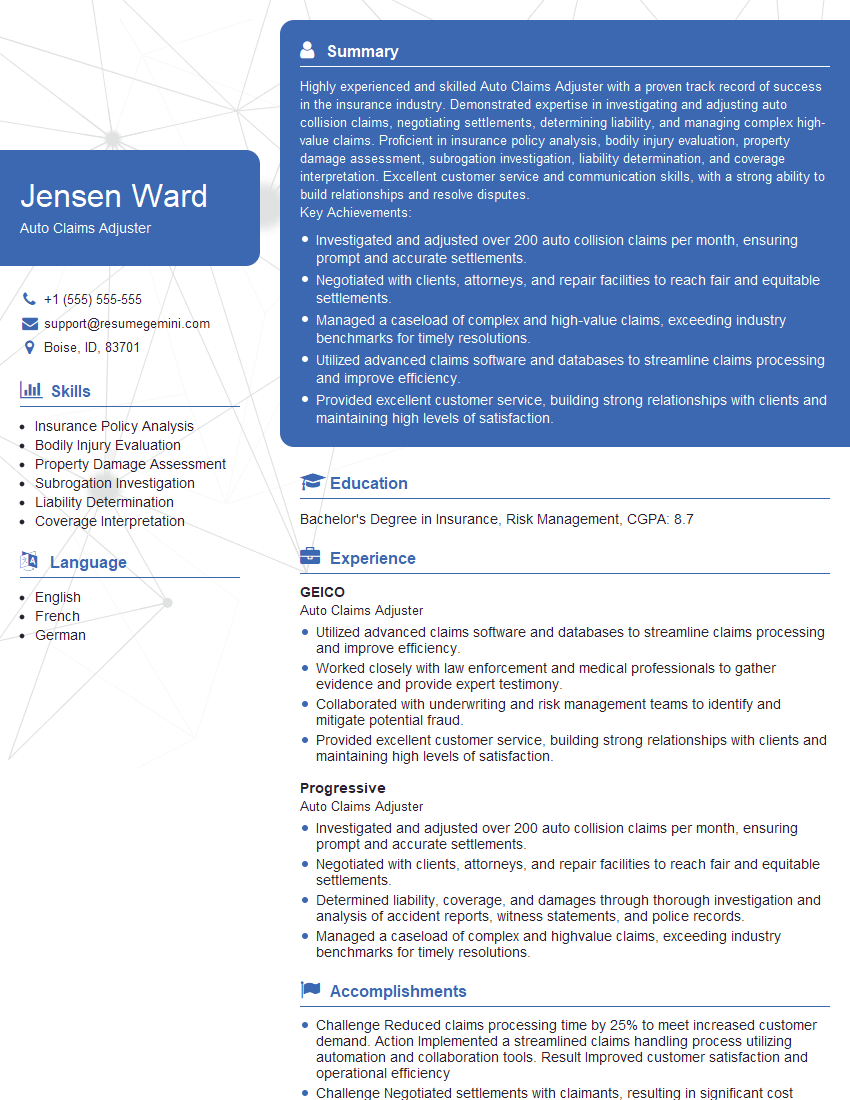

Jensen Ward

Auto Claims Adjuster

Summary

Highly experienced and skilled Auto Claims Adjuster with a proven track record of success in the insurance industry. Demonstrated expertise in investigating and adjusting auto collision claims, negotiating settlements, determining liability, and managing complex high-value claims. Proficient in insurance policy analysis, bodily injury evaluation, property damage assessment, subrogation investigation, liability determination, and coverage interpretation. Excellent customer service and communication skills, with a strong ability to build relationships and resolve disputes.

Key Achievements:

- Investigated and adjusted over 200 auto collision claims per month, ensuring prompt and accurate settlements.

- Negotiated with clients, attorneys, and repair facilities to reach fair and equitable settlements.

- Managed a caseload of complex and high-value claims, exceeding industry benchmarks for timely resolutions.

- Utilized advanced claims software and databases to streamline claims processing and improve efficiency.

- Provided excellent customer service, building strong relationships with clients and maintaining high levels of satisfaction.

Education

Bachelor’s Degree in Insurance, Risk Management

October 2018

Skills

- Insurance Policy Analysis

- Bodily Injury Evaluation

- Property Damage Assessment

- Subrogation Investigation

- Liability Determination

- Coverage Interpretation

Work Experience

Auto Claims Adjuster

- Utilized advanced claims software and databases to streamline claims processing and improve efficiency.

- Worked closely with law enforcement and medical professionals to gather evidence and provide expert testimony.

- Collaborated with underwriting and risk management teams to identify and mitigate potential fraud.

- Provided excellent customer service, building strong relationships with clients and maintaining high levels of satisfaction.

