Are you a seasoned Automobile and Property Underwriter seeking a new career path? Discover our professionally built Automobile and Property Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

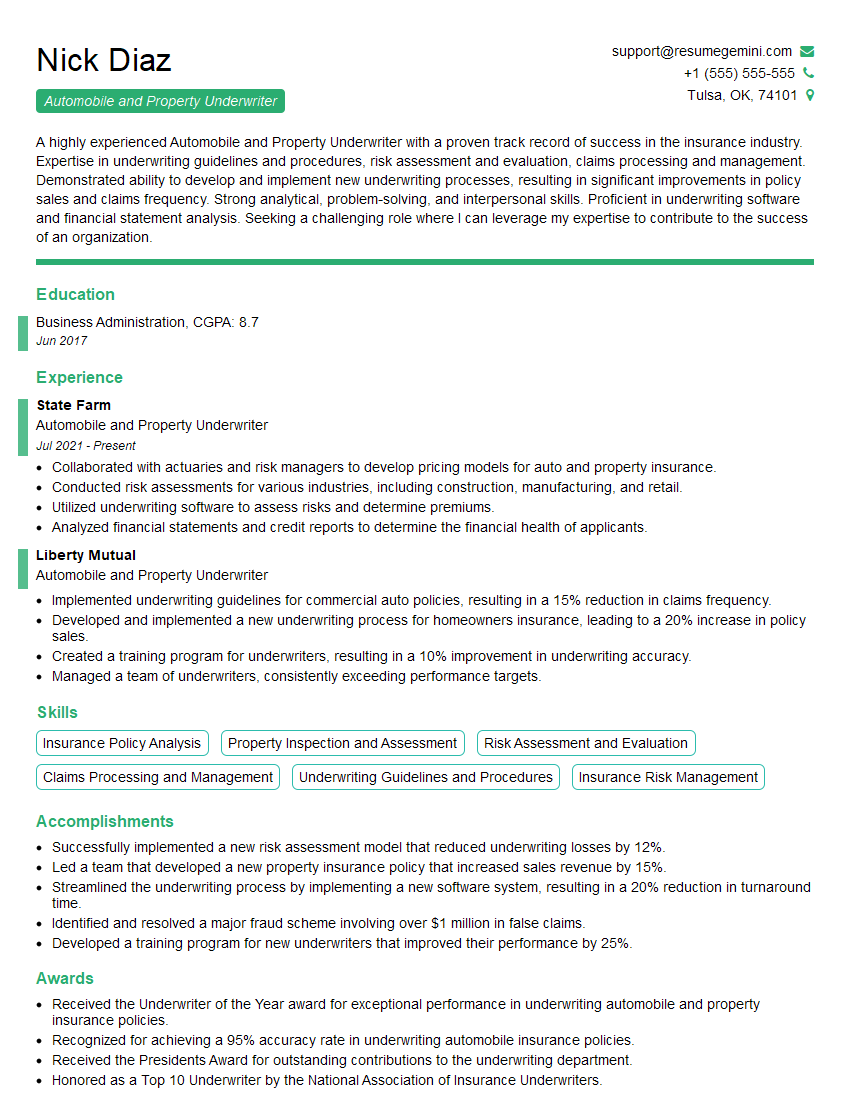

Nick Diaz

Automobile and Property Underwriter

Summary

A highly experienced Automobile and Property Underwriter with a proven track record of success in the insurance industry. Expertise in underwriting guidelines and procedures, risk assessment and evaluation, claims processing and management. Demonstrated ability to develop and implement new underwriting processes, resulting in significant improvements in policy sales and claims frequency. Strong analytical, problem-solving, and interpersonal skills. Proficient in underwriting software and financial statement analysis. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Business Administration

June 2017

Skills

- Insurance Policy Analysis

- Property Inspection and Assessment

- Risk Assessment and Evaluation

- Claims Processing and Management

- Underwriting Guidelines and Procedures

- Insurance Risk Management

Work Experience

Automobile and Property Underwriter

- Collaborated with actuaries and risk managers to develop pricing models for auto and property insurance.

