Are you a seasoned Bank Examiner seeking a new career path? Discover our professionally built Bank Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

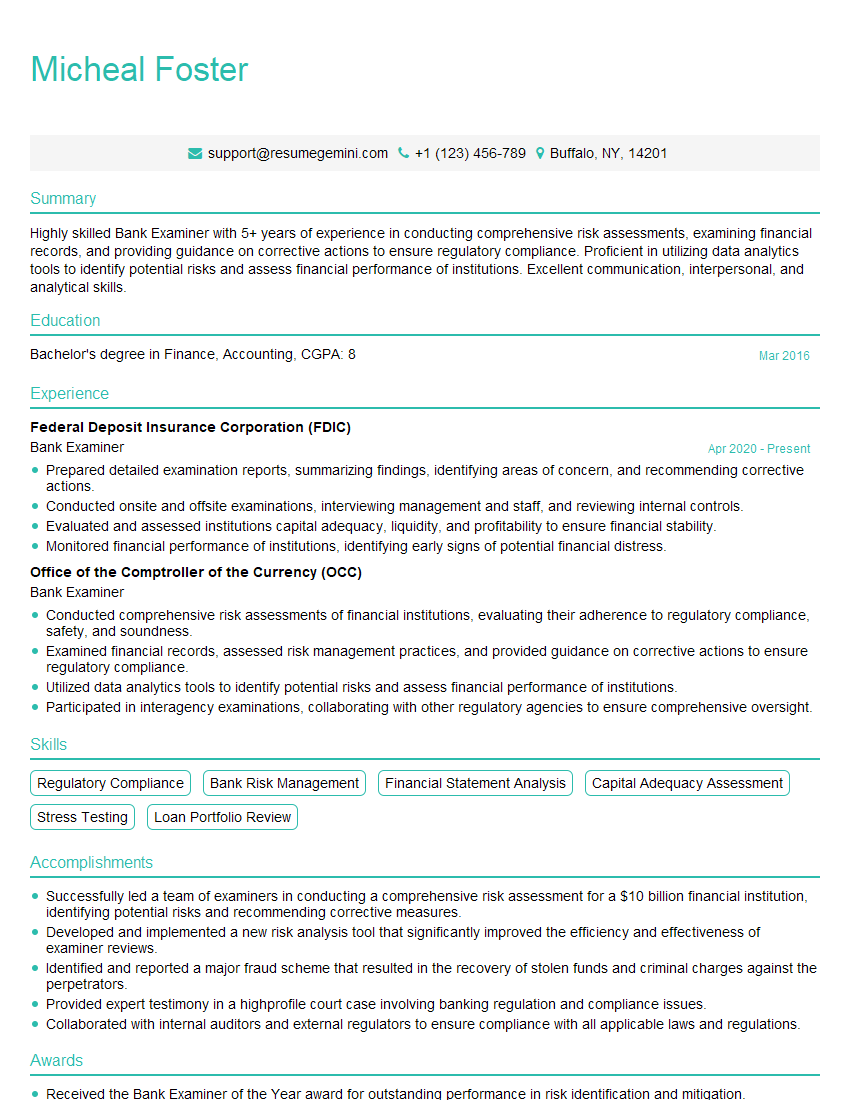

Micheal Foster

Bank Examiner

Summary

Highly skilled Bank Examiner with 5+ years of experience in conducting comprehensive risk assessments, examining financial records, and providing guidance on corrective actions to ensure regulatory compliance. Proficient in utilizing data analytics tools to identify potential risks and assess financial performance of institutions. Excellent communication, interpersonal, and analytical skills.

Education

Bachelor’s degree in Finance, Accounting

March 2016

Skills

- Regulatory Compliance

- Bank Risk Management

- Financial Statement Analysis

- Capital Adequacy Assessment

- Stress Testing

- Loan Portfolio Review

Work Experience

Bank Examiner

- Prepared detailed examination reports, summarizing findings, identifying areas of concern, and recommending corrective actions.

- Conducted onsite and offsite examinations, interviewing management and staff, and reviewing internal controls.

- Evaluated and assessed institutions capital adequacy, liquidity, and profitability to ensure financial stability.

