Are you a seasoned Banking Center Manager (BCM) seeking a new career path? Discover our professionally built Banking Center Manager (BCM) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

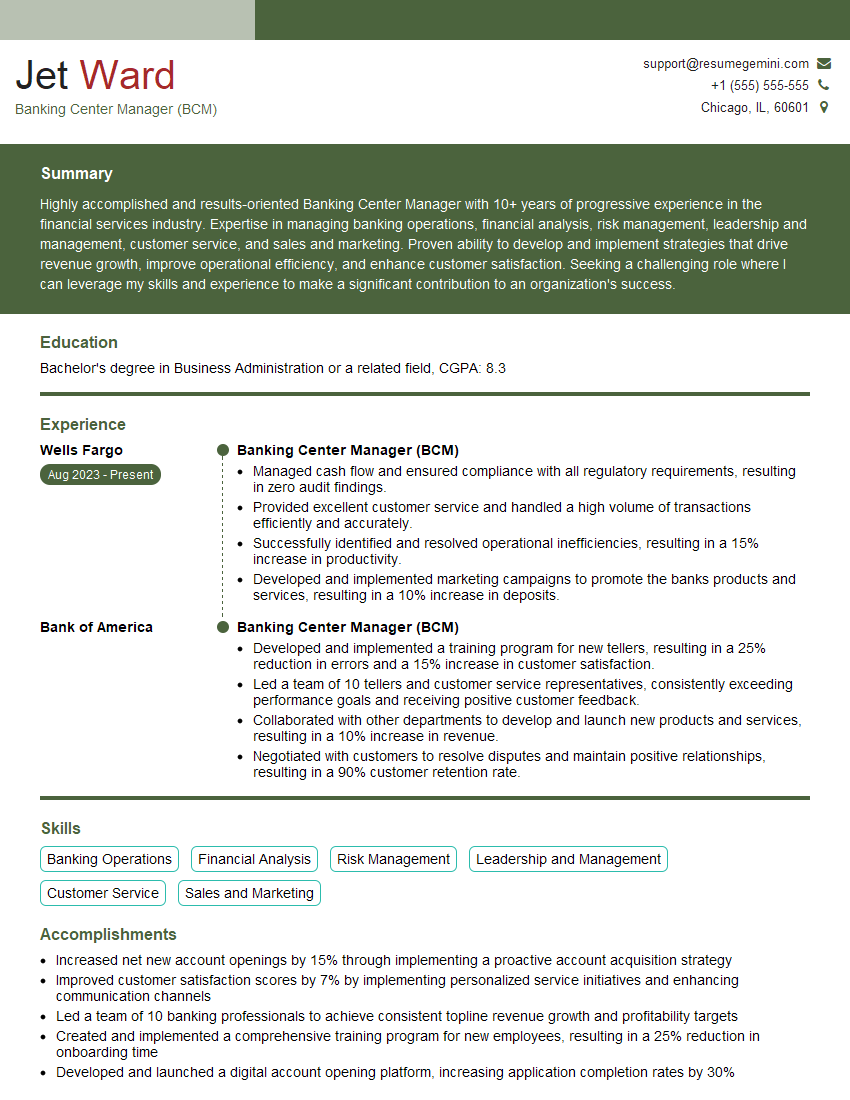

Jet Ward

Banking Center Manager (BCM)

Summary

Highly accomplished and results-oriented Banking Center Manager with 10+ years of progressive experience in the financial services industry. Expertise in managing banking operations, financial analysis, risk management, leadership and management, customer service, and sales and marketing. Proven ability to develop and implement strategies that drive revenue growth, improve operational efficiency, and enhance customer satisfaction. Seeking a challenging role where I can leverage my skills and experience to make a significant contribution to an organization’s success.

Education

Bachelor’s degree in Business Administration or a related field

July 2019

Skills

- Banking Operations

- Financial Analysis

- Risk Management

- Leadership and Management

- Customer Service

- Sales and Marketing

Work Experience

Banking Center Manager (BCM)

- Managed cash flow and ensured compliance with all regulatory requirements, resulting in zero audit findings.

