Are you a seasoned Banker Mason seeking a new career path? Discover our professionally built Banker Mason Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

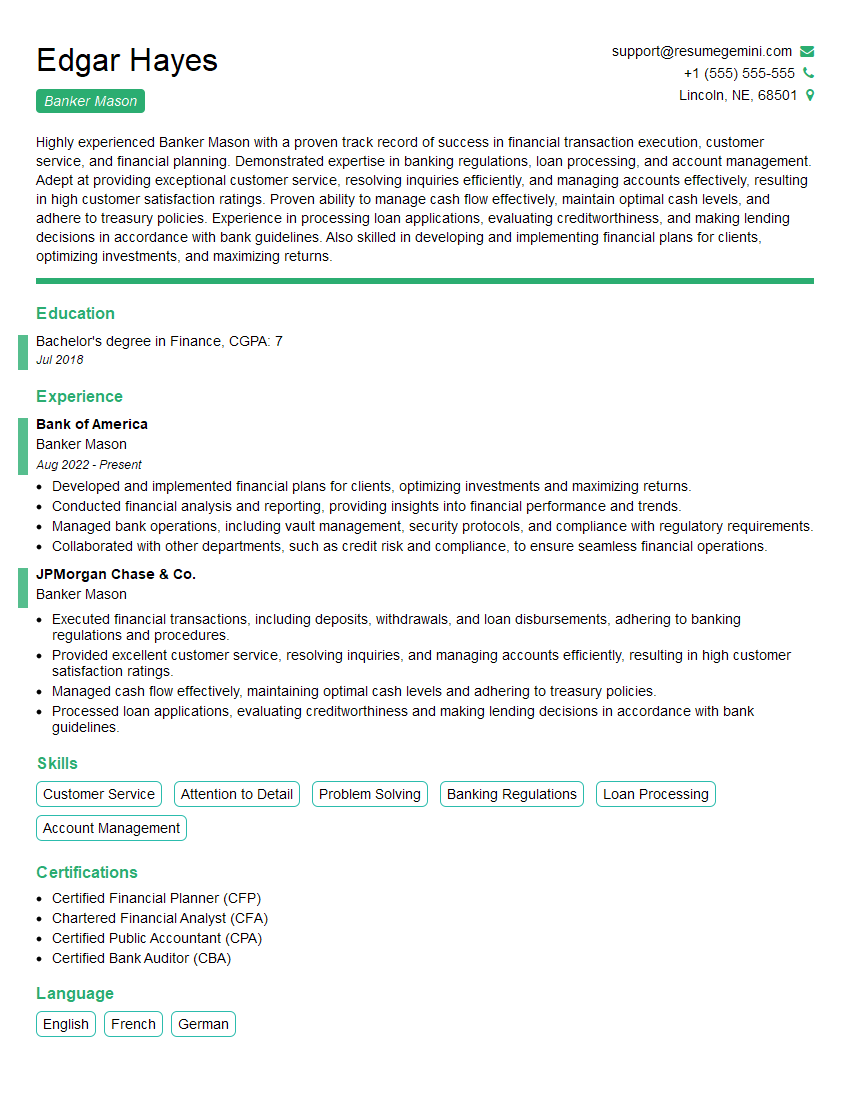

Edgar Hayes

Banker Mason

Summary

Highly experienced Banker Mason with a proven track record of success in financial transaction execution, customer service, and financial planning. Demonstrated expertise in banking regulations, loan processing, and account management. Adept at providing exceptional customer service, resolving inquiries efficiently, and managing accounts effectively, resulting in high customer satisfaction ratings. Proven ability to manage cash flow effectively, maintain optimal cash levels, and adhere to treasury policies. Experience in processing loan applications, evaluating creditworthiness, and making lending decisions in accordance with bank guidelines. Also skilled in developing and implementing financial plans for clients, optimizing investments, and maximizing returns.

Education

Bachelor’s degree in Finance

July 2018

Skills

- Customer Service

- Attention to Detail

- Problem Solving

- Banking Regulations

- Loan Processing

- Account Management

Work Experience

Banker Mason

- Developed and implemented financial plans for clients, optimizing investments and maximizing returns.

- Conducted financial analysis and reporting, providing insights into financial performance and trends.

- Managed bank operations, including vault management, security protocols, and compliance with regulatory requirements.

- Collaborated with other departments, such as credit risk and compliance, to ensure seamless financial operations.

Banker Mason

- Executed financial transactions, including deposits, withdrawals, and loan disbursements, adhering to banking regulations and procedures.

- Provided excellent customer service, resolving inquiries, and managing accounts efficiently, resulting in high customer satisfaction ratings.

- Managed cash flow effectively, maintaining optimal cash levels and adhering to treasury policies.

- Processed loan applications, evaluating creditworthiness and making lending decisions in accordance with bank guidelines.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Bank Auditor (CBA)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banker Mason

- Highlight your skills in customer service, attention to detail, problem-solving, and banking regulations.

- Quantify your accomplishments whenever possible to showcase your impact on the organization.

- Use action verbs and specific examples to demonstrate your abilities and experience.

- Tailor your resume to each job you apply to, emphasizing the skills and experience that are most relevant to the role.

- Proofread your resume carefully before submitting it to ensure there are no errors.

Essential Experience Highlights for a Strong Banker Mason Resume

- Executing financial transactions (deposits, withdrawals, and loan disbursements) while adhering to banking regulations and procedures.

- Providing excellent customer service by resolving inquiries and managing accounts efficiently to ensure high customer satisfaction ratings.

- Managing cash flow effectively to maintain optimal cash levels and adhere to treasury policies.

- Processing loan applications, evaluating creditworthiness, and making lending decisions in accordance with bank guidelines.

- Developing and implementing financial plans for clients to optimize investments and maximize returns.

- Conducting financial analysis and reporting to provide insights into financial performance and trends.

- Managing bank operations, including vault management, security protocols, and compliance with regulatory requirements.

Frequently Asked Questions (FAQ’s) For Banker Mason

What are the primary responsibilities of a Banker Mason?

Banker Masons are responsible for a wide range of duties, including executing financial transactions, providing customer service, processing loan applications, and developing financial plans for clients.

What skills are required to be a successful Banker Mason?

Successful Banker Masons typically possess strong customer service skills, attention to detail, problem-solving abilities, and knowledge of banking regulations.

What is the career path for a Banker Mason?

Banker Masons can advance to various roles within the financial industry, such as Branch Manager, Loan Officer, or Financial Advisor.

What is the salary range for a Banker Mason?

The salary range for Banker Masons can vary depending on their experience, location, and employer. According to Salary.com, the average salary for Banker Masons in the United States is around $60,000 per year.

What are the benefits of working as a Banker Mason?

Banker Masons enjoy a variety of benefits, including competitive salaries, comprehensive health insurance, paid time off, and opportunities for professional development.

What is the job outlook for Banker Masons?

The job outlook for Banker Masons is expected to be positive in the coming years, as the demand for financial services continues to grow.