Are you a seasoned Banking Supervisor seeking a new career path? Discover our professionally built Banking Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

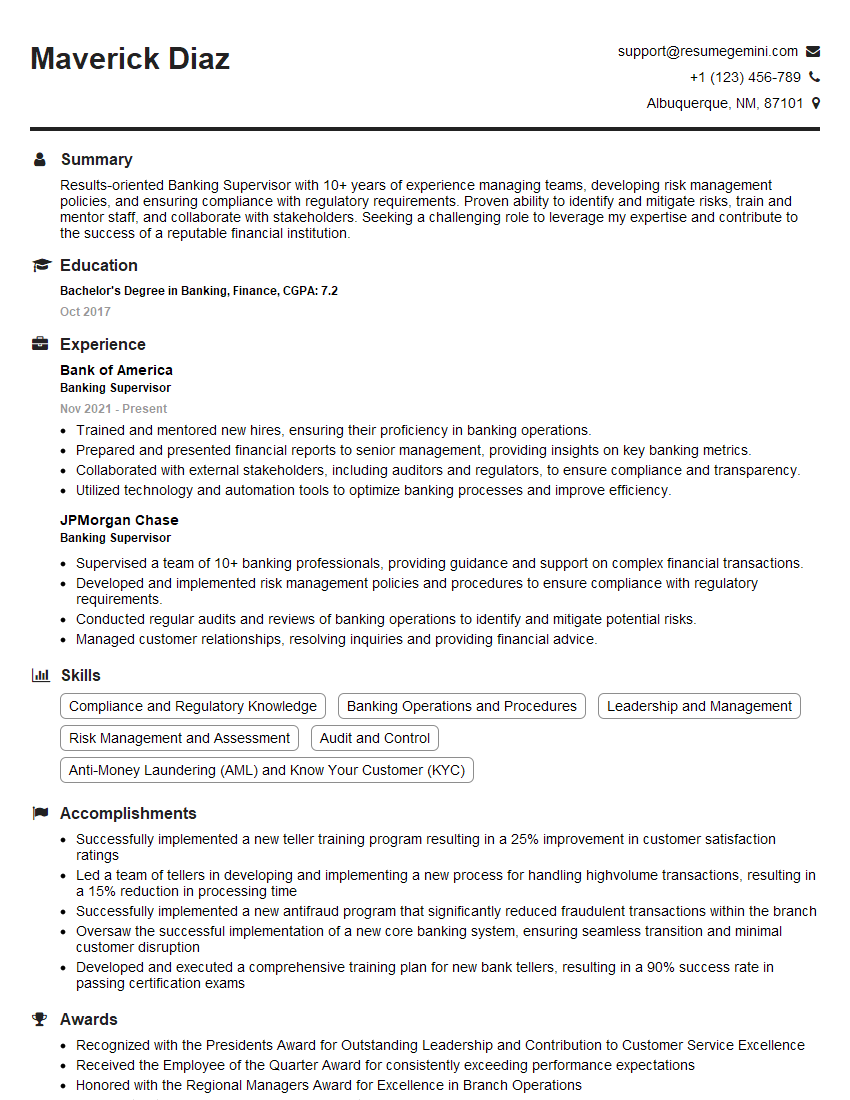

Maverick Diaz

Banking Supervisor

Summary

Results-oriented Banking Supervisor with 10+ years of experience managing teams, developing risk management policies, and ensuring compliance with regulatory requirements. Proven ability to identify and mitigate risks, train and mentor staff, and collaborate with stakeholders. Seeking a challenging role to leverage my expertise and contribute to the success of a reputable financial institution.

Education

Bachelor’s Degree in Banking, Finance

October 2017

Skills

- Compliance and Regulatory Knowledge

- Banking Operations and Procedures

- Leadership and Management

- Risk Management and Assessment

- Audit and Control

- Anti-Money Laundering (AML) and Know Your Customer (KYC)

Work Experience

Banking Supervisor

- Trained and mentored new hires, ensuring their proficiency in banking operations.