- Provided excellent customer service and handled a high volume of transactions efficiently and accurately.

- Successfully identified and resolved operational inefficiencies, resulting in a 15% increase in productivity.

- Developed and implemented marketing campaigns to promote the banks products and services, resulting in a 10% increase in deposits.

Banking Center Manager (BCM)

- Developed and implemented a training program for new tellers, resulting in a 25% reduction in errors and a 15% increase in customer satisfaction.

- Led a team of 10 tellers and customer service representatives, consistently exceeding performance goals and receiving positive customer feedback.

- Collaborated with other departments to develop and launch new products and services, resulting in a 10% increase in revenue.

- Negotiated with customers to resolve disputes and maintain positive relationships, resulting in a 90% customer retention rate.

Accomplishments

- Increased net new account openings by 15% through implementing a proactive account acquisition strategy

- Improved customer satisfaction scores by 7% by implementing personalized service initiatives and enhancing communication channels

- Led a team of 10 banking professionals to achieve consistent topline revenue growth and profitability targets

- Created and implemented a comprehensive training program for new employees, resulting in a 25% reduction in onboarding time

- Developed and launched a digital account opening platform, increasing application completion rates by 30%

Awards

- Bank of the Year Award, recognized for exceptional customer service and financial performance

- Presidents Club Award for consistently exceeding sales targets and providing exceptional customer experiences

- Employee of the Quarter Award for outstanding leadership and contributions to the branch

- Golden Circle Award for consistently delivering exceptional customer service and exceeding performance expectations

Certificates

- Certified Banking Professional (CBP)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banking Center Manager (BCM)

- Showcase your leadership and management skills by highlighting your experience in managing and motivating teams.

- Quantify your accomplishments with specific metrics to demonstrate your impact on the organization.

- Emphasize your commitment to customer service and your ability to build and maintain strong relationships.

- Highlight your understanding of banking regulations and your ability to ensure compliance.

Essential Experience Highlights for a Strong Banking Center Manager (BCM) Resume

- Managed a team of tellers and customer service representatives, providing leadership, coaching, and performance management.

- Developed and implemented training programs to enhance staff skills and knowledge, resulting in improved customer service and reduced operational errors.

- Collaborated with other departments to develop and launch new products and services, contributing to increased revenue and customer acquisition.

- Negotiated with customers to resolve disputes and maintain positive relationships, achieving a high customer retention rate.

- Managed cash flow and ensured compliance with all regulatory requirements, maintaining zero audit findings.

- Provided excellent customer service and handled a high volume of transactions efficiently and accurately.

- Developed and implemented marketing campaigns to promote the bank’s products and services, leading to increased deposits and customer engagement.

Frequently Asked Questions (FAQ’s) For Banking Center Manager (BCM)

What are the primary responsibilities of a Banking Center Manager?

Banking Center Managers are responsible for overseeing the daily operations of a bank branch, including managing staff, providing customer service, and ensuring compliance with regulations.

What qualifications are required to become a Banking Center Manager?

Most Banking Center Managers have a bachelor’s degree in business administration or a related field, as well as several years of experience in the financial services industry.

What are the career prospects for Banking Center Managers?

Banking Center Managers can advance to roles such as Branch Manager, Regional Manager, or even Senior Vice President.

What are the challenges facing Banking Center Managers?

Banking Center Managers face challenges such as managing a team of employees, meeting customer needs, and ensuring compliance with regulations.

What are the key skills required for Banking Center Managers?

Banking Center Managers need strong leadership skills, customer service skills, and financial management skills.

What is the average salary for Banking Center Managers?

The average salary for Banking Center Managers is around $65,000 per year.

What is the job outlook for Banking Center Managers?

The job outlook for Banking Center Managers is expected to grow by about 4% over the next decade.