Are you a seasoned Banking Center Manager seeking a new career path? Discover our professionally built Banking Center Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

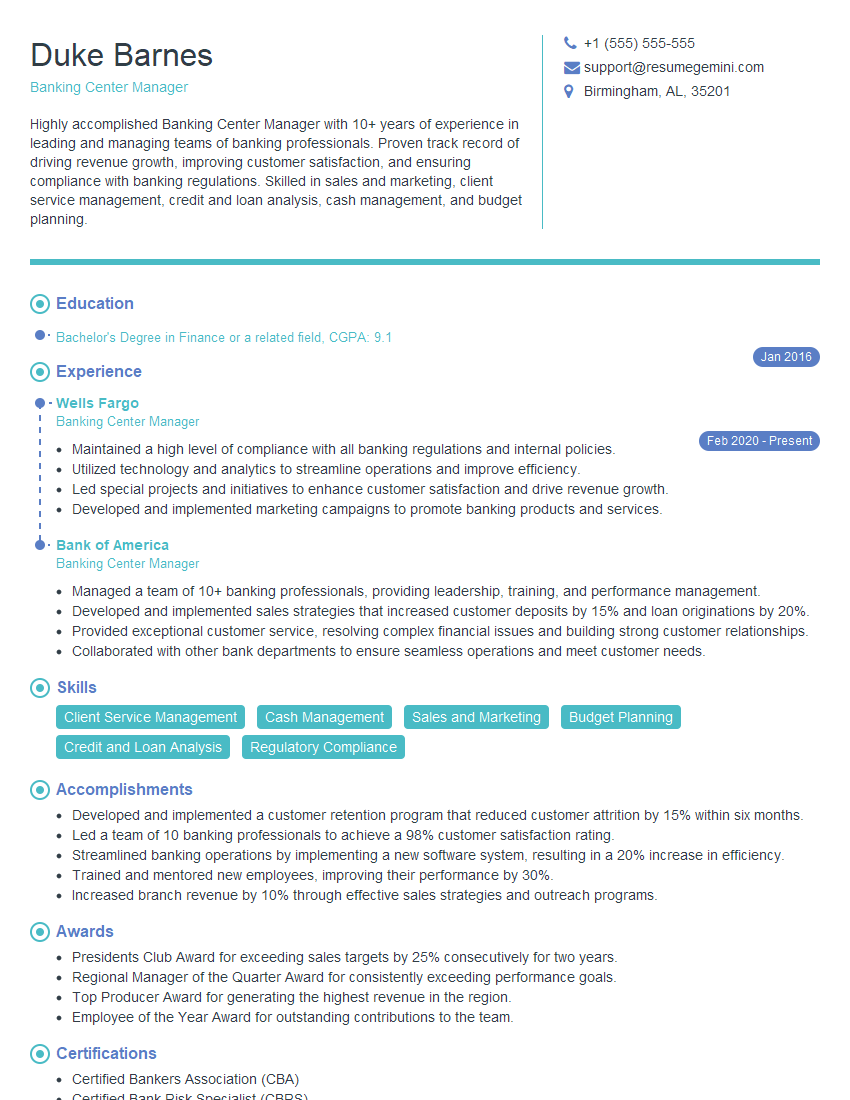

Duke Barnes

Banking Center Manager

Summary

Highly accomplished Banking Center Manager with 10+ years of experience in leading and managing teams of banking professionals. Proven track record of driving revenue growth, improving customer satisfaction, and ensuring compliance with banking regulations. Skilled in sales and marketing, client service management, credit and loan analysis, cash management, and budget planning.

Education

Bachelor’s Degree in Finance or a related field

January 2016

Skills

- Client Service Management

- Cash Management

- Sales and Marketing

- Budget Planning

- Credit and Loan Analysis

- Regulatory Compliance

Work Experience

Banking Center Manager

- Maintained a high level of compliance with all banking regulations and internal policies.

- Utilized technology and analytics to streamline operations and improve efficiency.

- Led special projects and initiatives to enhance customer satisfaction and drive revenue growth.

- Developed and implemented marketing campaigns to promote banking products and services.

Banking Center Manager

- Managed a team of 10+ banking professionals, providing leadership, training, and performance management.

- Developed and implemented sales strategies that increased customer deposits by 15% and loan originations by 20%.

- Provided exceptional customer service, resolving complex financial issues and building strong customer relationships.

- Collaborated with other bank departments to ensure seamless operations and meet customer needs.

Accomplishments

- Developed and implemented a customer retention program that reduced customer attrition by 15% within six months.

- Led a team of 10 banking professionals to achieve a 98% customer satisfaction rating.

- Streamlined banking operations by implementing a new software system, resulting in a 20% increase in efficiency.

- Trained and mentored new employees, improving their performance by 30%.

- Increased branch revenue by 10% through effective sales strategies and outreach programs.

Awards

- Presidents Club Award for exceeding sales targets by 25% consecutively for two years.

- Regional Manager of the Quarter Award for consistently exceeding performance goals.

- Top Producer Award for generating the highest revenue in the region.

- Employee of the Year Award for outstanding contributions to the team.

Certificates

- Certified Bankers Association (CBA)

- Certified Bank Risk Specialist (CBRS)

- Certified Cash Manager (CCM)

- Certified Financial Crime Specialist (CFCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banking Center Manager

- Highlight your leadership skills and experience in managing a team.

- Quantify your accomplishments with???? measurements, such as the percentage increase in customer deposits or loan originations.

- Emphasize your customer service skills and ability to build strong customer relationships.

- Showcase your knowledge of banking regulations and compliance.

- Include any additional skills or experience that would be relevant to the position, such as sales and marketing, or credit and loan analysis.

Essential Experience Highlights for a Strong Banking Center Manager Resume

- Managed a team of 10+ banking professionals, providing leadership, training, and performance management.

- Developed and implemented sales strategies that increased customer deposits by 15% and loan originations by 20%.

- Provided exceptional customer service, resolving complex financial issues and building strong customer relationships.

- Collaborated with other bank departments to ensure seamless operations and meet customer needs.

- Maintained a high level of compliance with all banking regulations and internal policies.

- Led special projects and initiatives to enhance customer satisfaction and drive revenue growth.

- Developed and implemented marketing campaigns to promote banking products and services.

Frequently Asked Questions (FAQ’s) For Banking Center Manager

What are the key responsibilities of a Banking Center Manager?

Banking Center Managers are responsible for leading and managing a team of banking professionals, developing and implementing sales strategies, providing exceptional customer service, collaborating with other bank departments, maintaining compliance with banking regulations, and leading special projects and initiatives.

What are the qualifications for becoming a Banking Center Manager?

Banking Center Managers typically need a bachelor’s degree in finance or a related field, as well as several years of experience in the banking industry. They also need to have strong leadership, management, and communication skills.

What are the career advancement opportunities for Banking Center Managers?

Banking Center Managers can advance to positions such as Branch Manager, Regional Manager, or Vice President of Retail Banking.

What is the average salary for a Banking Center Manager?

The average salary for a Banking Center Manager is around $65,000 per year.

What are the benefits of working as a Banking Center Manager?

Banking Center Managers enjoy a number of benefits, including a competitive salary, health insurance, paid time off, and opportunities for professional development.