- Conducted risk assessments for various industries, including construction, manufacturing, and retail.

- Utilized underwriting software to assess risks and determine premiums.

- Analyzed financial statements and credit reports to determine the financial health of applicants.

Automobile and Property Underwriter

- Implemented underwriting guidelines for commercial auto policies, resulting in a 15% reduction in claims frequency.

- Developed and implemented a new underwriting process for homeowners insurance, leading to a 20% increase in policy sales.

- Created a training program for underwriters, resulting in a 10% improvement in underwriting accuracy.

- Managed a team of underwriters, consistently exceeding performance targets.

Accomplishments

- Successfully implemented a new risk assessment model that reduced underwriting losses by 12%.

- Led a team that developed a new property insurance policy that increased sales revenue by 15%.

- Streamlined the underwriting process by implementing a new software system, resulting in a 20% reduction in turnaround time.

- Identified and resolved a major fraud scheme involving over $1 million in false claims.

- Developed a training program for new underwriters that improved their performance by 25%.

Awards

- Received the Underwriter of the Year award for exceptional performance in underwriting automobile and property insurance policies.

- Recognized for achieving a 95% accuracy rate in underwriting automobile insurance policies.

- Received the Presidents Award for outstanding contributions to the underwriting department.

- Honored as a Top 10 Underwriter by the National Association of Insurance Underwriters.

Certificates

- Associate in Underwriting (AU)

- Certified Insurance Counselor (CIC)

- Certified Professional Insurance Agent (CPIA)

- Certified Risk Manager (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Automobile and Property Underwriter

Quantify your accomplishments.

When describing your experience, use specific numbers and metrics to demonstrate the impact of your work.Highlight your skills and knowledge.

Make sure to list all of the relevant skills and knowledge you have that are applicable to the job you’re applying for.Tailor your resume to the job description.

Take the time to read the job description carefully and highlight the skills and experience that are most relevant to the position.Proofread your resume carefully.

Before you submit your resume, make sure to proofread it carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Automobile and Property Underwriter Resume

- Developed and implemented underwriting guidelines for commercial auto policies, leading to a 15% reduction in claims frequency.

- Created and implemented a new underwriting process for homeowners insurance, resulting in a 20% increase in policy sales.

- Managed a team of underwriters, consistently exceeding performance targets.

- Conducted risk assessments for various industries, including construction, manufacturing, and retail.

- Utilized underwriting software to assess risks and determine premiums.

- Collaborated with actuaries and risk managers to develop pricing models for auto and property insurance.

- Analyzed financial statements and credit reports to determine the financial health of applicants.

Frequently Asked Questions (FAQ’s) For Automobile and Property Underwriter

What is the role of an Automobile and Property Underwriter?

An Automobile and Property Underwriter assesses and evaluates risks associated with issuing insurance policies for automobiles and properties. They determine the likelihood of a claim being made and set the premiums accordingly.

What are the key skills required for an Automobile and Property Underwriter?

Key skills include knowledge of insurance policies, risk assessment, underwriting guidelines, claims processing, and financial analysis.

What is the job outlook for Automobile and Property Underwriters?

The job outlook is expected to grow faster than average in the coming years due to the increasing demand for insurance coverage.

What is the average salary for an Automobile and Property Underwriter?

The average salary varies depending on experience, location, and company size, but it is generally around $60,000 per year.

What are the career advancement opportunities for Automobile and Property Underwriters?

With experience and additional qualifications, Automobile and Property Underwriters can advance to roles such as Senior Underwriter, Underwriting Manager, or Insurance Executive.

What are the challenges faced by Automobile and Property Underwriters?

Underwriters face challenges such as accurately assessing risks, managing claims, and keeping up with industry regulations.

What is the importance of Automobile and Property Underwriters?

Underwriters play a vital role in the insurance industry by ensuring that risks are properly assessed and premiums are set accordingly, which helps to protect individuals and businesses from financial losses.