- Monitored financial performance of institutions, identifying early signs of potential financial distress.

Bank Examiner

- Conducted comprehensive risk assessments of financial institutions, evaluating their adherence to regulatory compliance, safety, and soundness.

- Examined financial records, assessed risk management practices, and provided guidance on corrective actions to ensure regulatory compliance.

- Utilized data analytics tools to identify potential risks and assess financial performance of institutions.

- Participated in interagency examinations, collaborating with other regulatory agencies to ensure comprehensive oversight.

Accomplishments

- Successfully led a team of examiners in conducting a comprehensive risk assessment for a $10 billion financial institution, identifying potential risks and recommending corrective measures.

- Developed and implemented a new risk analysis tool that significantly improved the efficiency and effectiveness of examiner reviews.

- Identified and reported a major fraud scheme that resulted in the recovery of stolen funds and criminal charges against the perpetrators.

- Provided expert testimony in a highprofile court case involving banking regulation and compliance issues.

- Collaborated with internal auditors and external regulators to ensure compliance with all applicable laws and regulations.

Awards

- Received the Bank Examiner of the Year award for outstanding performance in risk identification and mitigation.

- Recognized as a top performer in the Bank Examiner Certification Program.

- Received the Presidents Award for Outstanding Service to the Banking Industry.

- Recognized as a subject matter expert in bank regulation and compliance.

Certificates

- Certified Bank Examiner (CBE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Information Systems Auditor (CISA)

- Certified Information Security Manager (CISM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Examiner

- Highlight your experience in regulatory compliance and bank risk management

- Quantify your accomplishments with specific metrics and results

- Showcase your analytical and problem-solving skills

- Emphasize your ability to work independently and as part of a team

- Tailor your resume to the specific requirements of each job you apply for

Essential Experience Highlights for a Strong Bank Examiner Resume

- Conduct comprehensive risk assessments of financial institutions, evaluating their adherence to regulatory compliance, safety, and soundness

- Examine financial records, assess risk management practices, and provide guidance on corrective actions to ensure regulatory compliance

- Utilize data analytics tools to identify potential risks and assess financial performance of institutions

- Participate in interagency examinations, collaborating with other regulatory agencies to ensure comprehensive oversight

- Prepare detailed examination reports, summarizing findings, identifying areas of concern, and recommending corrective actions

- Conducted onsite and offsite examinations, interviewing management and staff, and reviewing internal controls

- Evaluated and assessed institutions capital adequacy, liquidity, and profitability to ensure financial stability

Frequently Asked Questions (FAQ’s) For Bank Examiner

What is the role of a Bank Examiner?

Bank Examiners are responsible for ensuring the safety and soundness of financial institutions by conducting risk assessments, examining financial records, and providing guidance on corrective actions to ensure regulatory compliance

What are the qualifications to become a Bank Examiner?

Typically, a bachelor’s degree in Finance, Accounting, or a related field is required, along with experience in financial analysis and regulatory compliance

What are the key skills required for a Bank Examiner?

Strong analytical, problem-solving, and communication skills are essential, as well as proficiency in regulatory compliance and bank risk management

What is the career outlook for Bank Examiners?

The career outlook for Bank Examiners is expected to be positive, as the demand for qualified professionals to ensure the safety and soundness of financial institutions continues to grow

What are the earning potential for Bank Examiners?

The earning potential for Bank Examiners varies depending on experience, qualifications, and location, but salaries can range from $50,000 to $100,000 or more

What are the challenges faced by Bank Examiners?

Bank Examiners face challenges such as the increasing complexity of financial institutions, the evolving regulatory landscape, and the need to stay abreast of new technologies and risks

What are the rewards of being a Bank Examiner?

The rewards of being a Bank Examiner include the opportunity to make a positive impact on the financial system, the intellectual challenge of working with complex financial data, and the chance to work with a team of dedicated professionals

What is the difference between a Bank Examiner and a Bank Auditor?

Bank Examiners are responsible for ensuring the safety and soundness of financial institutions, while Bank Auditors are responsible for providing assurance that financial institutions are operating in accordance with applicable laws and regulations