- Prepared and presented financial reports to senior management, providing insights on key banking metrics.

- Collaborated with external stakeholders, including auditors and regulators, to ensure compliance and transparency.

- Utilized technology and automation tools to optimize banking processes and improve efficiency.

Banking Supervisor

- Supervised a team of 10+ banking professionals, providing guidance and support on complex financial transactions.

- Developed and implemented risk management policies and procedures to ensure compliance with regulatory requirements.

- Conducted regular audits and reviews of banking operations to identify and mitigate potential risks.

- Managed customer relationships, resolving inquiries and providing financial advice.

Accomplishments

- Successfully implemented a new teller training program resulting in a 25% improvement in customer satisfaction ratings

- Led a team of tellers in developing and implementing a new process for handling highvolume transactions, resulting in a 15% reduction in processing time

- Successfully implemented a new antifraud program that significantly reduced fraudulent transactions within the branch

- Oversaw the successful implementation of a new core banking system, ensuring seamless transition and minimal customer disruption

- Developed and executed a comprehensive training plan for new bank tellers, resulting in a 90% success rate in passing certification exams

Awards

- Recognized with the Presidents Award for Outstanding Leadership and Contribution to Customer Service Excellence

- Received the Employee of the Quarter Award for consistently exceeding performance expectations

- Honored with the Regional Managers Award for Excellence in Branch Operations

- Recipient of the Chairmans Award for Innovation and Leadership

Certificates

- Certified Banking Risk Manager (CBRM)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Services Auditor (CFSA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banking Supervisor

- Highlight your leadership and management skills, emphasizing your ability to motivate and develop teams.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Showcase your knowledge of banking regulations and compliance, including AML and KYC requirements.

- Emphasize your technological proficiency and your ability to utilize automation tools to enhance efficiency

Essential Experience Highlights for a Strong Banking Supervisor Resume

- Supervise and lead a team of 10+ banking professionals, providing guidance and support on complex financial transactions

- Develop and implement risk management policies and procedures to ensure compliance with regulatory requirements

- Conduct regular audits and reviews of banking operations to identify and mitigate potential risks

- Manage customer relationships, resolving inquiries and providing financial advice

- Train and mentor new hires, ensuring their proficiency in banking operations

- Prepare and present financial reports to senior management, providing insights on key banking metrics

- Collaborate with external stakeholders, including auditors and regulators, to ensure compliance and transparency

Frequently Asked Questions (FAQ’s) For Banking Supervisor

What are the key responsibilities of a Banking Supervisor?

Banking Supervisors are responsible for overseeing banking operations, ensuring compliance with regulations, and managing teams of banking professionals. They conduct audits, develop risk management policies, and provide guidance on complex financial transactions.

What qualifications are required to become a Banking Supervisor?

Most Banking Supervisors hold a Bachelor’s Degree in Banking, Finance, or a related field. They also typically have several years of experience in the banking industry, with a strong understanding of banking regulations and compliance.

What are the career prospects for Banking Supervisors?

Banking Supervisors can advance to senior management positions, such as Branch Manager or Chief Compliance Officer. With additional experience and qualifications, they may also move into roles in risk management, financial analysis, or consulting.

What are the challenges faced by Banking Supervisors?

Banking Supervisors face challenges such as the increasing complexity of banking regulations, the need to stay abreast of technological advancements, and the pressure to balance compliance with profitability.

What are the key skills required for Banking Supervisors?

Banking Supervisors should possess excellent leadership and management skills, as well as strong analytical and problem-solving abilities. They should also have a deep understanding of banking regulations and compliance, and be proficient in the use of teknologi.

What is the job outlook for Banking Supervisors?

The job outlook for Banking Supervisors is expected to be positive in the coming years, as banks continue to face increasing regulatory pressure and the need to manage risk effectively.