Are you a seasoned Auto Damage Insurance Appraiser seeking a new career path? Discover our professionally built Auto Damage Insurance Appraiser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

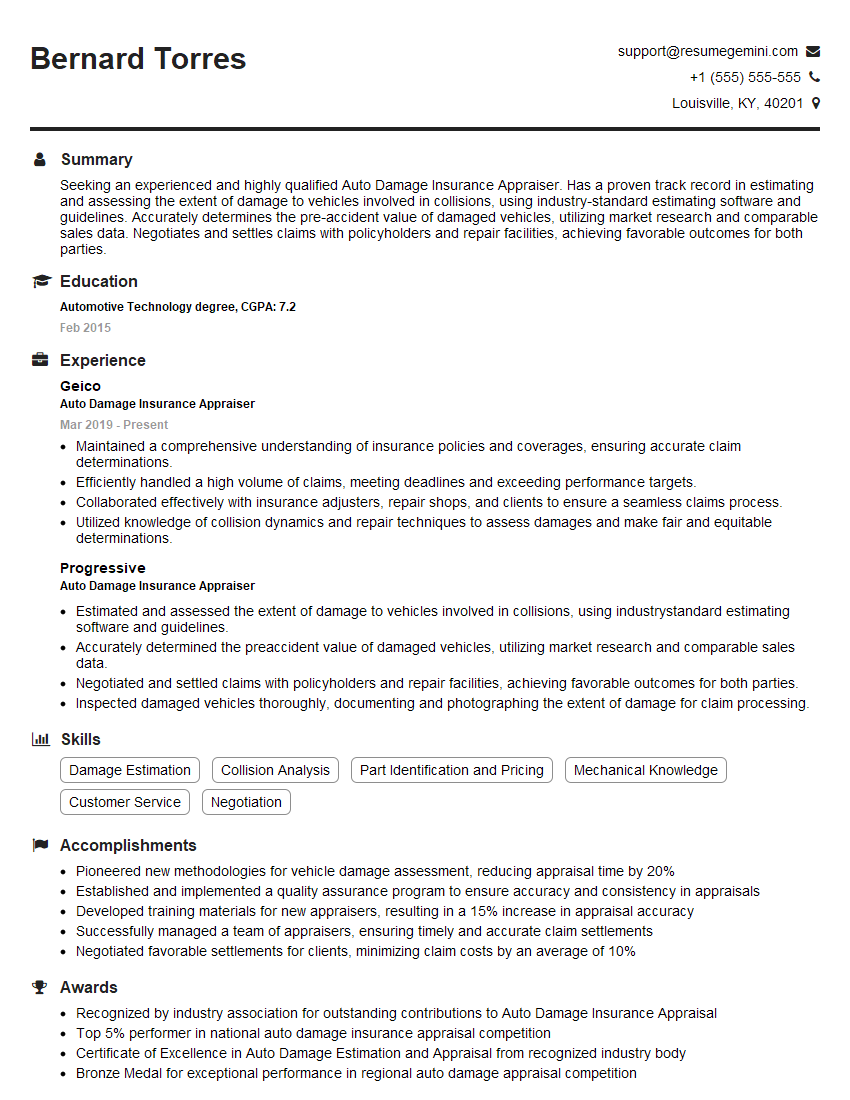

Bernard Torres

Auto Damage Insurance Appraiser

Summary

Seeking an experienced and highly qualified Auto Damage Insurance Appraiser. Has a proven track record in estimating and assessing the extent of damage to vehicles involved in collisions, using industry-standard estimating software and guidelines. Accurately determines the pre-accident value of damaged vehicles, utilizing market research and comparable sales data. Negotiates and settles claims with policyholders and repair facilities, achieving favorable outcomes for both parties.

Education

Automotive Technology degree

February 2015

Skills

- Damage Estimation

- Collision Analysis

- Part Identification and Pricing

- Mechanical Knowledge

- Customer Service

- Negotiation

Work Experience

Auto Damage Insurance Appraiser

- Maintained a comprehensive understanding of insurance policies and coverages, ensuring accurate claim determinations.