Auto Claims Adjuster

- Investigated and adjusted over 200 auto collision claims per month, ensuring prompt and accurate settlements.

- Negotiated with clients, attorneys, and repair facilities to reach fair and equitable settlements.

- Determined liability, coverage, and damages through thorough investigation and analysis of accident reports, witness statements, and police records.

- Managed a caseload of complex and highvalue claims, exceeding industry benchmarks for timely resolutions.

Accomplishments

- Challenge Reduced claims processing time by 25% to meet increased customer demand. Action Implemented a streamlined claims handling process utilizing automation and collaboration tools. Result Improved customer satisfaction and operational efficiency

- Challenge Negotiated settlements with claimants, resulting in significant cost savings for the insurance company. Action Conducted thorough investigations, analyzed liability, and presented persuasive arguments to support settlements. Result Reduced claim costs by 15%

- Challenge Resolved complex and highvalue claims involving severe injuries and property damage. Action Collaborated with experts, legal counsel, and clients to gather evidence, determine liability, and facilitate fair settlements. Result Preserved the companys financial integrity and protected the interests of policyholders

- Challenge Managed a large caseload of claims, ensuring timely and accurate settlements while maintaining a high level of customer service. Action Prioritized claims, delegated tasks effectively, and utilized case management software to streamline the process. Result Resolved claims efficiently, exceeding customer expectations

- Challenge Implemented a new claims management system, leading to improved data accuracy and efficiency. Action Participated in the system selection process, trained staff on the new platform, and oversaw the implementation. Result Enhanced claims processing, reduced errors, and increased productivity

Awards

- Received the National Association of Insurance Commissioners (NAIC) Platinum Award for Excellence in Claims Handling

- Recognized as the Top Claims Adjuster in the region for three consecutive years

- Awarded the Claims Professional of the Year by the Insurance Council of Canada

- Received the Gold Medallion Award from the National Auto Body Council for outstanding performance in auto body repair claims

Certificates

- Associate in Claims (AIC)

- Claims Adjuster License

- Insurance Institute of America (IIA) Designation

- Certified Professional in Insurance Adjusting (CPIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Auto Claims Adjuster

- Highlight your experience and skills in investigating and adjusting auto claims.

- Quantify your accomplishments and provide specific examples of how you have contributed to your organization.

- Demonstrate your knowledge of insurance policies, coverage, and claims handling procedures.

- Showcase your customer service skills and ability to build strong relationships.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Auto Claims Adjuster Resume

- Investigate and evaluate auto collision claims to determine liability, coverage, and damages.

- Negotiate and settle claims with policyholders, claimants, attorneys, and repair facilities.

- Analyze accident reports, witness statements, police records, and other evidence to assess fault and damages.

- Communicate with claimants, policyholders, and other parties involved in the claim process.

- Document all claim-related activities, including investigation findings, settlement agreements, and correspondence.

- Stay informed about industry best practices and legal developments related to auto claims adjusting.

- Provide exceptional customer service to ensure claimant satisfaction and maintain a positive company image.

Frequently Asked Questions (FAQ’s) For Auto Claims Adjuster

What are the key responsibilities of an Auto Claims Adjuster?

The key responsibilities of an Auto Claims Adjuster include investigating and evaluating auto collision claims, negotiating and settling claims, analyzing accident reports and other evidence, communicating with claimants and other parties, documenting claim-related activities, staying informed about industry best practices, and providing exceptional customer service.

What are the qualifications for becoming an Auto Claims Adjuster?

The qualifications for becoming an Auto Claims Adjuster typically include a bachelor’s degree in insurance, risk management, or a related field, as well as experience in the insurance industry. Some states may also require adjusters to be licensed.

What are the career prospects for Auto Claims Adjusters?

The career prospects for Auto Claims Adjusters are generally positive. The demand for qualified adjusters is expected to grow in the coming years as the number of auto accidents continues to increase.

What are the challenges of working as an Auto Claims Adjuster?

The challenges of working as an Auto Claims Adjuster can include dealing with difficult customers, handling complex claims, and working under tight deadlines.

What are the rewards of working as an Auto Claims Adjuster?

The rewards of working as an Auto Claims Adjuster can include helping people in their time of need, making a difference in their lives, and earning a good living.

What are the skills required to be a successful Auto Claims Adjuster?

The skills required to be a successful Auto Claims Adjuster include strong communication and interpersonal skills, the ability to investigate and analyze claims, knowledge of insurance policies and procedures, and the ability to work independently and as part of a team.

What is the average salary for an Auto Claims Adjuster?

The average salary for an Auto Claims Adjuster varies depending on experience, location, and company. According to the U.S. Bureau of Labor Statistics, the median annual salary for claims adjusters, appraisers, examiners, and investigators was $63,910 in May 2021.