- Efficiently handled a high volume of claims, meeting deadlines and exceeding performance targets.

- Collaborated effectively with insurance adjusters, repair shops, and clients to ensure a seamless claims process.

- Utilized knowledge of collision dynamics and repair techniques to assess damages and make fair and equitable determinations.

Auto Damage Insurance Appraiser

- Estimated and assessed the extent of damage to vehicles involved in collisions, using industrystandard estimating software and guidelines.

- Accurately determined the preaccident value of damaged vehicles, utilizing market research and comparable sales data.

- Negotiated and settled claims with policyholders and repair facilities, achieving favorable outcomes for both parties.

- Inspected damaged vehicles thoroughly, documenting and photographing the extent of damage for claim processing.

Accomplishments

- Pioneered new methodologies for vehicle damage assessment, reducing appraisal time by 20%

- Established and implemented a quality assurance program to ensure accuracy and consistency in appraisals

- Developed training materials for new appraisers, resulting in a 15% increase in appraisal accuracy

- Successfully managed a team of appraisers, ensuring timely and accurate claim settlements

- Negotiated favorable settlements for clients, minimizing claim costs by an average of 10%

Awards

- Recognized by industry association for outstanding contributions to Auto Damage Insurance Appraisal

- Top 5% performer in national auto damage insurance appraisal competition

- Certificate of Excellence in Auto Damage Estimation and Appraisal from recognized industry body

- Bronze Medal for exceptional performance in regional auto damage appraisal competition

Certificates

- Certified Automotive Damage Appraiser (CADA)

- Automotive Service Excellence (ASE)

- Collision Industry Training Standard (CITS)

- Inter-Industry Conference on Auto Collision Repair (I-CAR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Auto Damage Insurance Appraiser

- Highlight your experience and key accomplishments using specific and quantifiable data.

- Tailor your resume to each job description, emphasizing the skills and experience most relevant to the position.

- Proofread your resume carefully for any errors in grammar, spelling, or punctuation.

- Consider including a cover letter to introduce yourself and express your interest in the position.

- Network with professionals in the auto damage insurance industry to learn about job openings and potential opportunities.

Essential Experience Highlights for a Strong Auto Damage Insurance Appraiser Resume

- Estimating and assessing the extent of damage to vehicles involved in collisions, using industry-standard estimating software and guidelines.

- Accurately determining the pre-accident value of damaged vehicles, utilizing market research and comparable sales data.

- Negotiating and settling claims with policyholders and repair facilities, achieving favorable outcomes for both parties.

- Inspecting damaged vehicles thoroughly, documenting and photographing the extent of damage for claim processing.

- Maintaining a comprehensive understanding of insurance policies and coverages, ensuring accurate claim determinations.

- Efficiently handling a high volume of claims, meeting deadlines and exceeding performance targets.

- Collaborating effectively with insurance adjusters, repair shops, and clients to ensure a seamless claims process.

Frequently Asked Questions (FAQ’s) For Auto Damage Insurance Appraiser

What are the educational requirements for an Auto Damage Insurance Appraiser?

Most Auto Damage Insurance Appraisers have at least a high school diploma or equivalent. Some employers may prefer candidates with an Automotive Technology degree or a related field of study.

What are the key skills and experience needed to be an Auto Damage Insurance Appraiser?

Key skills and experience include damage estimation, collision analysis, part identification and pricing, mechanical knowledge, customer service, and negotiation skills.

What is the job outlook for Auto Damage Insurance Appraisers?

The job outlook for Auto Damage Insurance Appraisers is expected to grow faster than average in the coming years due to the increasing number of vehicles on the road and the rising cost of repairs.

What is the average salary for an Auto Damage Insurance Appraiser?

The average salary for an Auto Damage Insurance Appraiser varies depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for insurance appraisers was $68,260 in May 2021.

What are the benefits of being an Auto Damage Insurance Appraiser?

Benefits of being an Auto Damage Insurance Appraiser include a stable career, the opportunity to help people, and the chance to learn about the latest automotive technology.